Retail Research - HDFC Securities

Retail Research - HDFC Securities

Retail Research - HDFC Securities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Housing and Urban Development Corporation Ltd<br />

Tax Free Bonds: Tranche - 2 February 21, 2013<br />

Summary: Housing and Urban Development Corporation (HUDCO) has come out with the Tranche – 2 public issue of tax free bonds to raise<br />

Rs 500 crore with an option to retain over-subscription up to the residual shelf limit of Rs 2,785.5 crore. The issue is open for subscription on<br />

February 21, 2013 and closes on March 15, 2013 (with an option for early closure or extension, as may be decided by the Board of<br />

HUDCO). The issue consists of two series of Bonds – 10 year and 15 year carrying interest @ 7.03% and 7.19% p.a. respectively. <strong>Retail</strong><br />

Individuals and HUF (applying for upto Rs.10 lakhs) would get an additional 50 bps interest rate.<br />

The CBDT has authorised HUDCO to raise the Bonds aggregating to Rs. 5,000 crores in Fiscal 2013. It came out with the Tranche 1 Issue,<br />

which opened for subscription on January 9, 2013 and closed on February 7, 2013. The amount collected in terms of applications in the<br />

Tranche – I Issue was reported to be Rs. 2,214.484 crores. From this Tranche 2, the company proposes to raise Rs. 500 crore with an option<br />

to retain oversubscription upto the Residual Shelf Limit.<br />

Credit Rating agencies – CARE and IRRPL have assigned ratings of ‘CARE AA+’ and ‘IND AA+’ respectively to this issue. Instruments with<br />

this rating are considered to have high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low<br />

credit risk.<br />

Tax-free bonds differ from tax saving bonds. The interest income from the instrument is not taxed in tax-free bonds while investible amount<br />

does not form part of the total income in tax saving bonds. In tax-free bonds there is no upper limit. This financial year, infrastructure<br />

companies like NHAI, PFC, IRFC, IIFCL were given permission to raise Rs 60,000 crore via tax-free bonds.<br />

HUDCO has in FY12 issued Tax free Bonds of Rs.1,000 each with coupon rates of 8.10% and 8.20% for 10 & 15 years bonds respectively.<br />

These bonds are currently quoted at Rs. 1,055 and Rs.1,070 offering YTM of 7.20% and 7.34% respectively (trading data as of Feb 19, 2013).<br />

In FY13, in tranche I, the company offered coupon rate of 7.34% and 7.51% for 10 & 15 years bonds respectively. They are currently quoted<br />

at Rs. 955 and Rs.1,008 offering YTM of 8.02% and 7.45% respectively (trading data as of Feb 21, 2013).<br />

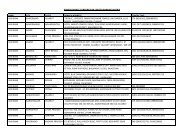

Investors may also consider the tax free bonds which are currently trading in the secondary markets. The following table lists out the tax free<br />

bonds which are available for trading in the secondary markets such as BSE and NSE.<br />

Comparison of tax free bonds which are available for trading in the secondary markets:<br />

Issuer<br />

Series<br />

Credit<br />

Rating<br />

Date of<br />

Allotment<br />

Coupo<br />

n Rate<br />

Residual<br />

Maturity<br />

(Year)<br />

Coupon<br />

payment<br />

frequency<br />

Interest paid on<br />

Latest<br />

Traded<br />

Price<br />

(Rs)<br />

YTM<br />

Daily<br />

Averag<br />

e<br />

Volume<br />

(Nos)<br />

NHAI 820NHAI22 AAA 25-Jan-12 8.20% 8.94 Annual 1st of October 1096 7.19% 4340<br />

NHAI 830NHAI27 AAA 25-Jan-12 8.30% 13.94 Annual 1st of October 1085 7.65% 5776<br />

PFC 820PFC2022 AAA 1-Feb-12 8.20% 8.96 Annual 15th of October 1084 7.32% 1739<br />

PFC 830PFC2027 AAA 1-Feb-12 8.30% 13.96 Annual 15th of October 1108 7.36% 1862<br />

PFC 719PFC2023 AAA 4-Jan-13 7.19% 9.88 Annual 4th of January 993 7.41% 12<br />

PFC 736PFC2028 AAA 4-Jan-13 7.36% 14.88 Annual 4th of January 1002 7.43% 458<br />

IRFC Series -80 AAA 23-Feb-12 8.00% 9.02 Annual 15th of October 1074 7.27% 818<br />

IRFC Series -80 A AAA 23-Feb-12 8.10% 14.02 Annual 15th of October 1094 7.32% 4001<br />

HUDCO Series – 1 AA+ 5-Mar-12 8.10% 9.05 Annual 5th of March 1055 7.20% 419<br />

HUDCO Series – 2 AA+ 5-Mar-12 8.20% 14.05 Annual 5th of March 1070 7.34% 5854<br />

HUDCO Series – 4 AA+ 16-Feb-13 7.34% 9.99 Annual 16th of February 955* 8.02% 50<br />

HUDCO Series – 5 AA+ 16-Feb-13 7.51% 14.99 Annual 16th of February 1006* 7.45% 2800<br />

REC 793REC22 AAA 27-Mar-12 7.93% 9.11 Annual 1st of July 1082 7.43% 342<br />

REC 812REC27 AAA 27-Mar-12 8.12% 14.11 Annual 1st of July 1115 7.37% 915<br />

REC 722REC22TF AAA 19-Dec-12 7.22% 9.84 Annual 1st of December 1009 7.26% 460<br />

REC 738REC27TF AAA 19-Dec-12 7.38% 14.84 Annual 1st of December 1007 7.43% 1276<br />

IIFCL 719IIFCL23 AAA 22-Jan-13 7.19% 9.93 Annual 22nd of January 993 7.36% 32<br />

IIFCL 736IIFCL28 AAA 22-Jan-13 7.36% 14.93 Annual 22nd of January 992.5 7.50% 416<br />

IIFCL 740IIFCL33 AAA 22-Jan-13 7.40% 19.94 Annual 22nd of January 1010 7.35% 2407<br />

* - Traded data as on Feb 21, 2013. For the rest, Feb 19, 2013.<br />

Objects of the Issue: HUDCO intends to deploy the Issue proceeds towards lending purposes, working capital requirements, augmenting the<br />

resource base of its and other operational requirements (including debt servicing, which includes servicing of both the principal amounts as<br />

well as interest payments of various debt facilities availed by the Company in the past and currently outstanding in its books of accounts,<br />

including loans and market borrowings). The Issue proceeds shall not be utilized for providing loan to or acquisition of shares of any person<br />

who is part of the same group or who is under the same management as that of HUDCO.<br />

Issue Terms:<br />

Issuer<br />

Issue<br />

Issue Price and minimum<br />

application<br />

Stock Exchanges proposed for<br />

listing<br />

Issuance<br />

Housing and Urban Development Corporation Limited<br />

Public Issue by Housing and Urban Development Corporation Limited of tax free bonds of face value<br />

of Rs 1,000 each, in the nature of secured, redeemable, non-convertible bonds aggregating Rs.500<br />

Crores with an option to retain an over subscription upto a total of the residual Shelf Limit.<br />

Rs.1,000 & Rs.5,000 respectively<br />

NSE & BSE<br />

Both physical and dematerialized form<br />

<strong>Retail</strong> <strong>Research</strong> 1

Trading<br />

Trading Lot<br />

Depositories<br />

Rating<br />

Security<br />

Security Cover<br />

Compulsorily in dematerialized form<br />

1 (one) Bond<br />

NSDL and CDSL<br />

‘CARE AA+’ from CARE and ‘IND AA+’ from IRRPL.<br />

The security for the Bonds, being a floating first pari-passu charge on present and future receivables<br />

of HUDCO to the extent of amount mobilized under the Issue. The company reserves the right to<br />

create first pari-passu charge on present and future receivables for its present and future financial<br />

requirements.<br />

At least 100% of the outstanding Bonds at any point of time.<br />

Issue Details:<br />

Options Tranche – 2 Series I Tranche – 2 Series II<br />

Frequency of Interest Payment Annual Annual<br />

Tenor 10 years 15 years<br />

Redemption amount (Rs / bond)<br />

Repayment of the Face Value + interest<br />

Minimum Application Size<br />

5 Bonds (Rs. 5,000) across all of the Series of Bonds<br />

Put/Call Option None None<br />

Coupon Rates for Category - I, II and III Applicants (% p.a.) 7.03% 7.19%<br />

Coupon Rates for Category - IV Applicants (% p.a.) 7.53% 7.69%<br />

Mode of payment<br />

Direct Credit, NECS, RTGS, NEFT and. Cheques or<br />

Demand drafts.<br />

Coupon Rate (%) p.a for Category I, II and III: 7.03% per annum 7.19% per annum<br />

Effective pre-tax yield (per annum) for tax payers in 10% income tax bracket * 7.81% 7.99%<br />

Effective pre-tax yield (per annum) for tax payers in 20% income tax bracket * 8.79% 8.99%<br />

Effective pre-tax yield (per annum) for tax payers in 30% income tax bracket * 10.04% 10.27%<br />

Coupon Rate (%) p.a for Category IV (Only in primary issue): 7.53% per annum 7.69% per annum<br />

Effective pre-tax yield (per annum) for tax payers in 10% income tax bracket * 8.37% 8.54%<br />

Effective pre-tax yield (per annum) for tax payers in 20% income tax bracket * 9.41% 9.61%<br />

Effective pre-tax yield (per annum) for tax payers in 30% income tax bracket * 10.76% 10.99%<br />

* = without considering education cess & secondary and higher education cess<br />

Step-down clause: To promote the retail participation and prevent malpractices in the application process, the issue bestows higher coupon<br />

rate only for primary retail subscribers who apply upto Rs.10 lakhs (category IV only). Accordingly, the Series I and Series II will be allotted to<br />

Category IV investors with an aggregate coupon rate of 7.53% p.a. and 7.69% p.a., respectively.<br />

Additional coupon rate of 0.50% is to be paid to original allottees under Category IV Portion. In the event the Bonds held by the original<br />

Allottees under Category IV are sold/ transferred (except in case of transfer of Bonds to legal heir in the event of death of the original Allottee),<br />

the coupon rate shall stand revised to the coupon rate applicable for Allottees falling under Category I, Category II and Category III.<br />

This clause is beneficial for retail investors who want to hold the bonds till maturity or long term. However this also means that category IV<br />

investors will get to participate less in the price upside if the interest rate cycle turns down.<br />

Taxation:<br />

Tax Free: The Bonds are tax free in nature (exempt u/s 10(15)(iv)(h) of the Income Tax Act, 1961 and the interest on the Bonds will not form<br />

part of the total income.<br />

TDS: Since the interest Income on these bonds is exempt, no Tax Deduction at Source is required.<br />

Long Term Capital Gains: Under section 2 (29A) & 2 (42A) of the Income Tax Act, the Bonds are treated as a long term capital asset if the<br />

same is held for more than 12 Months where they are subject to the tax at the rate of 20% of capital gains with indexation or 10% of capital<br />

gains without indexation.<br />

Short Term Capital Gains: Short-term capital gains, where bonds are held for a period of not more than 12 months would be taxed at the<br />

normal tax rates.<br />

STT: <strong>Securities</strong> Transaction Tax (STT) is not applicable on transactions in the Bonds.<br />

Gift Tax: As per section 56(2)(vii) of the I.T. Act, the gift shall be taxable as the income of the recipient where the aggregate fair market value<br />

of which exceeds Rs. 50,000.<br />

Wealth Tax: No wealth tax is levied.<br />

Cess: A 2% education cess and 1% secondary and higher education cess on the total income tax (including surcharge for corporate only) is<br />

payable by all categories of tax payers.<br />

DTC: The Hon’ble Finance Minister has presented the Direct Tax Code Bill, 2010 (‘DTC Bill’) on August 30, 2010. On the finalization of the<br />

DTC Bill and on obtaining the approval of the Indian cabinet, the DTC Bill will be placed before the Indian Parliament for its approval and<br />

notification as an Act of Parliament. Accordingly, it is currently unclear what effect the Direct Tax Code would have on the investors.<br />

<strong>Retail</strong> <strong>Research</strong> 2

Who can apply?<br />

Category I:<br />

• Public Financial Institutions, scheduled commercial banks, multilateral and bilateral development financial institutions, state industrial<br />

development corporations, which are authorised to invest in the Bonds;<br />

• FIIs and their sub – accounts (other than a sub-account which is a foreign corporate or foreign individual), registered with SEBI<br />

• Provident funds and pension funds with minimum corpus of ` 25 crores, which are authorised to invest in the Bonds;<br />

• Insurance companies registered with the IRDA;<br />

• National Investment Fund;<br />

• Insurance funds set up and managed by the army, navy or air force of the Union of India or set up and managed by the Department of<br />

Posts, India;<br />

• Mutual funds; and<br />

• Alternative Investment Funds, subject to investment conditions applicable to them under the <strong>Securities</strong> and Exchange Board of India<br />

(Alternative Investment Funds) Regulations, 2012.<br />

Category II:<br />

• Companies within the meaning of section 3 of the Companies Act, Limited Liability Partnerships and other bodies corporate registered<br />

under the applicable laws in India and authorised to invest in the Bonds.<br />

Category III:<br />

The following Investors applying for an amount aggregating to above Rs. 10 lakhs across all Series of Bonds in the Issue.<br />

• Resident Indian individuals;<br />

• Eligible NRIs on a repatriation or non – repatriation basis; and<br />

• Hindu Undivided Families through the Karta.<br />

Category IV:<br />

The following Investors applying for an amount aggregating to up to and including Rs. 10 lakhs across all Series of Bonds in the Issue.<br />

• Resident Indian individuals;<br />

• Eligible NRIs on a repatriation or non – repatriation basis; and<br />

• Hindu Undivided Families through the Karta.<br />

Who can not apply?<br />

• Minors without a guardian name;<br />

• Foreign nationals; (i) based in the USA, and/or, (ii) domiciled in the USA, and/or, (iii) residents/citizens of the USA, and/or, (iv) subject to<br />

any taxation laws of the USA<br />

• Overseas Corporate Bodies;<br />

• Indian Venture Capital Funds;<br />

• Foreign Venture Capital Funds;<br />

• Qualified Foreign Investors<br />

• Regional rural banks;<br />

• Societies;<br />

• Co-operative societies<br />

• Public/ private charitable/ religious trusts;<br />

• Scientific and/or industrial research organisations;<br />

• Partnership firms;<br />

• Persons ineligible to contract under applicable statutory/ regulatory requirements; and<br />

• Any category of investor other than the Investors mentioned under Categories I, II, III and IV.<br />

Basis of Allotment:<br />

Applicants belonging to all three Categories will be allocated as given in the table below:<br />

Portion QIB Corporate HNI <strong>Retail</strong> Individual<br />

Reservation for each Portion<br />

25% of the Overall<br />

Issue Size<br />

15% of the Overall<br />

Issue Size<br />

20% of the Overall<br />

Issue Size<br />

40% of the Overall<br />

Issue Size<br />

In case of an oversubscription, allotments to the maximum extent, as possible, will be made on a first-come first-serve basis and thereafter on<br />

proportionate basis, i.e. full allotment of Bonds to the applicants on a first come first basis up to the date falling 1 (one) day prior to the date of<br />

oversubscription and proportionate allotment of Bonds to the applicants on the date of oversubscription (based on the date of upload of each<br />

Application on the electronic Application platform of BSE, in each Portion).). Further, Allotment shall be on first come first serve basis, with<br />

HUDCO having the discretion to close the Issue early irrespective of whether any of the Portion(s) are fully subscribed.<br />

Credit Rating:<br />

CARE has assigned a rating of ‘CARE AA+’ to the Bonds vide letter dated January 29, 2013. India Ratings and <strong>Research</strong> Private Limited<br />

(formerly Fitch Ratings India Private. Limited) ("IRRPL") has assigned a rating of ‘IND AA+’ to the Bonds vide letter dated January 29, 2013.<br />

Instruments with this rating are considered to have high degree of safety regarding timely servicing of financial obligations. Such instruments<br />

carry very low credit risk.<br />

Interest on application money: Interest @ 7.03% / 7.19 % p.a (+ 50 bps if applicable) shall be paid on amounts allotted from the date of<br />

realization of the cheque(s)/demand draft(s) or 3 (three) days from the date of receipt of the application (being the date of submission of each<br />

application as duly acknowledged by the Bankers to the Issue) whichever is later upto one day prior to the Deemed Date of Allotment.<br />

<strong>Retail</strong> <strong>Research</strong> 3

Interest on Refund: 5% p.a for all categories.<br />

Liquidity and Exit Options: The Bonds will be listed on NSE and BSE.<br />

Company Background: HUDCO is a techno financial institution engaged in the financing and promotion of housing and urban infrastructure<br />

projects throughout India. It was established on April 25, 1970 as a wholly owned government company with the objective to provide long term<br />

finance and undertake housing and urban infrastructure development programmes. It is a public financial institution under section 4A of the<br />

Companies Act and has been conferred the status of Mini-ratna. Hudco has a pan-India presence through its wide network of zonal, regional<br />

and development offices and occupies a key position in the GoI’s growth plans and implementation of its policies for the housing and urban<br />

infrastructure sector.<br />

Business of HUDCO is broadly classified into two business platforms: Housing finance and Urban infrastructure finance. It also provides<br />

consultancy services in the field of urban and regional planning, design and development, environmental engineering, social development,<br />

government programmes and others. Its business is supported by capacity building activities through HSMI, and alternative building materials<br />

and cost-effective technology promotion.<br />

As on September 30, 2012, HUDCO has provided finance for over 15 million dwelling units and over 1,600 urban infrastructure projects in<br />

India. Further, up to September 30, 2012, it has sanctioned loans of Rs 41,274 crores for housing and Rs 90,874 crores for urban<br />

infrastructure on a cumulative basis, of which Rs 31,050 crores and Rs 50,599 crores has been disbursed respectively. As part of consultancy<br />

services, up to September 30, 2012, it had appraised 1,253 projects with a project cost of Rs 26,482.92 crores under JNNURM.<br />

Competitive Strengths:<br />

• Key strategic position in the GoI's plans for growth of the housing and urban infrastructure sector.<br />

• Strong financial position.<br />

• Pan-India presence.<br />

• Established track record.<br />

• Varied consultancy services in housing and urban infrastructure sector.<br />

• Wide pool of skilled and professional workforce.<br />

Strategy:<br />

• Enhance participation in implementation of government programmes on housing and urban infrastructure<br />

• Increase financing of the housing and urban infrastructure projects<br />

• Develop strategic alliances with various agencies.<br />

• Enhance income from fee-based activities.<br />

Risks & Concerns:<br />

• If the level of NPAs in Hudco’s loan portfolio were to increase, its financial condition would be adversely affected.<br />

• Hudco may not be able to foreclose on the value of its collateral on a timely basis, or at all, when borrowers default on their obligations to it<br />

and this may have a materially adverse effect on its business, results of operations and financial condition.<br />

• Business of Hudco is vulnerable to interest rate volatility and will be impacted by any volatility in such interest rates in its operations, which<br />

could cause its net interest margins to decline and adversely affect the profitability.<br />

• Any inability to meet debt finance obligations may have an adverse effect on Hudco’s business and results of operations.<br />

• Financing of Indian housing and urban infrastructure sector is very competitive and increasing competition may result in declining margins<br />

and market shares.<br />

• Hudco may be unable to secure funding at competitive rates, which could adversely affect its growth, expansion and results of operations.<br />

• Business of Hudco may be adversely affected by future regulatory changes.<br />

• Hudco has high loan concentrations with its top ten borrowers contributing to 29.78% of its total loans outstanding as on March 31, 2012<br />

and default by any one of them could significantly affect its business.<br />

• In the event of Hudco failing to meet the capital adequacy and statutory liquidity requirements on account of any changes in the existing<br />

regulatory policy, its results of operation and financial condition could be severely affected.<br />

• Hudco is subject to risks arising from exchange rate fluctuations and devaluation of the Indian rupee against any foreign currencies, which<br />

could increase its cost of finance, thereby adversely affecting its results of operation and financial condition.<br />

• Hudco benefit from certain tax benefits available to it as a public financial institution and if these benefits are no longer available to it, its<br />

business, and financial condition, results of operations may be adversely affected.<br />

• Any downgrading in credit rating of Hudco’s Bonds may affect the trading price of the Bonds.<br />

• Changes in interest rates may affect the prices of the Bonds<br />

• A debenture redemption reserve will be created, only up to an extent of 50% for the Bonds and in the event of default in excess of such<br />

reserve; Bondholders may find it difficult to enforce their interests.<br />

• The proposed new Indian taxation system could adversely affect Hudco’s business and the price of the Bonds.<br />

Financials - P&L Consolidated:<br />

(Rs In Crores)<br />

Particulars<br />

31-12-12<br />

(9 month FY12 FY11 FY10<br />

ended)<br />

Operating Income 1967.95 2738.36 2263.46 2421.80<br />

Other Income 65.08 40.27 15.13 106.55<br />

Total Income 2033.03 2778.63 2278.59 2528.35<br />

Expenditure 243.06 205.05 173.08 326.56<br />

Operating Profit 1789.97 2573.58 2105.51 2201.79<br />

<strong>Retail</strong> <strong>Research</strong> 4

OPM % 90.95 93.98 93.02 90.92<br />

Interest & Financial Charges 1167.32 1629.08 1273.27 1413.76<br />

Depreciation 3.60 4.60 11.42 4.52<br />

Prior Period Adjustment (Net Income) 0.16 0.07 0.29 0.87<br />

PBT 619.82 939.97 821.11 784.38<br />

PBTM % 31.49 34.33 36.28 32.39<br />

Tax (incl. FBT & DT) 192.46 309.64 271.08 289.07<br />

Effective Tax Rate % 31.05 32.94 33.01 36.85<br />

PAT 427.20 630.33 550.03 495.31<br />

PATM % 21.70 23.02 24.30 20.45<br />

Balance Sheet Consolidated:<br />

(Rs In Crores)<br />

FY12 FY11 FY10<br />

EQUITY AND LIABILITIES<br />

Share Holder's Funds 5988.89 5520.97 5097.09<br />

Non-current Liabilities 14336.93 10096.50 11765.21<br />

Current Liabilities 7167.66 7119.46 5121.12<br />

Total 27493.48 22736.93 21983.42<br />

ASSETS<br />

Non-current Assets 20010.87 17683.11 16183.16<br />

Current Assets 7482.61 5053.82 5800.26<br />

Total 27493.48 22736.93 21983.42<br />

RETAIL RESEARCH Fax: (022) 30753435 Corporate Office,<br />

<strong>HDFC</strong> securities Limited, I Think Techno Campus, Bulding –B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station Opp. Crompton Greaves,<br />

Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435 Website: www.hdfcsec.com<br />

Disclaimer: This document has been prepared by <strong>HDFC</strong> securities Limited and is meant for sole use by the recipient and not for circulation.<br />

This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a<br />

solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or<br />

complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities<br />

referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this<br />

document. This report is intended for Non-institutional Clients only.<br />

Disclaimer: <strong>HDFC</strong> Bank (a shareholder in <strong>HDFC</strong> securities Ltd) is associated with this issue in the capacity of Bankers to the issue and will<br />

earn fees for its services. This report is prepared in the normal course, solely upon information generally available to the public. No<br />

representation is made that it is accurate or complete. Notwithstanding that <strong>HDFC</strong> Bank is acting for Housing and Urban Development<br />

Corporation Limited, this report is not issued with the authority of Housing and Urban Development Corporation Limited. Readers of this<br />

report are advised to take an informed decision on the issue after independent verification and analysis.<br />

<strong>Retail</strong> <strong>Research</strong> 5