Arizona Rural Health Clinic Designation Manual - Arizona Center for ...

Arizona Rural Health Clinic Designation Manual - Arizona Center for ...

Arizona Rural Health Clinic Designation Manual - Arizona Center for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F. RHC Cost Report (con’t)<br />

Fiscal Intermediaries <strong>for</strong> the independent RHCs is available online at: http://www.cms.hhs.gov/apps/contacts/incardir.asp].<br />

As has been previously noted, there are two types of RHC’s - Independent and Provider-based. Each must<br />

fi le a cost report, but the cost report is different <strong>for</strong> each of the two types of RHC’s.<br />

All <strong>Rural</strong> <strong>Health</strong> <strong>Clinic</strong>s are presumed to be independent unless the clinic requests designation as a provider-based<br />

facility. Whereas, an independent RHC can be owned by any type of entity authorized under<br />

State law to own a medical practice: physicians; physician assistants; nurse practitioners; certifi ed nurse<br />

midwives; hospitals; skilled nursing facilities; home health agencies; <strong>for</strong>-profi t corporations; not-<strong>for</strong>-profi t<br />

corporations; or government entities; only those entities recognized by Medicare as a “provider” can own<br />

a provider-based RHC. Entities designated by Medicare as providers are: hospitals, skilled nursing facilities,<br />

and home health agencies. Although this chapter will focus on the fi ling of an independent RHC cost<br />

report, the provider-based RHC cost report is very similar. A provider-based cost report is fi led as a part of<br />

the sponsoring provider’s cost report. It is prepared on Schedule M.<br />

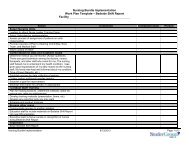

The following list includes the title and explanation of each worksheet contained in the RHC cost report:<br />

•Worksheet S<br />

This is the statistical data and certifi cation statement (requires original signature when submitted). The<br />

statistical data includes in<strong>for</strong>mation such as: whether the cost report is based on actual or projected cost,<br />

time period covered, provider name, Medicare number, location, provider numbers of physicians/PAs/NPs/<br />

CNMs, operational control, hours of operation, etc.<br />

•Worksheet A, Columns 1 & 2<br />

Worksheet A is used to record the trial balance of expense accounts from the provider books and records<br />

<strong>for</strong> the cost reporting period stated. The total dollar amount of Column 1 and 2 should tie to the records of<br />

the provider <strong>for</strong> total expenses. (Column 1 is <strong>for</strong> compensation amounts, while column 2 reports amounts<br />

other than compensation). Column 3 is the total of Column 1 & 2. This worksheet also provides <strong>for</strong> the necessary<br />

reclassifi cations (Column 4) and adjustments (Column 6) to certain accounts.<br />

•Worksheet A-1, Column 4<br />

This worksheet provides <strong>for</strong> reclassifi cation of any amounts in order to refl ect the proper cost allocation in<br />

a given cost center. This worksheet “moves” certain amounts from one cost center to another cost center.<br />

Supporting documentation is needed <strong>for</strong> each reclassifi cation made on this worksheet.<br />

•Worksheet A-2, Column 6<br />

This worksheet provides <strong>for</strong> adjustments, which are necessary under the Medicare principles of reimbursement.<br />

Types of items to be entered on this Worksheet are 1) those needed to adjust expenses incurred {accrual<br />

accounting} 2) those that represent recovery of expenses through refunds, sales, etc. 3) those needed<br />

to adjust expenses that are non-allowable <strong>for</strong> Medicare purposes 4) those needed to adjust expenses in<br />

accordance with offsets from “other/miscellaneous” income received. Supporting documentation is needed<br />

<strong>for</strong> each adjustment made on this worksheet.<br />

•Worksheet A-2-1, Column 6, Flows thru Worksheet A-1<br />

This worksheet fl ows into the above worksheet A-2 at the net amount of the total adjustment. It provides<br />

<strong>for</strong> in<strong>for</strong>mation and amounts on related parties of the organization including costs applicable to services,<br />

facilities, and supplies furnished to providers by a related organization or by common ownership. This worksheet<br />

allows <strong>for</strong> any adjustments that are needed to reduce related party transactions amounts to allowable<br />

Medicare amounts.<br />

40