Annual Report 2011 - Hysan Development Company Limited

Annual Report 2011 - Hysan Development Company Limited

Annual Report 2011 - Hysan Development Company Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Our Marketplace<br />

and Our Response<br />

In <strong>2011</strong>, uncertain global economic environment set the<br />

backdrop for the property leasing market in Hong Kong.<br />

Our three leasing segments responded successfully to<br />

such market changes.<br />

Hong Kong Economy<br />

The Hong Kong economy recorded a moderate GDP<br />

growth of 5% in <strong>2011</strong>. The growth moderation was mainly<br />

caused by a slowdown in exports since the second<br />

quarter of <strong>2011</strong> amid a worsening global economic<br />

environment. Domestic consumption nevertheless<br />

displayed remarkable resilience throughout the year,<br />

thereby rendering a strong cushion to overall economic<br />

performance. Total employment in Hong Kong rose to 3.7<br />

million as of December <strong>2011</strong>, while the unemployment<br />

rate fell to 3.3%. Inflation rate was 5.3% in <strong>2011</strong>.<br />

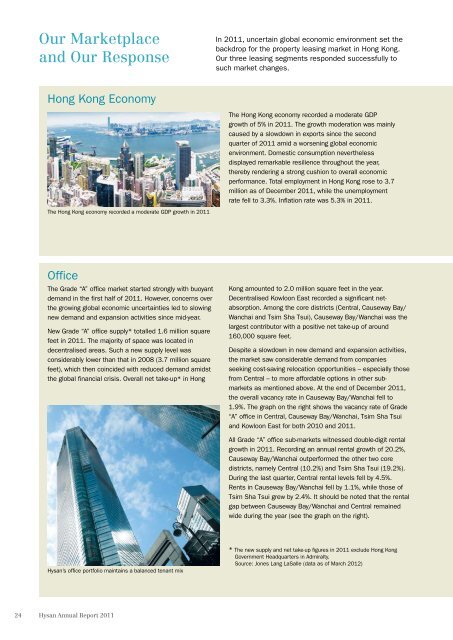

The Hong Kong economy recorded a moderate GDP growth in <strong>2011</strong><br />

Office<br />

The Grade “A” office market started strongly with buoyant<br />

demand in the first half of <strong>2011</strong>. However, concerns over<br />

the growing global economic uncertainties led to slowing<br />

new demand and expansion activities since mid-year.<br />

New Grade “A” office supply* totalled 1.6 million square<br />

feet in <strong>2011</strong>. The majority of space was located in<br />

decentralised areas. Such a new supply level was<br />

considerably lower than that in 2008 (3.7 million square<br />

feet), which then coincided with reduced demand amidst<br />

the global financial crisis. Overall net take-up* in Hong<br />

Kong amounted to 2.0 million square feet in the year.<br />

Decentralised Kowloon East recorded a significant netabsorption.<br />

Among the core districts (Central, Causeway Bay/<br />

Wanchai and Tsim Sha Tsui), Causeway Bay/Wanchai was the<br />

largest contributor with a positive net take-up of around<br />

160,000 square feet.<br />

Despite a slowdown in new demand and expansion activities,<br />

the market saw considerable demand from companies<br />

seeking cost-saving relocation opportunities – especially those<br />

from Central – to more affordable options in other submarkets<br />

as mentioned above. At the end of December <strong>2011</strong>,<br />

the overall vacancy rate in Causeway Bay/Wanchai fell to<br />

1.9%. The graph on the right shows the vacancy rate of Grade<br />

“A” office in Central, Causeway Bay/Wanchai, Tsim Sha Tsui<br />

and Kowloon East for both 2010 and <strong>2011</strong>.<br />

All Grade “A” office sub-markets witnessed double-digit rental<br />

growth in <strong>2011</strong>. Recording an annual rental growth of 20.2%,<br />

Causeway Bay/Wanchai outperformed the other two core<br />

districts, namely Central (10.2%) and Tsim Sha Tsui (19.2%).<br />

During the last quarter, Central rental levels fell by 4.5%.<br />

Rents in Causeway Bay/Wanchai fell by 1.1%, while those of<br />

Tsim Sha Tsui grew by 2.4%. It should be noted that the rental<br />

gap between Causeway Bay/Wanchai and Central remained<br />

wide during the year (see the graph on the right).<br />

<strong>Hysan</strong>’s office portfolio maintains a balanced tenant mix<br />

* The new supply and net take-up figures in <strong>2011</strong> exclude Hong Kong<br />

Government Headquarters in Admiralty.<br />

Source: Jones Lang LaSalle (data as of March 2012)<br />

24<br />

<strong>Hysan</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>