IATA LIST OF TICKET AND AIRPORT TAXES AND FEES

IATA LIST OF TICKET AND AIRPORT TAXES AND FEES

IATA LIST OF TICKET AND AIRPORT TAXES AND FEES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5. French Overseas Territories are: French Polynesia, Mayotte, New<br />

Caledonia.<br />

6. Continental France is Metropolitan France, Corsica, excluded.<br />

Corsican airports are AJA, BIA, CLY, FSC.<br />

7. "Domestic within France" means: All French airports situated in<br />

Metropolitan France (Corsica included). "Other international" means<br />

destinations which are not listed above.<br />

SEE PAGE 9 for description of Interlineable taxes, charges, fees.<br />

First Eff. date : Revision date : 1-Jan-2002<br />

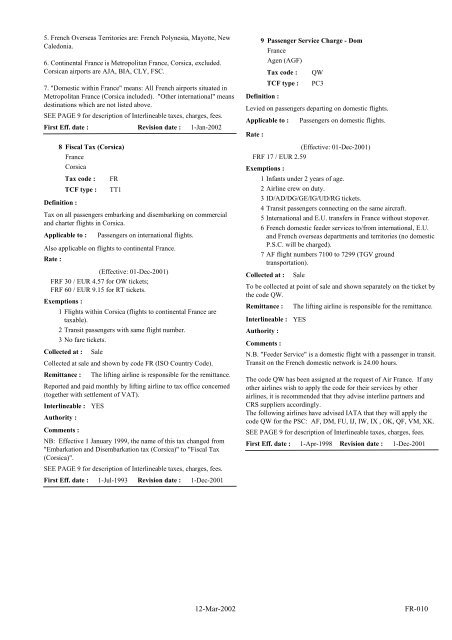

8 Fiscal Tax (Corsica)<br />

France<br />

Corsica<br />

Definition :<br />

FR<br />

TT1<br />

Tax on all passengers embarking and disembarking on commercial<br />

and charter flights in Corsica.<br />

Applicable to : Passengers on international flights.<br />

Also applicable on flights to continental France.<br />

Rate :<br />

Exemptions :<br />

Collected at : Sale<br />

Collected at sale and shown by code FR (ISO Country Code).<br />

Remittance : The lifting airline is responsible for the remittance.<br />

Reported and paid monthly by lifting airline to tax office concerned<br />

(together with settlement of VAT).<br />

Interlineable : YES<br />

Authority :<br />

Comments :<br />

Tax code :<br />

TCF type :<br />

(Effective: 01-Dec-2001)<br />

FRF 30 / EUR 4.57 for OW tickets;<br />

FRF 60 / EUR 9.15 for RT tickets.<br />

1 Flights within Corsica (flights to continental France are<br />

taxable).<br />

2 Transit passengers with same flight number.<br />

3 No fare tickets.<br />

NB: Effective 1 January 1999, the name of this tax changed from<br />

"Embarkation and Disembarkation tax (Corsica)" to "Fiscal Tax<br />

(Corsica)".<br />

SEE PAGE 9 for description of Interlineable taxes, charges, fees.<br />

First Eff. date : 1-Jul-1993 Revision date :<br />

1-Dec-2001<br />

9 Passenger Service Charge - Dom<br />

France<br />

Agen (AGF)<br />

Definition :<br />

QW<br />

PC3<br />

Levied on passengers departing on domestic flights.<br />

Applicable to : Passengers on domestic flights.<br />

Rate :<br />

Collected at : Sale<br />

To be collected at point of sale and shown separately on the ticket by<br />

the code QW.<br />

Remittance : The lifting airline is responsible for the remittance.<br />

Interlineable :<br />

Authority :<br />

Comments :<br />

Tax code :<br />

TCF type :<br />

(Effective: 01-Dec-2001)<br />

FRF 17 / EUR 2.59<br />

Exemptions :<br />

1 Infants under 2 years of age.<br />

2 Airline crew on duty.<br />

3 ID/AD/DG/GE/IG/UD/RG tickets.<br />

4 Transit passengers connecting on the same aircraft.<br />

5International and E.U. transfers in France without stopover.<br />

6 French domestic feeder services to/from international, E.U.<br />

and French overseas departments and territories (no domestic<br />

P.S.C. will be charged).<br />

7 AF flight numbers 7100 to 7299 (TGV ground<br />

transportation).<br />

YES<br />

N.B. "Feeder Service" is a domestic flight with a passenger in transit.<br />

Transit on the French domestic network is 24.00 hours.<br />

The code QW has been assigned at the request of Air France. If any<br />

other airlines wish to apply the code for their services by other<br />

airlines, it is recommended that they advise interline partners and<br />

CRS suppliers accordingly.<br />

The following airlines have advised <strong>IATA</strong> that they will apply the<br />

code QW for the PSC: AF, DM, FU, IJ, IW, IX , OK, QF, VM, XK.<br />

SEE PAGE 9 for description of Interlineable taxes, charges, fees.<br />

First Eff. date : 1-Apr-1998 Revision date :<br />

1-Dec-2001<br />

12-Mar-2002 FR-010