COMMITTED TO THOSE LINKED TO THE LAND - John Deere

COMMITTED TO THOSE LINKED TO THE LAND - John Deere

COMMITTED TO THOSE LINKED TO THE LAND - John Deere

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

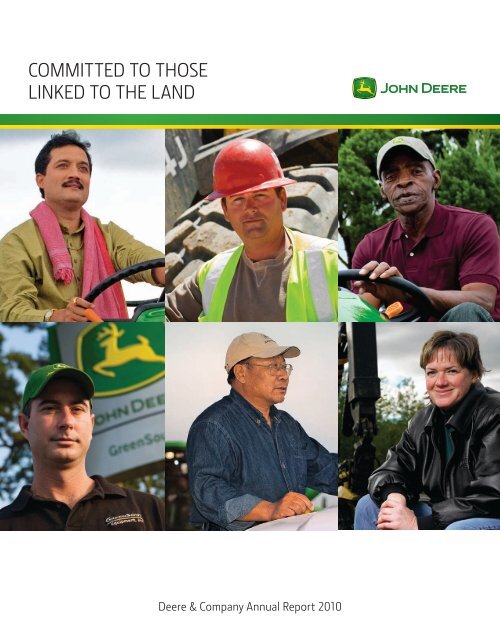

<strong>COMMITTED</strong> <strong>TO</strong> <strong>THOSE</strong><br />

<strong>LINKED</strong> <strong>TO</strong> <strong>THE</strong> <strong>LAND</strong><br />

<strong>Deere</strong> & Company Annual Report 2010

CHAIRMAN’S MESSAGE<br />

PERFORMANCE STAGES STRONG REBOUND;<br />

COMPANY SETS AMBITIOUS COURSE FOR FUTURE<br />

Samuel R. Allen, Chairman and CEO<br />

ABOUT <strong>THE</strong> COVER:<br />

Some of the faces of those who depend on<br />

<strong>John</strong> <strong>Deere</strong> products to cultivate, harvest,<br />

transform, enrich or build upon the land.<br />

Our employees and dealers are committed<br />

to helping customers meet the world’s<br />

growing need for food, fuel, shelter and<br />

infrastructure in a profi table, productive<br />

and sustainable way.<br />

The year 2010 will be remembered as a pivotal one for <strong>John</strong> <strong>Deere</strong>.<br />

The company delivered sharply improved financial results despite<br />

sluggish global economic conditions that restrained sales in<br />

certain regions and businesses.<br />

<strong>John</strong> <strong>Deere</strong> also proceeded with significant investments aimed at<br />

widening our manufacturing footprint and expanding our global<br />

market presence. As a result, the company remains well-positioned<br />

to capitalize on growth in the world economy and, longer term,<br />

to benefi t from broad economic trends that hold attractive<br />

promise for the future.<br />

We maintained our strong financial condition as well. <strong>Deere</strong>’s<br />

equipment operations ended the year essentially debt-free on a<br />

net basis, while our credit company’s balance sheet remained<br />

conservatively capitalized.<br />

In a step that could have a major impact on the company’s future,<br />

an ambitious blueprint was introduced to guide our efforts in<br />

meeting the world’s increasing need for food, shelter and<br />

infrastructure. The next evolution of the <strong>John</strong> <strong>Deere</strong> Strategy<br />

places a sharp focus on producing the agricultural and<br />

construction equipment<br />

Net Sales and Revenues (MM) solutions required by global<br />

$28,438<br />

2008<br />

$23,112<br />

2009<br />

$26,005<br />

2010<br />

markets that are gaining in<br />

both size and stature.<br />

For fiscal 2010, <strong>Deere</strong> reported<br />

income of nearly $1.9 billion,<br />

on net sales and revenues<br />

of $26.0 billion. Both figures<br />

were the second-highest in<br />

the company’s history, trailing<br />

Operating Profit (MM)<br />

only 2008. Income more<br />

than doubled on a 13 percent<br />

$3,420 $1,607 $3,408 increase in sales and revenues.<br />

Earnings, in rising by nearly<br />

$1 billion, staged their largest<br />

single-year improvement ever.<br />

All our business units reported<br />

higher profit in relation to 2009.<br />

2008 2009 2010<br />

Net Income *(MM)<br />

$2,053 $873 $1,865<br />

The company again generated<br />

strong cash flow as a result of<br />

its solid financial performance<br />

and the skillful execution of our<br />

business plans. Net cash from<br />

2008 2009 2010<br />

*Net income attributable to <strong>Deere</strong> & Company<br />

2

<strong>John</strong> <strong>Deere</strong> 8345R tractor has more power than earlier models and “smart tractor”<br />

telematics. Integrated with machine controls, telematics allows remote monitoring<br />

and increased productivity. <strong>Deere</strong>’s 8R-series tractors are equipped with<br />

engines that meet more-rigorous emissions standards taking effect in 2011.<br />

operating activities equaled $2.3 billion on an enterprise basis.<br />

The total was more than enough to fund a healthy level of capital<br />

projects, resume share repurchases, and pay out a record amount<br />

in dividends to shareholders.<br />

<strong>Deere</strong>’s performance reflected continued success delivering<br />

more profit from a lean slate of productive assets. Our profit and<br />

asset model aims for all businesses to earn their cost of capital –<br />

and deliver SVA, or Shareholder Value Added – across the<br />

business cycle. In 2010, SVA reached a record $1.714 billion.<br />

All company business units had improved SVA performance for<br />

the year. What’s more, despite significantly higher sales and<br />

factory production, asset levels remained well under control.<br />

A&T Pacing Performance<br />

Our performance was led by the Agriculture and Turf (A&T)<br />

division, which delivered particularly impressive results. With a<br />

sales increase of just 10 percent, A&T reported almost twice as<br />

much operating profit and more than four times the level of SVA<br />

achieved in 2009. <strong>Deere</strong>’s largest division efficiently managed<br />

assets, brought advanced new products to market and broadened<br />

its customer base. A&T results were aided by positive farm<br />

conditions and strong sales of large equipment, particularly in<br />

the United States.<br />

Sales also rose dramatically in Brazil after a steep decrease in<br />

2009. However, conditions in Europe – our second-largest regional<br />

market, after North America – showed a further decline.<br />

In other parts of our business, Construction and Forestry (C&F)<br />

saw an impressive rebound with sales increasing by 41 percent<br />

and operating profit turning strongly positive. C&F had success<br />

introducing advanced new products, expanding into new<br />

geographies and picking up market share in key categories. The<br />

division’s results were especially noteworthy in light of underlying<br />

weakness in U.S. construction markets. Even with the year’s<br />

sharp improvement, sales remained well below what traditionally<br />

has been considered a trough level.<br />

Making a further contribution to last year’s performance was<br />

<strong>John</strong> <strong>Deere</strong> Credit, which recorded significantly higher financial<br />

results while continuing to provide competitive financing to<br />

our equipment customers. Credit’s earnings jumped 85 percent<br />

as a result of higher loan margins and loan quality in addition to<br />

growth in the average portfolio of about $1 billion. Loan quality<br />

remained quite strong as the provision for loss declined to less<br />

than $50 for each $10,000 of portfolio value.<br />

2

Introduced in 2010, the <strong>John</strong> <strong>Deere</strong> 5036C tractor was designed and built<br />

in India to help increase mechanization and food production. The two<br />

5C models, with 35 and 41 horsepower, are the first <strong>John</strong> <strong>Deere</strong> tractors<br />

designed in India. Engineering and design responsibility for the company’s<br />

entire global utility tractor line was transferred to India in 2010.<br />

Powerful Tailwinds Shaping Plans<br />

As we’ve pointed out in previous messages, powerful global<br />

economic trends are lending support to our current performance<br />

and future prospects. The world’s population continues to grow,<br />

adding many thousands of new mouths to feed every day.<br />

Of equal importance, rising prosperity, particularly in developing<br />

economies such as China and India, is leading to a greater need<br />

for food and energy.<br />

As a result, worldwide stocks of key farm commodities have<br />

fallen near historic lows in relation to use. Grain prices have risen<br />

in response, propelling farm incomes to unprecedented levels.<br />

The combination of low grain reserves and higher global demand<br />

bodes well for crop prices over the long term. This, in turn,<br />

should help sustain our customers’ profi tability and support<br />

further profi table growth for <strong>John</strong> <strong>Deere</strong>.<br />

It is widely believed that agricultural output will need to double<br />

by mid-century to satisfy demand – and do so from essentially<br />

the same amount of land – requiring further advances in farming<br />

mechanization and productivity. In our view, <strong>John</strong> <strong>Deere</strong> is uniquely<br />

positioned to meet this challenge and is investing accordingly.<br />

At the same time, more people are moving from rural areas<br />

to cities, increasing the need for infrastructure development.<br />

Today, more than half of the world’s population resides in urban<br />

areas. That percentage is expected to reach 70 percent in the<br />

next 40 years – meaning that more people could be living in cities<br />

by 2050 than now make up the world’s entire population. Such a<br />

migration will lead to tremendous demand for roads, bridges,<br />

and buildings – and for the equipment needed to construct them.<br />

The implications for our company are both clear and compelling:<br />

Trends of this nature should help support demand for innovative<br />

farm, construction, forestry and turf-care equipment for years,<br />

if not generations, to come.<br />

4

Workhorse four-wheel-drive loaders such as the 744K help contractors<br />

meet the world’s growing need for shelter and infrastructure.<br />

The 744K was <strong>Deere</strong>’s first high-horsepower machine equipped with<br />

low-emissions Interim-Tier 4-certified engines that help curb air pollution.<br />

Targeting SVA Growth<br />

Partly as a result of these positive macroeconomic factors,<br />

extending the <strong>John</strong> <strong>Deere</strong> brand to a wider worldwide audience<br />

remains a top priority. Last year, in spite of weakness in Europe,<br />

sales outside the U.S. and Canada increased 14 percent and<br />

represented about 35 percent of the company total.<br />

A number of important projects were announced or moved<br />

ahead to promote growth on a global scale. These included a<br />

new manufacturing and parts complex in Russia that went into<br />

operation during the year. We also opened a joint-venture facility<br />

in India for the manufacture of backhoes and four-wheel-drive<br />

loaders and broke ground for a new combine-harvester facility<br />

in India. In December 2010, <strong>Deere</strong> announced plans for a<br />

construction-equipment factory in China for the production of<br />

four-wheel-drive loaders and excavators. These investments<br />

build on earlier ones that have added significantly to our capacity<br />

and marketing presence worldwide.<br />

Expanding our product range and entering attractive new<br />

businesses are vital to our growth. Among the products debuting<br />

last year was a midsize-tractor line built in India that targets a<br />

broad customer segment of the developing world. In addition,<br />

<strong>Deere</strong> introduced its most advanced forestry harvesters and<br />

forwarders to customers in North America and added power to<br />

its largest row-crop tractors. Further, the company brought out<br />

a family of zero-turn-radius mowers for smaller-scale commercial<br />

customers and introduced high-performance utility vehicles<br />

that can travel at speeds above 40 miles per hour.<br />

Honored for Innovation<br />

Again in 2010, the company was widely honored for its highly<br />

advanced products and features. Included were nine awards<br />

from a major U.S. agricultural-engineering group, a silver medal<br />

from a leading Russian trade show, and fi ve medals awarded<br />

at an international agricultural trade fair in Spain. Among the<br />

products honored were the company’s flagship 8R row-crop<br />

tractor, which had strong customer response in its first full year<br />

on the market, and an innovative steering system that enhances<br />

efficiency and safety.<br />

In addition, the company launched new engines that meet<br />

customer requirements for power and efficiency with lower<br />

emissions. The engines will be more widely available on products<br />

being introduced or sold beginning in 2011. In a move reflecting<br />

<strong>Deere</strong>’s focus on providing advanced products on an increasingly<br />

global scale, technology centers were opened or expanded in<br />

Germany and China.<br />

5

<strong>John</strong> <strong>Deere</strong>’s innovative 748H skidder is one of several products assembled at the<br />

company’s facility near Moscow, Russia, that went into operation during the year.<br />

The factory also produces high-horsepower tractors, combines, backhoe loaders<br />

and motor graders for promising markets in Russia and neighboring areas.<br />

Investors Seeing Strong Returns<br />

<strong>John</strong> <strong>Deere</strong> investors shared in our success of 2010. Stockholders<br />

realized a total return of 72 percent during the fiscal year<br />

compared with about 17 percent for the overall U.S. equity<br />

market. This signified the financial community’s recognition of<br />

our achievements and our attractive prospects for growth in<br />

the future. Roughly one-third of the company’s cash fl ow from<br />

operations was returned to our owners in dividends and share<br />

repurchases. Dividends totaled about $500 million for the year,<br />

a record, while share repurchases of nearly $360 million were<br />

made. Since mid-2004, the company has increased the quarterly<br />

dividend rate on eight occasions (through first-quarter 2011)<br />

and repurchased more than 100 million shares of common stock.<br />

Revised Strategy Unveiled<br />

As our world changes, so must <strong>John</strong> <strong>Deere</strong>. With those words,<br />

the company in 2010 introduced an ambitious blueprint to<br />

guide its efforts in meeting the world’s expanding needs in the<br />

years ahead. The next evolution of the <strong>John</strong> <strong>Deere</strong> Strategy<br />

builds on the company’s strong record of achievement. It raises<br />

the bar on growth and profi tability and puts more emphasis<br />

on global expansion.<br />

The strategy concentrates the company’s focus on two growth<br />

areas – agricultural and construction equipment solutions.<br />

Other operations – turf, forestry, parts, engines, intelligent<br />

solutions, and financial services – have vital roles supporting<br />

or complementing the growth operations. Emphasizing a lineup<br />

of tightly knit operations puts <strong>Deere</strong> in a stronger position<br />

to leverage strengths, optimize investments, efficiently target<br />

leadership and employee resources, and extend its ability to<br />

compete in the global marketplace.<br />

Further, the revised strategy sets out challenging metrics<br />

including $50 billion in mid-cycle sales by 2018 and 12 percent<br />

mid-cycle operating margins by 2014. Meeting these goals<br />

would result in a near-doubling of sales, a healthy increase in<br />

profitability, and an almost three-fold increase in economic profit,<br />

or SVA. The strategic plan targets roughly half of the company’s<br />

sales coming from outside the U.S. and Canada by 2018, versus<br />

about one-third today.<br />

In addition, measures are being introduced to help assure that<br />

financial performance remains sustainable as we accelerate<br />

our growth aspirations. “Health” metrics, as they’re being<br />

known, pertain to product quality, market share and employee<br />

engagement, among other areas.<br />

6

Among the most powerful utility vehicles available, the 50-hp <strong>John</strong> <strong>Deere</strong> Gator<br />

XUV 825i is one of an array of products with wide appeal that increase dealer<br />

traffic and attract new customers. Thanks to broad product lines and unmatched<br />

customer knowledge and service capabilities, independent <strong>John</strong> <strong>Deere</strong> dealers<br />

play a vital role in the company’s success.<br />

Aiming Higher, Moving Faster<br />

The <strong>John</strong> <strong>Deere</strong> Strategy calls on us to aim higher, move faster<br />

and perform better than ever before. Yet we firmly believe its<br />

goals are within reach based on the company’s proven capabilities<br />

and previous record of accomplishment. Successfully executed,<br />

the strategy will allow us to serve customers, employees,<br />

neighbors, business partners and investors at a higher level for<br />

years to come.<br />

Regardless of the changes required to realize our ambitions,<br />

<strong>John</strong> <strong>Deere</strong>’s commitment to how we do business is not subject<br />

to revision or reconsideration. Our values unite us. They also<br />

differentiate us. Our values have sustained the loyalty of<br />

generations of customers and are a powerful source of inspiration<br />

for thousands of talented employees, suppliers and dealers.<br />

They also have helped deliver solid returns to our investors<br />

over many years. We therefore reaffirm our dedication to the<br />

company’s values – integrity, quality, commitment and innovation<br />

– in order to move ahead wherever we do business.<br />

Extending Proud Record of Citizenship<br />

Being a responsible corporate citizen and a progressive employer<br />

are essential to being a great company. To this end, the company<br />

and the <strong>John</strong> <strong>Deere</strong> Foundation continued their support in 2010<br />

of worthy organizations that address world hunger, community<br />

betterment and higher education.<br />

With world hunger solutions remaining the signature program of<br />

the <strong>John</strong> <strong>Deere</strong> Foundation, KickStart International, a maker of<br />

manual irrigation pumps for subsistence farmers, continued to be<br />

a major recipient of foundation support. Support also continued<br />

for Opportunity International, a group that provides microfinance<br />

services to farmers in Africa. In the United States, the company<br />

increased funding for student “backpack” programs, which provide<br />

food supplies for more than 5,000 needy children over weekends.<br />

Economic development remained another priority, with grants<br />

of $2.8 million approved for programs in fi ve U.S. communities in<br />

which <strong>Deere</strong> has a significant presence.<br />

<strong>Deere</strong>’s leadership in environmental responsibility took further<br />

strides in 2010. Company facilities in China, Spain and the<br />

United States were recognized for their successful environmental<br />

practices, including sustainable building design and commitment to<br />

7

<strong>John</strong> <strong>Deere</strong> 3522 sugarcane harvester is company’s first two-row model.<br />

The machine, introduced in 2010, boosts productivity and cuts down<br />

on fuel consumption. Sugarcane is widely used in Brazil as a source of<br />

the renewable fuel ethanol.<br />

energy conservation. On the product side, the <strong>John</strong> <strong>Deere</strong> 8320R<br />

tractor set fuel-efficiency records for its size class in the<br />

Nebraska-lab tests. Further, two applications relying on globalpositioning<br />

satellite technology – iGrade and iSteer – were<br />

introduced to help customers manage surface water and<br />

equipment operation with greater efficiency and precision.<br />

With respect to our employees, <strong>John</strong> <strong>Deere</strong>’s exceptional safety<br />

record continued in 2010. More than half of over 100 company<br />

locations ended the year without a lost-time injury. About<br />

one-third of our units completed 2010 with more than one million<br />

hours worked since the last such injury.<br />

Realizing that the success we attain can be no greater than<br />

the talent we attract and nurture, <strong>John</strong> <strong>Deere</strong> introduced a series<br />

of rigorous competencies for its leaders during the year. The aim<br />

is to drive higher, more sustainable levels of employee engagement<br />

while tying the role of managers throughout the organization<br />

more directly to company business goals. One new leadership<br />

competency, proactively leading change, underscores the vital<br />

importance of change in guiding <strong>John</strong> <strong>Deere</strong> toward new levels<br />

of achievement.<br />

Well-Positioned for Future<br />

With our strong 2010 performance, the company remains<br />

well-positioned to capture the economic tailwinds that hold<br />

such promise for our future. Thanks in large part to the<br />

dedication and hard work of talented <strong>John</strong> <strong>Deere</strong> employees,<br />

our plans for helping meet the world’s growing need for<br />

advanced agricultural and construction equipment are well on<br />

track and moving ahead at an accelerated rate. That’s a chief<br />

reason we remain so confident about the company’s prospects<br />

and our ability to deliver significant value to customers and<br />

investors in the years ahead.<br />

We firmly believe this is a great time to be associated with<br />

<strong>John</strong> <strong>Deere</strong>. To all who share our commitment to improving<br />

global living standards and our passion for serving those<br />

linked to the land, we say thanks for your continuing support.<br />

On behalf of the <strong>John</strong> <strong>Deere</strong> team, December 17, 2010<br />

Samuel R. Allen<br />

8

In 2010, <strong>John</strong> <strong>Deere</strong> Water opened its latest precision irrigation-equipment<br />

manufacturing center, in India. The company’s highly engineered systems<br />

allow improved crop quality and yields without increasing water use.<br />

This helps farmers control input costs while maximizing crop value.<br />

2010 HIGHLIGHTS<br />

DEERE ENTERPRISE – SVA (MM)<br />

– Improved financial results<br />

and continued asset<br />

$1,702 $1,714<br />

discipline yield Shareholder<br />

Value Added (SVA) –<br />

operating profit minus<br />

a capital charge –<br />

of $1.714 billion, slightly<br />

above previous high (2008).<br />

– Resulting from higher profit<br />

and strong execution,<br />

-$84<br />

cash flow from operations<br />

reaches $2.282 billion<br />

2008 2009 2010<br />

for year, second-best ever.<br />

– Providing basis for future growth, capital spending totals<br />

$795 million while R&D expense tops $1 billion mark for first time.<br />

– Quarterly dividend rate increased by 7% in third quarter; share<br />

repurchases resume, totaling nearly $360 million for year.<br />

– Exhibiting increasing focus on serving global markets, company<br />

opens a technology and innovation center in Germany; expands<br />

product research and development center in China.<br />

EQUIPMENT OPERATIONS – SVA (MM)<br />

– Operating profit more than<br />

doubles, to $2.909 billion;<br />

results aided by higher<br />

volumes and improved pricing.<br />

$1,643 $64 $1,650<br />

– SVA for equipment operations<br />

–<br />

hits record $1.650 billion due<br />

to higher profit and continued<br />

success managing assets.<br />

Reflecting success serving an<br />

2008 2009 2010<br />

increasingly global customer<br />

audience, sales outside U.S. and Canada increase by about<br />

$1 billion, or 14%. Increase comes mostly from Central and<br />

South America, led by improved markets in Brazil.<br />

– Showing leadership in engine technology, <strong>John</strong> <strong>Deere</strong> Power<br />

Systems is one of first engine makers to get over-175-hp<br />

engines certified to meet stricter emissions standards taking<br />

effect in 2011. New 9.0L engines are expected to provide<br />

fuel economy similar to earlier models and can use biodieselblended<br />

fuels.<br />

9

AGRICULTURE & TURF – SVA (MM)<br />

– Aided by healthy farm sector<br />

and large-equipment sales<br />

in U.S. and Brazil, operating<br />

profit nearly doubles, to<br />

$2.790 billion.<br />

– SVA shows more than<br />

four-fold increase on modest<br />

10% sales gain, bolstered<br />

by dramatic improvement<br />

in profi t.<br />

$1,494 * $4 41 $1,813<br />

2008 2009 2010<br />

* 2008 restated to reflect 2009 combination<br />

of former Agricultural and Commercial &<br />

Consumer Equipment segments.<br />

– <strong>John</strong> <strong>Deere</strong> Technology<br />

Center-India, at Pune,<br />

named global engineering lead for development of small tractors<br />

for all markets.<br />

– Results helped by higher sales of premium lawn tractors, utility<br />

vehicles and commercial mowing equipment.<br />

– Company’s largest-ever product introduction in Latin America<br />

features 50 products, including 2-row sugarcane harvester.<br />

– Investment of approximately $100 million announced to modernize<br />

Waterloo, Iowa, foundry; project will enhance manufacturing<br />

flexibility and responsiveness.<br />

CONSTRUCTION & FORESTRY – SVA (MM)<br />

– Sales climb 41% as demand<br />

picks up for company’s<br />

$149<br />

–<br />

innovative construction<br />

and forestry products;<br />

operating profit stages<br />

strong turnaround, rising<br />

to $119 million.<br />

Higher profit and rigorous<br />

-$377 -$163<br />

asset management result in<br />

improved SVA performance. 2008 2009 2010<br />

– Demonstrating division’s increasing focus on serving global<br />

markets, C&F opens joint-venture factory in Tamil Nadu,<br />

India; facility will produce backhoes and wheel loaders for<br />

Asian markets.<br />

– Division announces plans for its first wholly-owned<br />

construction-equipment production facility outside U.S.<br />

Factory near Tianjin, China, will build wheel loaders and<br />

excavators primarily for developing markets.<br />

– <strong>Deere</strong> becomes first company to begin shipping construction<br />

machines with above-175-hp engines (744K loader) certified<br />

to meet rigorous U.S. Interim Tier 4 emissions standards.<br />

FINANCIAL SERVICES – SVA (MM)<br />

– Helped by improved financing<br />

spreads and a lower provision<br />

for losses, net income attributable<br />

to <strong>Deere</strong> & Company<br />

reaches $372.5 million; return<br />

on equity climbs to 12.2%.<br />

$59 $64<br />

– Reflecting division’s vital role in<br />

-$148<br />

supporting sale of <strong>John</strong> <strong>Deere</strong><br />

equipment, average portfolio<br />

2008 2009 2010<br />

of loans and leases increases by 5%, to $23.5 billion.<br />

– Credit quality remains high: losses on average portfolio decline<br />

to 0.48%.<br />

– Increasing focus on risk protection for ag producers, insurance<br />

company is launched to oversee crop-insurance business.<br />

– <strong>John</strong> <strong>Deere</strong> Financial becomes new name for operation<br />

formerly known as <strong>John</strong> <strong>Deere</strong> Credit; new name (officially<br />

adopted in October 2010) better represents full breadth of<br />

products and services being offered.<br />

– Sale of wind-energy business completed; move illustrates a<br />

sharpened focus on core operations.<br />

5-YEAR CUMULATIVE <strong>TO</strong>TAL RETURN<br />

<strong>Deere</strong> compared to S&P 500 Index<br />

and S&P 500 Construction & Farm Machinery Index<br />

$300<br />

$250<br />

$200<br />

$150<br />

$100<br />

$50<br />

$0<br />

2005 2006 2007 2008 2009 2010<br />

<strong>Deere</strong> & Company S&P 500 Construction & Farm Machinery S&P 500<br />

At October 31 2005 2006 2007 2008 2009 2010<br />

<strong>Deere</strong> & Company $100.00 $143.15 $264.60 $133.71 $162.52 $279.26<br />

S&P Con & Farm Mach $100.00 $127.09 $186.91 $90.16 $124.72 $197.55<br />

S&P 500 $100.00 $116.34 $133.28 $85.17 $93.52 $108.97<br />

The graph compares the cumulative total returns of <strong>Deere</strong> & Company, the S&P 500 Construction &<br />

Farm Machinery Index, and the S&P 500 Stock Index over a five-year period. It assumes $100<br />

was invested on October 31, 2005, and that dividends were reinvested. <strong>Deere</strong> & Company stock<br />

price at October 31, 2010, was $76.80. The Standard & Poor’s 500 Construction & Farm Machinery<br />

Index is made up of <strong>Deere</strong> (DE), Caterpillar (CAT), Paccar (PCAR), and Cummins (CMI). The stock<br />

performance shown in the graph is not intended to forecast and does not necessarily indicate<br />

future price performance.<br />

Copyright © 2010 Standard & Poor’s, a division of The McGraw-Hill Companies, Inc.<br />

All rights reserved.<br />

10

FINANCIAL REVIEW<br />

TABLE OF CONTENTS<br />

SVA: FOCUSING ON GROWTH AND SUSTAINABLE PERFORMANCE<br />

Shareholder Value Added (SVA) – essentially, the difference between operating profit and<br />

pretax cost of capital – is a metric used by <strong>John</strong> <strong>Deere</strong> to evaluate business results and<br />

measure sustainable performance.<br />

In arriving at SVA, each equipment segment is assessed a pretax cost of assets – generally<br />

12% of average identifiable operating assets with inventory at standard cost (believed to more<br />

closely approximate the current cost of inventory and the company’s related investment).<br />

Financial-services businesses are assessed a cost of average equity – approximately 15%<br />

pretax in 2010, versus 18% previously, due to lower leverage.<br />

The amount of SVA is determined by deducting the asset or equity charge from operating profit.<br />

Management’s Discussion<br />

and Analysis ........................... 12<br />

Reports of Management<br />

and Independent Registered<br />

Public Accounting Firm .......... 23<br />

Consolidated Financial<br />

Statements ........................... 24<br />

Notes to Consolidated<br />

Financial Statements ............. 28<br />

Selected Financial Data .......... 56<br />

Additional information on these metrics and their relationship to amounts presented in accordance with U.S. GAAP<br />

can be found at our website, www.<strong>John</strong><strong>Deere</strong>.com. Note: Some totals may vary due to rounding.<br />

DEERE EQUIPMENT OPERATIONS<br />

$MM unless indicated 2008 2009 2010<br />

Net Sales 25803 20756 23573<br />

Operating Profit 2927 1365 2909<br />

Average Assets<br />

With Inventories @ Std Cost 10812 10950 10494<br />

With Inventories @ LIFO 9652 9647 9196<br />

OROA % @ LIFO 30.3 14.1 31.6<br />

Asset Turns (Std Cost) 2.39 1.90 2.25<br />

Operating Margin % x 11.34 x 6.58 x 12.34<br />

OROA % @ Standard Cost 27.1 12.5 27.7<br />

$MM 2008 2009 2010<br />

Average Assets @ Std Cost 10812 10950 10494<br />

Operating Profit 2927 1365 2909<br />

Cost of Assets -1284 -1301 -1259<br />

SVA 1643 64 1650<br />

<strong>Deere</strong> Equipment Operations, to create and grow SVA,<br />

are targeting an operating return on average operating<br />

assets (OROA) of 20% at mid-cycle sales volumes –<br />

and other ambitious returns at other points in the cycle.<br />

(For purposes of this calculation, operating assets are<br />

average identifi able assets during the year with inventories<br />

valued at standard cost.)<br />

AGRICULTURE & TURF*<br />

$MM unless indicated 2008* 2009 2010<br />

Net Sales 20985 18122 19868<br />

Operating Profit 2461 1448 2790<br />

Average Assets<br />

With Inventories @ Std Cost 8171 8500 8138<br />

With Inventories @ LIFO 7196 7397 7035<br />

OROA % @ LIFO 34.2 19.6 39.7<br />

Asset Turns (Std Cost) 2.57 2.13 2.44<br />

Operating Margin % x 11.73 x 7.99 x 14.04<br />

OROA % @ Standard Cost 30.1 17.0 34.3<br />

$MM 2008* 2009 2010<br />

Average Assets @ Std Cost 8171 8500 8138<br />

Operating Profit 2461 1448 2790<br />

Cost of Assets -967 -1007 -977<br />

SVA 1494 441 1813<br />

*2008 fi gures are the combined results of the former<br />

Agricultural Equipment and Commercial & Consumer<br />

Equipment segments for that year. They were combined in<br />

2009 to form the Agriculture and Turf segment.<br />

CONSTRUCTION & FORESTRY<br />

$MM unless indicated 2008 2009 2010<br />

Net Sales 4818 2634 3705<br />

Operating Profit (Loss) 466 (83) 119<br />

Average Assets<br />

With Inventories @ Std Cost 2641 2450 2356<br />

With Inventories @ LIFO 2456 2250 2161<br />

OROA % @ LIFO 19.0 -3.7 5.5<br />

Asset Turns (Std Cost) 1.82 1.08 1.57<br />

Operating Margin % x 9.67 x -3.15 x 3.21<br />

OROA % @ Standard Cost 17.6 -3.4 5.1<br />

$MM 2008 2009 2010<br />

Average Assets @ Std Cost 2641 2450 2356<br />

Operating Profit 466 -83 119<br />

Cost of Assets -317 -294 -282<br />

SVA 149 -377 -163<br />

FINANCIAL SERVICES<br />

$MM unless indicated 2008 2009 2010<br />

Net Income Attributable<br />

to <strong>Deere</strong> & Company 337 203 373<br />

Average Equity 2355 2732 3064<br />

ROE % 14.3 7.4 12.2<br />

$MM 2008 2009 2010<br />

Operating Profi t 493 242 499<br />

Change in Allowance for<br />

Doubtful Receivables (4) 68 (14)<br />

SVA Income 489 310 485<br />

Average Equity 2355 2732 3064<br />

Average Allowance for<br />

Doubtful Receivables 183 195 232<br />

SVA Average Equity 2538 2927 3296<br />

SVA Income 489 310 485<br />

Cost of Equity -430 -458 -421<br />

SVA 59 -148 64<br />

The Financial Services SVA metric is calculated on a<br />

pretax basis, with certain adjustments. Operating profi t<br />

is adjusted for changes in the allowance for doubtful<br />

receivables, while the actual allowance is added to the<br />

equity base. These adjustments are made to refl ect actual<br />

write-offs in both income and equity.<br />

11

MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

RESULTS OF OPERATIONS FOR <strong>THE</strong> YEARS ENDED<br />

OC<strong>TO</strong>BER 31, 2010, 2009 AND 2008<br />

OVERVIEW<br />

Organization<br />

The company’s Equipment Operations generate revenues and<br />

cash primarily from the sale of equipment to <strong>John</strong> <strong>Deere</strong> dealers<br />

and distributors. The Equipment Operations manufacture and<br />

distribute a full line of agricultural equipment; a variety of<br />

commercial, consumer and landscapes equipment and products;<br />

and a broad range of equipment for construction and forestry.<br />

The company’s Financial Services primarily provide credit<br />

services, which mainly finance sales and leases of equipment<br />

by <strong>John</strong> <strong>Deere</strong> dealers and trade receivables purchased from<br />

the Equipment Operations. In addition, Financial Services<br />

offer crop risk mitigation products. The information in the<br />

following discussion is presented in a format that includes<br />

information grouped as consolidated, Equipment Operations<br />

and Financial Services. The company also views its operations<br />

as consisting of two geographic areas, the U.S. and Canada,<br />

and outside the U.S. and Canada. The company’s reportable<br />

operating segments consist of agriculture and turf, construction<br />

and forestry, and credit.<br />

Trends and Economic Conditions<br />

Industry farm machinery sales in the U.S. and Canada for 2011<br />

are forecast to be approximately the same as 2010. Industry sales<br />

in Western Europe are forecast to increase 5 to 10 percent,<br />

while South American industry sales are projected to be<br />

approximately the same. Industry sales in Central Europe and<br />

the Commonwealth of Independent States are expected to have<br />

moderate gains. Industry sales of turf and utility equipment in the<br />

U.S. and Canada are expected to be approximately the same.<br />

The company’s agriculture and turf equipment sales increased<br />

10 percent in 2010 and are forecast to increase by 7 to 9 percent<br />

for 2011. Construction equipment markets are forecast to be<br />

somewhat improved, while global forestry markets are expected<br />

to move significantly higher in 2011. The company’s construction<br />

and forestry sales increased 41 percent in 2010 and are<br />

forecast to increase by 25 to 30 percent in 2011. Net income<br />

for the company’s credit operations in 2011 is forecast to increase<br />

to approximately $360 million.<br />

Items of concern include the uncertainty of the global<br />

economic recovery, the impact of sovereign and state debt,<br />

capital market disruptions, the availability of credit for the<br />

company’s customers and suppliers, the effectiveness of<br />

governmental actions in respect to monetary policies, trade and<br />

general economic conditions, and financial regulatory reform.<br />

Significant fluctuations in foreign currency exchange rates and<br />

volatility in the price of many commodities could also impact<br />

the company’s results. The availability of certain components<br />

that could impact the company’s ability to meet production<br />

schedules continues to be monitored. Designing and producing<br />

products with engines that continue to meet high performance<br />

standards and increasingly stringent engine emissions regulations<br />

is one of the company’s major priorities.<br />

12<br />

The company’s strong performance for the year reflects<br />

a disciplined approach to executing the company’s business<br />

plans and was achieved despite continuing weakness in certain<br />

regions and business sectors. Although conditions continued<br />

to be positive in the U.S. farm sector, European agricultural<br />

markets remained soft. The company’s construction equipment<br />

sales benefited from somewhat stronger overall demand,<br />

but remained far below normal levels. With the company’s<br />

performance in 2010, it remains well positioned to capitalize<br />

on positive global economic trends.<br />

2010 COMPARED WITH 2009<br />

CONSOLIDATED RESULTS<br />

Worldwide net income attributable to <strong>Deere</strong> & Company in<br />

2010 was $1,865 million, or $4.35 per share diluted ($4.40<br />

basic), compared with $873 million, or $2.06 per share diluted<br />

($2.07 basic), in 2009. Included in net income for 2009 were<br />

charges of $381 million pretax ($332 million after-tax), or $.78<br />

per share diluted and basic, related to impairment of goodwill<br />

and voluntary employee separation expenses (see Note 5).<br />

Net sales and revenues increased 13 percent to $26,005 million<br />

in 2010, compared with $23,112 million in 2009. Net sales of<br />

the Equipment Operations increased 14 percent in 2010 to<br />

$23,573 million from $20,756 million last year. The sales<br />

increase was primarily due to higher shipment volumes.<br />

The increase also included a favorable effect for foreign currency<br />

translation of 3 percent and a price increase of 2 percent.<br />

Net sales in the U.S. and Canada increased 14 percent in 2010.<br />

Net sales outside the U.S. and Canada increased by 14 percent<br />

in 2010, which included a favorable effect of 5 percent for<br />

foreign currency translation.<br />

Worldwide Equipment Operations had an operating<br />

profit of $2,909 million in 2010, compared with $1,365 million<br />

in 2009. The higher operating profit was primarily due to<br />

higher shipment and production volumes, improved price<br />

realization, the favorable effects of foreign currency exchange<br />

and lower raw material costs, partially offset by increased<br />

postretirement costs and higher incentive compensation expenses.<br />

Last year was also affected by a goodwill impairment charge and<br />

voluntary employee separation expenses.<br />

The Equipment Operations’ net income, including<br />

noncontrolling interests, was $1,492 million in 2010, compared<br />

with $677 million in 2009. The same operating factors<br />

mentioned above affected these results.<br />

Net income of the company’s Financial Services operations<br />

attributable to <strong>Deere</strong> & Company in 2010 increased to<br />

$373 million, compared with $203 million in 2009. The increase<br />

was primarily a result of improved financing spreads and a lower<br />

provision for credit losses. Additional information is presented in<br />

the following discussion of the “Worldwide Credit Operations.”<br />

The cost of sales to net sales ratio for 2010 was 73.8 percent,<br />

compared with 78.3 percent last year. The decrease was<br />

primarily due to higher shipment and production volumes,<br />

improved price realization, favorable effects of foreign currency<br />

exchange and lower raw material costs. A larger goodwill<br />

impairment charge and voluntary employee separation expenses<br />

affected last year’s ratio.

Finance and interest income decreased this year due to<br />

lower financing rates, partially offset by a larger average portfolio.<br />

Other income increased primarily as a result of an increase in<br />

wind energy income, higher commissions from crop insurance<br />

and higher service revenues. Research and development<br />

expenses increased primarily as a result of increased spending in<br />

support of new products including designing and producing<br />

products with engines to meet more stringent emissions<br />

regulations. Selling, administrative and general expenses<br />

increased primarily due to increased incentive compensation<br />

expenses, higher postretirement benefit costs and the effect of<br />

foreign currency translation. Interest expense decreased due to<br />

lower average borrowing rates and lower average borrowings.<br />

Other operating expenses increased primarily due to the<br />

write-down of wind energy assets classified as held for sale<br />

(see Notes 4 and 30). The equity in income of unconsolidated<br />

affiliates increased as a result of higher income from construction<br />

equipment manufacturing affiliates due to increased levels of<br />

construction activity.<br />

The company has several defined benefit pension plans<br />

and defined benefit health care and life insurance plans.<br />

The company’s postretirement benefit costs for these plans in<br />

2010 were $658 million, compared with $312 million in 2009,<br />

primarily due to a decrease in discount rates. The long-term<br />

expected return on plan assets, which is reflected in these costs,<br />

was an expected gain of 8.2 percent in 2010 and 2009, or $883<br />

million in 2010 and $857 million in 2009. The actual return<br />

was a gain of $1,273 million in 2010 and $1,142 million in<br />

2009. In 2011, the expected return will be approximately<br />

8.0 percent. The company expects postretirement benefit costs<br />

in 2011 to be approximately the same as 2010. The company<br />

makes any required contributions to the plan assets under<br />

applicable regulations and voluntary contributions from time<br />

to time based on the company’s liquidity and ability to make<br />

tax-deductible contributions. Total company contributions to<br />

the plans were $836 million in 2010 and $358 million in 2009,<br />

which include direct benefit payments for unfunded plans.<br />

These contributions also included voluntary contributions to<br />

total plan assets of approximately $650 million in 2010 and<br />

$150 million in 2009. Total company contributions in 2011<br />

are expected to be approximately $316 million, which include<br />

direct benefit payments. The company has no significant<br />

contributions to pension plan assets required in 2011 under<br />

applicable funding regulations. See the following discussion of<br />

“Critical Accounting Policies” for more information about<br />

postretirement benefit obligations.<br />

BUSINESS SEGMENT AND GEOGRAPHIC AREA RESULTS<br />

The following discussion relates to operating results by reportable<br />

segment and geographic area. Operating profit is income<br />

before certain external interest expense, certain foreign<br />

exchange gains or losses, income taxes and corporate expenses.<br />

However, operating profit of the credit segment includes the<br />

effect of interest expense and foreign currency exchange gains<br />

or losses.<br />

Worldwide Agriculture and Turf Operations<br />

The agriculture and turf segment had an operating profit of<br />

$2,790 million in 2010, compared with $1,448 million in 2009.<br />

13<br />

Net sales increased 10 percent this year primarily due to higher<br />

production and shipment volumes. Sales also increased due to<br />

foreign currency translation and improved price realization.<br />

The increase in operating profit was due to increased shipment<br />

and production volumes, improved price realization, the<br />

favorable effects of foreign currency exchange and lower raw<br />

material costs, partially offset by higher postretirement benefit<br />

costs and increased incentive compensation expenses. Last year’s<br />

results were affected by a goodwill impairment charge and<br />

voluntary employee separation expenses.<br />

Worldwide Construction and Forestry Operations<br />

The construction and forestry segment had an operating profit<br />

of $119 million in 2010, compared with a loss of $83 million in<br />

2009. Net sales increased 41 percent for the year due to higher<br />

shipment and production volumes. The operating profit<br />

improvement in 2010 was primarily due to higher shipment and<br />

production volumes, partially offset by higher postretirement<br />

benefit costs and increased incentive compensation expenses.<br />

Worldwide Credit Operations<br />

The operating profit of the credit operations was $465 million<br />

in 2010, compared with $223 million in 2009. The increase in<br />

operating profit was primarily due to improved financing spreads<br />

and a lower provision for credit losses. Total revenues of the<br />

credit operations, including intercompany revenues, increased<br />

1 percent in 2010, primarily reflecting the larger portfolio.<br />

The average balance of receivables and leases financed was<br />

5 percent higher in 2010, compared with 2009. Interest expense<br />

decreased 28 percent in 2010 as a result of lower borrowing<br />

rates and lower average borrowings. The credit operations’ ratio<br />

of earnings to fixed charges was 1.72 to 1 in 2010, compared<br />

with 1.24 to 1 in 2009.<br />

Equipment Operations in U.S. and Canada<br />

The equipment operations in the U.S. and Canada had an<br />

operating profit of $2,302 million in 2010, compared with<br />

$1,129 million in 2009. The increase was due to higher<br />

shipment and production volumes, improved price realization<br />

and lower raw material costs, partially offset by increased<br />

postretirement benefit costs and higher incentive compensation<br />

expenses. Last year’s operating profit was affected by a goodwill<br />

impairment charge and voluntary employee separation expenses.<br />

Net sales increased 14 percent primarily due to higher volumes<br />

and improved price realization. The physical volume increased<br />

10 percent, compared with 2009.<br />

Equipment Operations outside U.S. and Canada<br />

The equipment operations outside the U.S. and Canada had<br />

an operating profit of $607 million in 2010, compared with<br />

$236 million in 2009. The increase was primarily due to the<br />

effects of higher shipment and production volumes, the<br />

favorable effects of foreign currency exchange rates, improved<br />

price realization and decreases in raw material costs, partially<br />

offset by higher incentive compensation expenses. Net sales<br />

were 14 percent higher primarily reflecting increased volumes<br />

and the effect of foreign currency translation. The physical<br />

volume increased 8 percent, compared with 2009.

MARKET CONDITIONS AND OUTLOOK<br />

Company equipment sales are projected to increase 10 to 12<br />

percent for fiscal year 2011 and increase about 34 percent for<br />

the first quarter, compared with the same periods in 2010.<br />

Included is an unfavorable currency translation impact of about<br />

1 percent for the year and about 2 percent for the first quarter<br />

of 2011. Net income attributable to <strong>Deere</strong> & Company is<br />

anticipated to be approximately $2.1 billion for the year.<br />

Fiscal year 2011 will be a record year for new model<br />

introductions for the company, due in large part to the<br />

implementation of more rigorous global engine emissions<br />

standards. The company’s earnings forecast reflects the<br />

complexity of transitioning to these new equipment models as<br />

well as increased product costs to comply with the regulations.<br />

In addition, the company projects higher raw material costs<br />

in 2011 and a less favorable sales mix in the agriculture and<br />

turf segment.<br />

Agriculture and Turf. Worldwide sales of the company’s<br />

agriculture and turf segment are forecast to increase by 7 to 9<br />

percent for fiscal year 2011, benefiting from generally favorable<br />

global farm conditions. Farmers in most of the company’s key<br />

markets are experiencing solid levels of income due to strong<br />

global demand for agricultural commodities, low grain stockpiles<br />

in relation to use, and high prices for crops such as corn,<br />

wheat, soybeans, sugar and cotton.<br />

After increasing in 2010, industry farm machinery sales in<br />

the U.S. and Canada are forecast to be about the same in 2011<br />

as a result of production limits and transitional issues associated<br />

with the broad launch of Interim Tier 4 compliant equipment.<br />

Industry sales in Western Europe are forecast to increase<br />

5 to 10 percent, while sales in Central Europe and the<br />

Commonwealth of Independent States are expected to see<br />

moderate gains from the depressed level in 2010. Industry sales<br />

in Asia also are forecast to grow moderately.<br />

In South America, industry sales are projected to be about<br />

the same in 2011 relative to the strong levels of 2010, although<br />

the company’s sales in the region are expected to benefit from a<br />

broader lineup of recently introduced products.<br />

Industry sales of turf and utility equipment in the U.S.<br />

and Canada are expected to be approximately the same after<br />

experiencing some recovery in 2010.<br />

Construction and Forestry. Worldwide sales of the company’s<br />

construction and forestry equipment are forecast to rise by<br />

25 to 30 percent for fiscal year 2011. The increase reflects<br />

market conditions that are somewhat improved in relation to<br />

the relatively low level in 2010. In addition, sales to independent<br />

rental companies are expected to see further growth.<br />

World forestry markets are expected to move significantly<br />

higher as a result of improved wood and pulp prices.<br />

Credit. Net income in fiscal year 2011 for the company’s<br />

credit operations is forecast to be approximately $360 million.<br />

The forecast increase from 2010 primarily is due to growth in<br />

the portfolio.<br />

SAFE HARBOR STATEMENT<br />

Safe Harbor Statement under the Private Securities Litigation Reform<br />

Act of 1995: Statements under “Overview,” “Market Conditions<br />

and Outlook” and other forward-looking statements herein that<br />

relate to future events, expectations and operating periods<br />

involve certain factors that are subject to change, and important<br />

risks and uncertainties that could cause actual results to differ<br />

materially. Some of these risks and uncertainties could affect<br />

particular lines of business, while others could affect all of the<br />

company’s businesses.<br />

The company’s agricultural equipment business is subject<br />

to a number of uncertainties including the many interrelated<br />

factors that affect farmers’ confidence. These factors include<br />

worldwide economic conditions, demand for agricultural<br />

products, world grain stocks, weather conditions (including its<br />

effects on timely planting and harvesting), soil conditions,<br />

harvest yields, prices for commodities and livestock, crop and<br />

livestock production expenses, availability of transport for crops,<br />

the growth of non-food uses for some crops (including ethanol<br />

and biodiesel production), real estate values, available acreage for<br />

farming, the land ownership policies of various governments,<br />

changes in government farm programs and policies (including<br />

those in the U.S., Russia and Brazil), international reaction to<br />

such programs, global trade agreements, animal diseases and<br />

their effects on poultry and beef consumption and prices, crop<br />

pests and diseases, and the level of farm product exports<br />

(including concerns about genetically modified organisms).<br />

Factors affecting the outlook for the company’s turf and<br />

utility equipment include general economic conditions,<br />

consumer confidence, weather conditions, customer profitability,<br />

consumer borrowing patterns, consumer purchasing preferences,<br />

housing starts, infrastructure investment, spending by municipalities<br />

and golf courses, and consumable input costs.<br />

General economic conditions, consumer spending<br />

patterns, real estate and housing prices, the number of housing<br />

starts and interest rates are especially important to sales of the<br />

company’s construction and forestry equipment. The levels of<br />

public and non-residential construction also impact the results<br />

of the company’s construction and forestry segment. Prices for<br />

pulp, paper, lumber and structural panels are important to sales<br />

of forestry equipment.<br />

14

All of the company’s businesses and its reported results are<br />

affected by general economic conditions in the global markets<br />

in which the company operates, especially material changes in<br />

economic activity in these markets; customer confidence in<br />

general economic conditions; foreign currency exchange rates,<br />

especially fluctuations in the value of the U.S. dollar; interest<br />

rates; and inflation and deflation rates. General economic<br />

conditions can affect demand for the company’s equipment as<br />

well. The current economic conditions and outlook in certain<br />

sectors have dampened demand for certain equipment.<br />

Customer and company operations and results could be<br />

affected by changes in weather patterns; the political and social<br />

stability of the global markets in which the company operates;<br />

the effects of, or response to, terrorism and security threats<br />

(including those in Mexico); wars and other conflicts and the<br />

threat thereof; and the spread of major epidemics (including<br />

H1N1 and other influenzas).<br />

Significant changes in market liquidity conditions could<br />

impact access to funding and associated funding costs, which<br />

could reduce the company’s earnings and cash flows.<br />

Market conditions could also negatively impact customer access<br />

to capital for purchases of the company’s products; borrowing<br />

and repayment practices; and the number and size of customer<br />

loan delinquencies and defaults. A sovereign debt crisis, in<br />

Europe or elsewhere, could negatively impact currencies,<br />

global financial markets, social and political stability, funding<br />

sources and costs, customers, and company operations and<br />

results. State debt crises also could negatively impact customers,<br />

suppliers, demand for equipment, and company operations and<br />

results. The company’s investment management activities could<br />

be impaired by changes in the equity and bond markets, which<br />

would negatively affect earnings.<br />

Additional factors that could materially affect the company’s<br />

operations and results include changes in and the impact of<br />

governmental trade, banking, monetary and fiscal policies,<br />

including financial regulatory reform, and governmental<br />

programs in particular jurisdictions or for the benefit of certain<br />

industries or sectors (including protectionist policies and trade<br />

and licensing restrictions that could disrupt international<br />

commerce); actions by the U.S. Federal Reserve Board and other<br />

central banks; actions by the U.S. Securities and Exchange<br />

Commission (SEC), the U.S. Commodity Futures Trading<br />

Commission and other financial regulators; actions by environmental,<br />

health and safety regulatory agencies, including those<br />

related to engine emissions (in particular Interim Tier 4 and<br />

Final Tier 4 emission requirements), noise and the risk of climate<br />

change; changes in labor regulations; changes to accounting<br />

standards; changes in tax rates and regulations; and actions by<br />

other regulatory bodies including changes in laws and regulations<br />

affecting the sectors in which the company operates.<br />

Other factors that could materially affect results include<br />

production, design and technological innovations and difficulties,<br />

including capacity and supply constraints and prices; the availability<br />

and prices of strategically sourced materials, components<br />

and whole goods; delays or disruptions in the company’s supply<br />

chain due to weather, natural disasters or financial hardship or<br />

the loss of liquidity by suppliers; start-up of new plants and new<br />

products; the success of new product initiatives and customer<br />

acceptance of new products; changes in customer purchasing<br />

behavior in response to changes in equipment design to meet<br />

government regulations and other standards; oil and energy<br />

prices and supplies; the availability and cost of freight; actions<br />

of competitors in the various industries in which the company<br />

competes, particularly price discounting; dealer practices<br />

especially as to levels of new and used field inventories; labor<br />

relations; acquisitions and divestitures of businesses, the integration<br />

of new businesses; the implementation of organizational<br />

changes; changes in company declared dividends and common<br />

stock issuances and repurchases.<br />

Company results are also affected by changes in the level<br />

of employee retirement benefits, changes in market values of<br />

investment assets and the level of interest rates, which impact<br />

retirement benefit costs, and significant changes in health care<br />

costs including those which may result from governmental<br />

action.<br />

The liquidity and ongoing profitability of <strong>John</strong> <strong>Deere</strong><br />

Capital Corporation (Capital Corporation) and other credit<br />

subsidiaries depend largely on timely access to capital to meet<br />

future cash flow requirements and fund operations and the costs<br />

associated with engaging in diversified funding activities and to<br />

fund purchases of the company’s products. If market volatility<br />

increases and general economic conditions worsen, funding<br />

could be unavailable or insufficient. Additionally, customer<br />

confidence levels may result in declines in credit applications<br />

and increases in delinquencies and default rates, which could<br />

materially impact write-offs and provisions for credit losses.<br />

The company’s outlook is based upon assumptions<br />

relating to the factors described above, which are sometimes<br />

based upon estimates and data prepared by government agencies.<br />

Such estimates and data are often revised. The company, except<br />

as required by law, undertakes no obligation to update or revise<br />

its outlook, whether as a result of new developments or<br />

otherwise. Further information concerning the company and<br />

its businesses, including factors that potentially could materially<br />

affect the company’s financial results, is included in other filings<br />

with the SEC.<br />

2009 COMPARED WITH 2008<br />

CONSOLIDATED RESULTS<br />

Worldwide net income in 2009 was $873 million, or $2.06<br />

per share diluted ($2.07 basic), compared with $2,053 million,<br />

or $4.70 per share diluted ($4.76 basic), in 2008. Included in<br />

net income for 2009 were charges of $381 million pretax<br />

($332 million after-tax), or $.78 per share diluted and basic,<br />

related to impairment of goodwill and voluntary employee<br />

separation expenses (see Note 5). Net sales and revenues<br />

decreased 19 percent to $23,112 million in 2009, compared<br />

with $28,438 million in 2008. Net sales of the Equipment<br />

Operations decreased 20 percent in 2009 to $20,756 million<br />

from $25,803 million in 2008. The sales decrease was primarily<br />

due to lower shipment volumes. The decrease also included<br />

an unfavorable effect for currency translation of 4 percent,<br />

15

more than offset by price realization of 5 percent. Net sales in<br />

the U.S. and Canada decreased 14 percent in 2009. Net sales<br />

outside the U.S. and Canada decreased by 28 percent in 2009,<br />

which included an unfavorable effect of 8 percent for currency<br />

translation.<br />

Worldwide Equipment Operations had an operating<br />

profit of $1,365 million in 2009, compared with $2,927 million<br />

in 2008. The deterioration in operating profit was primarily due<br />

to lower shipment and production volumes, the unfavorable<br />

effects of foreign currency exchange, a goodwill impairment<br />

charge, higher raw material costs and voluntary employee<br />

separation expenses, partially offset by improved price realization<br />

and lower selling, administrative and general expenses.<br />

The Equipment Operations’ net income, including<br />

noncontrolling interests, was $677 million in 2009, compared<br />

with $1,677 million in 2008. The same operating factors<br />

mentioned above, in addition to a higher effective tax rate,<br />

affected these results.<br />

Trade receivables and inventories at October 31, 2009<br />

were $5,014 million, compared with $6,276 million in 2008,<br />

or 24 percent of net sales in both years.<br />

Net income of the company’s Financial Services<br />

operations in 2009 decreased to $203 million, compared with<br />

$337 million in 2008. The decrease was primarily a result<br />

of a higher provision for credit losses, lower commissions from<br />

crop insurance, narrower financing spreads and higher losses<br />

from construction equipment operating lease residual values,<br />

partially offset by a lower effective tax rate primarily from wind<br />

energy tax credits and lower selling, administrative and general<br />

expenses. Additional information is presented in the following<br />

discussion of the “Worldwide Credit Operations.”<br />

The cost of sales to net sales ratio for 2009 was 78.3<br />

percent, compared with 75.9 percent in 2008. The increase<br />

was primarily due to lower shipment and production volumes,<br />

unfavorable effects of foreign exchange, a goodwill impairment<br />

charge, higher raw material costs and voluntary employee<br />

separation expenses.<br />

Finance and interest income declined in 2009 due to lower<br />

financing rates and a smaller average portfolio. Other income<br />

decreased primarily as a result of lower commissions from crop<br />

insurance and lower earnings from marketable securities.<br />

Research and development expenses increased primarily as a<br />

result of increased spending in support of new products<br />

including designing and producing products with engines to meet<br />

more stringent emissions regulations. Selling, administrative and<br />

general expenses decreased primarily due to lower compensation<br />

expenses and the effect of currency translation. Interest expense<br />

decreased due to lower average borrowing rates, partially offset<br />

by higher average borrowings. The equity in income of<br />

unconsolidated affiliates decreased as a result of lower income<br />

from construction equipment manufacturing affiliates impacted<br />

by the low levels of construction activity.<br />

The company has several defined benefit pension plans<br />

and defined benefit health care and life insurance plans.<br />

The company’s postretirement benefit costs for these plans in<br />

2009 were $312 million, compared with $277 million in 2008.<br />

The long-term expected return on plan assets, which is<br />

reflected in these costs, was an expected gain of 8.2 percent in<br />

2009 and 2008, or $857 million in 2009 and $920 million in<br />

2008. The actual return was a gain of $1,142 million in 2009 and<br />

a loss of $2,158 million in 2008. Total company contributions to<br />

the plans were $358 million in 2009 and $431 million in 2008,<br />

which include direct benefit payments for unfunded plans.<br />

These contributions also included voluntary contributions to<br />

total plan assets of approximately $150 million in 2009 and<br />

$297 million in 2008.<br />

BUSINESS SEGMENT AND GEOGRAPHIC AREA RESULTS<br />

Worldwide Agriculture and Turf Operations<br />

The agriculture and turf segment had an operating profit of<br />

$1,448 million in 2009, compared with $2,461 million in 2008.<br />

Net sales decreased 14 percent in 2009 due to lower shipment<br />

volumes and the unfavorable effects of currency translation,<br />

partially offset by improved price realization. The decrease<br />

in operating profit was primarily due to lower shipment and<br />

production volumes, unfavorable effects of foreign currency<br />

exchange, a goodwill impairment charge, higher raw material<br />

costs and voluntary employee separation expenses, partially offset<br />

by improved price realization and lower selling, administrative<br />

and general expenses.<br />

Worldwide Construction and Forestry Operations<br />

The construction and forestry segment had an operating loss<br />

of $83 million in 2009, compared with an operating profit of<br />

$466 million in 2008. Net sales decreased 45 percent in 2009<br />

reflecting the pressure from market conditions. The operating<br />

profit was lower primarily due to lower shipment and production<br />

volumes and lower equity in income from unconsolidated<br />

affiliates, partially offset by improved price realization and lower<br />

selling, administrative and general expenses.<br />

Worldwide Credit Operations<br />

The operating profit of the credit operations was $223 million<br />

in 2009, compared with $478 million in 2008. The decrease in<br />

operating profit was primarily due to a higher provision for<br />

credit losses, lower commissions from crop insurance, narrower<br />

financing spreads, a higher pretax loss from wind energy<br />

projects and higher losses from construction equipment<br />

operating lease residual values, partially offset by lower selling,<br />

administrative and general expenses. Total revenues of the<br />

credit operations, including intercompany revenues, decreased<br />

11 percent in 2009, primarily reflecting the lower financing<br />

rates and a smaller portfolio. The average balance of receivables<br />

and leases financed was 1 percent lower in 2009, compared<br />

with 2008. Interest expense decreased 8 percent in 2009 as a<br />

result of lower average borrowing rates, partially offset by<br />

higher average borrowings. The credit operations’ ratio of<br />

earnings to fixed charges was 1.24 to 1 in 2009, compared with<br />

1.45 to 1 in 2008.<br />

16

Equipment Operations in U.S. and Canada<br />

The equipment operations in the U.S. and Canada had an<br />

operating profit of $1,129 million in 2009, compared with<br />

$1,831 million in 2008. The decrease was primarily due to<br />

lower shipment and production volumes, a goodwill impairment<br />

charge, higher raw material costs and voluntary employee<br />

separation expenses, partially offset by improved price realization<br />

and decreased selling, administrative and general expenses.<br />

Net sales decreased 14 percent due to lower volumes and the<br />

unfavorable effects of currency translation, partially offset by<br />

improved price realization. The physical volume decreased<br />

18 percent, compared with 2008.<br />

Equipment Operations outside U.S. and Canada<br />

The equipment operations outside the U.S. and Canada had<br />

an operating profit of $236 million in 2009, compared with<br />

$1,096 million in 2008. The decrease was primarily due to the<br />

effects of lower shipment and production volumes, unfavorable<br />

effects of foreign currency exchange rates and increases in raw<br />

material costs, partially offset by improved price realization and<br />

decreased selling, administrative and general expenses. Net sales<br />

were 28 percent lower reflecting lower volumes and the effect<br />

of currency translation, partially offset by improvements in price<br />

realization. The physical volume decreased 26 percent, compared<br />

with 2008.<br />

CAPITAL RESOURCES AND LIQUIDITY<br />

The discussion of capital resources and liquidity has been<br />

organized to review separately, where appropriate, the company’s<br />

consolidated totals, Equipment Operations and Financial<br />

Services operations.<br />

CONSOLIDATED<br />

Positive cash flows from consolidated operating activities in<br />

2010 were $2,282 million. This resulted primarily from net<br />

income adjusted for non-cash provisions and an increase in<br />

accounts payable and accrued expenses, which were partially<br />

offset by an increase in trade receivables and inventories.<br />

Cash outflows from investing activities were $2,109 million in<br />

2010, primarily due to the cost of receivables and equipment<br />

on operating leases exceeding the collections of receivables and<br />

the proceeds from sales of equipment on operating leases by<br />

$1,376 million and purchases of property and equipment of<br />

$762 million. Cash outflows from financing activities were<br />

$1,010 million in 2010 primarily due to dividends paid of<br />

$484 million, repurchases of common stock of $359 million<br />

and a decrease in borrowings of $299 million, which were<br />

partially offset by proceeds from issuance of common stock<br />

of $129 million (resulting from the exercise of stock options).<br />

Cash and cash equivalents decreased $861 million during 2010.<br />

Over the last three years, operating activities have<br />

provided an aggregate of $6,216 million in cash. In addition,<br />

increases in borrowings were $2,091 million, proceeds from<br />

maturities and sales of marketable securities exceeded purchases<br />

by $1,368 million and proceeds from issuance of common stock<br />

were $255 million. The aggregate amount of these cash flows<br />

was used mainly to purchase property and equipment of<br />

$2,781 million, repurchase common stock of $2,040 million,<br />

acquire receivables and equipment on operating leases that<br />

exceeded collections and the proceeds from sales of equipment<br />

on operating leases by $2,008 million, pay dividends to stockholders<br />

of $1,405 million and acquire businesses for $348 million.<br />

Cash and cash equivalents also increased $1,512 million over<br />

the three-year period.<br />

Given the continued volatility in the global economy,<br />

there has been a reduction in liquidity in some global markets<br />

that continues to affect the funding activities of the company.<br />

However, the company has access to most global markets at a<br />

reasonable cost and expects to have sufficient sources of global<br />

funding and liquidity to meet its funding needs. Sources of<br />

liquidity for the company include cash and cash equivalents,<br />

marketable securities, funds from operations, the issuance of<br />

commercial paper and term debt, the securitization of retail<br />

notes (both public and private markets) and committed and<br />

uncommitted bank lines of credit. The company’s commercial<br />

paper outstanding at October 31, 2010 and 2009 was<br />

$2,028 million and $286 million, respectively, while the total<br />

cash and cash equivalents and marketable securities position<br />

was $4,019 million and $4,844 million, respectively.<br />