Arizona Rural Health Clinic Designation Manual - Arizona Center for ...

Arizona Rural Health Clinic Designation Manual - Arizona Center for ...

Arizona Rural Health Clinic Designation Manual - Arizona Center for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

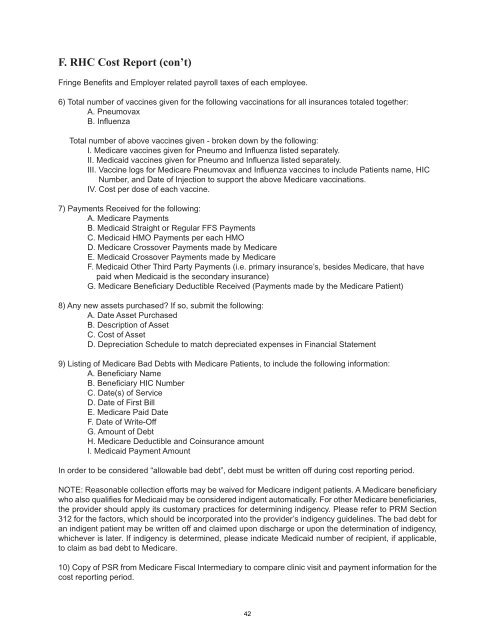

F. RHC Cost Report (con’t)<br />

Fringe Benefi ts and Employer related payroll taxes of each employee.<br />

6) Total number of vaccines given <strong>for</strong> the following vaccinations <strong>for</strong> all insurances totaled together:<br />

A. Pneumovax<br />

B. Infl uenza<br />

Total number of above vaccines given - broken down by the following:<br />

I. Medicare vaccines given <strong>for</strong> Pneumo and Infl uenza listed separately.<br />

II. Medicaid vaccines given <strong>for</strong> Pneumo and Infl uenza listed separately.<br />

III. Vaccine logs <strong>for</strong> Medicare Pneumovax and Infl uenza vaccines to include Patients name, HIC<br />

Number, and Date of Injection to support the above Medicare vaccinations.<br />

IV. Cost per dose of each vaccine.<br />

7) Payments Received <strong>for</strong> the following:<br />

A. Medicare Payments<br />

B. Medicaid Straight or Regular FFS Payments<br />

C. Medicaid HMO Payments per each HMO<br />

D. Medicare Crossover Payments made by Medicare<br />

E. Medicaid Crossover Payments made by Medicare<br />

F. Medicaid Other Third Party Payments (i.e. primary insurance’s, besides Medicare, that have<br />

paid when Medicaid is the secondary insurance)<br />

G. Medicare Benefi ciary Deductible Received (Payments made by the Medicare Patient)<br />

8) Any new assets purchased If so, submit the following:<br />

A. Date Asset Purchased<br />

B. Description of Asset<br />

C. Cost of Asset<br />

D. Depreciation Schedule to match depreciated expenses in Financial Statement<br />

9) Listing of Medicare Bad Debts with Medicare Patients, to include the following in<strong>for</strong>mation:<br />

A. Beneficiary Name<br />

B. Beneficiary HIC Number<br />

C. Date(s) of Service<br />

D. Date of First Bill<br />

E. Medicare Paid Date<br />

F. Date of Write-Off<br />

G. Amount of Debt<br />

H. Medicare Deductible and Coinsurance amount<br />

I. Medicaid Payment Amount<br />

In order to be considered “allowable bad debt”, debt must be written off during cost reporting period.<br />

NOTE: Reasonable collection ef<strong>for</strong>ts may be waived <strong>for</strong> Medicare indigent patients. A Medicare benefi ciary<br />

who also qualifi es <strong>for</strong> Medicaid may be considered indigent automatically. For other Medicare benefi ciaries,<br />

the provider should apply its customary practices <strong>for</strong> determining indigency. Please refer to PRM Section<br />

312 <strong>for</strong> the factors, which should be incorporated into the provider’s indigency guidelines. The bad debt <strong>for</strong><br />

an indigent patient may be written off and claimed upon discharge or upon the determination of indigency,<br />

whichever is later. If indigency is determined, please indicate Medicaid number of recipient, if applicable,<br />

to claim as bad debt to Medicare.<br />

10) Copy of PSR from Medicare Fiscal Intermediary to compare clinic visit and payment in<strong>for</strong>mation <strong>for</strong> the<br />

cost reporting period.<br />

42