Annual Report 2011 - Syrah Resources Ltd

Annual Report 2011 - Syrah Resources Ltd

Annual Report 2011 - Syrah Resources Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Syrah</strong> <strong>Resources</strong> Limited<br />

Notes to the financial statements<br />

30 June <strong>2011</strong><br />

Note 17. Financial instruments<br />

Financial risk management objectives<br />

The consolidated entity's activities expose it to a variety of financial risks: market risk (including foreign currency risk,<br />

price risk and interest rate risk), credit risk and liquidity risk. The consolidated entity's overall risk management<br />

program focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the<br />

financial performance of the consolidated entity. The consolidated entity uses different methods to measure different<br />

types of risk to which it is exposed. These methods include sensitivity analysis in the case of interest rate, foreign<br />

exchange and other price risks, ageing analysis for credit risk and beta analysis in respect of investment portfolios to<br />

determine market risk.<br />

Risk management is carried out by the Board. The policies employed to mitigate risk include identification and<br />

analysis of the risk exposure of the consolidated entity appropriate procedures, controls and risk limits. The Board<br />

identifies risk and evaluates the effectiveness of its responses.<br />

Market risk<br />

Foreign currency risk<br />

Foreign exchange risk arises from future commercial transactions and recognised financial assets and financial<br />

liabilities denominated in a currency that is not the entity’s functional currency. The risk is measured using sensitivity<br />

analysis and cash flow forecasting.<br />

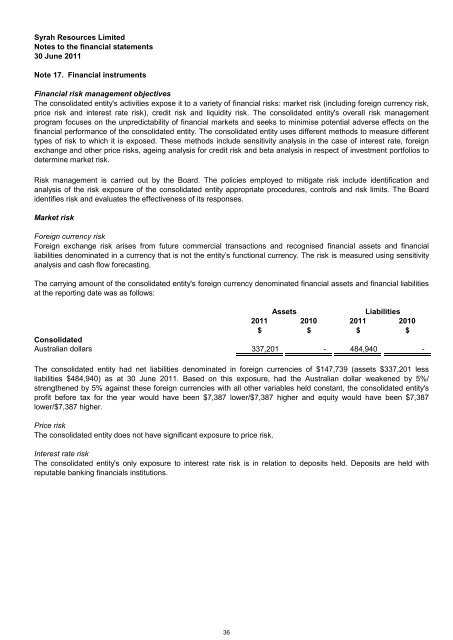

The carrying amount of the consolidated entity's foreign currency denominated financial assets and financial liabilities<br />

at the reporting date was as follows:<br />

Consolidated<br />

Australian dollars<br />

Assets<br />

Liabilities<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

$ $ $ $<br />

337,201 - 484,940 -<br />

The consolidated entity had net liabilities denominated in foreign currencies of $147,739 (assets $337,201 less<br />

liabilities $484,940) as at 30 June <strong>2011</strong>. Based on this exposure, had the Australian dollar weakened by 5%/<br />

strengthened by 5% against these foreign currencies with all other variables held constant, the consolidated entity's<br />

profit before tax for the year would have been $7,387 lower/$7,387 higher and equity would have been $7,387<br />

lower/$7,387 higher.<br />

Price risk<br />

The consolidated entity does not have significant exposure to price risk.<br />

Interest rate risk<br />

The consolidated entity's only exposure to interest rate risk is in relation to deposits held. Deposits are held with<br />

reputable banking financials institutions.<br />

36