Annual Report 2011 - Syrah Resources Ltd

Annual Report 2011 - Syrah Resources Ltd

Annual Report 2011 - Syrah Resources Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

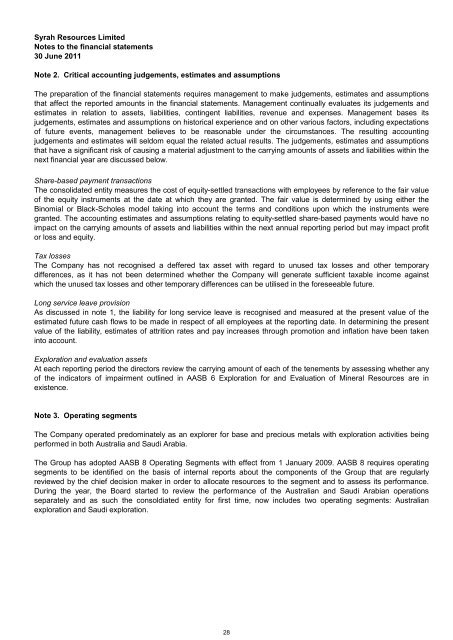

<strong>Syrah</strong> <strong>Resources</strong> Limited<br />

Notes to the financial statements<br />

30 June <strong>2011</strong><br />

Note 2. Critical accounting judgements, estimates and assumptions<br />

The preparation of the financial statements requires management to make judgements, estimates and assumptions<br />

that affect the reported amounts in the financial statements. Management continually evaluates its judgements and<br />

estimates in relation to assets, liabilities, contingent liabilities, revenue and expenses. Management bases its<br />

judgements, estimates and assumptions on historical experience and on other various factors, including expectations<br />

of future events, management believes to be reasonable under the circumstances. The resulting accounting<br />

judgements and estimates will seldom equal the related actual results. The judgements, estimates and assumptions<br />

that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the<br />

next financial year are discussed below.<br />

Share-based payment transactions<br />

The consolidated entity measures the cost of equity-settled transactions with employees by reference to the fair value<br />

of the equity instruments at the date at which they are granted. The fair value is determined by using either the<br />

Binomial or Black-Scholes model taking into account the terms and conditions upon which the instruments were<br />

granted. The accounting estimates and assumptions relating to equity-settled share-based payments would have no<br />

impact on the carrying amounts of assets and liabilities within the next annual reporting period but may impact profit<br />

or loss and equity.<br />

Tax losses<br />

The Company has not recognised a deffered tax asset with regard to unused tax losses and other temporary<br />

differences, as it has not been determined whether the Company will generate sufficient taxable income against<br />

which the unused tax losses and other temporary differences can be utilised in the foreseeable future.<br />

Long service leave provision<br />

As discussed in note 1, the liability for long service leave is recognised and measured at the present value of the<br />

estimated future cash flows to be made in respect of all employees at the reporting date. In determining the present<br />

value of the liability, estimates of attrition rates and pay increases through promotion and inflation have been taken<br />

into account.<br />

Exploration and evaluation assets<br />

At each reporting period the directors review the carrying amount of each of the tenements by assessing whether any<br />

of the indicators of impairment outlined in AASB 6 Exploration for and Evaluation of Mineral <strong>Resources</strong> are in<br />

existence.<br />

Note 3. Operating segments<br />

The Company operated predominately as an explorer for base and precious metals with exploration activities being<br />

performed in both Australia and Saudi Arabia.<br />

The Group has adopted AASB 8 Operating Segments with effect from 1 January 2009. AASB 8 requires operating<br />

segments to be identified on the basis of internal reports about the components of the Group that are regularly<br />

reviewed by the chief decision maker in order to allocate resources to the segment and to assess its performance.<br />

During the year, the Board started to review the performance of the Australian and Saudi Arabian operations<br />

separately and as such the consoldiated entity for first time, now includes two operating segments: Australian<br />

exploration and Saudi exploration.<br />

28