Feasibility Study - Department of Transport

Feasibility Study - Department of Transport

Feasibility Study - Department of Transport

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

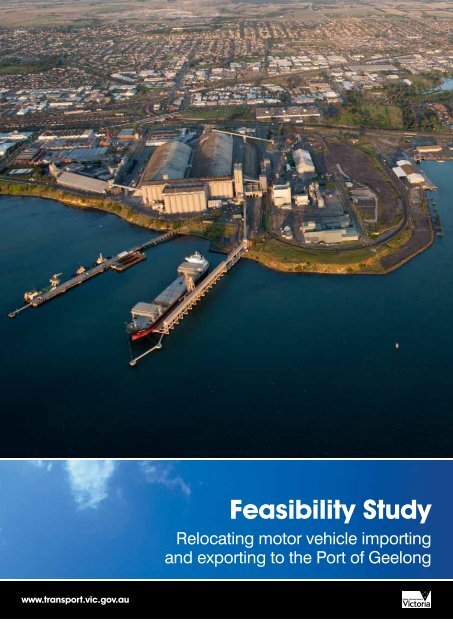

<strong>Feasibility</strong> <strong>Study</strong><br />

Relocating motor vehicle importing<br />

and exporting to the Port <strong>of</strong> Geelong<br />

www.transport.vic.gov.au

This publication is copyright. No part may be reproduced<br />

by any process except in accordance with the provisions<br />

<strong>of</strong> the Copyright Act 1968.<br />

© State <strong>of</strong> Victoria 2012<br />

Authorised by the Victorian Government, 121 Exhibition St,<br />

Melbourne Victoria 3000.<br />

If you would like to receive this publication in an accessible<br />

format, such as large print or audio please telephone Public<br />

Affairs Branch, <strong>Department</strong> <strong>of</strong> <strong>Transport</strong> on (03) 9655 6000.<br />

2 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

Contents<br />

1. Purpose <strong>of</strong> this document 4<br />

2. The freight task 5<br />

3. Technical feasibility assessment 8<br />

4. Impacts and benefits<br />

<strong>of</strong> the Geelong option 15<br />

5. Delivery issues 18<br />

6. Geelong option –<br />

summary <strong>of</strong> key findings 19<br />

7. Alternative option –<br />

Webb Dock West 21<br />

10. Conclusions 25<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 3

1. Purpose <strong>of</strong> this document<br />

Background<br />

In February 2011, the Minister for Ports, the Hon Dr Denis<br />

Napthine, announced a feasibility study into relocating<br />

the import and export <strong>of</strong> motor vehicles from the Port <strong>of</strong><br />

Melbourne to Victoria’s second largest port, the Port <strong>of</strong><br />

Geelong.<br />

Consistent with its 2035 Port Development Strategy, the<br />

Port <strong>of</strong> Melbourne Corporation (PoMC) has proposed<br />

consolidating current motor vehicle import and export<br />

activities at Webb Dock West within the Port <strong>of</strong> Melbourne,<br />

with capacity to handle all forecast imports and exports<br />

for at least 25 years, along with a significant proportion <strong>of</strong><br />

on-wharf pre-delivery inspection (PDI) activity.<br />

The Port <strong>of</strong> Geelong provides a potential alternative<br />

location for the import and export <strong>of</strong> motor vehicles,<br />

and may have the benefit <strong>of</strong> delivering regional<br />

economic growth.<br />

In July 2011, the <strong>Department</strong> <strong>of</strong> <strong>Transport</strong> (DOT) released<br />

the Discussion Paper: Relocating motor vehicle importing<br />

and exporting to the Port <strong>of</strong> Geelong (“discussion<br />

paper”), which detailed the current automotive industry<br />

and supply chain, set out a concept proposal for an<br />

automotive terminal at Geelong, and invited submissions<br />

from interested parties. The discussion paper was<br />

developed in close consultation with the automotive<br />

industry, shipping lines, PoMC and the Port <strong>of</strong> Geelong.<br />

The discussion paper set out the policy drivers for<br />

investigating the possible relocation <strong>of</strong> motor vehicle<br />

importing and exporting to Geelong:<br />

• tackling road congestion, particularly on<br />

Melbourne’s freeways, arterial roads and port<br />

access roads<br />

• enhancing regional development<br />

• ensuring efficient automotive supply chains for<br />

imported and exported vehicles<br />

• supporting local vehicle manufacturing.<br />

There were 64 submissions received from a variety <strong>of</strong><br />

stakeholders including motor vehicle manufacturers,<br />

shipping lines, peak bodies, local government,<br />

community groups and from the ports <strong>of</strong> Melbourne<br />

and Geelong. Stakeholder input and advice has been<br />

critical to developing a holistic understanding <strong>of</strong> the<br />

current industry and in identifying all the potential issues<br />

associated with relocation to Geelong.<br />

4 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

This feasibility study<br />

This feasibility study describes and<br />

quantifies the technical, economic,<br />

environmental and social feasibility<br />

<strong>of</strong> the proposal, and the associated<br />

impacts and benefits. It includes<br />

information in the following areas:<br />

• the freight task – describes and<br />

quantifies the current freight<br />

task and the forecast growth in<br />

the importing and exporting <strong>of</strong><br />

motor vehicles<br />

• automotive supply chain –<br />

describes how the supply chain<br />

would work if motor vehicle<br />

import and export activities were<br />

relocated to the Port <strong>of</strong> Geelong<br />

• environmental, social and<br />

business impacts <strong>of</strong> relocation<br />

to Geelong<br />

• commercial and economic<br />

considerations – including cost<br />

impacts, employment benefits<br />

and suggested commercial<br />

models and governance<br />

arrangements.<br />

Webb Dock West represents an<br />

alternative to relocation in Geelong<br />

and is discussed at the end <strong>of</strong><br />

this study.<br />

2. The freight task<br />

Motor vehicle imports and exports<br />

The discussion paper presented vehicle import and<br />

export forecasts to 2050, assuming ongoing local<br />

manufacturing at current levels.<br />

Industry submitters to the discussion paper generally<br />

supported the forecasts.<br />

The forecasts were reviewed during the feasibility study,<br />

including analysis <strong>of</strong> the impact <strong>of</strong> different scenarios for<br />

local manufacturing and exporting.<br />

Two demand scenarios are evaluated in this<br />

feasibility study:<br />

• imports and exports continue in line with the<br />

forecasts set out in the discussion paper<br />

• imports continue in line with the forecasts<br />

set out in the discussion paper but exports<br />

continue at a reduced level consistent with<br />

recent trends (approximately 40-50,000 vehicles<br />

exported annually).<br />

Related and general cargoes<br />

Motor vehicles are imported and exported on Roll-on<br />

Roll-<strong>of</strong>f vessels (RoRo). Some <strong>of</strong> these vessels also<br />

carry a small proportion <strong>of</strong> general and break-bulk<br />

cargoes, including:<br />

• High and Heavy (HiHe) vehicles such as combine<br />

harvesters, tractors and excavators<br />

Demand forecasts adopted for this feasibility study<br />

2015 2020 2025 2035 2050<br />

Demand Task 1 – Import/Export<br />

Import Vehicles 375,000 472,000 560,000 790,000 1,252,000<br />

Export Vehicles 110,000 110,000 110,000 110,000 110,000<br />

TOTAL 485,000 582,000 670,000 900,000 1,362,000<br />

Demand Task 2 – Import/Export<br />

Import Vehicles 375,000 472,000 560,000 790,000 1,252,000<br />

Export Vehicles 40,000 40,000 40,000 40,000 40,000<br />

TOTAL 415,000 512,000 600,000 830,000 1,292,000<br />

Sources: Port <strong>of</strong> Melbourne Corporation 2010 (Total and CAGR to 2035), Federal Chamber <strong>of</strong> Automotive Industries and<br />

industry discussions (Exports), <strong>Study</strong> team (2050 CAGR and forecasts to align with long term strategic port planning)<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 5

• machinery and equipment such as generators,<br />

turbines, transformers, paper bales, train carriages<br />

and forestry machinery loaded on to wheeled trailers<br />

• project cargoes which can include very large and<br />

very heavy loads, such as pre-assembled plant.<br />

These trades would also relocate to the Port <strong>of</strong> Geelong<br />

and, in addition to the land area required for motor<br />

vehicle import and export, would require:<br />

• approximately five hectares <strong>of</strong> open-air and<br />

undercover storage areas to allow for inspection,<br />

processing, cleaning and storage prior to delivery<br />

to <strong>of</strong>f-site long term storage or directly to customers<br />

• ramps, pavement strengths and overhead<br />

clearances capable <strong>of</strong> handling HiHe loads <strong>of</strong> at<br />

least 350 tonnes net.<br />

Corio Quay North and South are currently used for breakbulk<br />

trades including steel imports for the motor vehicle<br />

industry and exports <strong>of</strong> aluminium ingots from Alcoa.<br />

These existing break-bulk trades could share undercover<br />

and outdoor storage provided for other related trades, or<br />

could be relocated to other parts <strong>of</strong> the Port <strong>of</strong> Geelong,<br />

subject to acceptable commercial terms being reached<br />

with relevant parties.<br />

Ships and cargo exchanges<br />

RoRo vessels enable vehicles and<br />

other cargo to be driven <strong>of</strong>f the<br />

vessel via side and stern ramps. It<br />

is expected that the average size <strong>of</strong><br />

RoRo vessels will increase over time<br />

as outlined in the following table.<br />

The average number <strong>of</strong> vehicles<br />

exchanged per vessel call is also<br />

expected to increase over time,<br />

due to:<br />

• increases in ship size<br />

and capacity<br />

• reduction in the number <strong>of</strong><br />

port calls per vessel as overall<br />

trade volumes increase and<br />

shipping lines seek to achieve<br />

efficiencies.<br />

Increasing ship sizes and cargo<br />

exchange rates will require longer<br />

berths, additional lay down<br />

and terminal space and greater<br />

stevedoring services per ship call<br />

in future.<br />

Forecast ship fleet adopted for this study<br />

Length<br />

Typical<br />

registered<br />

draught<br />

Typical<br />

beam 2010 2015 2020 2025 2035 2050<br />

(m) (m) (m) (% <strong>of</strong> car carrier ships calling at Melbourne)<br />

< 191 5 – 8 20 – 28 49 38 31 25 18 15<br />

191-210 8.8 32.2 34 37 39 40 39 36<br />

211-230 9.5 32.2 8 13 15 17 20 22<br />

231-250 11.3 32.2 6 8 10 12 16 19<br />

251-270 11.5 32.2 3 4 5 6 7 8<br />

> 270 11.7 33 0 0 0 0 0 0<br />

Forecast vehicle exchanges per ship call<br />

2015 2020 2025 2030 2035 2040 2045 2050<br />

Average Vessel<br />

Size (CEU)<br />

6,117 6,250 6,368 6,432 6,496 6,517 6,538 6,559<br />

Vessel Exchange 18.6% 19.8% 21.0% 22.2% 23.4% 24.6% 25.8% 27.0%<br />

Average Vessel<br />

Exchange<br />

(Vehicles/visit)<br />

1,138 1,238 1,337 1,428 1,520 1,603 1,687 1,771<br />

6 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

Land-side supply chains<br />

The discussion paper described<br />

in detail the current supply chain<br />

for motor vehicle imports and<br />

exports, as summarised in the<br />

following diagrams.<br />

Exported vehicle supply chain<br />

Toyota’s export vehicles are<br />

transported directly from the<br />

production line to port up to 10<br />

days prior to export. Reliability <strong>of</strong><br />

export vessel schedules is crucial for<br />

Toyota as shipments from Australia<br />

are linked to a global schedule <strong>of</strong><br />

vessel movements.<br />

Imported vehicle supply chain<br />

Most imports are transported away<br />

from the port precinct within the three<br />

days ‘free storage’ <strong>of</strong>fered by the<br />

terminal operators:<br />

• 40 per cent <strong>of</strong> vehicles are<br />

transported direct to dealers<br />

following PDI at on-wharf facilities<br />

• 60 per cent <strong>of</strong> vehicles are transported to <strong>of</strong>fwharf<br />

facilities, mainly in Altona/Laverton for PDI<br />

prior to subsequent transport to dealers, or for<br />

long-term storage.<br />

The logistics approach chosen largely depends on the<br />

manufacturer’s business model. Some manufacturers aim<br />

to reduce delivery time and inventory holding costs by<br />

conducting on-wharf PDI and delivery within three days.<br />

Manufacturers that are less driven by delivery schedules<br />

or import cars which are not pre-sold are more likely to<br />

transport their vehicles to Altona/Laverton.<br />

As more <strong>of</strong> the industry aims to improve supply-chain<br />

efficiency and reduce inventory costs, the proportion<br />

<strong>of</strong> on-wharf PDI is likely to increase to 60 per cent or<br />

more over time. This is consistent with current practice<br />

interstate where new, purpose-built vehicle import<br />

facilities have been established at the Fisherman Islands<br />

Cargo Terminal at the Port <strong>of</strong> Brisbane and the Port<br />

Kembla Terminal at the Port <strong>of</strong> Port Kembla.<br />

Distribution <strong>of</strong> imported motor vehicles reflects<br />

the current population distribution <strong>of</strong> Melbourne.<br />

Approximately 60 per cent <strong>of</strong> vehicles are currently<br />

sold through dealers in the eastern and south-eastern<br />

suburbs, while the rest are sold in the west and north.<br />

In the future this will move closer to 50/50 given higher<br />

residential growth rates in the west and north.<br />

Production plant<br />

Car transport company<br />

Consolidation at<br />

export wharf<br />

Stevedore<br />

Ship<br />

A few only<br />

Most<br />

Dealer<br />

About 40<br />

per cent<br />

On wharf<br />

PDI<br />

A few<br />

Storage<br />

Dealer<br />

Ship<br />

Wharf stack<br />

(terminal<br />

operator)<br />

About 60<br />

per cent<br />

Off wharf<br />

site<br />

Most<br />

Off wharf<br />

PDI<br />

Dealer<br />

A few<br />

Dealer<br />

Storage<br />

Dealer<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 7

3. Technical feasibility<br />

assessment<br />

Channel<br />

Key issues<br />

Submitters to the discussion paper raised a number <strong>of</strong><br />

concerns regarding the Geelong shipping channel:<br />

• The long, narrow and one-way nature <strong>of</strong> the channel<br />

at Geelong could lead to congestion delays,<br />

worsening over time as ship numbers increase<br />

to meet likely medium to long term demand and<br />

capacity requirements.<br />

• Car-carrying vessels are high-sided and more<br />

susceptible to high winds. This could cause delays<br />

in accessing the channel in windy conditions and<br />

require more expensive tugs.<br />

• Car-carriers operate to global schedules and any<br />

delays caused by channel congestion could impact<br />

on international delivery times and increase costs.<br />

• The priority access regime which currently existing<br />

at the Port <strong>of</strong> Geelong for deep draught ships<br />

during high tide could delay access to the channel<br />

for car-carrier ships. At some other Australian ports,<br />

car-carriers can tend to have priority due to their<br />

fast turn around time.<br />

Issues assessment<br />

The declared depth <strong>of</strong> the channel into the Port <strong>of</strong><br />

Geelong is 12.3 metres, which can cater to the largest<br />

forecast car-carrier/ RoRo vessel. The channel is 42.6<br />

kilometres long and 120 metres wide, and is a one-way<br />

channel for the majority <strong>of</strong> its length.<br />

Modelling undertaken by the Victorian Regional Channels<br />

Authority (VRCA) and supported by the Port Phillip Sea<br />

Pilots (PPSP) indicates that vessels would be able to<br />

safely transit the Geelong channel at wind speeds less<br />

than 15 knots without tug assistance. The modelling has<br />

also shown that the largest current car carrier vessels<br />

could safely transit the channel in wind speeds up to 25<br />

knots with tug assistance from Point Henry.<br />

There is nevertheless the possibility that ship’s masters,<br />

having ultimate responsibility for the safe navigation <strong>of</strong><br />

vessels may be more conservative when accessing and<br />

traversing the channel, potentially requiring tugs for its<br />

full length or in winds less than 15 knots.<br />

More powerful specialised tugs would be required in the<br />

port. Towage costs at the Port <strong>of</strong> Geelong would be likely<br />

to rise slightly to cover the cost <strong>of</strong> the new tugs, and this<br />

cost increase would be shared by all port users.<br />

Further modelling undertaken by<br />

VRCA investigated the potential for<br />

congestion and delays in the channel<br />

taking into account a range <strong>of</strong> factors<br />

including forecast ship numbers,<br />

berth availability, tides and wind.<br />

This modelling allowed two ships to<br />

be transiting the channel at once,<br />

rather than the current practice <strong>of</strong> a<br />

single vessel transit, and found:<br />

• Channel utilisation increases<br />

from 39 per cent in 2015 to<br />

62 per cent to 2030 and<br />

would be the primary cause <strong>of</strong><br />

future delays<br />

• Subject to three berths being<br />

constructed, with ultimate<br />

expansion to four, berth<br />

availability would not be a<br />

major cause <strong>of</strong> delay<br />

• Wind can significantly<br />

compound delays under<br />

adverse conditions<br />

By 2030, approximately half <strong>of</strong> all<br />

inbound car-carrying ships would<br />

be delayed. While most <strong>of</strong> these<br />

would experience delays <strong>of</strong> less<br />

than one hour, the remainder would<br />

be exposed to an average delay <strong>of</strong><br />

more than four hours, and in some<br />

cases, delays under adverse wind<br />

conditions could be greater than a<br />

day as the port clears vessels.<br />

Quay & berths<br />

Key issues<br />

The quay must be <strong>of</strong> sufficient<br />

depth and width to safely handle the<br />

anticipated ship size in the mid to<br />

long term without tide assistance.<br />

Ideally the quay depth would<br />

match the channel depth to make<br />

navigation as simple as possible.<br />

There must be sufficient berth<br />

capacity, in terms <strong>of</strong> number and<br />

length <strong>of</strong> berths, to handle forecast<br />

ship call volumes and ship sizes.<br />

The number <strong>of</strong> berths required<br />

to meet the forecast ship calls is<br />

as follows:<br />

• initially, two berths will<br />

be required<br />

• a third will be required<br />

from 2020<br />

• a fourth between 2045<br />

and 2050<br />

• depending on export volumes<br />

in the future, three berths may<br />

be sufficient.<br />

At least some <strong>of</strong> the berths should be<br />

capable <strong>of</strong> handling HiHe loads <strong>of</strong> at<br />

least 350 tonnes net.<br />

Issues assessment<br />

The Port <strong>of</strong> Geelong would be able<br />

to provide a total <strong>of</strong> four berths to<br />

meet demand out to at least 2050.<br />

This could be achieved through<br />

reclamation <strong>of</strong> land at Corio Quay<br />

South (further covered in the<br />

Land section).<br />

All berths could have side and rear<br />

ramp access except for Corio Quay<br />

North, which would have only rear<br />

ramp access. The quay would be<br />

wide enough to accommodate the<br />

widest forecast car carriers.<br />

All areas could have a handling<br />

capacity <strong>of</strong> 350 tonnes, though a<br />

specified area could be provided for<br />

heavier weights.<br />

Approximately 290,000 cubic<br />

metres <strong>of</strong> dredging would be<br />

required over 34.9 hectares <strong>of</strong><br />

seabed at Corio Quay and its swing<br />

basin to deepen these areas from<br />

their current 11.0 metres to 12.3<br />

metres, highlighted in the shaded<br />

area <strong>of</strong> the following diagram.<br />

Area requiring dredging or<br />

reclaiming at Corio Quay<br />

Dredging works would be coordinated<br />

and funded by the VRCA<br />

and is likely to cost in excess <strong>of</strong><br />

$10 million although the cost <strong>of</strong><br />

positioning dredges into Australia<br />

could increase this cost significantly.<br />

Disposal <strong>of</strong> dredged material could<br />

occur at a pre-existing dredged<br />

materials disposal ground within Port<br />

Philip Bay, subject to environmental<br />

approvals. Initial investigations have<br />

not detected any contaminated<br />

sediments but further analysis would<br />

be required.<br />

8 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

Proposed South Corio depth 12.3m<br />

Total Area 34.6ha<br />

Total dredged area 27.3ha<br />

Total dredged material 260.674 m3<br />

Proposed Extension<br />

(7.3ha)<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 9

Land<br />

Key issues<br />

Submitters to the discussion paper raised a number<br />

<strong>of</strong> concerns in relation to the land available at the Port<br />

<strong>of</strong> Geelong:<br />

• Industry estimates <strong>of</strong> land required for an effective<br />

and efficient terminal (including comparison with<br />

interstate terminals) ranged from 40-60 hectares.<br />

• There appears to be insufficient land to cater to<br />

current volumes and forecast growth in the import<br />

and export <strong>of</strong> motor vehicles.<br />

• There appears to be insufficient land to provide for<br />

on-wharf processing for between 60-85 per cent <strong>of</strong><br />

imported vehicles, in line with industry preferences<br />

and forecasts.<br />

• The land available at the Port <strong>of</strong> Geelong is<br />

at different elevations and would be poorly<br />

configured, which is likely to lead to less efficient<br />

terminal operations.<br />

• Any proposal for an automotive terminal at Geelong<br />

should be based on the current practice <strong>of</strong> stacking<br />

cars at the terminal for priority delivery to their<br />

intended destination, with three days <strong>of</strong> free atwharf<br />

storage for imports and 10 days for exports.<br />

The relocation <strong>of</strong> related general cargoes creates<br />

an additional land requirement <strong>of</strong> five hectares <strong>of</strong><br />

storage area, including under-cover storage for weather<br />

sensitive cargoes.<br />

Further minor land may be required for Customs and<br />

Australian Quarantine and Inspection Service facilities.<br />

Issues assessment<br />

A total 24.8 hectare footprint could be<br />

provided adjacent to Corio Quay with<br />

17.5 hectares currently held by Ports<br />

Pty Ltd and a further 7.3 hectares<br />

added through land reclamation.<br />

However, it is likely there would only<br />

be useable land <strong>of</strong> approximately<br />

20 hectares, taking into account the<br />

suboptimal configuration <strong>of</strong> the site,<br />

the different levels and grades, the<br />

rail loop bisection and the need to<br />

provide underpasses.<br />

Initial investigations and consultation<br />

with land owners have identified an<br />

additional 10 hectares <strong>of</strong> land that<br />

could potentially be available west <strong>of</strong><br />

Corio Quay Road.<br />

Analysis has shown that while other<br />

terminals around Australia are larger,<br />

they are not currently operating at<br />

full capacity and more intensive<br />

operations may require less land<br />

at Geelong.<br />

An evaluation was undertaken <strong>of</strong><br />

the land likely to be required for a<br />

‘high intensity’ facility handling<br />

motor vehicle imports and exports,<br />

as well as related cargoes in both<br />

Demand Task forecasts, for each<br />

<strong>of</strong> three scenarios:<br />

• no on-wharf PDI<br />

• 40 per cent <strong>of</strong> vehicles undergo<br />

on-wharf PDI<br />

• 85 per cent <strong>of</strong> vehicles undergo<br />

on-wharf PDI.<br />

The results for Demand Task 1<br />

are shown in Table 4 below. Land<br />

requirements for Demand Task 2<br />

were around five per cent lower, but<br />

would constrain throughput in the<br />

event <strong>of</strong> higher export volumes or<br />

lower than expected efficiency.<br />

Potential land areas<br />

available at Port <strong>of</strong> Geelong<br />

In excess <strong>of</strong> 80 and possibly more<br />

than 100 hectares additional land<br />

would be required on-wharf in the ‘85<br />

per cent PDI’ scenario. As this area<br />

is not available at either Geelong<br />

or Melbourne, this option is not<br />

considered feasible.<br />

Land required at port – motor vehicle imports, exports & HiHe (ha): Demand Task 1<br />

2015 2020 2030 2040 2050<br />

Land available at Port <strong>of</strong> Geelong – useable 20.0 20.0 20.0 20.0 20.0<br />

No on-wharf PDI<br />

total area required for imports/exports & HiHe 21.3 24.8 27.6 33.9 45.1<br />

land deficit (additional land required) 1.3 4.8 7.6 13.9 25.1<br />

40% on-wharf PDI<br />

total area required for imports/exports, HiHe and PDI 33.4 38.6 51.7 70.9 98.0<br />

land deficit (additional land required) 13.4 18.6 31.7 50.9 78.0<br />

85% on-wharf PDI<br />

total area required for imports/exports, HiHe and PDI 47.1 54.8 75.5 106.8 151.8<br />

land deficit (additional land required) 27.1 34.8 55.5 86.8 131.8<br />

10 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

Key<br />

Dual Gauge Rail Line<br />

Underpass<br />

CQS4<br />

Maximum Ship Length 264 m<br />

Potential Future Berth<br />

N<br />

Area 1 – 2.8 ha<br />

Area 2 – 3.2 ha<br />

Area 3 – 11.5 ha<br />

Area 4 – 7.3 ha<br />

TOTAL – 24.8 ha<br />

CQN Shed 3<br />

CQN Shed 2<br />

Maximum Ship Length 264 m<br />

1 Berth – 270 m Quayline<br />

CQN1<br />

CQS1 CQS3<br />

Ship Length 264 m Ship Length 264 m<br />

Area 4<br />

7.3 ha<br />

Hardstand Pavement<br />

Corio Quay Road<br />

Area 2<br />

3.2 ha<br />

Hardstand Pavement<br />

Area 1<br />

2.8 ha<br />

Area 3<br />

11.5 ha<br />

Cowies Creek<br />

Princes Highway<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 11

In the ‘no on-wharf PDI’ scenario:<br />

• The existing land at Geelong is likely to be able to<br />

handle the initial volume <strong>of</strong> imports and current<br />

reduced export volumes until 2020 but not the<br />

higher export volume.<br />

• After 2020, given forecast growth in imports and/<br />

or recovery <strong>of</strong> export volumes, up to 14 hectares <strong>of</strong><br />

additional land/floor space needs to be secured to<br />

meet mid-to long-term demand to at least 2040.<br />

• This indicates that a multi-storey car park is likely<br />

to be required at Geelong, located either within<br />

the current port boundary or on land west <strong>of</strong> Corio<br />

Quay Road.<br />

• If a five storey car park were built on a 3.8 hectare<br />

footprint, this would provide for 10,000 vehicle<br />

spots which would be sufficient to cater for demand<br />

to 2035. Detailed cost estimates have not been<br />

prepared but using benchmark industry estimates,<br />

the construction could cost in the order <strong>of</strong> $135 –<br />

$150 million.<br />

In the ‘40 per cent <strong>of</strong> vehicles undergo on-wharf<br />

PDI’ scenario:<br />

• Any provision for on-wharf PDI would immediately<br />

exceed the 20 hectares <strong>of</strong> available useable land<br />

currently owned by Ports Pty Ltd. Therefore a<br />

further 14 hectares <strong>of</strong> additional land/floor space<br />

would be required at project start-up and up to 50<br />

hectares <strong>of</strong> additional floor space required to meet<br />

long-term demand.<br />

• This indicates that a very large multi-storey car<br />

park should be considered an essential part<br />

<strong>of</strong> any proposal to accommodate on-wharf PDI<br />

at Geelong.<br />

• If a five storey car park were built on a 10 hectare<br />

footprint, this would provide for 26,000 vehicle<br />

spots which would be sufficient to cater for<br />

demand to at least 2035. Detailed cost estimates<br />

have not been prepared but using benchmark<br />

industry estimates, the construction could cost in<br />

the order <strong>of</strong> $370 million.<br />

Terminal operations<br />

and access<br />

Key issues<br />

Submitters to the discussion<br />

paper raised a number <strong>of</strong> issues<br />

to be addressed in the layout and<br />

operation <strong>of</strong> an automotive terminal<br />

at the Port <strong>of</strong> Geelong, including:<br />

• The most efficient terminal<br />

design would enable each<br />

activity to be conducted at<br />

ground level within designated<br />

areas and using current industry<br />

‘stacking’ procedures, including<br />

imports, exports, PDI and high<br />

and heavy.<br />

• A land constrained terminal<br />

could create additional<br />

operating costs as a<br />

consequence <strong>of</strong> lower<br />

productivity and efficiency,<br />

and could increase<br />

wharf congestion.<br />

• Multi-storey car parks are<br />

predominantly used in landconstrained<br />

ports for vehicles<br />

with longer dwell times, such<br />

as exports.<br />

• The standard free storage dwell<br />

times <strong>of</strong> three days for imports<br />

and 10 days for exports need<br />

to be maintained to enable<br />

flexible and efficient utilisation<br />

<strong>of</strong> stevedoring and transport<br />

resources. Any reduction in<br />

these dwell times would create<br />

peaks in demand that other<br />

areas <strong>of</strong> the supply chain may<br />

be unable to meet.<br />

• The terminal would need to be<br />

multi-user and provide for 24/7<br />

open access with transparent<br />

charging arrangements allowing<br />

usage by any stevedore or PDI<br />

provider interested in servicing<br />

the automotive sector.<br />

Issues assessment<br />

While the three day and 10 day<br />

lay-down time could be shortened<br />

to increase capacity, it is considered<br />

that the current periods remain<br />

appropriate as the basis <strong>of</strong> design for<br />

any new facility at Geelong. These<br />

have been used in calculating land<br />

requirements in this study.<br />

A multi-storey car park could handle<br />

export volumes, any limited PDI<br />

conducted at port, as well as imports<br />

with longer dwell times at the port.<br />

An automotive terminal at Port <strong>of</strong><br />

Geelong could operate 24/7 and<br />

provide for multi-user open access.<br />

Appropriate governance, project<br />

financing, delivery and performance<br />

requirements would need to be<br />

established in project agreements<br />

between the State and the private<br />

port owner, or in regulation. It is<br />

expected that the entity financing the<br />

terminal will recover its costs through<br />

user charges.<br />

12 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

Stevedoring<br />

Key issues<br />

Submitters to the discussion paper<br />

raised concerns about impacts<br />

on stevedoring operations if motor<br />

vehicle imports and exports are<br />

relocated to the Port <strong>of</strong> Geelong:<br />

• Pre-sorting <strong>of</strong> cars for easy<br />

distribution to dealers is<br />

essential to the achievement<br />

<strong>of</strong> an efficient supply chain<br />

and should be provided for<br />

in any terminal design and<br />

operational plan.<br />

• there appears to be insufficient<br />

lay down area adjacent to<br />

the port to maintain dealer<br />

mark priority stacking at 500<br />

cars per hectare taking into<br />

account forecast demand.<br />

This, combined with the<br />

segregation <strong>of</strong> operational<br />

areas and possible multi-storey<br />

car park, would lead to less<br />

efficient stevedoring practices,<br />

increased wharf congestion,<br />

double-handling and additional<br />

overtime, as well as increased<br />

risk <strong>of</strong> vehicle damage and<br />

safety issues – all <strong>of</strong> which<br />

would increase costs.<br />

• Co-location <strong>of</strong> motor vehicles,<br />

break-bulk and general cargo is<br />

important for flexible utilisation<br />

<strong>of</strong> stevedoring labour and<br />

equipment, keeping costs down<br />

and enabling resources to be<br />

deployed for other uses during<br />

quieter periods. By locating<br />

RoRo cargo to Geelong, but<br />

retaining the balance <strong>of</strong> general<br />

cargo at the Port <strong>of</strong> Melbourne,<br />

it is likely that duplication <strong>of</strong><br />

stevedoring resources would<br />

result leading to increased costs<br />

to both streams <strong>of</strong> trade. Recent<br />

relocation <strong>of</strong> motor vehicle<br />

trades elsewhere in Australia<br />

have consolidated the trades in<br />

the same location.<br />

Issues assessment<br />

Assessment <strong>of</strong> land requirements<br />

undertaken for this study<br />

included provision for dealer<br />

mark priority stacking.<br />

Two stevedores currently service<br />

the motor vehicle industry in Victoria<br />

– Patrick Stevedores and POAGS.<br />

Both have a similar workforce size<br />

<strong>of</strong> around 200, employing a base <strong>of</strong><br />

predominantly permanent staff plus<br />

casual positions..<br />

There are insufficient facilities in<br />

Geelong to accommodate all the<br />

general cargo currently handled in<br />

Melbourne. As a result, there is likely<br />

to be duplication <strong>of</strong> equipment and<br />

other resources across Melbourne<br />

and Geelong, creating inefficiencies<br />

and higher stevedoring costs.<br />

It is likely that both stevedores would increase casual<br />

and permanent positions in Geelong, reduce number<br />

<strong>of</strong> permanent positions in Melbourne and increase the<br />

casual workforce in Melbourne.<br />

The use <strong>of</strong> a multi-storey car park would reduce<br />

stevedoring efficiency due to increased travel time and<br />

distance, requiring an extra gang to work each ship to<br />

ensure current dispatch schedules were maintained. It<br />

is likely that this would lead to a 10-15 per cent higher<br />

stevedoring cost.<br />

Pre-delivery inspection<br />

Key issues<br />

Submitters to the discussion paper raised a number <strong>of</strong><br />

concerns regarding potential arrangements for PDI in<br />

the supply chain from Geelong:<br />

• There appears to be insufficient land available<br />

for PDI to be conducted at the port. Loss <strong>of</strong> this<br />

capability would lead to increased costs along the<br />

supply chain, including handling and inventory<br />

costs, with all motor vehicles requiring rehandling at<br />

<strong>of</strong>f-wharf PDI facilities in Altona/Laverton, and less<br />

efficient supply chains.<br />

• Geelong is further away from the centre <strong>of</strong> the<br />

Melbourne metropolitan market, and would reduce<br />

the efficiency <strong>of</strong> the dealer distribution task (also<br />

addressed in the following section).<br />

Issues assessment<br />

An inability to conduct PDI at the port would:<br />

• impose a different supply chain model on the<br />

industry compared with practices elsewhere around<br />

Australia; reducing supply chain efficiency<br />

• prevent some manufacturers from implementing<br />

their ‘lean logistics chain’ business models<br />

• preclude other manufacturers from implementing<br />

this practice.<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 13

All PDI would occur at existing facilities in Altona/<br />

Laverton. The per-unit cost <strong>of</strong> the actual PDI activity is<br />

unlikely to increase, it is likely that storage and inventory<br />

costs would increase slightly costs. The transport<br />

and distribution task would also be less efficient, as<br />

discussed in the following section.<br />

If PDI activities are not relocated to Geelong, the<br />

employment benefits <strong>of</strong> the Geelong option are reduced.<br />

<strong>Transport</strong> & distribution<br />

Key issues<br />

Submitters to the discussion paper raised a number <strong>of</strong><br />

concerns regarding potential impacts on the transport<br />

and distribution task to and from Geelong:<br />

• There would be an increase in the overall travel time<br />

and distance which in turn would lead to increases<br />

in fuel and labour costs, as well as additional capital<br />

expenditure in the extra fleet required to meet the<br />

increased freight task.<br />

• Current supply chains are optimised around a<br />

central distribution location (the Port <strong>of</strong> Melbourne),<br />

which enables flexible utilisation <strong>of</strong> transport<br />

vehicles including back-loading. Relocation to<br />

Geelong would decrease the number <strong>of</strong> runs per<br />

day, increasing capital and resourcing costs.<br />

• In order to reduce this impact there is potential<br />

to use larger more efficient car carriers on the<br />

line haul from Geelong to Altona, though some<br />

transport companies have indicated that the current<br />

configuration is the most optimal for full road<br />

network access.<br />

• Over-dimensional transport providers have<br />

expressed concern regarding the extra travel time<br />

imposed by the less direct over-dimensional routes<br />

from the Port <strong>of</strong> Geelong, specifically height and<br />

weight restrictions.<br />

Issues assessment<br />

<strong>Transport</strong> constitutes a major proportion <strong>of</strong> the overall<br />

supply chain cost. The kilometres travelled in the overall<br />

distribution task would increase by 70 per cent. In 2015,<br />

this would be equivalent to an additional 20 million gross<br />

tonne kilometres, with this figure rising to 100 million<br />

gross tonne kilometres by 2040.<br />

Average travel times between<br />

Geelong and Altona/Laverton based<br />

on 2010 data, have been modelled<br />

at 47 minutes, versus 19 minutes<br />

between Melbourne and Altona/<br />

Laverton. As such, all imports<br />

would be exposed to an additional<br />

average cost <strong>of</strong> approximately $88<br />

resulting from the longer and less<br />

efficient transport task as well as a<br />

distribution point that is no longer<br />

central to the market. 1<br />

Exports to the Port <strong>of</strong> Geelong<br />

would experience an average travel<br />

time <strong>of</strong> 46 minutes, compared with<br />

the current 20 minutes to the Port<br />

<strong>of</strong> Melbourne, and a transport cost<br />

increase <strong>of</strong> $43 per vehicle.<br />

Additional capital costs would also<br />

result with transport companies<br />

needing to purchase more trucks<br />

given a loss <strong>of</strong> back-haul and<br />

triangulation opportunities.<br />

Rail is not considered a costcompetitive<br />

option for the distribution<br />

<strong>of</strong> motor vehicles in Victoria.<br />

A preliminary finding <strong>of</strong> this feasibility<br />

study is that there is insufficient<br />

land available to accommodate all<br />

imports, exports, PDI and related<br />

trades, without the acquisition <strong>of</strong><br />

additional land and construction <strong>of</strong> a<br />

multi-storey car park.<br />

The cost and complexity <strong>of</strong><br />

constructing a large multi-storey car<br />

park indicates that on-wharf PDI is<br />

not feasible in the event <strong>of</strong> relocation<br />

to Geelong.<br />

1. This cost represents a weighted average<br />

<strong>of</strong> transport cost impacts across all<br />

imported motor vehicles. However the<br />

actual cost impact will be higher on those<br />

motor vehicles currently delivered direct<br />

to dealer (approximately 40 per cent), with<br />

a lower cost impact for the remaining 60<br />

per cent <strong>of</strong> motor vehicles delivered from<br />

depots in Altona/Laverton.<br />

14 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

4. Impacts and<br />

benefits <strong>of</strong> the<br />

Geelong option<br />

Cost impacts to the motor<br />

vehicle industry<br />

The previous sections <strong>of</strong> this<br />

feasibility study set out likely<br />

impacts in each element <strong>of</strong> the<br />

supply chain in the event <strong>of</strong><br />

relocating motor vehicle imports<br />

and exports to Geelong.<br />

The following table summarises the<br />

estimated costs <strong>of</strong> these impacts,<br />

with relocation <strong>of</strong> import and export<br />

activities to the Port <strong>of</strong> Geelong,<br />

but with all PDI activities occurring<br />

<strong>of</strong>f-wharf at Altona/Laverton. The<br />

table also provides a comparison<br />

<strong>of</strong> forecast costs at Geelong with<br />

current arrangements.<br />

All elements <strong>of</strong> additional cost<br />

have been identified, including<br />

extra costs <strong>of</strong> towage and channel<br />

access; recovering the cost<br />

<strong>of</strong> capital investment in wharf<br />

and terminal infrastructure; and<br />

additional stevedoring, transport and<br />

distribution costs.<br />

It is envisaged that the terminal access component <strong>of</strong><br />

the costs below includes a ‘facility access charge’ which<br />

would be used to recoup costs <strong>of</strong> the capital expenditure<br />

over a 35 year return period.<br />

The costs below have been compiled through<br />

information provided by various industry stakeholders<br />

and independent research and analysis. They do<br />

not represent actual charges and should be treated<br />

as indicative.<br />

The estimated increase in costs per vehicle forecast for<br />

2015 are as follows:<br />

• For the 40 per cent <strong>of</strong> imports that are currently<br />

delivered direct to dealer from the port, an<br />

additional cost per vehicle <strong>of</strong> $198 would apply.<br />

• For the 60 per cent <strong>of</strong> imports that are currently<br />

delivered from Altona/Laverton, an additional cost<br />

per vehicle <strong>of</strong> $133 would apply.<br />

• On average, the additional cost per vehicle for<br />

imports would be approximately $159.<br />

• Exports would incur an additional cost <strong>of</strong> $108<br />

per vehicle.<br />

Applying these estimated cost increases to the forecast<br />

demand, in 2015 the total additional cost to industry for<br />

the first year <strong>of</strong> operation would be approximately $71.4<br />

million. In 2050 this additional operational cost would<br />

rise to approximately $211 million.<br />

Summary <strong>of</strong> cost impacts per vehicle<br />

Costs Current supply chain Geelong with <strong>of</strong>f-wharf PDI<br />

Channel and towage $21.84 $39.82<br />

Wharfage & terminal access $57.45 $95.25<br />

Stevedore services $60.00 $68.95<br />

Melbourne on-wharf PDI &<br />

transport (40%)<br />

$145.00 N/A<br />

Off-wharf PDI & transport (60%) $210.50 $278.90<br />

<strong>Transport</strong> costs (exports) $34.00 $77.00<br />

TOTALS<br />

Melbourne on-wharf PDI &<br />

transport (40%)<br />

Off-wharf PDI & transport imports<br />

(60%)<br />

$284.29 N/A<br />

$349.79 $482.92<br />

Exports costs $173.29 $281.02<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 15

Economic impact assessment<br />

Benefit Cost Analysis<br />

A Benefit Cost Analysis comparing the Port <strong>of</strong><br />

Melbourne with relocation to Geelong generates an<br />

overall negative Net Present Value (NPV) <strong>of</strong> -$48.03<br />

million. The results indicate that there would be net direct<br />

costs as a result <strong>of</strong> relocation.<br />

Wider Economic Impacts<br />

An assessment <strong>of</strong> the wider economic benefits such<br />

as agglomeration, increased State output and labour<br />

market impacts indicates only minimal benefits<br />

principally associated with an uplift in labour productivity<br />

could be attributed to the project.<br />

Employment generation<br />

The supply chain involved in importing and<br />

exporting motor vehicles supports approximately<br />

1,000 jobs, including:<br />

• 20 jobs in port and terminal management<br />

• 400 permanent and casual jobs in stevedoring<br />

• 500 jobs in on- and <strong>of</strong>f-wharf PDI activities<br />

• 150 jobs in distribution and transport.<br />

Relocating the import and export activities and on-wharf<br />

PDI to the Port <strong>of</strong> Geelong could have the potential to<br />

relocate a significant proportion <strong>of</strong> these jobs, resulting<br />

in direct and indirect employment benefits in the<br />

Geelong region.<br />

However, the findings <strong>of</strong> this feasibility study indicate<br />

that if motor vehicle and related trades were relocated<br />

to Geelong, but not PDI, then:<br />

• Approximately 20 new jobs would be created in<br />

port and terminal management<br />

• As the majority <strong>of</strong> the break-bulk trade would<br />

remain in Melbourne, the number <strong>of</strong> stevedore<br />

positions created would be less than currently exist<br />

in Melbourne.<br />

• The combined number <strong>of</strong> stevedore positions<br />

created would be approximately 160 permanent and<br />

100 casual ‘new’ jobs in Geelong A proportion <strong>of</strong><br />

the new jobs are likely to be filled by existing workers<br />

living in Melbourne’s west who would commute to<br />

Geelong. As such there would be a proportional<br />

reduction <strong>of</strong> permanent positions in Melbourne.<br />

• No jobs associated with PDI activities would<br />

relocate to Geelong.<br />

16 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

Bulk ship customers in the<br />

Port <strong>of</strong> Geelong<br />

While some bulk ship customers within the Port <strong>of</strong><br />

Geelong consider that the proposal could result in<br />

improvements to port services, some have expressed<br />

concern that the relocation <strong>of</strong> the car trade could impact<br />

on the current priority regime for deep draught ships,<br />

which require high tide access to the channel and berths.<br />

• A small number <strong>of</strong> new jobs<br />

would be created in transport<br />

and distribution, but existing<br />

contractors and drivers would<br />

continue to be employed in the<br />

first instance.<br />

• Jobs would grow as the freight<br />

task increases over time.<br />

Other business impacts<br />

Port <strong>of</strong> Geelong users<br />

The Port <strong>of</strong> Geelong principally<br />

handles bulk cargoes, including<br />

woodchips, fertilisers, petroleum<br />

products and grain, as well as<br />

break-bulk cargoes. These trades are<br />

generally compatible with each other,<br />

and share facilities and buffers to<br />

surrounding sensitive uses.<br />

The introduction <strong>of</strong> motor vehicle<br />

imports and exports would create<br />

potential for conflict between trades,<br />

particularly with respect to the risk <strong>of</strong><br />

damage to motor vehicles by other<br />

products. With the grain terminal<br />

adjacent to Corio Quay, the attraction<br />

<strong>of</strong> birds to this area could also<br />

result in damage to vehicles. These<br />

problems are being experienced in<br />

other ports around Australia where<br />

the motor vehicle trades have colocated<br />

with bulk trades and industry.<br />

Investigations conducted for this<br />

feasibility study indicate there would<br />

be some risk <strong>of</strong> potential business<br />

interruption and cost to existing Port<br />

<strong>of</strong> Geelong occupiers.<br />

Current break-bulk imports and exports –<br />

Corio Quay<br />

Current trades importing and exporting through Corio<br />

Quay would be directly impacted if the car trade relocates<br />

to Geelong. Steel coils are imported through Corio Quay<br />

South for the manufacturing <strong>of</strong> motor vehicles, with the<br />

steel stored undercover at berth. This storage facility<br />

would be removed as part <strong>of</strong> a Corio Quay development<br />

and another facility would need to be identified.<br />

Alcoa also produces aluminium ingots at its smelter at<br />

Point Henry for export through Corio Quay North.<br />

Subject to the parties reaching a commercial agreement<br />

to develop other facilities, the trades could be relocated<br />

within Geelong. Alternatively the products could be<br />

handled through Melbourne. The potential cost impacts<br />

<strong>of</strong> these options have not been quantified.<br />

Environmental and social issues<br />

The development and operation <strong>of</strong> a motor vehicle<br />

import and export facility at the Port <strong>of</strong> Geelong<br />

could have minor direct and indirect effects on the<br />

environment, including:<br />

• removal <strong>of</strong> native flora and fauna on project lands,<br />

including sea grass in areas to be dredged<br />

• indirect effects <strong>of</strong> dredge plumes and shipping<br />

operations on locations remote from actual<br />

project activities<br />

• disturbance and disposal <strong>of</strong> potentially<br />

contaminated materials in Corio Quay and on<br />

other project land<br />

• increased greenhouse gas emissions resulting from<br />

additional truck travel in the distribution task.<br />

Preliminary investigations indicate that impacts on the<br />

terrestrial and marine environments are likely to be<br />

acceptable and manageable. However, more detailed<br />

investigations would need to be undertaken to satisfy the<br />

requirements <strong>of</strong> State environmental consent processes.<br />

Preliminary investigations into potential social<br />

and amenity issues indicate that impacts would be<br />

low to moderate:<br />

• Shell Parade/Corio Quay Road and Mackey<br />

Street/Princes Highway would be the preferred<br />

access routes and would avoid trucks using local<br />

residential streets<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 17

• minor road upgrades would be required to meet<br />

safety requirements for the car-carrying truck fleet<br />

accessing the port<br />

• VRCA’s existing channel access and boating safety<br />

education program would adequately address<br />

marine safety issues<br />

• visual impacts would be evaluated in any required<br />

statutory approvals process<br />

• truck trips per day (one-way) in the port precinct<br />

would increase as shown below.<br />

Road congestion effects<br />

Relocation to Geelong would not perceptibly reduce<br />

congestion over the West Gate Bridge or on port access<br />

roads. The movement <strong>of</strong> motor vehicles represents only<br />

five per cent <strong>of</strong> the total port-related truck movements,<br />

which in turn represent approximately three per cent<br />

<strong>of</strong> traffic on the M1 and over the West Gate Bridge.<br />

Therefore, motor vehicle trades represent around 0.1 per<br />

cent <strong>of</strong> traffic on the West Gate Bridge.<br />

Truck numbers may reduce slightly if longer transport<br />

vehicles for the line-haul from Geelong to Altona/<br />

Laverton are introduced. However, these vehicles are<br />

unlikely to be suitable for the distribution task to dealers<br />

on smaller local roads.<br />

Additional truck trips per day from car trade growth<br />

5. Delivery issues<br />

A number <strong>of</strong> issues would need to<br />

be addressed to achieve the<br />

successful and timely relocation <strong>of</strong><br />

motor vehicle imports and exports<br />

to the Port <strong>of</strong> Geelong.<br />

Timing<br />

Relocation <strong>of</strong> motor vehicle<br />

trades to Geelong would need<br />

to be coordinated with other port<br />

development proposals within the<br />

Port <strong>of</strong> Melbourne. It is understood<br />

that the earliest possible date that<br />

relocation <strong>of</strong> the motor vehicle trades<br />

could be required is around 2014/15.<br />

Planning, design, approvals,<br />

procurement and construction<br />

<strong>of</strong> a facility would need to be<br />

completed within three to four<br />

years. This timeframe is considered<br />

tight but achievable.<br />

2020 2030 2050<br />

Port to Compound 35 50 98<br />

Compound to Dealer 42 63 128<br />

Factory to Port 10 11 12<br />

Total 87 124 238<br />

Ownership, access,<br />

competition and pricing<br />

The Port <strong>of</strong> Geelong is privately<br />

owned. If the motor vehicle trades<br />

were relocated to the port, the State<br />

would need to enter into binding<br />

project agreements with the port<br />

owner, its agents and financiers<br />

to ensure that an adequate level<br />

<strong>of</strong> service is provided to the<br />

motor vehicle industry, including<br />

expansion <strong>of</strong> the facility over time to<br />

accommodate forecast growth.<br />

The Government would draw on<br />

similar experiences in reaching<br />

agreements, eg. Public-Private<br />

Partnerships, in structuring the<br />

project agreements.<br />

The automotive handling and<br />

logistics services industry is<br />

concentrated in the hands <strong>of</strong> a few<br />

related and integrated companies.<br />

This includes terminal operation,<br />

stevedoring and PDI.<br />

Most industry submitters to the<br />

discussion paper supported a<br />

model whereby an independent<br />

operator develops and manages<br />

the facility at Geelong and<br />

makes it available on an open<br />

access arrangement, reflecting<br />

arrangements at other motor vehicle<br />

port terminals around Australia.<br />

18 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

It is envisaged that similar<br />

to other Australian ports, an<br />

independent pricing monitor such<br />

as a competition authority would<br />

be the appropriate body to monitor<br />

prices and charges at the port.<br />

Further consideration <strong>of</strong> the most<br />

appropriate regulatory framework<br />

is required. The Victorian Essential<br />

Services Commission may have a<br />

role to play in this regard.<br />

Statutory approvals<br />

The development <strong>of</strong> the Port <strong>of</strong><br />

Geelong to handle motor vehicle<br />

and related trades would require<br />

consents under a number <strong>of</strong><br />

State and Commonwealth<br />

legislation, including:<br />

• Coastal Management Act 1995<br />

(Vic) – approval for dredging,<br />

spoil disposal and land<br />

reclamation would be required<br />

• Planning and Environment Act<br />

1987 (Vic) – planning scheme<br />

amendment for the area <strong>of</strong><br />

land to be reclaimed would be<br />

required. The City <strong>of</strong> Greater<br />

Geelong is the relevant planning<br />

and responsible authority for the<br />

subject land at present<br />

• Environment Effects Act 1978<br />

(Vic) – a referral under this<br />

Act would be required,<br />

to determine whether an<br />

Environment Effects Statement<br />

(EES) would be needed<br />

• Environmental Protection and<br />

Biodiversity Conservation Act<br />

1999 (Cth) – referral <strong>of</strong> the<br />

proposal to the Commonwealth<br />

Minister for decision on whether<br />

a formal assessment and review<br />

process may be required.<br />

To date, no potentially significant<br />

environmental impacts have been<br />

identified on the marine or terrestrial<br />

environment. However, there is a risk<br />

that as new information comes to<br />

hand during future site and project<br />

investigations this could alter the<br />

initial assessment.<br />

6. Geelong option –<br />

summary <strong>of</strong> key findings<br />

This section summarises the<br />

key findings <strong>of</strong> feasibility investigations into<br />

relocating motor vehicle imports and<br />

exports to the Port <strong>of</strong> Geelong.<br />

<strong>Feasibility</strong> assessment<br />

Corio Quay could be redeveloped to provide sufficient<br />

berth and quay capacity to meet long-term demand for<br />

motor vehicle imports and exports and related trades<br />

The Geelong channel has sufficient depth for the<br />

forecast largest ship and capacity for initial ship<br />

numbers. However, by 2030 the one-way nature <strong>of</strong> the<br />

channel would result in delays to 50 per cent <strong>of</strong> in-bound<br />

car-carrying vessels. These vessels would experience<br />

an average <strong>of</strong> four hours delay, with adverse wind<br />

conditions exacerbating delays.<br />

The 20 hectares <strong>of</strong> available and useable land at grade<br />

within the Port <strong>of</strong> Geelong at project commencement<br />

would be sufficient to handle all imports and current<br />

reduced export volumes (around 40,000) until around<br />

2020, as well as providing five hectares <strong>of</strong> outdoor and<br />

undercover storage for related trades.<br />

An additional 15 hectares <strong>of</strong> useable land/floor space<br />

would be required to cater for demand to 2040. This<br />

could be achieved by:<br />

• acquisition <strong>of</strong> additional project land, most likely the<br />

land between the Melbourne-Geelong rail corridor<br />

and Princes Highway, and<br />

• construction <strong>of</strong> a multi-storey car park on the<br />

acquired land, or over Corio Quay South, or both, at<br />

an estimated cost <strong>of</strong> between $135-150 million.<br />

The multi-storey car park space would more likely<br />

be used for handling vehicles with longer dwell times<br />

at the port, such as exports and longer-term storage<br />

<strong>of</strong> imports.<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 19

Stevedoring services would be less efficient due to the<br />

need to manage vehicles within the multi-storey car park,<br />

increasing stevedoring costs by 10-15 per cent.<br />

There is insufficient land at the Port <strong>of</strong> Geelong for<br />

any on-wharf PDI. The cost <strong>of</strong> additional multi-storey<br />

car park space is likely to be prohibitive, and industry<br />

would probably choose to conduct all PDI at existing or<br />

expanded facilities at Altona/Laverton.<br />

The project could be delivered through a series <strong>of</strong><br />

project agreements between the State and the private<br />

owner <strong>of</strong> the Port <strong>of</strong> Geelong, its agents and financiers,<br />

which ensure that industry would be provided with an<br />

adequate level <strong>of</strong> service, including expansion <strong>of</strong> the<br />

facility over time to meet demand.<br />

Regulatory models are available to achieve an adequate<br />

level <strong>of</strong> competition, access, price control and regulation<br />

<strong>of</strong> the activities.<br />

Impacts and benefits<br />

The Geelong option would increase costs in most<br />

elements <strong>of</strong> the supply chain in comparison to the<br />

current arrangements at Port <strong>of</strong> Melbourne. The following<br />

are the estimated cost increases:<br />

• Channel and towage fees – $18 per vehicle<br />

• Recovery <strong>of</strong> capital investment in assets –<br />

$38 per vehicle<br />

• Stevedoring – $9 per vehicle<br />

• Average transport and distribution costs for imports<br />

– $88 per vehicle<br />

• Average transport costs for exports –<br />

$43 per vehicle<br />

• Off-wharf PDI processing – $6 per vehicle<br />

As such, the average additional cost per vehicle for<br />

imports would be approximately $159, and $108 per<br />

vehicle for exports. The total cost impact to industry<br />

across the entire supply chain would be in the order <strong>of</strong><br />

$71.4 million in the first year <strong>of</strong> operation and while this<br />

would decrease in real terms per vehicle over time it<br />

would still be $211 million in 2050.<br />

Lack <strong>of</strong> on-wharf PDI would prevent<br />

some manufacturers from achieving<br />

their current ‘lean logistics chain’<br />

models, and preclude others from<br />

implementing this practice.<br />

Introduction <strong>of</strong> motor vehicle imports<br />

and exports at the port could restrict<br />

the operations <strong>of</strong> existing bulk and<br />

break-bulk port users and occupiers.<br />

The potential environmental and<br />

social impacts <strong>of</strong> the option appear<br />

low to moderate, and manageable.<br />

If the automotive importing and<br />

exporting is relocated<br />

to Geelong the following direct<br />

employment benefits could result:<br />

• terminal operations –<br />

approximately 20<br />

fulltime equivalent (FTE)<br />

positions required<br />

• stevedores – 260 permanent<br />

and casual positions<br />

• PDI – no new positions with<br />

all PDI processing done in<br />

Altona/ Laverton<br />

The Geelong option has a negative<br />

net present value, reflecting the<br />

increased overall cost to industry<br />

and the limited economic and<br />

employment benefits created by<br />

the proposal.<br />

20 <strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong

7. Alternative option –<br />

Webb Dock West<br />

Whilst this study focuses on the<br />

technical, environmental, social and<br />

economic feasibility <strong>of</strong> relocating the<br />

import and export <strong>of</strong> motor vehicles<br />

to Geelong, an alternative potential<br />

site for the automotive trade exists<br />

at Webb Dock West in the Port <strong>of</strong><br />

Melbourne. A summary <strong>of</strong> this option<br />

is provided below.<br />

Technical feasibility<br />

Channel<br />

• The existing channel and swing<br />

basin are <strong>of</strong> sufficient depth<br />

and width to accommodate the<br />

anticipated ship sizes.<br />

• The Port Phillip channel is<br />

wider, two-way, and has a 30-<br />

60 minute shorter transit time<br />

than the Geelong channel. Tug<br />

assistance would not be required<br />

in the channel, but would<br />

continue to be required for larger<br />

vessels to assist with berthing<br />

under highwind conditions.<br />

• There is sufficient and reliable<br />

channel capacity in the long<br />

term to avoid delays for car<br />

carriers and other vessels.<br />

Quay and berths<br />

• Dredging would be required within Webb Dock<br />

to accommodate car carriers. Sediments are<br />

uncontaminated and may be disposed at a preexisting<br />

dredged materials disposal ground under<br />

existing approvals.<br />

• The estimated capital cost to develop Webb Dock<br />

West is similar to the capital investment required to<br />

develop berths in Geelong.<br />

• The proposal includes three berths capable <strong>of</strong><br />

simultaneously accommodating two 235 metre<br />

long vessels and a 265 metre long vessel. The<br />

berths would also support different operating<br />

capabilities (e.g. stern ramp, side ramp,<br />

lift-on lift-<strong>of</strong>f crane access) and would allow the<br />

berths to be used by other trades in the future.<br />

• Three berths for car carriers would meet<br />

requirements for at least 30 years.<br />

• The Port <strong>of</strong> Melbourne Corporation (PoMC) would<br />

to recover the cost <strong>of</strong> dredging and berth works<br />

through increased wharfage and rental charges.<br />

Land including PDI<br />

• PoMC would develop Webb Dock West with up<br />

to 45 hectares <strong>of</strong> flat, useable land, which would<br />

include an area <strong>of</strong> port land at the northern end <strong>of</strong><br />

Webb Dock.<br />

• This option is likely to provide sufficient capacity<br />

for the automotive and HiHe sectors until at least<br />

2035, with provision for more than 40 per cent onwharf<br />

PDI.<br />

• Further land is available for expansion <strong>of</strong> activities<br />

at the northern end <strong>of</strong> Webb Dock.<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 21

Terminal operations and access<br />

• There are a number <strong>of</strong> different terminal ownership<br />

and operational models currently in the Port <strong>of</strong><br />

Melbourne. Consolidating operations at Webb Dock<br />

West provides an opportunity to achieve economies<br />

<strong>of</strong> scale and productivity improvements and to<br />

provide a consistent open access arrangement.<br />

• PoMC intends to act as landlord to a single terminal<br />

operator providing multi-user open access to the<br />

terminal for stevedores, and common access for<br />

automotive vessels to all automotive berths.<br />

• An automotive terminal at WDW could operate 24/7<br />

and retain the three-day lay down time for imports<br />

and 10 days for exports as standard practice.<br />

Stevedores<br />

• Webb Dock West would be established as an<br />

open access terminal allowing any stevedoring<br />

company interested in the automotive trade to<br />

enter and operate.<br />

• A single terminal would enable the consolidation<br />

<strong>of</strong> resources handling passenger and commercial<br />

vehicles, break-bulk and general RoRo cargo all in<br />

the same location.<br />

• Stevedores would be able to continue to use dealer<br />

mark priority when discharging import ships for all<br />

pre-sold cars.<br />

• Current stevedore permanent, semi-permanent<br />

and casual positions would remain, with number <strong>of</strong><br />

positions expected to increase in line with growth<br />

in demand.<br />

<strong>Transport</strong> and distribution<br />

• <strong>Transport</strong> and distribution<br />

patterns would remain similar<br />

with potential for more efficient<br />

use <strong>of</strong> truck movements to result<br />

through consolidation<br />

<strong>of</strong> the industry.<br />

• Forecast congestion around the<br />

Port <strong>of</strong> Melbourne and Dynon<br />

precinct will reduce transport<br />

efficiency for movement <strong>of</strong> cars<br />

from WDW, and increased use<br />

<strong>of</strong> <strong>of</strong>f-peak truck movements<br />

likely to result.<br />

• The development <strong>of</strong> Webb<br />

Dock West for the automotive<br />

import and export trade would<br />

have relatively little impact on<br />

overall traffic along arterial<br />

routes such as on the West Gate<br />

Bridge. Over time an increased<br />

percentage <strong>of</strong> on-wharf PDI<br />

would slightly reduce truck<br />

numbers heading west over<br />

the bridge.<br />

Cost impacts<br />

• The capital investment required<br />

at Webb Dock West is similar<br />

to that required to develop<br />

Geelong. Full recovery <strong>of</strong><br />

the capital cost by Port <strong>of</strong><br />

Melbourne Corporation would<br />

increase car import and export<br />

costs by a similar amount as a<br />

Geelong development<br />

• The Port <strong>of</strong> Melbourne<br />

Corporation’s initial assessment<br />

<strong>of</strong> the cost impact <strong>of</strong> the Port<br />

Licence Fee on the car industry<br />

is approximately $12 per car.<br />

• Whilst there are additional<br />

costs arising from the capital<br />

investment at Webb Dock West,<br />

efficiency and productivity gains<br />

resulting from consolidation,<br />

including transport, would lead<br />

to less overall cost to industry<br />

when compared with relocation<br />

to Geelong.<br />

Industry views<br />

Industry submitters understand<br />

that development at the Webb<br />

Dock West will increase costs for<br />

the automotive industry and more<br />

recently it has been made aware<br />

<strong>of</strong> the impact <strong>of</strong> the Port Licence<br />

Fee. Nevertheless the industry<br />

have indicated that consolidation<br />

at Webb Dock West is the preferred<br />

solution as it meets many <strong>of</strong> their<br />

requirements for an efficient motor<br />

vehicle terminal, including:<br />

• a large, flat parcel <strong>of</strong> land with<br />

provision for on-wharf PDI for at<br />