STENA METALL AB - Stena Metall Group

STENA METALL AB - Stena Metall Group

STENA METALL AB - Stena Metall Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

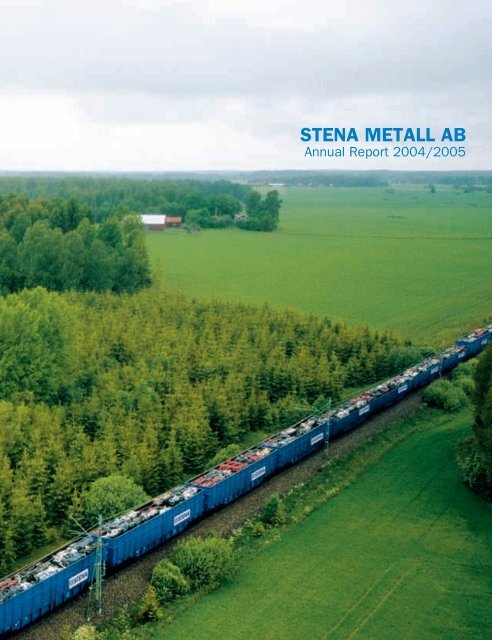

<strong>STENA</strong> <strong>METALL</strong> <strong>AB</strong><br />

Annual Report 2004/2005

Contents Highlights of 2004/2005<br />

▲<br />

Highlights of 2004/2005 ................. 1<br />

Chief Executive Offi cer’s comments ...... 2<br />

The <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> . .................. 6<br />

Business areas ......................... 7<br />

Advances in recycling ...................... 8<br />

Examples of recycling . ..................... 10<br />

Competence development ................ 12<br />

Research and development .............. 14<br />

Recycling . ................................... 16<br />

Sweden ................................... 17<br />

Denmark .................................. 28<br />

Norway .................................... 35<br />

Finland .................................... 38<br />

Poland ..................................... 42<br />

Russia ..................................... 45<br />

Trading ....................................... 46<br />

<strong>Stena</strong> Metal .............................. 47<br />

Steel ......................................... 48<br />

<strong>Stena</strong> Stål ................................ 49<br />

Oil ............................................ 50<br />

<strong>Stena</strong> Oil .................................. 51<br />

Finance ...................................... 52<br />

<strong>Stena</strong> <strong>Metall</strong> Finans ..................... 52<br />

The <strong>Stena</strong> Sphere ......................... 53<br />

Financial review<br />

Directors’ report ........................ 55<br />

Income statement – The <strong>Group</strong> ........ 57<br />

Changes in shareholders’ equity –<br />

The <strong>Group</strong> .............................. 57<br />

Balance sheet – The <strong>Group</strong>. ............ 58<br />

Statement of cash fl ow – The <strong>Group</strong> . . 60<br />

Accounting and valuation principles . . 61<br />

Notes to the fi nancial statements –<br />

The <strong>Group</strong> .............................. 64<br />

Parent Company – <strong>Stena</strong> <strong>Metall</strong> ....... 74<br />

Notes to the fi nancial statements –<br />

Parent Company ....................... 76<br />

<strong>Stena</strong> <strong>Metall</strong> <strong>AB</strong>’s holding of<br />

shares and participations ............ 80<br />

Proposed distribution of earnings ....... 82<br />

Auditors’ report ............................ 83<br />

Board of Directors .......................... 84<br />

Addresses ................................... 85<br />

The competence and customer focus of its<br />

employees is an important reason for the<br />

strong development of <strong>Stena</strong>’s Danish recycling<br />

operations. From left: Renè Larsen,<br />

customer representative, and Finn Andresen,<br />

foreman, at <strong>Stena</strong>’s scrap facility in Køge,<br />

Denmark.<br />

Major fl uctuations in the price of the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’s most commonly used raw materials.<br />

Global demand for ferrous and non-ferrous metals and paper remained strong.<br />

Successful international trading contributed strongly to improved income.<br />

Income before taxes amounted to SEK 686.1 million, the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’s highest<br />

level ever.<br />

Industry-specific and customized waste management solutions were further developed.<br />

Service was broadened in all home markets through an expansion to new locations.<br />

More material from various wastes can be recycled, benefiting the environment.<br />

Successful focus on hazardous waste management and other production waste.<br />

Signifi cant investments in production equipment and new technology.<br />

Trading by the Steel and Oil business areas developed positively.<br />

Focus on new competence and improvements through training, research and development<br />

projects, and cooperations.<br />

In a fi nancial market with positive undertones, <strong>Stena</strong> <strong>Metall</strong> Finans generated a good profi t.<br />

SEK million 2000/2001 2001/2002 2002/2003 2003/2004 2004/2005<br />

Revenue .................................... 14,287.6 14,605.9 15,967.5 17,207.4 20,879.0<br />

Operating income before items<br />

affecting comparability ................ 486.6 281.0 470.1 643.9 744.9<br />

Income before tax ........................ 507.2 315.2 107.6 609.6 686.1<br />

Net income for the year ................. 358.7 280.8 72.4 432.1 436.2<br />

Average number of employees ......... 1,489 1,798 1,879 2,136 2,561<br />

Cover: During the year <strong>Stena</strong> started using its own railway cars to transport scrap, reducing the<br />

need for road transports. Auto scrap, right, is being transported to the fragmentation plant in<br />

Hallstahammar, Sweden.

Chief Executive Officer’s comments<br />

Economic conditions remained favorable during fiscal year<br />

2004/2005. Our most important raw materials fluctuated greatly<br />

in price, and successful international trading had a major impact<br />

on our earnings. The <strong>Group</strong>’s income before tax was SEK 686.1<br />

million, an improvement of slightly over 12 percent compared<br />

to the previous year. We are growing and continue to prioritize<br />

all our areas. We are improving our offering and investing for<br />

the future in new competence and expanded capacity.<br />

Positive work ethic<br />

I am very grateful to be able to look back<br />

on a successful year. The rate of our development<br />

is affected by how well we earn<br />

our customers’ trust.<br />

We are never better than how people<br />

see us whenever we interact and everywhere<br />

we are located. We do business<br />

close to customers, and our local business<br />

acumen – the core of our business culture<br />

– is one of our most important strengths.<br />

We trust all our employees to use their<br />

competence and personal abilities to improve<br />

our offering. I would like to thank<br />

all of them for the fantastic commitment<br />

they showed during the year. A positive<br />

work ethic and continuous efforts to build<br />

our business have laid the foundation for<br />

positive results.<br />

To meet customers’ needs, we are<br />

broadening and expanding our collective<br />

know-how. We are investing more than<br />

ever in competence development. This includes<br />

everything from practically oriented<br />

courses on the materials we work with<br />

to training on the environment, IT, leadership<br />

and systematic improvements.<br />

A step ahead<br />

Waste management and recycling are becoming<br />

more complex and are subject to a<br />

growing set of laws and regulations in<br />

Europe. The trend among businesses that<br />

generate wastes is to seek out a single provider<br />

that can offer a wide range of professional<br />

recycling services. Our goal is to<br />

lead the industry’s development in this<br />

regard and stay a step ahead.<br />

A growing offering. The <strong>Stena</strong> <strong>Metall</strong><br />

<strong>Group</strong> is the Nordic leader in recycling<br />

and environmental services. Our growing<br />

business allows us to offer customized<br />

recycling concepts and a range of specialist<br />

expertise in all the countries where the<br />

<strong>Group</strong> is active. During the year we continued<br />

to focus on the goal of enhancing<br />

customer service. We have developed<br />

more industry-specific concepts, total<br />

waste management solutions, new products,<br />

advisory services and logistic solutions.<br />

Online services and customized training.<br />

Another example is our Customer<br />

Portal and Digital Waste Handbook,<br />

which give customers control of their<br />

waste management and support for waste<br />

sorting, labeling, etc. These services also<br />

help customers to meet their own environmental<br />

goals as well as government<br />

reporting requirements.<br />

It is positive to also see greater demand<br />

for environmental training, which teaches<br />

CEO Anders Jansson<br />

customers how to increase the value of<br />

their waste at the point where it arises,<br />

and sometimes even convert their wastes<br />

from a cost to a source of revenue. By<br />

sharing our competence in hazardous<br />

waste, we want to also support customers<br />

in their efforts to create safer work environments.<br />

Our growing production apparatus. We<br />

are investing continuously to develop our<br />

branches and production equipment, start<br />

new businesses and acquire companies<br />

with the goal of broadening our offering.<br />

At the end of the fiscal year the <strong>Stena</strong><br />

<strong>Metall</strong> <strong>Group</strong> had operations in more than<br />

230 locations.<br />

Customer-focused improvements. The<br />

<strong>Group</strong>’s companies are using Six Sigma<br />

methodology to systematically achieve<br />

improvements. We have devoted great<br />

energy to this process as a way to enhance<br />

service in cooperation with customers.<br />

Development<br />

Our goal is to lead the industry’s development<br />

of efficient and environmentally safe<br />

2

Chief Executive Officer’s comments<br />

The opening of a new hazardous waste treatment plant in Mongstad, Norway, makes it possible to offer hazardous waste services and total waste<br />

management solutions to customers operating onshore or offshore.<br />

processes to recycle wastes. Our aim is to<br />

process all waste products in the best way<br />

possible, to meet customers’ needs and to<br />

comply with new laws.<br />

Through R&D, we are developing new<br />

technology and processes to better recycle<br />

wastes in the future. More types of waste<br />

that used to end up in landfills due to a<br />

lack of profitable technology can instead<br />

be recycled and processed into high-grade<br />

raw material. One example is picture tube<br />

glass, which <strong>Stena</strong> is now able to recycle<br />

using effective technology at our facility<br />

in Germany. During the year new technology<br />

for Freon recycling was added in<br />

Halmstad. At our new plant in Mongstad,<br />

Norway, more than 95 percent of all common<br />

hazardous wastes are processed using<br />

unique technology. The plant produces no<br />

new waste, and the water from the hazardous<br />

waste it treats can be released back<br />

into nature.<br />

We are also building our know-how<br />

through cooperations. For example, we<br />

have established an alliance with Linköping<br />

University in industrial recycling.<br />

With Chalmers University of Technology,<br />

we have a research cooperation in soil<br />

decontamination and Freon destruction.<br />

Business growth<br />

At the same time that our international<br />

There is a wonderful drive in our company.<br />

In a continued strong economy, we developed very positively during the year,<br />

trading in ferrous and non-ferrous metals<br />

improved our position in every area. On scrap operations in every country were<br />

the whole, the market has been good, even strengthened significantly. In addition to<br />

if the prices of our most important raw continued strong growth in our Swedish<br />

materials have been volatile.<br />

and Finnish scrap operations, we have<br />

In all our home markets, we have continued<br />

to improve our product and service Denmark.<br />

greatly improved our market position in<br />

offering and expanded by adding new<br />

I am also grateful that we have strengthened<br />

our market shares in a very tough<br />

locations close to customers.<br />

scrap market in Poland.<br />

Shot-blasted and prepainted beams, one of <strong>Stena</strong> Stål’s main products, being loaded at the<br />

company’s main warehouse in Västerås, Sweden.<br />

3

Chief Executive Officer’s comments<br />

With a focus on improved production<br />

efficiency and a product and service offering<br />

designed with customers in mind,<br />

<strong>Stena</strong> Aluminium improved its income<br />

during the year despite continued weakness<br />

in the German market for aluminium<br />

alloys.<br />

Under tough market conditions with<br />

declining prices and tight competition, our<br />

recovered paper operations continued to<br />

produce good results. The development<br />

rate for products and services is very good<br />

in every market, at the same time that we<br />

established ourselves during the year as<br />

Poland’s leading waste paper company<br />

through organic growth and acquisitions.<br />

Our hazardous waste operations grew<br />

strongly in Denmark and Sweden during<br />

the fiscal year. In Mongstad, Norway we<br />

created a new, highly competitive base for<br />

development of our hazardous waste<br />

operations.<br />

Our efforts in the area we call “other<br />

production waste,” which began last year,<br />

were intensified in fiscal year 2004/2005.<br />

The business is developing positively and<br />

making a significant contribution to the<br />

<strong>Group</strong>’s overall recycling operations.<br />

<strong>Stena</strong> <strong>Metall</strong> is one of Europe’s leading<br />

electronics recyclers. During the year we<br />

Customized online services simplify waste<br />

management. They also support customers in<br />

their environmental work and in meeting legislative<br />

reporting requirements.<br />

continued to invest in new technology,<br />

capacity and know-how, at the same time<br />

that volume and income again grew. We<br />

intend to continue to grow in this area.<br />

Because of increased construction activity<br />

and positive conditions in the industrial<br />

sector, steel prices rose during the year,<br />

creating good opportunities for our Swedish<br />

steel wholesale operations. With a focus<br />

on production efficiency, logistic solutions,<br />

a broader product range and new<br />

customer-specific product and service<br />

solutions, <strong>Stena</strong> Stål developed very well.<br />

In a market with rapidly rising oil prices,<br />

<strong>Stena</strong> Oil has continued to build its business<br />

acumen by maintaining a focus on<br />

quality, safety and service.<br />

In a financial market with positive<br />

undertones, <strong>Stena</strong> <strong>Metall</strong> Finans generated<br />

a good profit.<br />

A future industry<br />

Recycling is one of the most important<br />

and effective ways to conserve our natural<br />

resources. Waste is becoming an important<br />

source of raw material, and it is becoming<br />

increasingly evident that we work<br />

in a future industry. My hope is that new<br />

EU legislation will lead to better harmonized<br />

competitive conditions within the<br />

European recycling industry. The clearer<br />

the goals in Europe’s environmental policies,<br />

the more we can invest in more<br />

efficient recycling.<br />

As the leading recycling and environmental<br />

service company in the Nordic region,<br />

we further strengthened our position<br />

during the year. Still, there is not a single<br />

area or single place where we cannot improve.<br />

With the support of long-term<br />

owners, financial strength and the business<br />

acumen of all our employees, we have<br />

a unique foundation for further improvements<br />

and growth. The positive economic<br />

picture has continued into the new fiscal<br />

year, although higher energy prices, nat-<br />

A positive work ethic is one of the <strong>Stena</strong> <strong>Metall</strong><br />

<strong>Group</strong>’s biggest strengths, and its investments<br />

in competence development are more extensive<br />

than ever. From left: Magnus Nihlén, who<br />

manages metals operations, and Magnus<br />

Persson, production manager, at <strong>Stena</strong><br />

Gotthard in Malmö.<br />

ural disasters and pricing uncertainty for<br />

other raw materials may cause some slowdown.<br />

If the economy continues to grow,<br />

there is a good chance that this year’s income<br />

will be in line with last year’s.<br />

Anders Jansson,<br />

Göteborg, October 2005<br />

4

Chief Executive Officer’s comments<br />

Price trends<br />

During the past year we have seen major fluctuations in<br />

the price of our main raw materials. We are experiencing<br />

very high levels, from an historical perspective, for most<br />

ferrous and non-ferrous metals, oil and scrap. One of the<br />

biggest reasons for these volatile, high prices is China’s<br />

tremendous growth in recent years.<br />

Freight<br />

Index<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

2002 2003<br />

2004 2005<br />

• Very high fl uctuations<br />

during the year<br />

• Finished the year at<br />

more “normal” levels<br />

Copper<br />

Steel scrap<br />

USD/ton<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

2002 2003<br />

2004 2005<br />

• Biggest price gain of all<br />

metals on London Metal<br />

Exchange<br />

• Reached record high<br />

• Good demand from China<br />

• Little increase in supply<br />

USD/ton<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2002<br />

2003<br />

2004 2005<br />

• Falling for much of the<br />

year<br />

• High prices during<br />

summer 2005<br />

• Strong demand from<br />

China and rest of Asia<br />

Aluminium<br />

Steel<br />

USD/ton<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

2002 2003<br />

2004 2005<br />

• Relatively stable price<br />

trend compared with<br />

other metals<br />

• Historically high price<br />

differential vs. copper<br />

USD/ton<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2002<br />

2003<br />

2004 2005<br />

• Falling prices for much<br />

of the year<br />

• Production cutbacks<br />

led to higher prices<br />

toward year-end<br />

• More than 1 billion<br />

tons of steel produced<br />

in 2004<br />

Nickel<br />

Pig iron<br />

USD/ton<br />

16,000<br />

12,000<br />

8,000<br />

4,000<br />

• Low inventories<br />

• Near record high<br />

USD/ton<br />

400<br />

300<br />

200<br />

100<br />

• Similar trend to steel<br />

scrap<br />

• Prices fell initially<br />

before rising during<br />

the summer<br />

0<br />

2002 2003<br />

2004 2005<br />

0<br />

2002<br />

2003<br />

2004 2005<br />

Oil<br />

Corrugated board<br />

USD/barrel<br />

80<br />

60<br />

40<br />

20<br />

0<br />

2002 2003<br />

2004 2005<br />

• Highest nominal<br />

oil price ever<br />

• Increased demand<br />

has driven up prices<br />

• Low inventories<br />

• Limited refi nery<br />

capacity<br />

Euro/ton<br />

160<br />

120<br />

80<br />

40<br />

0<br />

1999<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

• Falling prices during the<br />

year<br />

• Weak demand<br />

5

<strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong><br />

Operations in<br />

230 locations<br />

6

<strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong><br />

The <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> is the Nordic leader in recycling and environmental<br />

services. We recycle and process metals, paper, electronics,<br />

hazardous waste and chemicals. <strong>Stena</strong> offers customized service based<br />

on total waste management solutions and specialized expertise in a<br />

number of waste areas, complemented by training, online services<br />

and consulting services.<br />

The <strong>Group</strong> is also active in international trading in ferrous and<br />

non-ferrous products and oil.<br />

At the conclusion of the fiscal year <strong>Stena</strong> had operations at 230<br />

locations.<br />

<strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> facilities<br />

•<br />

New facilities added in 2004/2005<br />

The company also has operations in the following countries:<br />

<strong>Stena</strong> Metal Ltd, London, England<br />

<strong>Stena</strong> Metal, Inc., Stamford, USA; Belo Horizonte, Brazil;<br />

Rayong, Thailand; Tianjin, China<br />

Recycling business areas<br />

Ferrous and Non-<br />

Ferrous Metals<br />

Recovered Paper<br />

Environmental<br />

Services<br />

WEEE<br />

Aluminium<br />

The Ferrous and Non-<br />

Ferrous Metals business<br />

area collects and<br />

processes ferrous and<br />

non-ferrous scrap.<br />

Recovered paper, plastics<br />

and other wastes are<br />

collected and processed<br />

by the Recovered Paper<br />

business area.<br />

The Environmental<br />

Services business area<br />

handles hazardous waste<br />

from industry, health and<br />

dental care providers, the<br />

photography and graphic<br />

arts sectors, and offi ces.<br />

Through the WEEE<br />

business area, <strong>Stena</strong><br />

collects and recycles<br />

end-of-life electrical and<br />

electronic equipment.<br />

The Aluminium business<br />

area manufactures<br />

secondary aluminium<br />

from scrap for delivery to<br />

foundries and steel mills.<br />

Sweden<br />

Denmark<br />

Norway<br />

Finland<br />

Poland<br />

Russia<br />

<strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> operations<br />

Operations via partners<br />

Other business areas and operations<br />

Steel<br />

In this business area,<br />

<strong>Stena</strong> Stål trades in steel<br />

and offers pre-treatment<br />

of steel products and<br />

fl ame-cut plate.<br />

In this business area,<br />

<strong>Stena</strong> Oil trades in oil<br />

and supplies bunker oil<br />

to ships.<br />

Oil Trading Finance<br />

In the Trading business<br />

area, <strong>Stena</strong> Metal Inc.<br />

trades internationally in<br />

ferrous and non-ferrous<br />

products and other<br />

metallurgical raw<br />

materials.<br />

The <strong>Group</strong>’s financial<br />

operations comprise this<br />

business area.<br />

Environmental<br />

Technology<br />

<strong>Stena</strong> Miljöteknik is a<br />

development company<br />

that manages and<br />

coordinates development<br />

projects within the <strong>Stena</strong><br />

<strong>Metall</strong> <strong>Group</strong>.<br />

7

Advances in recycling<br />

More recycling, less landfilling<br />

The volume of waste that can be recycled instead of disposed<br />

in landfills has increased dramatically in many countries,<br />

including Sweden, in the last five years. This has been made<br />

possible through research and development projects, investment<br />

willingness, training, new laws and greater environmental<br />

awareness. Europe is becoming a “landfilling-free” society<br />

where waste resources are better utilized. The only sustainable,<br />

long-term solution is to use today’s products as the raw<br />

material for tomorrow.<br />

Conserving limited resources<br />

Resource conservation means, among<br />

other things, utilizing our shared natural<br />

resources in the best way possible. Important<br />

raw materials from mines, forests and<br />

oil reserves are used in various products<br />

and circulate through society and the ecocycle.<br />

When cars, computers, newspapers<br />

and other things we use become waste, the<br />

next challenge awaits: to recycle as much<br />

as possible and produce raw material for<br />

new products. In this way, we can reuse<br />

the material in circulation in society. For<br />

example, iron and other metals can be<br />

reused an unlimited number of times.<br />

Recovered paper can be recycled six or<br />

seven times. The water in hazardous waste<br />

can often be treated and released back into<br />

nature.<br />

Of course, there are also wastes that<br />

have been difficult to recycle earlier either<br />

because it has not been profitable or the<br />

technology has not been available.<br />

Progress is clearly being made, and the<br />

trend in Europe is toward higher recycling<br />

rates and less waste disposed in landfills –<br />

and removed from the ecocycle. This is<br />

possible through cooperations between<br />

lawmakers, researchers, businesses and the<br />

public.<br />

Cooperation makes more<br />

recycling possible<br />

New directives and laws in the EU and its<br />

member states in recent years require increased<br />

recycling while at the same time<br />

raising landfill costs or restricting their use<br />

for various types of waste. Demands have<br />

also been tightened on landfill design.<br />

Industrial companies and other businesses<br />

have shown a commitment to<br />

Landfill waste in Sweden 1994–2004<br />

000 tons<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

94 95 96 97 98 99 00 01 02 03 04 year<br />

During the period 1994–2004 landfill waste declined by 59 percent. Reported<br />

volumes represent household waste, certain construction and demolition waste,<br />

and production waste. Mining waste is not included. The statistics cover municipal<br />

and certain industrial landfi lls.<br />

Source: Swedish Association of Waste Management<br />

8

Advances in recycling<br />

<strong>AB</strong> Gustavsberg manufactures bathroom ceramics in Vårgårda. Since 1998 its landfill waste has<br />

declined from 60 to 10 tons per year at the same time that production has increased. The company<br />

has demonstrated its commitment to the environment. Thanks to a total waste management<br />

solution from <strong>Stena</strong>, certain wastes now generate revenue instead of costs. Pictured, from left:<br />

Gunnar Samuelsson, maintenance director at Gustavsberg, and Carolina Larsson, <strong>Stena</strong>’s sales<br />

representative in Borås.<br />

Packaging consumption per capita and recycling rates in a number of EU member<br />

states<br />

182<br />

76<br />

114<br />

63<br />

161<br />

Germany Sweden Denmark Finland Spain Greece<br />

Packaging consumption per capita 2001, kg<br />

Recycled packaging waste 2001, %<br />

57<br />

Source: EU, European Environment Agency. The reason for the variation in recycling rates may<br />

be cultural differences, though also varying geographic conditions. Raising the recycling rate in<br />

a sparsely populated country can be a greater challenge because of the longer transportation<br />

distances involved.<br />

88<br />

47<br />

145<br />

44<br />

92<br />

33<br />

reducing landfill waste, and been successful<br />

in doing so. <strong>Stena</strong> has helped, for example,<br />

with training in sorting techniques<br />

and advice on how to reduce landfill waste<br />

at the source.<br />

For companies and organizations, <strong>Stena</strong><br />

has developed a wide range of products<br />

and services for a variety of needs. In this<br />

way, we can help more customers to<br />

adopt cost-effective and environmentally<br />

safe waste management and thereby reduce<br />

the waste they produce and that ends<br />

up in landfills. The Deposit-free concept<br />

provides customers with a total waste<br />

management solution comprising waste<br />

audits, recycling stations, transports, permits,<br />

training, sorting handbooks, Internet<br />

services, etc. They benefit by cutting<br />

waste management costs and instead<br />

creating value from their waste. Moreover,<br />

they gain a better understanding of waste<br />

management and obtain support to certify<br />

their businesses, monitor legislation and<br />

reach their environmental goals.<br />

Clearer policies help the industry<br />

<strong>Stena</strong> is continuously investing in new<br />

technology and processes to make recycling<br />

more resource-efficient and environmentally<br />

safe. This is done in all of <strong>Stena</strong>’s<br />

markets in the Nordic countries and<br />

Poland. In the section on research and<br />

development (page 14), we describe in<br />

more detail several current projects,<br />

co operations and networks that <strong>Stena</strong><br />

participates in.<br />

To maximize future efforts to reduce<br />

landfill waste, we need clear signals from<br />

decision-makers and legislators. The clearer<br />

the terms of environmental policies, the<br />

more effective the recycling industry can<br />

be in investing in new technology and services<br />

that make it possible to recycle more<br />

of the material that previously ended up in<br />

landfills when there was no alternative.<br />

9

Examples of recycling<br />

Recycling products with producer responsibility<br />

Appliances containing Freon<br />

Recycled material: Iron, aluminium, copper, cables, compressors<br />

and plastics.<br />

Energy recovery: PUR foam.<br />

Disposal: Mercury, oil in compressors, Freon and capacitors.<br />

Computers (PCs)<br />

Recycled material: Metals in circuit boards, chassis and cables.<br />

Energy recovery: Plastic parts.<br />

Disposal: Wastes (plastics, rubber, epoxy) resulting when metals are<br />

recycled in mechanical and metallurgical processes.<br />

Monitors<br />

Recycled material: Metals in circuit boards, chassis and cables, and<br />

glass in the picture tube.<br />

Energy recovery: Plastic housing.<br />

Disposal: Waste (plastics, rubber, epoxy, phosphor powder) resulting when<br />

metals are recycled in mechanical and metallurgical processes.<br />

Cars (from 2007)<br />

By 2007 the EU’s ELV directive will have been introduced by all EU<br />

member states and Norway. After removing fuel, motor oils and other<br />

liquids from an end-of-life vehicle, at least 85 percent of its weight will<br />

have to be recycled. A maximum of 5 percent of this can be energy<br />

recovery, why 80 % has to be recycled material.<br />

Recycled material: Ferrous and non-ferrous metals from the body and<br />

drive train.<br />

Energy recovery: Plastics, fibers, rubber and other materials from the<br />

interior and exterior.<br />

Disposal: Wood, rubber, dirt/gravel and certain plastics.<br />

10<br />

Pasi Alho dismantles auto glass at a demonstration in Jyväskylä, Finland,<br />

where <strong>Stena</strong> showed how end-of-life vehicles are recycled.<br />

▲

Markeringstext<br />

11

Competence development<br />

We are constantly striving to be better<br />

The commitment of our employees and their collective competence<br />

is one of the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’s biggest strengths.<br />

<strong>Stena</strong>’s employees are offered a broad range of training in waste<br />

management, IT and leadership. We are continually adding new<br />

employees with specialized competence.<br />

<strong>Stena</strong> tries to make it simple for customers<br />

through personal service and rapid response.<br />

With experience, knowledge and<br />

on-time deliveries, we strive to be the reliable<br />

choice. By being creative and coming<br />

up with new solutions, we also want to<br />

help our customers to develop. Our core<br />

values – Simplicity, Reliability and Development<br />

– summarize what we want to<br />

stand for in every interaction and everything<br />

we do. Even toward each other<br />

within the <strong>Group</strong>.<br />

Training for employees and customers<br />

We take a goal-oriented approach to competence<br />

development for employees in all<br />

our areas. This is one way to proactively<br />

stay a step ahead. Through customized<br />

training, <strong>Stena</strong> shows how waste management<br />

can be made more efficient and safer.<br />

We also provide training in global environmental<br />

issues and develop support for<br />

waste sorting through handbooks and online<br />

services.<br />

Systematic improvements<br />

Six Sigma is a process of systematic improvements<br />

with a strong focus on the<br />

customer. Eventually all companies and<br />

units within the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> will<br />

work in the same way to achieve improvements<br />

using Six Sigma. To date around<br />

seventy improvement projects have begun.<br />

We work actively with occupational<br />

health and safety issues in order to create<br />

safer workplaces. This has meant emergency<br />

exercises, safety analyses and preventive<br />

fire safety. Several companies in<br />

the <strong>Group</strong> have received OHSAS 18001<br />

occupational health and safety certification<br />

in recent years. With this management<br />

system, they can perform risk audits<br />

and establish goals and action plans.<br />

Systematic efforts to reduce sick leave<br />

absences in Sweden have produced results,<br />

and the trend is positive. <strong>Stena</strong> is encouraging<br />

its employees to stay healthy, for<br />

example, by offering everyone in Sweden<br />

an annual subsidy for wellness and exercise<br />

activities.<br />

Industry of the future<br />

Recycling is an industry of the future, and<br />

<strong>Stena</strong> plays an important role in society<br />

by processing and recycling as much<br />

waste as possible. Every day we handle<br />

huge volumes of waste composed of finite<br />

resources, converting it to new raw ma terial<br />

that can be reused in the ecocycle. In<br />

this way, we contribute to sustainable<br />

development.<br />

12

Competence development<br />

13

Research and development<br />

Efforts to improve recycling<br />

The <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> conducts research and development<br />

projects together with various partners. The aim is to develop<br />

new technology and processes that are commercially sustainable<br />

and environmentally sound.<br />

Christer Forsgren,<br />

Head of Technology and<br />

Environmental Science,<br />

<strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>.<br />

He is also President of<br />

<strong>Stena</strong> Miljöteknik, a<br />

development company<br />

that manages and<br />

coordinates development projects within<br />

the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>.<br />

Today’s products are<br />

tomorrow’s raw material<br />

New products and materials used in<br />

society, together with new laws, are creating<br />

challenges for the recycling industry.<br />

To ensure it can handle future waste in a<br />

commercially sustainable and environmentally<br />

safe manner, <strong>Stena</strong> engages in<br />

research and development in cooperation<br />

with colleges and universities, government<br />

authorities, organizations and the business<br />

community.<br />

Several of the <strong>Group</strong>’s companies also<br />

share their expertise with manufacturers<br />

that want to develop environmentally<br />

sound products. For example, they provide<br />

advice on choosing the right materials<br />

or how a product should be designed to<br />

facilitate recycling in the future.<br />

Unique technology to<br />

treat hazardous waste<br />

During the year <strong>Stena</strong> Miljø opened a<br />

unique facility near Bergen, Norway,<br />

where more than 95 percent of all types of<br />

hazardous waste – including oil emulsions,<br />

paint and solvents – can be treated<br />

using evaporation technology. The waste<br />

is processed in a way that produces purified<br />

water, which can be released back<br />

into nature, along with fuel, which can be<br />

used either to power the plant or sold as a<br />

high-grade waste-based energy source.<br />

The flexibility of the process makes it possible<br />

to treat customers’ hazardous waste<br />

effectively and in an environmentally safe<br />

manner.<br />

Helping the environment with<br />

Freon recycling<br />

During the year <strong>Stena</strong> Gotthard’s Freon<br />

recycling facility in Halmstad was modernized.<br />

With its new dismantling equipment,<br />

cleaner material can be recycled<br />

from end-of-life appliances. After treatment,<br />

the insulation in refrigerators and<br />

freezers now contains so little Freon that<br />

it can be used as an absorbent and fuel.<br />

Ozone-depleting Freon and Freon-free<br />

coolants in appliances are processed<br />

directly in a catalytic converter, which<br />

generates a high recycling rate.<br />

During the year <strong>Stena</strong> began using new technology that allows it to recycle more material from<br />

low-grade electronic waste. Pictured, from left: Christer Forsgren, <strong>Stena</strong>, and Oliver Lindqvist,<br />

Professor of Inorganic Chemistry at Chalmers, at the new facility in Halmstad.<br />

Improved recycling of electronic waste<br />

In Halmstad, new process stages have<br />

been added to recycle low-grade electronic<br />

waste (vacuum cleaners, radios, etc.) that<br />

is pretreated by <strong>Stena</strong> Technoworld. As a<br />

result, more material is recycled and less<br />

has to be incinerated or disposed in landfills.<br />

The new technology will also make it<br />

14

Research and development<br />

Three important European<br />

recycling goals:<br />

• Increase recycling rates<br />

• Decrease landfi ll waste volumes<br />

• Develop environmentally sound waste<br />

management techniques<br />

Examples of the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong>’s<br />

cooperations:<br />

Chalmers FRIST<br />

Chalmers FRIST – Forum for Risk<br />

Investigation and Soil Treatment – is<br />

Sweden’s only competence center for<br />

contaminated soil. FRIST is a strategic<br />

cooperation managed jointly by Renova<br />

and Chalmers University of Technology<br />

that fi nances research in various<br />

treat ment methods for contaminated soil.<br />

University of Kalmar<br />

Cooperation in leachate water treatment.<br />

Linköping University and Chalmers<br />

Long-term cooperation agreements have<br />

been signed with Linköping University and<br />

Chalmers University of Technology.<br />

The new treatment plant in Mongstad, outside Bergen, can handle more than 95 percent of all<br />

hazardous waste. Plant Manager Ole Jonny Nygård in the processing room where hazardous waste<br />

undergoes evaporation treatment.<br />

possible to recycle more plastics from for many years but are still used in old<br />

electronic waste in the future.<br />

power supply equipment. The Karlstad<br />

plant can treat material with unlimited<br />

Recycling picture tube glass<br />

PCB content and remove it from the ecocycle.<br />

In an ongoing EU LIFE-project,<br />

During the fiscal year <strong>Stena</strong> Technoworld<br />

acquired the German company Griag the goal is to develop effective methods to<br />

Glasrecycling AG, which uses a uniquely increase recycling from waste cable and<br />

effective technology to separate picture capacitors. The workplace environment is<br />

tube glass. Only a few years ago there was improved as well.<br />

no alternative to landfills. Now various<br />

grades of glass can be separated and supplied<br />

as a high-grade raw material, for Projects that contribute to safe workplaces<br />

Working for a safer, better environment<br />

instance, to picture tube manufacturers are a priority of the <strong>Group</strong>. This applies,<br />

around the world.<br />

for example, to CE labeling of equipment<br />

and improvements to accident and incident<br />

reports. Major investments have also<br />

EU LIFE project encourages recycling<br />

In Karlstad, <strong>Stena</strong> Gotthard operates a recycling<br />

facility for transformers, cables mentation plant in Halmstad, Sweden.<br />

been made in noise reduction at the frag-<br />

and capacitors. PCBs have been forbidden<br />

AGS<br />

AGS, Alliance for Global Sustainability, a<br />

global network of leading universities,<br />

businesses and opinion-makers that<br />

addresses issues of sustainable<br />

development.<br />

BLICC<br />

BLICC, The Business Leaders Initiative on<br />

Climate Change. Government authorities,<br />

decision-makers and international<br />

companies are working together to<br />

systematically reduce greenhouse gas<br />

emissions. BLICC issues information and<br />

opinions and publishes its accomplishments<br />

in an annual report.<br />

WWF<br />

<strong>Stena</strong> supports WWF, the global<br />

conservation organization, on various<br />

Baltic Sea projects as well as Nature<br />

Watch, an environmental training program<br />

for Swedish youth.<br />

15

Recycling<br />

16

Recycling | Sweden<br />

Recycling | Sweden<br />

The customer offering was expanded<br />

during the year with total waste management<br />

solutions and services for hazardous<br />

and production waste. Production<br />

capacity is expanding, and service is now<br />

provided conveniently for customers at<br />

nearly 100 locations nationwide.<br />

Boliden is one of the leading mining and<br />

smelting companies in the world. <strong>Stena</strong> Miljö<br />

takes care of oil and other wastes from its<br />

copper smelter outside Skellefteå, in Sweden.<br />

Markus Larsson, a driver for <strong>Stena</strong> Miljö,<br />

cleans out one of Boliden’s oil separators.<br />

Global demand for ferrous and non-ferrous<br />

scrap and recovered paper remained<br />

high during the fiscal year. <strong>Stena</strong> continued<br />

to develop services and offer more<br />

products. With new branches and production<br />

facilities, it can provide customized<br />

recycling services and specialized expertise<br />

at more locations close to customers. New<br />

industry-specific and customized waste<br />

management solutions were developed<br />

during the year. In the Norrland region,<br />

a continued focus on hazardous waste has<br />

made it possible to offer more services to<br />

the steel, mining and pulp industries,<br />

among other customers. Treatment processes<br />

for “other production waste,” e.g.,<br />

combustible waste, also developed positively.<br />

With a broader offering, higher<br />

volume and greater efficiency, <strong>Stena</strong><br />

performed well in an industry facing<br />

increased competition in every area.<br />

Tighter recycling laws<br />

Waste management and recycling are regulated<br />

by a growing array of laws. <strong>Stena</strong> is<br />

staying on top of this trend through significant<br />

investments in research and development,<br />

competence, new technology and<br />

equipment. The WEEE directive introduced<br />

in Sweden on August 13, 2005<br />

tightens requirements on recycling and<br />

envir onmentally safe treatment of electronic<br />

waste. <strong>Stena</strong> had already met the<br />

WEEE requirements. The ELV directive<br />

raises r ecycling requirements on end-oflife<br />

vehicles in the years ahead. Producer<br />

responsibility poses a challenge for both<br />

producers and the recycling industry to<br />

find effective, environmentally safe<br />

processes.<br />

Total solutions being developed<br />

Demand is growing for single suppliers<br />

that can offer specialist expertise and total<br />

waste management solutions. This trend is<br />

being accelerated by customers’ commitment<br />

to environmental work, tighter legal<br />

requirements and more restrictions on<br />

landfill waste. Businesses are continuously<br />

facing new waste problems.<br />

Deposit-free is a total waste management<br />

solution designed to help customers<br />

meet their environmental goals, comply<br />

with increasingly complex laws and report<br />

to government authorities. The Depositfree<br />

concept was developed in 1997 and<br />

has been used by hundreds of companies,<br />

from small local businesses to nationwide<br />

groups.<br />

Mediclean Optimal, a total waste management<br />

solution for the health care sector,<br />

is developing positively and simplifies<br />

waste management at hospitals.<br />

<strong>Stena</strong> Gotthard <strong>AB</strong><br />

President Monica Svenner<br />

<strong>Stena</strong> Scanpaper <strong>AB</strong><br />

President Lorentz Rondahl<br />

<strong>Stena</strong> Miljö <strong>AB</strong><br />

President Finn Konsberg<br />

<strong>Stena</strong> Technoworld <strong>AB</strong><br />

President Phär Oscár<br />

<strong>Stena</strong> Aluminium <strong>AB</strong><br />

President Torbjörn Hedberg<br />

17

Recycling | Sweden<br />

Ferrous and Non-Ferrous<br />

Metals<br />

Customers are increasingly looking for a<br />

single contractor to meet all their waste<br />

management needs in an effective and<br />

environmentally safe manner. During<br />

the year <strong>Stena</strong> Gotthard developed specific<br />

solutions for the power and automotive<br />

industries. New services and<br />

improved recycling systems have broadened<br />

the customer offering.<br />

Enhanced industry solutions<br />

Since 1997 <strong>Stena</strong> Gotthard has been continuously<br />

developing total waste management<br />

solutions for individual customers as<br />

well as entire industries with similar<br />

needs. During the fiscal year a concept for<br />

the power and automotive industries was<br />

added. In autumn 2005 a special program<br />

for auto dismantlers is planned. Through<br />

the years thousands of our customers’<br />

employees have received environmental<br />

training from <strong>Stena</strong> as part of the Depositfree<br />

total concept. During the fiscal year,<br />

for example, an entire group of over 1,000<br />

employees received training in waste sorting<br />

and global environmental issues. They<br />

stay better informed and motivated, and<br />

the value of the waste <strong>Stena</strong> then takes<br />

care of rises. Customer seminars and<br />

newsletters are also appreciated.<br />

<strong>Stena</strong> Gotthard <strong>AB</strong><br />

<strong>Stena</strong> Gotthard collects ferrous and nonferrous<br />

scrap and other production waste<br />

and processes it at 67 branches and production<br />

facilities in Sweden. Scrap fragmentation<br />

is done in Halmstad, Hallstahammar,<br />

Huddinge and Malmö. Appliance<br />

pre-disassembly and Freon recycling are<br />

also part of operations.<br />

Quality-assured raw material is supplied<br />

to steel mills, foundries, metal smelters<br />

and incineration plants.<br />

➥ www.stenagotthard.se<br />

Together with the Keep Sweden Tidy Foundation, <strong>Stena</strong> has run a successful campaign to collect<br />

scrap in agricultural regions. The end-of-life vehicles from the island Runmarö in the Stockholm<br />

archipelago shown above are being transported for recycling on the mainland.<br />

Through a web-based portal, customers <strong>Stena</strong> Gotthard’s competence and alliances<br />

can maintain control of their entire waste with automakers and disassemblers will<br />

management operations. This service helps produce a suitable organization and technological<br />

solutions to meet the producer<br />

them to meet the reporting requirements<br />

of various authorities and with their own responsibility requirements of the ELV<br />

environmental work.<br />

directive.<br />

ELV: a challenge<br />

Cleaning the countryside of scrap<br />

Current EU directives that affect the Another current cooperation involves the<br />

European recycling industry will require campaign to clean up scrap from rural<br />

increased recycling, reductions in landfill areas, which <strong>Stena</strong> Gotthard managed<br />

waste and environmentally safer waste together with the Keep Sweden Tidy<br />

management. One example is the ELV Foundation. Using an approach best<br />

(End-of-Life Vehicles) directive, whose described as “call and we’ll pick it up,”<br />

long-term goal is to raise from 85 to 95 the campaign had successfully led to more<br />

percent the average weight of a vehicle than 11,000 pickups as of August 2005.<br />

that has to be recycled by 2015. This is a This extensive clean-up will continue in<br />

challenge for <strong>Stena</strong> and others in the industry.<br />

Major investments are needed to<br />

2005/2006.<br />

develop processes that will allow us to<br />

recycle more. This includes complex<br />

material that combines plastics and other<br />

materials and is increasingly used by the<br />

auto industry.<br />

18

Recycling | Sweden<br />

New services and recycling systems<br />

New products and services are continuously<br />

being developed. One current example<br />

is the <strong>Stena</strong> Separator, which makes<br />

it possible to recycle the ferrous and nonferrous<br />

metals in incinerator ash. In this<br />

way, valuable material is returned to the<br />

ecocycle rather than disposed in landfills.<br />

<strong>Stena</strong> Gotthard has also continued to develop<br />

customized recycling systems with<br />

new types of containers and dumpsters.<br />

Price and volume trends<br />

Prices started the fiscal year with a rise,<br />

but then fell drastically during the spring<br />

and picked up during the summer of 2005<br />

due to fluctuating demand primarily from<br />

Asia. The major fluctuations also affected<br />

customers, who received less money for<br />

their scrap. For steel mills, this trend has<br />

meant lower prices for raw materials, but<br />

also fewer order bookings. Several European<br />

steel mills halted production for<br />

short periods of the year.<br />

<strong>Stena</strong> Gotthard’s market share is stable,<br />

and satisfactory earnings were achieved<br />

through efficiency improvements and volume<br />

increases. <strong>Stena</strong> Gotthard has held its<br />

position well in spite of continued tough<br />

competition. Its services for other production<br />

waste have grown strongly.<br />

Recovered Paper<br />

During the year <strong>Stena</strong> Scanpaper continued<br />

its efforts to enhance services for<br />

customers and the public by modernizing<br />

recycling stations and investing in<br />

new collection systems and total waste<br />

management solutions.<br />

High paper collection rates<br />

Total collections of recovered paper in<br />

Sweden passed 1,500,000 tons for the first<br />

time in 2004/2005, according to the Swedish<br />

Forest Industries Federation. The main<br />

reason is higher consumption. About 64<br />

percent of all paper used in Sweden is recycled,<br />

a high figure from an international<br />

perspective. Paper used by mills passed 2<br />

million tons for the first time. Raw material<br />

prices changed little during the year in<br />

Sweden and internationally. <strong>Stena</strong> Scanpaper’s<br />

total volumes developed well and its<br />

income was satisfactory. Recovered paper<br />

remains a sought-after raw material in the<br />

market.<br />

Trading operations were again intensive,<br />

and access to material was good for<br />

an extended period. <strong>Stena</strong> Scanpaper’s<br />

German sales company performed very<br />

positively in terms of both volume and<br />

income.<br />

<strong>Stena</strong>’s fragmentation plant in Huddinge.<br />

Total solutions for customers<br />

The effective and environmentally safe<br />

waste management solutions <strong>Stena</strong> Scanpaper<br />

offers helped it to establish cooperations<br />

with a number of large, nationally<br />

active customers during the year.<br />

The branch network is continuously<br />

growing, and a new recycling plant for recovered<br />

paper goes on stream in Malmö in<br />

autumn 2005.<br />

More and more customers are trusting<br />

<strong>Stena</strong> for more than just traditional recycling<br />

services, e.g., to train their employ-<br />

20

Recycling | Sweden<br />

ees in sorting techniques. Interest in these<br />

services is increasing.<br />

Collection volumes for plastics and<br />

other production waste such as combustible<br />

material rose significantly during the<br />

fiscal year. One example is shrink and<br />

stretch wrap, a material commonly used<br />

by retailers in packaging. Collected volumes<br />

are on the rise, and there is good<br />

sales potential for the raw material.<br />

Modernization of recycling stations<br />

<strong>Stena</strong> Scanpaper has continued to work<br />

intensely to modernize its recycling stations.<br />

In some cases it has installed level<br />

gauges in containers. When a container<br />

begins to fill up, a message is sent via the<br />

Internet. Containers can then be emptied<br />

efficiently and at the right time, which in<br />

itself has environmental benefits.<br />

<strong>Stena</strong> Scanpaper has invested in collection<br />

vehicles as well, to improve transport<br />

efficiency, broaden geographic reach and<br />

expand its fleet to include vehicles that not<br />

only handle recovered paper but also<br />

other production waste.<br />

The dairy company Arla Foods has its largest Nordic facility in Götene, where <strong>Stena</strong> takes care of all the<br />

waste through a total waste management solution. Pictured in the cheese storehouse are, from left,<br />

<strong>Stena</strong> sales representative Rolf Fälth and Kent Johansson, environmental engineer at Arla Foods.<br />

More contracts<br />

Contracts to coordinate recycling operations<br />

have grown in number and now<br />

cover around a hundred Swedish municipalities.<br />

The job entails coordinating everyone<br />

who utilizes recycling stations as<br />

well as responsibility for signage and other<br />

information. Another important job is<br />

to provide a call center where the public<br />

can ask questions.<br />

<strong>Stena</strong> Scanpaper<br />

<strong>Stena</strong> Scanpaper collects and processes<br />

paper, cardboard, plastics and other production<br />

wastes from industry, retailers,<br />

offi ces and households. The company<br />

has operations in 16 locations.<br />

➥ www.stenascanpaper.se<br />

Recovered paper at <strong>Stena</strong> Scanpaper’s branch in Halmstad being loaded directly on railway cars<br />

for shipment to Swedish paper mills.<br />

21

Recycling | Sweden<br />

Environmental Services<br />

Hazardous waste operations are growing<br />

strongly in Sweden. By expanding to<br />

new areas, <strong>Stena</strong> Miljö can offer customers<br />

environmental services and total<br />

waste management solutions in more<br />

regions.<br />

The mail order company Ellos in Borås utilizes a total waste management solution from <strong>Stena</strong>.<br />

Pictured, from left, are Conny Karlsson, head of internal services at Ellos, and Morgan Larsson,<br />

<strong>Stena</strong>’s local branch manager.<br />

In around 50 municipalities, <strong>Stena</strong> Scanpaper<br />

also provides cleaning services, an ing companies, property owners and resi-<br />

paper and packaging are offered to hous-<br />

important job since clean recycling stations<br />

motivate the public to sort their continued during the fiscal year in municidents.<br />

This focus on residential collections<br />

waste.<br />

palities where conditions allowed.<br />

During the year Pressretur, an organization<br />

of major newsprint producers, Confidential document destruction<br />

accepted tenders for newspaper collections.<br />

<strong>Stena</strong> Scanpaper was successful in document destruction service. Specially<br />

<strong>Stena</strong> MDS is <strong>Stena</strong> Scanpaper’s mobile<br />

securing contracts with some 70 municipalities,<br />

thereby remaining one of the material on site at customer facilities. In<br />

equipped vehicles destroy confidential<br />

country’s largest newsprint recyclers. autumn 2005 a new vehicle with greater<br />

capacity will be placed in service, making<br />

Collections close to residents<br />

it possible to offer the service to more<br />

<strong>Stena</strong> Scanpaper is constantly bringing its customers.<br />

collection services closer to residents.<br />

Custom-designed systems for recovered<br />

Good potential in hazardous waste<br />

The potential in the Scandinavian hazardous<br />

waste market is good, and <strong>Stena</strong>’s volume<br />

continues to rise. Total volume in the<br />

market is otherwise relatively unchanged.<br />

At the same time that more types of waste<br />

are being classified as hazardous, many<br />

companies and other organizations are being<br />

successful in reducing their waste.<br />

The market is mature, and the ability to<br />

offer value-added to customers is critical<br />

to growth.<br />

With good service, total waste management<br />

solutions, broad-based operations<br />

and well-developed treatment methods,<br />

<strong>Stena</strong> Miljö is positioned to meet the competition.<br />

More customers are demanding<br />

total solutions in which a single provider<br />

takes responsibility for all their waste<br />

management. The increasingly stringent<br />

requirements authorities are placing on<br />

hazardous waste treatment are accelerating<br />

this trend.<br />

The rapid digitalization of society has<br />

drastically reduced the volume of photochemicals<br />

in recent years. This slowdown<br />

is expected to level off in the years ahead.<br />

Expanding branch network improves<br />

customer service<br />

The expansion in Norrland continued<br />

during the fiscal year, and in early 2005<br />

Rörsanering i Luleå <strong>AB</strong> was acquired. As<br />

a result, <strong>Stena</strong> Miljö can offer sewer and<br />

22

Recycling | Sweden<br />

drain cleaning and sludge removal, as well<br />

as services for the steel, mining, pulp and<br />

power industries in Luleå, Kiruna and<br />

their surroundings.<br />

A new service added in the hazardous<br />

waste sector is preventive maintenance of<br />

property drains. The business, which was<br />

started in Norrland, offers good development<br />

potential and complements the rest<br />

of the customer offering.<br />

Capacity at the facility in Åmål has<br />

been increased through the addition of an<br />

evaporation process. This, together with<br />

the cooperation with other <strong>Stena</strong> <strong>Metall</strong><br />

<strong>Group</strong> companies in the region, has created<br />

good prospects to offer total waste<br />

management solutions.<br />

In Eskilstuna, a new branch will be<br />

placed in service in autumn 2005 for intermediate<br />

storage and pretreatment of hazardous<br />

waste.<br />

Positive for health care services<br />

<strong>Stena</strong> Miljö is a leading processor of medical<br />

and dental waste. Volume rose during<br />

the year, and the Mediclean concept is<br />

now being used by a majority of the country’s<br />

hospitals. The expanded Mediclean<br />

Optimal service covers not only medical<br />

waste but also other production waste<br />

such as scrap, paper and electronics. Mediclean<br />

Optimal continues to develop positively.<br />

Online information support<br />

<strong>Stena</strong> Miljö offers training and information<br />

support in the form of a Digital<br />

Waste Handbook used by customers in<br />

<strong>Stena</strong> Miljö <strong>AB</strong><br />

<strong>Stena</strong> Miljö collects and processes hazardous<br />

waste from industry, offi ces, municipalities,<br />

the health care sector, printers<br />

and photo labs. It has operations in a<br />

dozen locations in Sweden.<br />

➥ www.stenamiljo.se<br />

Hazardous waste operations are growing strongly in Sweden. Jan Landen (above) is in charge of<br />

<strong>Stena</strong> Miljö’s warehouse in Malmö.<br />

the healthcare sector and industry. By going<br />

online, customers’ employees can find<br />

up-to-date information on laws and permits<br />

and receive support with sorting,<br />

labeling and packaging. The handbook is a<br />

valuable tool used on a daily basis by organizations<br />

with large staffs or geographically<br />

diverse operations. In a short time<br />

the service has attracted more than 5,000<br />

users. In the future it will be offered to<br />

The Digital Waste Handbook is an online<br />

customers in other industries.<br />

service used by customers to improve the<br />

effi ciency of their waste management.<br />

23

Recycling | Sweden<br />

The WEEE business area<br />

For 13 years the <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> has<br />

gained competence and experience in<br />

electronics recycling, and it is now one of<br />

Europe’s leaders in the fi eld. <strong>Stena</strong><br />

meets all the requirements in the WEEE<br />

directive (Waste Electrical and Electronic<br />

Equipment).<br />

<strong>Group</strong>-wide cooperation through the<br />

WEEE business area in the Nordic countries<br />

and Poland is enhancing customer<br />

service and leading to more effi cient, environmentally<br />

safer processes for collection<br />

and dismantling.<br />

During the fi scal year electronics recycling<br />

was started up in several new countries.<br />

In Poznan, Poland, a new facility for<br />

electronics and dismantling was opened.<br />

In Germany, <strong>Stena</strong> acquired Griag Glasrecycling,<br />

which recycles picture tube glass.<br />

In Vienna, Austria, it acquired electronics<br />

recycler Ecotronics Eco-effi cient Electronics<br />

and Services.<br />

The WEEE directive requires EU member<br />

states to introduce laws regulating<br />

end-of-life electrical and electronic equipment.<br />

It mandates produce responsibility,<br />

tighter requirements on safe processing<br />

and higher recycling rates for electronic<br />

waste.<br />

WEEE covers computers, printers, monitors,<br />

mobile phones, stereos, televisions,<br />

refrigerators and freezers, among other<br />

things.<br />

WEEE<br />

<strong>Stena</strong> Technoworld’s operations are developing<br />

strongly, with refined processes<br />

making it possible to recycle more electrical<br />

and electronic waste. Volume continues<br />

to rise and tighter recycling requirements<br />

in the EU will create new<br />

business opportunities in the years<br />

ahead.<br />

For years <strong>Stena</strong> has maintained a productive<br />

cooperation with El-Kretsen, a producer-owned<br />

material company with the<br />

highest volume of electronic waste in<br />

Sweden. A new agreement signed with El-<br />

Kretsen after the summer of 2005 stretches<br />

until autumn 2007 and ensures that <strong>Stena</strong><br />

Technoworld will remain a major player<br />

in the market.<br />

Through various proven collection systems<br />

such as GreenCollect and Techno-<br />

Box, the service can be customized to include<br />

electronics bins, transports,<br />

transportation documents and statistical<br />

feedback. During the year the collection<br />

concept was refined for customers in the<br />

Nordic countries and Poland.<br />

Cooperations with <strong>Stena</strong>’s other recycling<br />

companies and total waste management<br />

solutions have helped <strong>Stena</strong> Technoworld<br />

to raise its volume.<br />

Tighter EU requirements<br />

With 13 years of experience, the <strong>Stena</strong><br />

<strong>Metall</strong> <strong>Group</strong> has proven expertise in electronics<br />

recycling and is one of Europe’s<br />

leaders in the field. This gives it good<br />

prospects when the EU’s WEEE directive<br />

is introduced by member states beginning<br />

in autumn 2005.<br />

The directive requires increased recycling<br />

and environmentally safe processing<br />

of electrical and electronic waste. <strong>Stena</strong><br />

welcomes this development, which will<br />

lead to more consistent competitive conditions<br />

in Europe.<br />

The WEEE directive was introduced in<br />

Sweden on August 13, 2005, and <strong>Stena</strong><br />

Technoworld is cooperating directly with<br />

several electronics manufacturers.<br />

Process development<br />

Prices in the electronic waste market have<br />

faced stiff pressure for several years.<br />

Cost-effective processes to collect,<br />

transport, dismantle and sell recovered<br />

material are continuously being developed.<br />

In a number of ongoing research<br />

and development projects (see page 14),<br />

the aim is to develop effective techniques<br />

to recycle more material from WEEE in<br />

the future.<br />

One successful example concerns picture<br />

tube glass, where processes have been<br />

improved. Conical and monitor glass in<br />

the picture tube are separated and reused<br />

as a high-quality raw material by picture<br />

tube manufacturers.<br />

From left: Detlef Oertel, President of Griag<br />

Glasrecycling AG, and Hans Fredriksson,<br />

Business Controller, <strong>Stena</strong> Technoworld,<br />

examine picture tube glass being stored<br />

for recycling.<br />

<strong>Stena</strong> Technoworld <strong>AB</strong><br />

<strong>Stena</strong> Technoworld recycles end-of-life<br />

electronics at dismantling facilities in<br />

Bräkne-Hoby and Västerås.<br />

➥ www.technoworld.se<br />

The <strong>Stena</strong> <strong>Metall</strong> <strong>Group</strong> is continuously<br />

developing processes to effi ciently and<br />

safely recycle electronics. Else-Gun Karlsson<br />

dismantles a scanner at <strong>Stena</strong> Technoworld in<br />

Bräkne-Hoby, Sweden.<br />

▲<br />

24

Recycling | Sweden<br />

Smelt aluminium is molded into bars that can<br />

then be supplied to customers.<br />

Aluminium<br />

To improve service for the steel industry,<br />

Boxholms Aluminiumåtervinning<br />

was acquired during the fiscal year.<br />

Thanks to significant investments in<br />

technology in recent years, <strong>Stena</strong> Aluminium<br />

can offer customers the market’s<br />

highest product quality.<br />

<strong>Stena</strong> Aluminium today offers over 400<br />

customized aluminium alloys primarily to<br />

suppliers of the automotive, electronics,<br />

furniture and engineering industries.<br />

Volume was positive during the year, and<br />

the company raised its market share in<br />

Sweden, laying the foundation for further<br />

growth in the years ahead.<br />

New technology strengthens customer<br />

offering<br />

In recent years <strong>Stena</strong> Aluminium has added<br />

new smelting furnaces at its plant in<br />

Älmhult that offer numerous benefits in<br />

terms of efficiency, customer value and<br />

environmental safety. More raw scrap can<br />

be utilized and returned to the ecocycle,<br />

energy consumption has been reduced<br />

drastically, and the technology makes it<br />

possible to offer customers alloys with a<br />

high, consistent quality. In addition,<br />

employees now have a better working<br />

en vironment.<br />

<strong>Stena</strong> Aluminium’s production technology<br />

is identical at its plants in Älmhult in<br />

Sweden and Kolding, Denmark. This<br />

makes it possible to offer customers the<br />

same product quality from both facilities.<br />

The company’s operations in Denmark<br />

are described on page 33.<br />

Improved service for the steel industry<br />

In autumn 2005 <strong>Stena</strong> Aluminium ac -<br />

quir ed Boxholms Aluminiumåtervinning,<br />

a smelter that manufactures specialized<br />

aluminium products used by the steel industry<br />

to ensure end products with a high<br />

level of purity and quality. The acquisition<br />

makes <strong>Stena</strong> Aluminium Scandinavia’s<br />

leading producer and supplier of aluminium<br />

for steel industry.<br />

Important <strong>Group</strong> cooperation<br />

The cooperation with the <strong>Stena</strong> <strong>Metall</strong><br />

<strong>Group</strong>’s other recycling companies is important<br />

to <strong>Stena</strong> Aluminium’s production<br />

volume. Moreover, it makes it possible to<br />

offer total waste management solutions to<br />

<strong>Stena</strong> Aluminium’s customers.<br />

<strong>Stena</strong> Aluminium <strong>AB</strong><br />

<strong>Stena</strong> Aluminium is the leading supplier<br />

of recycled aluminium in Scandinavia. In<br />

Sweden, production facilities are located<br />

in Älmhult and Boxholm. By using recycled<br />

aluminium as a raw material instead<br />

of new bauxite, the energy consumed in<br />

production is reduced by 95 percent.<br />

➥ www.stenaaluminium.com<br />

Byarums Bruk in Småland manufactures park<br />

and lawn furniture. From left: <strong>Stena</strong> Aluminium<br />

sales representative Elisabeth Gustafsson and<br />

Hans Pruth, president and owner of Byarums<br />

Bruk, examine an aluminium frame for an outdoor<br />

bench.<br />

▲<br />

26

Återvinning ❘ Sverige<br />

27

Recycling | Denmark<br />

Recycling | Denmark<br />

With specialized expertise in ferrous<br />

and non-ferrous scrap, recovered paper,<br />

hazardous waste and electronic waste,<br />

<strong>Stena</strong> can offer customers in Denmark a<br />

wide range of recycling and consulting<br />

services.<br />

In autumn 2005 a new processing facility for<br />

ferrous and non-ferrous scrap was opened in<br />

Frederikshavn.<br />

Expanded customer service<br />