California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

California Comprehensive Annual Financial Report - City of Temecula

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

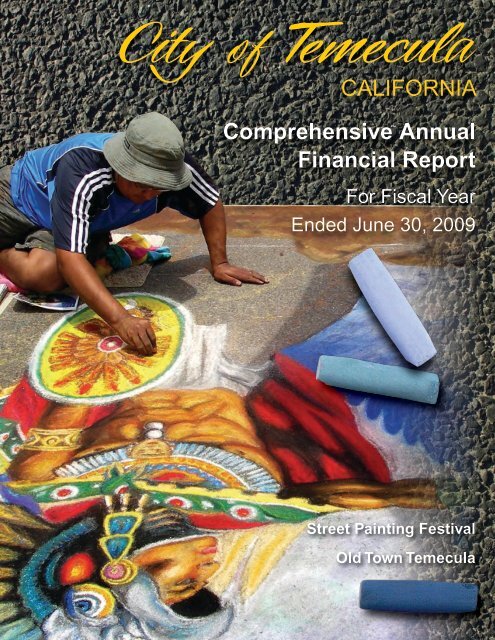

<strong>City</strong> <strong>of</strong> Te m e c u<br />

<strong>California</strong><br />

<strong>Comprehensive</strong> <strong>Annual</strong><br />

<strong>Financial</strong> <strong>Report</strong><br />

For Fiscal Year<br />

Ended June 30, 2009<br />

Street Painting Festival<br />

Old Town <strong>Temecula</strong>

CALIFORNIA<br />

<strong>Comprehensive</strong> <strong>Annual</strong><br />

<strong>Financial</strong> <strong>Report</strong><br />

FOR FISCAL YEAR ENDED<br />

JUNE 30, 2009<br />

MAYOR<br />

Maryann Edwards<br />

MAYOR PRO TEMPORE<br />

Jeff Comerchero<br />

COUNCIL MEMBERS<br />

Chuck Washington<br />

Ronald H. Roberts<br />

Michael S. Naggar<br />

CITY MANAGER<br />

Shawn D. Nelson<br />

Prepared by the Finance Department<br />

Genie Roberts, CPA<br />

Director <strong>of</strong> Finance

CITY OF TEMECULA<br />

COMPREHENSIVE ANNUAL FINANCIAL REPORT<br />

for Fiscal Year Ended June 30, 2009<br />

INTRODUCTORY SECTION<br />

TABLE OF CONTENTS<br />

Page<br />

Number<br />

Letter <strong>of</strong> Transmittal .................................................................................................... v<br />

Government Finance Officers Association Award ....................................................... xvii<br />

Organizational Chart ................................................................................................... xviii<br />

Staff Directory ............................................................................................................. xix<br />

FINANCIAL SECTION<br />

INDEPENDENT AUDITORS’ REPORT ...................................................................... 1<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS ..................................................... 3<br />

BASIC FINANCIAL STATEMENTS<br />

Government-Wide <strong>Financial</strong> Statements:<br />

Statement <strong>of</strong> Net Assets ........................................................................ 16<br />

Statement <strong>of</strong> Activities ........................................................................... 17<br />

Fund <strong>Financial</strong> Statements:<br />

Balance Sheet – Governmental Funds .................................................. 18<br />

Reconciliation <strong>of</strong> the Balance Sheet <strong>of</strong> Governmental Funds<br />

to the Statement <strong>of</strong> Net Assets .............................................................. 21<br />

Statement <strong>of</strong> Revenues, Expenditures and Changes in<br />

Fund Balances – Governmental Funds ................................................. 22<br />

Reconciliation <strong>of</strong> the Statement <strong>of</strong> Revenues, Expenditures<br />

and Changes in Fund Balances <strong>of</strong> Governmental Funds to<br />

the Statement <strong>of</strong> Activities ..................................................................... 24<br />

Budgetary Comparison Statement - General Fund ................................ 25<br />

Budgetary Comparison Statement - Community Services District ........ 26<br />

Budgetary Comparison Statement - Redevelopment<br />

Agency – Special Revenue .................................................................... 27<br />

Statement <strong>of</strong> Net Assets – Proprietary Funds ........................................ 28<br />

Statement <strong>of</strong> Revenues, Expenses and Changes in Fund<br />

Net Assets – Proprietary Funds ............................................................. 29<br />

i

CITY OF TEMECULA<br />

COMPREHENSIVE ANNUAL FINANCIAL REPORT<br />

for Fiscal Year Ended June 30, 2009<br />

TABLE OF CONTENTS<br />

Page<br />

Number<br />

Statement <strong>of</strong> Cash Flows – Proprietary Funds ...................................... 30<br />

Statement <strong>of</strong> Fiduciary Net Assets – Fiduciary Funds ........................... 31<br />

Notes to <strong>Financial</strong> Statements .......................................................................... 33<br />

SUPPLEMENTAL SCHEDULES<br />

COMBINING AND INDIVIDUAL FUND STATEMENTS AND SCHEDULES<br />

Combining Balance Sheet – Non-major Governmental Funds ......................... 68<br />

Combining Statement <strong>of</strong> Revenues, Expenditures and Changes in<br />

Fund Balances – Non-major Governmental Funds ........................................... 75<br />

Budgetary Comparison Schedules – Special Revenue Funds:<br />

Gas Tax ................................................................................................. 82<br />

State Transportation .............................................................................. 83<br />

Development Impact .............................................................................. 84<br />

CDBG .................................................................................................... 85<br />

AB 2766 ................................................................................................. 86<br />

AB 3229 COPS ...................................................................................... 87<br />

Measure “A” ........................................................................................... 88<br />

Summer Youth Employment Program ................................................... 89<br />

Budgetary Comparison Schedules – Capital Projects Funds:<br />

Capital Outlay ........................................................................................ 90<br />

Redevelopment Agency – Capital Projects ............................................ 91<br />

Budgetary Comparison Schedules – Debt Service Funds:<br />

Community Services District .................................................................. 92<br />

Debt Service Fund ................................................................................. 93<br />

Redevelopment Agency – Debt Service ................................................ 94<br />

Combining Statement <strong>of</strong> Net Assets – Internal Service Funds ......................... 96<br />

Combining Statement <strong>of</strong> Revenues, Expenses and Changes<br />

In Fund Net Assets – Internal Service Funds ................................................... 98<br />

Combining Statement <strong>of</strong> Cash Flows – Internal Service Funds ........................ 100<br />

Combining Balance Sheet – Agency Fund ....................................................... 104<br />

Combining Statement <strong>of</strong> Changes in Assets and Liabilities – Agency Fund ..... 105<br />

ii

STATISTICAL SECTION<br />

CITY OF TEMECULA<br />

COMPREHENSIVE ANNUAL FINANCIAL REPORT<br />

for Fiscal Year Ended June 30, 2009<br />

TABLE OF CONTENTS<br />

iii<br />

Page<br />

Number<br />

Description <strong>of</strong> Statistical Section Contents .................................................................. 107<br />

Locator Map ................................................................................................................ 109<br />

<strong>Financial</strong> Trends:<br />

Net Assets by Component – Last Ten Fiscal Years ............................................. 110<br />

Changes in Net Assets – Last Ten Fiscal years ................................................... 111<br />

Fund Balances <strong>of</strong> Governmental Funds – Last Ten Fiscal Years ......................... 112<br />

Changes in Fund Balances <strong>of</strong> Governmental Funds – Last Ten Fiscal Years ...... 113<br />

Government-Wide Revenues – Last Ten Fiscal Years ......................................... 114<br />

Government-Wide Expenses by Program – Last Ten Fiscal Years ...................... 115<br />

General Governmental Revenues by Source – Last Ten Fiscal Years ................. 116<br />

General Governmental Expenditures by Function – Last Ten Fiscal Years ......... 117<br />

Revenue Capacity:<br />

Property Tax Rates – Direct and Overlapping Governments –<br />

Last Ten Fiscal Years ........................................................................................... 119<br />

Principal Secured Property Owners – Last Ten Fiscal Years ............................... 120<br />

Property Tax Levies and Collections – Last Ten Fiscal Years .............................. 122<br />

Assessed and Estimated Actual Value <strong>of</strong> Taxable Property –<br />

Last Ten Fiscal Years ........................................................................................... 123<br />

Debt Capacity:<br />

Schedule <strong>of</strong> Direct and Overlapping Debt............................................................. 125<br />

Ratio <strong>of</strong> Outstanding Debt by Type – Last Ten Fiscal Years ................................ 126<br />

Ratio <strong>of</strong> General Bonded Debt – Last Ten Fiscal Years ....................................... 127<br />

Legal Debt Margin – Last Ten Fiscal Years .......................................................... 128<br />

Pledged Revenue Coverage – Last Ten Fiscal Years .......................................... 130<br />

Demographic and Economic Information:<br />

Demographic and Economic Statistics – Last Ten Calendar Years ...................... 131<br />

Largest Employers by Number <strong>of</strong> Employees ....................................................... 132<br />

Operating Information:<br />

Operating Indicators by Function .......................................................................... 133<br />

Full-Time <strong>City</strong> Employees – Last Ten Fiscal Years .............................................. 134<br />

Capital Asset Statistics by Function – Last Six Fiscal Years ................................ 135<br />

Comparative <strong>City</strong> Information –<br />

FY 2008-09 and FY 2007-08 Operating Budget ................................................... 136<br />

Demographics and Miscellaneous Statistics ......................................................... 137<br />

``````````````````````````````````````

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

43200 Business Park Drive<br />

P.O. Box 9033<br />

Telephone: 951-694-6444<br />

Facsimile: 951-694-6479<br />

December 10, 2009<br />

Honorable Mayor, Members <strong>of</strong> the <strong>City</strong> Council, and <strong>City</strong> Manager:<br />

The <strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong> <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> for the fiscal year<br />

ended June 30, 2009, prepared by the Finance Department, is submitted herewith. The<br />

responsibility for the accuracy <strong>of</strong> the data and the completeness and fairness <strong>of</strong> the<br />

presentation, including all disclosures, rests with the <strong>City</strong>. To the best <strong>of</strong> my knowledge<br />

and belief, the enclosed data is accurate in all material respects and is reported in a<br />

manner designed to present fairly the financial position and results <strong>of</strong> operations <strong>of</strong> the<br />

various major funds and fund types <strong>of</strong> the <strong>City</strong>. All disclosures necessary to enable the<br />

reader to gain an understanding <strong>of</strong> the <strong>City</strong>'s financial activities have been included.<br />

This report includes all funds <strong>of</strong> the <strong>City</strong>.<br />

Management <strong>of</strong> the <strong>City</strong> is responsible for establishing and maintaining an internal<br />

control structure designed to ensure the assets <strong>of</strong> the government are protected from<br />

loss, theft, or misuse, and to ensure that adequate accounting data is compiled to allow<br />

the preparation <strong>of</strong> financial statements in conformity with generally accepted accounting<br />

principles. The internal control structure is designed to provide reasonable, but not<br />

absolute, assurance that these objectives are met. The concept <strong>of</strong> reasonable<br />

assurance recognizes that: (1) the cost <strong>of</strong> the control should not exceed the benefits<br />

likely to be derived; and, (2) the valuation <strong>of</strong> costs and benefits requires estimates and<br />

judgments by management.<br />

Budgets are adopted annually by the <strong>City</strong> Council through resolution. As provided by<br />

<strong>City</strong> ordinance, the Director <strong>of</strong> Finance is responsible for preparing the budget and for<br />

its implementation after adoption. All appropriations lapse at year-end, except those<br />

approved for carryover. The <strong>City</strong> Manager has the legal authority to transfer operating<br />

budget appropriations within a department. Changes to total departmental<br />

appropriations require the majority approval <strong>of</strong> the <strong>City</strong> Council.<br />

The <strong>City</strong> maintains budgetary controls to ensure compliance with legal provisions<br />

embodied in the annual budget adopted by the <strong>City</strong> Council. The level <strong>of</strong> budgetary<br />

control (that is, the level at which expenditures cannot legally exceed the appropriated<br />

amount) is established at the department level.<br />

It is the policy <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> to have an audit performed annually by an<br />

independent certified public accountant. Lance, Soll & Lunghard, LLP, performed the<br />

independent audit <strong>of</strong> the June 30, 2009 financial statements. Their opinion is included<br />

with the basic financial statements.<br />

v

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

Management’s Discussion and Analysis (MD&A) immediately follows the independent<br />

auditor’s report and provides a narrative introduction, overview, and analysis <strong>of</strong> the<br />

basic financial statements. The MD&A complements this letter <strong>of</strong> transmittal and should<br />

be read in conjunction with it.<br />

THE CITY OF TEMECULA AND ITS SERVICES<br />

Following a vote by the residents on November 7, 1989, the <strong>City</strong> incorporated under the<br />

general laws <strong>of</strong> the State <strong>of</strong> <strong>California</strong>, on December 1, 1989. The <strong>Temecula</strong><br />

Community Services District (TCSD), also established at that time, is responsible for<br />

providing parks and recreation services to the citizens <strong>of</strong> <strong>Temecula</strong>, as well as street<br />

lighting, slope maintenance, and refuse hauling in certain areas <strong>of</strong> the District. The<br />

activities <strong>of</strong> the TCSD are included with the activities <strong>of</strong> the <strong>City</strong> for financial reporting<br />

purposes because the <strong>City</strong> Council, serving as the Board <strong>of</strong> Directors, has full<br />

accountability for the TCSD’s fiscal matters.<br />

The County <strong>of</strong> Riverside transferred responsibility for the <strong>Temecula</strong> Redevelopment<br />

Agency (RDA) to the <strong>City</strong> on July 1, 1991. The County established the project area in<br />

1988. The activities <strong>of</strong> the RDA are included with the activities <strong>of</strong> the <strong>City</strong> for financial<br />

reporting purposes, because the <strong>City</strong> Council, serving as the Board <strong>of</strong> Directors, has full<br />

accountability for the RDA’s fiscal matters.<br />

The Industrial Development Authority <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> (Authority) was activated<br />

on March 22, 1994. The purpose <strong>of</strong> the Authority is to provide alternative methods <strong>of</strong><br />

financing certain facilities in order to prevent the loss <strong>of</strong> existing jobs, increase<br />

employment opportunities, and otherwise contribute to the economic development <strong>of</strong><br />

the <strong>City</strong>. The activities <strong>of</strong> the Authority are included with the activities <strong>of</strong> the <strong>City</strong> for<br />

financial reporting purposes because the <strong>City</strong> Council, serving as the Board <strong>of</strong><br />

Directors, has full accountability for the Authority’s fiscal matters.<br />

The <strong>Temecula</strong> Public Financing Authority (TPFA) was established pursuant to a Joint<br />

Exercise <strong>of</strong> Powers Agreement, dated April 24, 2001, by and between the <strong>City</strong> and the<br />

Redevelopment Agency. The <strong>City</strong> and the Redevelopment Agency formed the TPFA<br />

for the primary purpose <strong>of</strong> assisting in the financing and refinancing <strong>of</strong> a community<br />

facilities district and the issuance <strong>of</strong> bonds necessary to finance the public<br />

improvements. The TPFA may establish other community facilities districts in the future<br />

in connection with the financing <strong>of</strong> public improvements in the <strong>City</strong> and could also be<br />

used in connection with other <strong>City</strong> and Agency financings.<br />

ACCOMPLISHMENTS<br />

Under the direction <strong>of</strong> the <strong>City</strong> Council and <strong>City</strong> Manager, department staff made<br />

significant strides toward the goals set forth for fiscal year 2008-09. The <strong>City</strong> Council<br />

adopted the revised Noise Ordinance; instituted the Mayor’s Youth Employment<br />

Program; established <strong>City</strong>/County Schools Partnership; established the Business<br />

Recognition Program; and established the <strong>Temecula</strong> Higher Education Foundation. In<br />

addition, the <strong>City</strong> partnered with Cal State University San Marcos to open an <strong>of</strong>f-campus<br />

center in <strong>Temecula</strong> in response to rapid enrollment growth from the region.<br />

vi

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

Construction was also completed the parking structure at the Promenade Mall,<br />

completed the Bike Trails Master Plan; completed the Liquid Natural Gas and<br />

Compressed Natural Gas Station; and began construction <strong>of</strong> the Parking Garage and<br />

Civic Center projects in Old Town <strong>Temecula</strong>. The <strong>City</strong> also received a rating upgrade<br />

from Standard & Poor’s on its outstanding 2008 Certificates <strong>of</strong> Participation, from an<br />

underlying A rating to an A+ rating. The <strong>City</strong>’s very strong fiscal position and balanced<br />

general fund operations were contributing factors to this rating upgrade. Other<br />

accomplishments include:<br />

Community Services:<br />

The Recreation Services Division successfully implemented key elements <strong>of</strong> the<br />

<strong>Temecula</strong> Youth Master Plan; planned, programmed and implemented four “rhythms”<br />

teen dances; successfully planned, programmed and implemented “Special Games”<br />

events for special needs youth; and enhanced the annual 4 th <strong>of</strong> July Extravaganza to<br />

include a Family Fun Play Area. Another outcome <strong>of</strong> the Youth Master Plan was the<br />

development and implementation <strong>of</strong> the Mayor’s Summer Youth Employment Program.<br />

This Division successfully obtained a $412,000 stimulus grant from the federal<br />

government and another $20,000 grant from Riverside County. During the summer<br />

2009, the Mayor’s Summer Youth Employment Program was responsible for the<br />

employment <strong>of</strong> over 250 young adults in summer jobs.<br />

The Community Services Division completed construction <strong>of</strong> the Murrieta Creek Trail<br />

project, completed the construction documents for Phase I <strong>of</strong> the Redhawk Park<br />

Improvements, and facilitated the construction <strong>of</strong> the YMCA building at the Margarita<br />

Community Park. The <strong>Temecula</strong> Public Library introduced the “Book Buzz” After<br />

School Reading Program; expanded outreach programs to children and staff at school<br />

campuses to provide library cards and book delivery on campus; and <strong>of</strong>fered twentyfour<br />

children’s programs per month and thirty teen programs per year through<br />

partnership with the Friends <strong>of</strong> the Library. Staff also completed the Trails and<br />

Bikeways Guide; organized two community clean ups, and three household hazardous<br />

waste events.<br />

The Maintenance Services Division is responsible for providing landscape and facility<br />

maintenance services for parks, medians, slope areas, recreation facilities, and <strong>City</strong><br />

administrative <strong>of</strong>fices. The Division maintains the 308 developed acres <strong>of</strong> parks and<br />

236.5 acres <strong>of</strong> perimeter landscaping and medians. During the past year, it completed<br />

numerous park and facility rehabilitation and repair projects, including Temeku Hills<br />

Park Split Rail Fence Replacement, Loma Linda Park Lighting Installation, Patricia H.<br />

Birdsall Sports Park Buildings Anti-Graffiti Coating; <strong>Temecula</strong> Middle School Sports<br />

Field Re-Lamping, <strong>Temecula</strong> Duck Pond Veterans Memorial Phase 3 Paver Installation,<br />

Margarita Community Park Tennis Court Windscreen Replacement, and various other<br />

repair projects. The Division also provided thorough construction plan review <strong>of</strong> the<br />

<strong>Temecula</strong> YMCA at Margarita Community Park, Murrieta Creek Multi-Purpose Trail<br />

Project, Old Town Civic Center Town Square, and the S.A.F.E. building. It also<br />

vii

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

completed construction oversight for the <strong>Temecula</strong> Civic Center Town Square,<br />

Pechanga Parkway Road Widening and Landscape Median, and Jefferson Road<br />

Median at the Marriott. The Program also completed the Veteran’s Memorial Paver<br />

Installation Phase 3, Kent Hintergardt Memorial Park Play Structure Replacement,<br />

Imagination Workshop Kitchen Improvements, and Ronald Regan Sports Park<br />

Dasherboard System and Scoreboard Installation.<br />

The Cultural Arts Division provides an array <strong>of</strong> cultural arts programs and activities that<br />

are both educational and entertaining for the community. During the past year, it<br />

<strong>of</strong>fered over 100 arts classes, excursions, youth Band Jam, and other after school<br />

activities. It also produced the annual Summer Concert and the Movies in the Park<br />

series. The Division also produced the 3rd annual Youth Film Festival, implemented six<br />

exhibitions at the <strong>Temecula</strong> Valley History Museum, facilitated the fountain and mosaic<br />

designs for the new Civic Center. It also received the <strong>California</strong> Parks and Recreation<br />

Society (CPRS) Award <strong>of</strong> Excellence in the category <strong>of</strong> “Single Focus Brochure” for the<br />

Theater and <strong>Temecula</strong> Presents.<br />

Public Works<br />

The Capital Improvement Program (CIP) <strong>of</strong> the Public Works Department is dedicated<br />

to providing high-quality engineering and project management services for the<br />

development, design, and construction <strong>of</strong> cost-effective circulation, infrastructure, park,<br />

and redevelopment projects that support and enhance the quality <strong>of</strong> life for residents,<br />

businesses, and visitors. Over the past year, this Program was responsible for the<br />

continued project management for the new parking structure and civic center projects in<br />

Old Town <strong>Temecula</strong>, as well as the related undergrounding <strong>of</strong> utilities and street and<br />

pavement improvements; completed the Murrieta Creek Multi-Purpose Trail; and is<br />

nearing completion <strong>of</strong> the Pechanga Parkway Phase II widening project. The CIP also<br />

completed design work for both the Rancho <strong>California</strong> Road and De Portola Road<br />

pavement rehabilitation projects, and awarded design and construction contracts for<br />

various <strong>City</strong>wide traffic signal installations and design <strong>of</strong> the Winchester Road<br />

Beautification project.<br />

The Maintenance Division provides a well-maintained public right-<strong>of</strong>-way system that<br />

supports the safe and efficient movement <strong>of</strong> vehicles and pedestrian traffic. The<br />

Division planted new street trees throughout residential neighborhoods under the “Trees<br />

for <strong>Temecula</strong>” tree planning program, provided support for various special events,<br />

maintained the public right-<strong>of</strong>-way areas and related drainage systems, completed<br />

70,000 square feet <strong>of</strong> pavement repairs, and cleaned 2,500 catch basins. The Division<br />

also provided emergency response through the Public Works “After-Hours Call-Out<br />

Program.”<br />

The Traffic Engineering Division is responsible for ensuring that the integrity <strong>of</strong> the<br />

<strong>City</strong>’s General Plan Circulation Element is maintained by improving traffic circulation,<br />

addressing safety related issues, and maintaining traffic signal operations. The Division<br />

conducts necessary traffic studies and prepares reports for the Traffic Safety<br />

viii

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

Commission, which makes recommendations to the <strong>City</strong> Council regarding traffic issues<br />

in the <strong>City</strong>. In addition, it also performed review <strong>of</strong> traffic impact analysis reports for<br />

proposed developments. During the past year, this Division, using the Closed Circuit<br />

Television (CCTV) cameras, monitored traffic signal coordination conditions from <strong>City</strong><br />

Hall, modified signal operations in the event <strong>of</strong> traffic incidents, and provided response<br />

assistance to Police Department, Maintenance, and CIP. The Division also installed<br />

and upgraded CCTV communication equipment at various locations to enhance,<br />

monitor, and improve traffic signal coordination capabilities on <strong>City</strong> arterials. The<br />

Division also implemented traffic signaling coordination programs along several<br />

corridors to improve traffic circulation, deployed additional hardwired and wireless traffic<br />

signal communication equipment to monitor traffic signal operations and improve<br />

progression along the <strong>City</strong>’s arterial corridors. The signal technicians developed and<br />

installed a working traffic signal lab in the <strong>City</strong> yard to be used for performing diagnostic<br />

testing <strong>of</strong> traffic signal controllers and equipment.<br />

The purpose <strong>of</strong> the National Pollutant Discharge Elimination System (NPDES) Program<br />

is to establish, implement, and maintain programs for the protection, preservation, and<br />

enhancement <strong>of</strong> water quality in <strong>Temecula</strong>’s local water courses. Over this past year,<br />

the NPDES Program worked with various resource agencies to address local and<br />

watershed-wide policies and practices to comply with State regulations, managed<br />

permit inspection requirements, and fulfilled training requirements for the inspection<br />

programs. It also managed the progress <strong>of</strong> the <strong>City</strong>’s GIS-based inventory <strong>of</strong> storm<br />

water conveyance systems, provided current NPDES information on the <strong>City</strong>’s website<br />

for customers, generated the annual report for the San Diego Regional Water Quality<br />

Control Board, and was an active member in various technical committees.<br />

Community Development<br />

The Land Development Division has reviewed, plan checked, and inspected numerous<br />

residential, commercial, and circulation improvement projects. They provided<br />

inspection services and engineering oversight <strong>of</strong> major projects such as the Harveston<br />

development, Pr<strong>of</strong>essional Hospital Supply expansion, various Old Town projects, and<br />

the Promenade Mall and Wal-Mart Expansion, as well as for various commercial and<br />

industrial developments. Staff also enforced compliance with NPDES and FEMA review<br />

and oversight programs.<br />

The Planning Division began development <strong>of</strong> the Old Town Specific Plan Amendment to<br />

address the ten goals and recommendations resulting from the community vision<br />

process and also began preparation <strong>of</strong> the related environmental impact report. It also<br />

reviewed and approved multiple development plan modifications for tenant facades<br />

within the Promenade Mall expansion and completed the <strong>California</strong> Environmental<br />

Quality Act (CEQA) Environmental Review Procedures Handbook for private<br />

development <strong>of</strong> CIP projects. The Planning Commission approved a new Mercedes<br />

Benz dealership and a new 125,000 square foot hotel. The Division also completed and<br />

circulated an environmental impact report for the Santa Margarita Annexation area and<br />

ix

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

submitted a Sphere and Influence Expansion and Annexation Application to the Local<br />

Agency Formation Commission (LAFCO). Additionally, it prepared the <strong>City</strong>’s first<br />

Heritage Tree and Small Wind Energy Conservation Ordinances, and began<br />

development <strong>of</strong> the <strong>Temecula</strong> Sustainability Plan, the Green House Emissions<br />

Inventory and Climate Action Plan, <strong>Temecula</strong> Energy Efficiency Improvement Program,<br />

and the Sustainable Communities Strategy.<br />

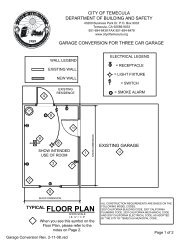

The Building and Safety Division automated its inspection processing through the use <strong>of</strong><br />

Accela Wireless technology, in addition to the automation for the processing <strong>of</strong><br />

Certificates <strong>of</strong> Occupancy. This technology also connected the combined resources <strong>of</strong><br />

the building inspectors and code enforcement <strong>of</strong>ficers in performing 18,912 building<br />

inspections.<br />

The Code Enforcement Division continued the enforcement <strong>of</strong> <strong>City</strong> Land Use Guidelines<br />

and <strong>City</strong> Municipal Codes, as well as the abatement <strong>of</strong> nuisances, which includes weed<br />

and abandoned vehicles. The Division implemented Accela Wireless systems for report<br />

monitoring and managing the investigation process for all Code Enforcement Officers<br />

and Park Rangers. It also improved enforcement <strong>of</strong> case documentation and record<br />

keeping practices for foreclosed properties in correlation with the Geographic<br />

Information System (GIS).<br />

Fire Services<br />

The <strong>Temecula</strong> Fire Department has continued to respond to all types <strong>of</strong> fires, medical<br />

emergencies, vehicle collisions, hazardous materials spills, and public assists within the<br />

<strong>City</strong>. The Department is dedicated to protect life, property, and the environment<br />

throughout the <strong>City</strong>. This is accomplished through a comprehensive emergency service<br />

response program utilizing a highly trained work force, progressive technology, and<br />

modern equipment. Fire prevention education also remains a priority, and Fire<br />

personnel attend numerous public safety fairs and community events to educate and<br />

promote fire safety. Fire protection planning staff performed plan checks and<br />

inspections on the many new development projects occurring within the <strong>City</strong> and have<br />

continued development <strong>of</strong> the <strong>Annual</strong> Fire Life Safety Program.<br />

Police Services<br />

The <strong>Temecula</strong> Police Department continued to respond effectively to the law<br />

enforcement and public safety demands <strong>of</strong> this growing <strong>City</strong>. Police maintained a<br />

strong presence in the community with a ratio <strong>of</strong> one <strong>of</strong>ficer for every 910 residents.<br />

The Department continues to be involved in many community special events and<br />

educational programs directed at crime prevention and community outreach. The<br />

Police Activities League (P.A.L.) continues to join together <strong>of</strong>ficers and <strong>Temecula</strong> youth<br />

(ages 7-17). The goal is to provide a variety <strong>of</strong> activities to keep the kids <strong>of</strong>f the streets<br />

and to teach respect for law enforcement. The Department was awarded $98,000 in<br />

grants from the <strong>California</strong> Office <strong>of</strong> Traffic Safety and Department <strong>of</strong> Alcoholic Beverage<br />

Control to increase enforcement <strong>of</strong> DUI and underage drinking violations.<br />

x

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

The Department's Crime Prevention Unit continued to provide crime prevention training<br />

and services to <strong>City</strong> residents and businesses. Much <strong>of</strong> this was accomplished by<br />

heading local Neighborhood Watch and Business Watch organizations and working<br />

closely with local businesses. These crime prevention <strong>of</strong>ficers work closely with other<br />

<strong>City</strong> staff in advance <strong>of</strong> planning for a variety <strong>of</strong> special events held in the <strong>City</strong> each<br />

year, and assists in the processing and issuance <strong>of</strong> a variety <strong>of</strong> <strong>City</strong>-required permits.<br />

Business and Industry<br />

The <strong>City</strong> is headquarters to a wide array <strong>of</strong> corporations and entrepreneurial operations.<br />

As <strong>Temecula</strong>’s economic base diversifies, <strong>Temecula</strong> actively nurtures the development<br />

<strong>of</strong> industry clusters. These industries represent some <strong>of</strong> the best opportunities for<br />

quality job creation.<br />

• Biomedical/Biotech<br />

• Health technology/manufacturing<br />

• Telecommunications<br />

• Electronics<br />

• Semiconductor Manufacturing<br />

• High-Tech manufacturing<br />

• Tourism<br />

• Retail<br />

• Green Technology/Solar<br />

• Aerospace<br />

Economic Development<br />

<strong>Temecula</strong> is one <strong>of</strong> the most prosperous communities in the Inland Empire region.<br />

<strong>Temecula</strong> residents enjoy one <strong>of</strong> the finest life styles in Southern <strong>California</strong>. A variety <strong>of</strong><br />

factors are behind this including geography, which plays a role due to the <strong>City</strong> receiving<br />

growth impulses from both San Diego and Orange Counties. A mountain gap that<br />

allows ocean breezes to flow into the <strong>City</strong> provides a moderate climate by Inland Empire<br />

standards and has permitted the development <strong>of</strong> award winning wineries. <strong>Temecula</strong>’s<br />

leadership has approached economic growth from a qualitative standpoint, providing the<br />

<strong>City</strong> with a large percentage <strong>of</strong> the Inland Empire’s higher paying and high technology<br />

firms, as well as an expansive industrial base. The <strong>City</strong>’s average income levels are<br />

higher than the surrounding region. The educational performance <strong>of</strong> its young people is<br />

above State averages, and <strong>Temecula</strong> is one <strong>of</strong> Southern <strong>California</strong>’s safest cities. In<br />

2009, The <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> was recognized by Relocate-America.com as one <strong>of</strong> the<br />

“Top 100 Places to Live”, based on its prospects for future growth, the business climate,<br />

and local government.<br />

xi

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

The <strong>City</strong> continues its efforts to grow and sustain the economy <strong>of</strong> <strong>Temecula</strong> through<br />

business attraction, retention, workforce development, higher education, tourism and<br />

film. The <strong>City</strong> partners with the Chamber <strong>of</strong> Commerce, Convention and Visitors<br />

Bureau, Riverside County Economic Development Agency, Riverside County Workforce<br />

Development Agency, Inland Empire Film Commission, and Economic Development<br />

Corporation <strong>of</strong> Southwest <strong>California</strong>. These alliances create synergy by leveraging<br />

assets and resources necessary to reinforce our markets. The <strong>City</strong> has also worked to<br />

develop and market <strong>Temecula</strong> as a tourist destination and continues to promote large<br />

scale events to attract visitors from other areas. Plans have begun for the construction<br />

<strong>of</strong> the new <strong>Temecula</strong> Regional Hospital project. This hospital will be the first hospital<br />

within the <strong>City</strong> to serve the medical needs <strong>of</strong> residents. Pr<strong>of</strong>essional Hospital Supply<br />

(PHS), the <strong>City</strong>’s largest sales tax generating business, recently added over 600,000<br />

square feet <strong>of</strong> space, which is anticipated to result in increased sales tax to the <strong>City</strong>, as<br />

well as 20%-30% growth in jobs over the next five years. Abbott Laboratories recently<br />

added over 300,000 square feet with the completion <strong>of</strong> two new buildings, including<br />

<strong>of</strong>fice, lab, manufacturing space, and a parking structure. Springhill Suites, a new 142<br />

unit hotel, recently opened in the <strong>City</strong> and will provide visitors with another opportunity<br />

to enjoy their stay in the <strong>Temecula</strong> Valley and the Planning Commission has approved a<br />

new 168 room hotel, as well as a new Mercedes-Benz dealership. The recent 125,000<br />

square foot expansion <strong>of</strong> the Promenade Mall added upscale retail shops and<br />

restaurants, road improvements, and two parking structures. Businesses have been<br />

attracted to <strong>Temecula</strong> for a number <strong>of</strong> reasons, including its highly skilled labor force,<br />

school system, close proximity to San Diego, Los Angeles, and Orange Counties,<br />

quality and affordable housing, and excellent quality <strong>of</strong> life. The <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> is<br />

also committed to providing excellent, expeditious, and clear development guidance to<br />

companies located or planning to locate to <strong>Temecula</strong> throughout the development<br />

process.<br />

The <strong>City</strong> is a major retail hub along the Interstate 15 corridor and continues to promote<br />

to help lure high-end retail and restaurants. The <strong>City</strong> remains engaged in business<br />

retention and expansion efforts and supports the <strong>Temecula</strong> Valley Chamber <strong>of</strong><br />

Commerce’s “Shop <strong>Temecula</strong> First” campaign. The <strong>City</strong> continues to work with<br />

colleges and universities to develop multiple higher education opportunities. <strong>Temecula</strong><br />

Valley Unified School District recently approved a ten-year lease with <strong>California</strong> State<br />

University San Marcos to utilize a portion <strong>of</strong> a vacated elementary school campus. In<br />

conjunction with the lease, the <strong>City</strong> approved funding in the amount <strong>of</strong> $3 million to<br />

provide the needed tenant improvements and development costs for the facility.<br />

<strong>California</strong> State University San Marcos anticipates construction to commence after<br />

January 2010 and the facility to be operational by the fall <strong>of</strong> 2010.<br />

Housing and Redevelopment<br />

The <strong>Temecula</strong> Redevelopment Agency activities during fiscal year 2008-09 included the<br />

acquisitions <strong>of</strong> eleven very-low income units conveyed to the Agency as part <strong>of</strong> the<br />

negotiations that took place with the developer in the previous fiscal year. The Agency<br />

then put out a Request for Proposal for the sale <strong>of</strong> those housing units to qualified<br />

affordable housing organizations. An affordable housing partner was chosen and the<br />

eleven units were subsequently sold to Jamboree Housing.<br />

xii

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

The Agency also entered into an Exclusive Negotiating Agreement with Clearwater<br />

Development for the sale <strong>of</strong> approximately twenty acres <strong>of</strong> land owned by the Housing<br />

Set-Aside Fund. The Agency entered into negotiations with a large affordable housing<br />

developer for the development <strong>of</strong> 110 affordable housing units with a mix <strong>of</strong> moderate,<br />

family affordable, and senior housing. The Agency extended the Exclusive Negotiating<br />

Agreement with Pelican Properties for the development <strong>of</strong> the 52,000 square foot<br />

commercial space adjacent to the Civic Center currently under construction. The<br />

Agency purchased land in the Pujol Neighborhood for the eventual construction <strong>of</strong> two<br />

additional Habitat for Humanity homes that will join five existing Habitat for Humanity<br />

homes.<br />

The Agency continued with its ongoing programs funding $88,536 in forgivable loans<br />

and grants for the Residential Improvement program, $63,649 for the Façade<br />

Improvement Program, and $200,494 for the First Time Homebuyer’s Program.<br />

Finally, the Agency assisted expansion <strong>of</strong> the Promenade Mall through bonds sold in<br />

the prior fiscal year, which resulted in the construction <strong>of</strong> two new parking structures, as<br />

well as the construction <strong>of</strong> a new “<strong>City</strong> Walk”, which is an outdoor shopping area with<br />

tenants such as Apple, Pottery Barn, Yard House, and P.F. Chang’s.<br />

ECONOMIC CONDITION AND OUTLOOK<br />

The <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> is a dynamic community comprised <strong>of</strong> approximately 102,604<br />

citizens <strong>of</strong> various cultural backgrounds. The <strong>City</strong> has experienced a 379 percent<br />

growth in population since 1990. The <strong>City</strong>’s 2009 median household income is<br />

estimated at $82,380 and the 2009 average household income is estimated at $95,692,<br />

placing the <strong>City</strong>’s average household income above the average <strong>of</strong> $69,376 for the<br />

United States.<br />

Sales tax continues to be the <strong>City</strong>'s largest revenue source. Sales and Use Tax<br />

revenue is projected to slightly increase from an actual <strong>of</strong> $23,327,370 in fiscal year<br />

2008-09 to $23,956,600 in fiscal year 2009-10. This increase is primarily a result <strong>of</strong><br />

anticipated sales tax growth due to the completed expansions <strong>of</strong> the Promenade Mall<br />

and Pr<strong>of</strong>essional Hospital Supply. With the grand opening <strong>of</strong> the Promenade Mall in<br />

October 1999, and the commercial development in the area surrounding the mall, the<br />

<strong>City</strong>’s sales tax base was strengthened and over 1,500 jobs were created. <strong>Temecula</strong>’s<br />

taxable retail sales record is the envy <strong>of</strong> most Inland Empire cities. In 1999, <strong>Temecula</strong><br />

broke the $1 billion mark. <strong>Temecula</strong> continues to exceed the county and surrounding<br />

areas with respect to sales per capita.<br />

<strong>Temecula</strong> is an exceptional community where residents experience a strong sense <strong>of</strong><br />

community and family values. This vineyard-covered region <strong>of</strong>fers picturesque<br />

landscapes and a serene lifestyle. Golf courses, abundant recreation and cultural<br />

opportunities, award-winning schools, safe and attractive neighborhoods, and a sky<br />

filled with colorful hot air balloons provide the ideal setting for family living.<br />

xiii

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

<strong>Temecula</strong>’s tremendous assets produce an energetic atmosphere that stimulates<br />

business opportunity and growth. Strategically located along the Interstate 15 and<br />

Interstate 215 corridor, equidistant from San Diego County, Los Angeles County and<br />

Orange County business centers, <strong>Temecula</strong> is an attraction to progressive businesses.<br />

The <strong>City</strong>’s pro-business attitude, lower operating costs, and well-educated workforce<br />

continues to make it one <strong>of</strong> Southern <strong>California</strong>’s premier communities.<br />

Long-Term <strong>Financial</strong> Planning<br />

The <strong>City</strong> Council annually adopts the five-year Capital Improvement Program (CIP)<br />

budget, which serves as a planning tool to coordinate the financing and scheduling <strong>of</strong><br />

major projects undertaken by the <strong>City</strong>. It is revised each year to address changing<br />

needs, priorities, and financial conditions. The budget is developed by key<br />

management based on community comments and feedback, availability <strong>of</strong> funding, and<br />

priority ranking guidelines set by <strong>City</strong> Council. Through workshops, needs are identified<br />

by category, i.e., Circulation Projects, Infrastructure / Other Projects, Parks / Recreation<br />

Projects, Redevelopment / Housing Projects.<br />

The fiscal year 2010-14 CIP budget identifies a total <strong>of</strong> seventy projects, consisting <strong>of</strong><br />

twenty-seven Circulation Projects totaling $272,672,863; eighteen Infrastructure/Other<br />

Projects totaling $70,971,743; sixteen Parks and Recreation Projects totaling<br />

$9,080,307; and, nine Redevelopment/Housing Projects totaling $40,949,175. The total<br />

cost to complete all <strong>of</strong> the proposed projects is $393,629,088 <strong>of</strong> which $142,561,323 is<br />

programmed for fiscal year 2009-10. There is also over $58 million <strong>of</strong> projects with<br />

unspecified funding sources. These projects have been identified as necessary<br />

infrastructure for the <strong>City</strong>, and will require that funding sources be identified before the<br />

projects can commence. Administrative costs associated with managing these projects<br />

have been estimated (generally five to ten percent <strong>of</strong> estimated construction costs), and<br />

included in each project budget.<br />

Some <strong>of</strong> the major projects planned for construction in the next few years include the<br />

completion <strong>of</strong> a new Civic Center in Old Town <strong>Temecula</strong>, with a new parking structure,<br />

the new French Valley Interchange, an Ultimate Interchange at Interstate 15 and State<br />

Route 79 South (<strong>Temecula</strong> Parkway), Main Street Bridge Replacement, Pavement<br />

Rehabilitation projects on Rancho <strong>California</strong> and De Portola Roads, and various park<br />

improvements.<br />

It is impossible to review the economic forces affecting <strong>Temecula</strong> and the Inland Empire<br />

without predicting a rosy future for the <strong>City</strong>. The region’s geographic location,<br />

competitive cost structure and sophisticated logistics have put it in a position to have<br />

one <strong>of</strong> the nation’s fastest growing economy. <strong>Temecula</strong> remains one <strong>of</strong> the fastest<br />

growing and most prosperous communities in the Inland Empire.<br />

xiv

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

Cash Management Policies and Practices<br />

The <strong>City</strong> Council annually adopts an investment policy, which is intended to minimize<br />

credit and market risks, while maintaining a competitive yield on its portfolio. During the<br />

2008-09 fiscal year, idle funds were deposited in accordance with this policy in demand<br />

deposit accounts and invested primarily in a pooled investment account administered by<br />

the State <strong>of</strong> <strong>California</strong>.<br />

At all times, the investment policy was adhered to, and safety and liquidity objectives<br />

were placed above rates <strong>of</strong> return considerations in making deposits and investments.<br />

All deposits during the year were either insured by the Federal Deposit Insurance<br />

Corporation, or collateralized. The majority <strong>of</strong> the <strong>City</strong>’s investments were in the Local<br />

Agency Investment Fund (state pool).<br />

The state pool cannot be categorized in terms <strong>of</strong> credit risk in accordance with the<br />

guidelines <strong>of</strong> the Governmental Accounting Standards Board. Nevertheless, given the<br />

size and liquidity <strong>of</strong> the pool, the investment policies governing the pool, and the<br />

investment expertise <strong>of</strong> the pool's management, it is believed that these investments<br />

clearly conformed to the <strong>City</strong>'s investment policy.<br />

Risk Management<br />

The <strong>City</strong>'s insurance policies cover property, general liability, and worker's<br />

compensation exposures through basic deductibles, $150,000 self-insured retention,<br />

and flat fees, respectively. In the case <strong>of</strong> general liability coverage, the <strong>City</strong>'s maximum<br />

coverage per occurrence is $10 million, while the aggregate coverage is $10 million,<br />

maximum.<br />

The <strong>City</strong>'s Risk Management program focuses on proactive identification <strong>of</strong> exposures<br />

to eliminate any potential impacts to public safety and welfare. This is accomplished<br />

through effectively monitoring <strong>City</strong> programs, particularly those in the Community<br />

Services and Public Works Departments, and by providing clear guidance to correct<br />

those situations where exposures have been identified. Additionally, the <strong>City</strong> works<br />

closely with all contracted insurance carriers to ensure that the transfer <strong>of</strong> liability occurs<br />

timely, when applicable.<br />

Pension and Other Post-Employment Benefits<br />

The <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> has a defined benefit pension plan that provides retirement and<br />

disability benefits, annual cost-<strong>of</strong>-living adjustments, and death benefits to plan<br />

members and beneficiaries. The plan is part <strong>of</strong> the Public Agency portion <strong>of</strong> the<br />

<strong>California</strong> Public Employees’ Retirement System (CalPERS), an agent multipleemployer<br />

plan administered by CalPERS, which acts as a common investment and<br />

administrative agent for participating public entities within the State <strong>of</strong> <strong>California</strong>. An<br />

actuarial basis is used to determine the amount necessary to fund the benefits for its<br />

xv

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Letter <strong>of</strong> Transmittal - continued<br />

CAFR Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

members. The <strong>City</strong> pays 100 percent for the employer and employee share <strong>of</strong> funding<br />

this plan. In 2008, the <strong>City</strong> contracted with CalPERS Employer Trust Fund to pre-fund<br />

the retiree health liability.<br />

The <strong>City</strong> contracts with private deferred compensation administration firms to act as<br />

agent <strong>of</strong> the <strong>City</strong> to fulfill all the <strong>City</strong>’s administrative responsibilities. The amount<br />

deferred is not available to employees until termination, retirement, death or<br />

unavoidable emergency. The <strong>City</strong> <strong>of</strong>fers these plans to the employees, but does not<br />

fund these plans.<br />

Project employees (part-time, temporary) are provided pension benefits through a<br />

defined contribution plan. Federal legislation requires contribution <strong>of</strong> at least 7.5<br />

percent to a retirement plan. The <strong>City</strong> and the employee each contribute 3.75% <strong>of</strong> the<br />

employee’s salary into the plan. The <strong>City</strong>’s contribution is fully vested immediately.<br />

Medical Benefits are provided at time <strong>of</strong> retirement for all represented employees <strong>of</strong> the<br />

<strong>City</strong> who meet the eligibility requirements as defined as a PERS service or industrial<br />

disability retirement.<br />

ACKNOWLEDGMENTS<br />

Preparation <strong>of</strong> the <strong>City</strong>'s <strong>Comprehensive</strong> <strong>Annual</strong> <strong>Financial</strong> <strong>Report</strong> is an undertaking <strong>of</strong><br />

the Finance Department. Special credit is due to Rudy Graciano, Revenue Manager,<br />

Pascale Brown, Accounting Manager, Jennifer Crummel, Senior Accountant, and Judy<br />

McNabb, Administrative Assistant, as well as the entire Finance Department staff. Their<br />

year-long hard work and dedication have made this report possible.<br />

I would like to express my appreciation to the <strong>City</strong> Manager, the <strong>City</strong> Council, and the<br />

Finance Committee for their interest and support in planning and conducting the<br />

financial operations <strong>of</strong> the <strong>City</strong> in a responsible and progressive manner.<br />

Sincerely,<br />

Genie Roberts, CPA<br />

Genie Roberts, CPA<br />

Director <strong>of</strong> Finance<br />

xvi

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

GOVERNMENT FINANCE OFFICERS<br />

ASSOCIATION AWARD<br />

xvii

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

CITY ORGANIZATIONAL CHART<br />

xviii

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

STAFF DIRECTORY<br />

EXECUTIVE MANAGEMENT:<br />

<strong>City</strong> Manager ............................................................... Shawn D. Nelson<br />

Assistant <strong>City</strong> Manager ................................................ Aaron Adams<br />

Assistant <strong>City</strong> Manager ................................................ Bob Johnson<br />

Deputy <strong>City</strong> Manager ................................................... Grant Yates<br />

<strong>City</strong> Attorney ................................................................ Peter M. Thorson<br />

<strong>City</strong> Clerk/Director <strong>of</strong> Support Services ....................... Susan W. Jones<br />

Director <strong>of</strong> Finance ...................................................... Genie Roberts<br />

Director <strong>of</strong> Public Works .............................................. Greg Butler<br />

<strong>City</strong> Engineer ............................................................... Dan York<br />

Director <strong>of</strong> Community Services .................................. Herman D. Parker<br />

Director <strong>of</strong> Planning / Housing/Redevelopment ........... Patrick Richardson<br />

Director <strong>of</strong> Information Systems .................................. Tim Thorson<br />

Chief <strong>of</strong> Police ............................................................. Andre O’Harra<br />

Fire Chief ..................................................................... Glenn Patterson<br />

FINANCE DEPARTMENT:<br />

Director <strong>of</strong> Finance ...................................................... Genie Roberts<br />

Revenue Manager ....................................................... Rudy Graciano<br />

Accounting Manager .................................................... Pascale Brown<br />

Fiscal Services Manager ............................................. Roberto Cardenas<br />

Senior Management Analyst........................................ Heidi Schrader<br />

Senior Debt Analyst ..................................................... David Bilby<br />

Senior Accountant ....................................................... Jennifer Crummel<br />

Administrative Assistant .............................................. Judy McNabb<br />

Purchasing Coordinator II ............................................ Mary Vollmuth<br />

Accounting Specialist .................................................. Monica Jorgenson<br />

Accounting Specialist .................................................. Jada Yonker<br />

Accounting Specialist .................................................. Leah Thomas<br />

Business License Specialist/Cashier ........................... Debbie Brown<br />

Business License Specialist/Cashier ........................... Pam Espinoza<br />

Accounting Assistant ................................................... Jill Dickey<br />

xix

Brandon W. Burrows, C.P.A<br />

Donald L. Parker, C.P.A<br />

Michael K. Chu, C.P.A<br />

David E. Hale, C.P.A, C.F.P.<br />

A Pr<strong>of</strong>essional Corporation<br />

Donald G. Slater, C.P.A<br />

Richard K. Kikuchi, C.P.A<br />

Susan F. Matz, C.P.A.<br />

INDEPENDENT AUDITORS’ REPORT<br />

To the Honorable Mayor and Members <strong>of</strong> the <strong>City</strong> Council<br />

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong>, <strong>California</strong><br />

We have audited the accompanying financial statements <strong>of</strong> the governmental activities, each major fund,<br />

and the aggregate remaining fund information <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>, <strong>California</strong>, as <strong>of</strong> and for the year<br />

ended June 30, 2009, which collectively comprise the <strong>City</strong>'s basic financial statements as listed in the<br />

table <strong>of</strong> contents. These financial statements are the responsibility <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>'s<br />

management. Our responsibility is to express opinions on these financial statements based on our audit.<br />

We conducted our audit in accordance with auditing standards generally accepted in the United States <strong>of</strong><br />

America and the standards applicable to financial audits contained in Government Auditing Standards<br />

issued by the Comptroller General <strong>of</strong> the United States. Those standards require that we plan and<br />

perform the audit to obtain reasonable assurance about whether the financial statements are free <strong>of</strong><br />

material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts<br />

and disclosures in the financial statements. An audit also includes assessing the accounting principles<br />

used and significant estimates made by management, as well as evaluating the overall financial<br />

statement presentation. We believe that our audit provides a reasonable basis for our opinions.<br />

In our opinion, the financial statements referred to above present fairly, in all material respects, the<br />

respective financial position <strong>of</strong> the governmental activities, each major fund, and the aggregate remaining<br />

fund information <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>, <strong>California</strong>, as <strong>of</strong> June 30, 2009, and the respective changes in<br />

financial position and cash flows, where applicable, and the respective budgetary comparison for the<br />

General Fund, Community Services District, and Redevelopment Agency Special Revenue Fund there<strong>of</strong><br />

for the year then ended in conformity with accounting principles generally accepted in the United States <strong>of</strong><br />

America<br />

In accordance with Government Auditing Standards, we have also issued our report dated<br />

October 12, 2009, on our consideration <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>'s internal control over financial reporting<br />

and our tests <strong>of</strong> its compliance with certain provisions <strong>of</strong> laws, regulations, contracts, and grant<br />

agreements and other matters. The purpose <strong>of</strong> that report is to describe the scope <strong>of</strong> our testing <strong>of</strong><br />

internal control over financial reporting and compliance and the results <strong>of</strong> that testing, and not to provide<br />

an opinion on the internal control over financial reporting or on compliance. That report is an integral part<br />

<strong>of</strong> an audit .performed in accordance with Government Auditing Standards and should be considered<br />

in assessing the results <strong>of</strong> our audit.<br />

The management's discussion and analysis and the other required supplementary information identified<br />

in the accompanying table <strong>of</strong> contents are not a required part <strong>of</strong> the basic financial statements but are<br />

supplementary information required by the accounting principles generally accepted in the United States<br />

<strong>of</strong> America.<br />

1<br />

Lance, Soll & Lunghard, LLP 203 North Brea Boulevard Suite 203 Brea, CA 92821 TEL: 714.672.0022 Fax: 714.672.0331 www.lslcpas.com<br />

41185 Golden Gate Circle Suite 103 Murrieta, CA 92562 TEL: 951.304.2728 Fax: 951.304.3940

To the Honorable Mayor and Members <strong>of</strong> the <strong>City</strong> Council<br />

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong>, <strong>California</strong><br />

We have applied certain limited procedures to the management's discussion and analysis, which<br />

consisted principally <strong>of</strong> inquiries <strong>of</strong> management regarding the methods <strong>of</strong> measurement and<br />

presentation <strong>of</strong> this required supplementary information. However, we did not audit the management's<br />

discussion and analysis and express no opinion on it.<br />

Our audit was conducted for the purpose <strong>of</strong> forming opinions on the financial statements that collectively<br />

comprise the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>'s basic financial statements. The accompanying introductory section, the<br />

combining and individual fund statements, budgetary schedules and statistical tables are presented for<br />

purposes <strong>of</strong> additional analysis and are not a required part <strong>of</strong> the basic financial statements. The<br />

accompanying combining and individual nonmajor fund financial statements and budgetary schedules<br />

have been subjected to the auditing procedures applied in the audit <strong>of</strong> the basic financial statements and<br />

in our opinion are fairly stated in all material respects in relation to the basic financial statements taken as<br />

a whole. The accompanying introductory section and statistical tables have not been subjected to the<br />

auditing procedures applied in the audit <strong>of</strong> the basic financial statements and, accordingly, we express<br />

not opinion on them.<br />

October 12, 2009<br />

2

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Management’s Discussion and Analysis<br />

Fiscal Year Ended June 30, 2009<br />

As management <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>, we <strong>of</strong>fer readers <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>’s<br />

financial statements this narrative overview and analysis <strong>of</strong> the financial activities <strong>of</strong> the<br />

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong> for the fiscal year ended June 30, 2009. We encourage readers to<br />

consider the information presented here in conjunction with additional information that<br />

we have furnished in our letter <strong>of</strong> transmittal, which can be found in the introductory<br />

section <strong>of</strong> this report, and with the <strong>City</strong>’s financial statements, which follow this<br />

discussion.<br />

<strong>Financial</strong> Highlights<br />

• The assets <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> exceeded its liabilities, at June 30, 2009, by<br />

$728.8 million (net assets.).<br />

• The government’s total net assets increased by $11.4 million. This increase is<br />

primarily attributable to capital grants and contribution revenues received to fund<br />

capital and infrastructure improvements in the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> and donation <strong>of</strong><br />

assets to the <strong>City</strong>’s infrastructure from improvements constructed by property<br />

owners.<br />

• As <strong>of</strong> June 30, 2009, the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>’s governmental funds reported<br />

combined ending fund balances <strong>of</strong> $190.4 million, a decrease <strong>of</strong> $24.6 million.<br />

Approximately 65% <strong>of</strong> this total amount, $123.7 million, is available for spending<br />

at the government’s discretion (unreserved fund balance).<br />

• At the end <strong>of</strong> the current fiscal year, unreserved fund balance for the general<br />

fund was $38.3 million, or 71.5% <strong>of</strong> total general fund expenditures excluding<br />

transfers.<br />

• The <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>’s total long-term liabilities decreased by $1.2 million during<br />

the current fiscal year. This decrease was primarily the result <strong>of</strong> principal debt<br />

service payments for Tax Allocation Bonds and Certificates <strong>of</strong> Participation.<br />

Overview <strong>of</strong> the <strong>Financial</strong> Statements<br />

The discussion and analysis are intended to serve as an introduction to the <strong>City</strong> <strong>of</strong><br />

<strong>Temecula</strong>’s basic financial statements. The <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>’s basic financial<br />

statements comprise three components: 1) government-wide financial statements; 2)<br />

fund financial statements; and, 3) notes to the financial statements. This report also<br />

contains other supplementary information in addition to the basic financial statements<br />

themselves.<br />

Government-Wide <strong>Financial</strong> Statements<br />

The government-wide financial statements are designed to provide readers with a broad<br />

overview <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>’s finances in a manner similar to a private-sector<br />

business.<br />

See Independent Auditors’ <strong>Report</strong><br />

3

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Management’s Discussion and Analysis - continued<br />

Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />

The statement <strong>of</strong> net assets presents information on all the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>’s assets<br />

and liabilities, with the difference between the two reported as net assets. Over time,<br />

increases or decreases in net assets may serve as a useful indicator <strong>of</strong> whether the<br />

financial position <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> is improving or deteriorating.<br />

The statement <strong>of</strong> activities presents information showing how the government’s net<br />

assets changed during the most recent fiscal year. All changes in net assets are<br />

reported as soon as the underlying events giving rise to the change occurs, regardless<br />

<strong>of</strong> the timing <strong>of</strong> related cash flows. Thus, revenues and expenses are reported in this<br />

statement for some items that will only result in cash flows in the future fiscal periods<br />

(e.g., uncollected taxes and earned but unused vacation leave).<br />

The government-wide financial statement presents information about the functions <strong>of</strong><br />

the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong> that is principally supported by taxes and intergovernmental<br />

revenues (governmental activities). The governmental activities <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

include general government, public safety, public works, community services, and<br />

community development.<br />

The government-wide financial statements can be found on pages 16-17 <strong>of</strong> this report.<br />

Fund <strong>Financial</strong> Statements<br />

A fund is a grouping <strong>of</strong> related accounts that is used to maintain control over resources<br />

that have been segregated for specific activities or objectives. The <strong>City</strong> <strong>of</strong> <strong>Temecula</strong>,<br />

like other state and local governments, uses fund accounting to ensure and<br />

demonstrate compliance with finance-related legal requirements. All <strong>of</strong> the funds <strong>of</strong> the<br />

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong> can be divided into three categories: governmental funds; proprietary<br />

funds; and, fiduciary funds.<br />

Governmental Funds. Governmental funds are used to account for essentially the<br />

same functions reported as governmental activities in the government-wide financial<br />

statements. However, unlike the government-wide financial statements, governmental<br />

fund financial statements focus on near-term inflows and outflows <strong>of</strong> spendable<br />

resources, as well as on balances on spendable resources available at the end <strong>of</strong> the<br />

fiscal year. Such information may be useful in evaluating a government’s near-term<br />

financing requirements.<br />

Because the focus <strong>of</strong> governmental funds are narrower than that <strong>of</strong> the governmentwide<br />

financial statements, it is useful to compare the information presented for<br />

governmental funds with similar information presented for governmental activities in the<br />

government-wide financial statements. By doing so, readers may better understand the<br />

long-term impact <strong>of</strong> the government’s near-term financing decisions. Both the<br />

governmental fund balance sheet and governmental fund statement <strong>of</strong> revenues,<br />

expenditures, and changes in fund balances provide a reconciliation to facilitate this<br />

comparison between governmental funds and governmental activities.<br />

See Independent Auditors’ <strong>Report</strong><br />

4

<strong>City</strong> <strong>of</strong> <strong>Temecula</strong><br />

Management’s Discussion and Analysis - continued<br />

Fiscal Year Ended June 30, 2009<br />

---------------------------------------------<br />