Annual Report 2011 - Hysan Development Company Limited

Annual Report 2011 - Hysan Development Company Limited

Annual Report 2011 - Hysan Development Company Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion<br />

and Analysis<br />

Treasury Policy<br />

Market Highlight<br />

The global economic recovery remained slow and uncertain in <strong>2011</strong>. Concerns about<br />

sovereign debt risks in the Euro zone and economic slowdown and high unemployment rates<br />

in the developed economies exerted pressure on the financial markets. Although the Asian<br />

economies maintained its growth trend in <strong>2011</strong>, the pace slowed down as tight liquidity led to<br />

depressed financial assets prices and increased borrowing costs in the second half of the<br />

year. Against this uncertain backdrop, the Group will continue to focus on liquidity<br />

management in 2012.<br />

Objectives<br />

We adhere to a policy of financial prudence. Our objectives are to:<br />

• maintain a strong financial position by actively managing debt levels and cash flow;<br />

• secure diversified funding sources from both banks and capital markets;<br />

• minimise re-financing and liquidity risks by attaining a healthy debt repayment capacity,<br />

diversified maturity profile, and availability of banking facilities with minimum collateral on<br />

debt;<br />

• manage the exposures arising from adverse market movements in interest rates and<br />

foreign exchange through appropriate hedging strategies;<br />

• monitor credit risks by imposing proper counter-party limits; and<br />

• reduce financial investment risks by holding quality marketable securities.<br />

To achieve the objective of financial prudence, <strong>Hysan</strong>’s Treasury policy manual lays down the<br />

acceptable range of operational parameters and gives guidance on our key performance<br />

indicators as set out in the table. Reflecting our strong financial position, the Group<br />

maintained its investment-grade credit ratings of Baa1 as rated by Moody’s and BBB as rated<br />

by Standard and Poor’s in <strong>2011</strong>.<br />

Treasury has an overall objective of optimising borrowing costs and the management of<br />

associated risks: that is, to minimise finance costs subject to the constraints of our<br />

operational parameters. The average cost of financing for <strong>2011</strong> was 2.7%, same as 2010.<br />

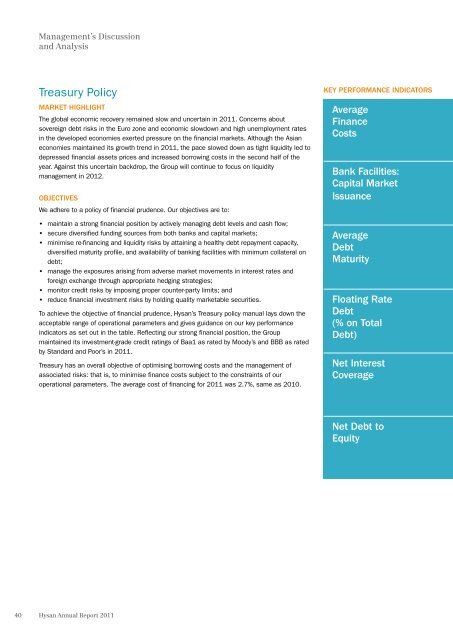

KEY PERFORMANCE INDICATORS<br />

Average<br />

Finance<br />

Costs<br />

Bank Facilities:<br />

Capital Market<br />

Issuance<br />

Average<br />

Debt<br />

Maturity<br />

Floating Rate<br />

Debt<br />

(% on Total<br />

Debt)<br />

Net Interest<br />

Coverage<br />

Net Debt to<br />

Equity<br />

40<br />

<strong>Hysan</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>