DREAMS FORECLOSED: The Rampant Theft of Americans' Homes

DREAMS FORECLOSED: The Rampant Theft of Americans' Homes

DREAMS FORECLOSED: The Rampant Theft of Americans' Homes

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DREAMS</strong> <strong>FORECLOSED</strong>: <strong>The</strong> <strong>Rampant</strong> <strong>The</strong>ft <strong>of</strong> Americans’ <strong>Homes</strong> Through Equity-stripping Foreclosure “Rescue” Scams<br />

facing late opposition in the form <strong>of</strong> a “push by ‘investors’ who claim we are undermining the<br />

American way <strong>of</strong> life.”<br />

Niemann says ads for foreclosure “assistance” festoon utility poles and street corners all<br />

over Prince George’s, a D.C. suburb with a large population <strong>of</strong> African-American<br />

pr<strong>of</strong>essionals, adding that the legislation is needed because without it “the most sophisticated<br />

(scammers) can do this legally.”<br />

Niemann also told the Washington Post that these scams are increasing on Maryland’s<br />

rural Eastern Shore, where there are many poorer residents whose property taxes are going up<br />

as the value <strong>of</strong> their homes rise. 10<br />

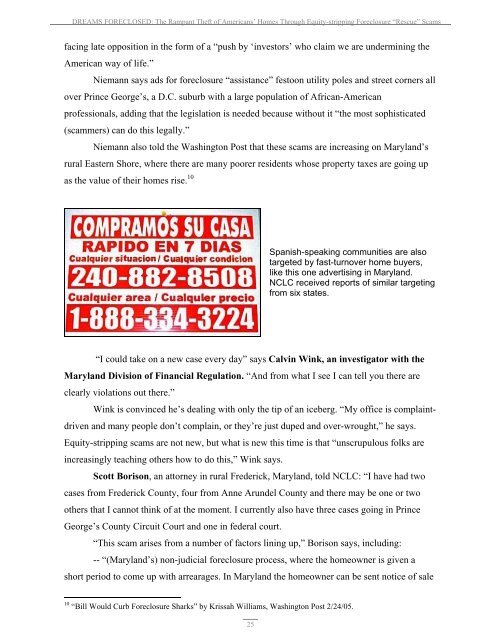

Spanish-speaking communities are also<br />

targeted by fast-turnover home buyers,<br />

like this one advertising in Maryland.<br />

NCLC received reports <strong>of</strong> similar targeting<br />

from six states.<br />

“I could take on a new case every day” says Calvin Wink, an investigator with the<br />

Maryland Division <strong>of</strong> Financial Regulation. “And from what I see I can tell you there are<br />

clearly violations out there.”<br />

Wink is convinced he’s dealing with only the tip <strong>of</strong> an iceberg. “My <strong>of</strong>fice is complaintdriven<br />

and many people don’t complain, or they’re just duped and over-wrought,” he says.<br />

Equity-stripping scams are not new, but what is new this time is that “unscrupulous folks are<br />

increasingly teaching others how to do this,” Wink says.<br />

Scott Borison, an attorney in rural Frederick, Maryland, told NCLC: “I have had two<br />

cases from Frederick County, four from Anne Arundel County and there may be one or two<br />

others that I cannot think <strong>of</strong> at the moment. I currently also have three cases going in Prince<br />

George’s County Circuit Court and one in federal court.<br />

“This scam arises from a number <strong>of</strong> factors lining up,” Borison says, including:<br />

-- “(Maryland’s) non-judicial foreclosure process, where the homeowner is given a<br />

short period to come up with arrearages. In Maryland the homeowner can be sent notice <strong>of</strong> sale<br />

10 “Bill Would Curb Foreclosure Sharks” by Krissah Williams, Washington Post 2/24/05.<br />

25