1. Why using a stochastic model

1. Why using a stochastic model

1. Why using a stochastic model

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

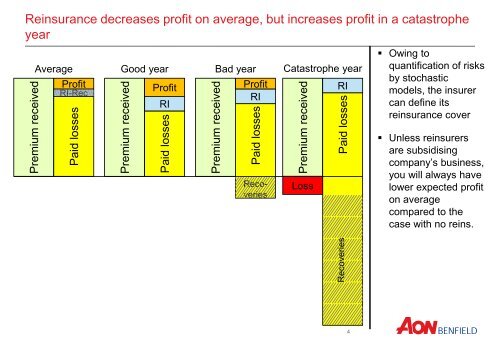

Recoveries<br />

Premium received<br />

Paid losses<br />

Premium received<br />

Paid losses<br />

Premium received<br />

Paid losses<br />

Premium received<br />

Paid losses<br />

Reinsurance decreases profit on average, but increases profit in a catastrophe<br />

year<br />

Average<br />

Profit<br />

RI-Rec<br />

Good year<br />

Profit<br />

RI<br />

Bad year<br />

Profit<br />

RI<br />

Catastrophe year<br />

RI<br />

• Owing to<br />

quantification of risks<br />

by <strong>stochastic</strong><br />

<strong>model</strong>s, the insurer<br />

can define its<br />

reinsurance cover<br />

Recoveries<br />

Loss<br />

• Unless reinsurers<br />

are subsidising<br />

company’s business,<br />

you will always have<br />

lower expected profit<br />

on average<br />

compared to the<br />

case with no reins.<br />

4