Underneath the glitz and gloss of Los Angeles, the heart of ...

Underneath the glitz and gloss of Los Angeles, the heart of ...

Underneath the glitz and gloss of Los Angeles, the heart of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

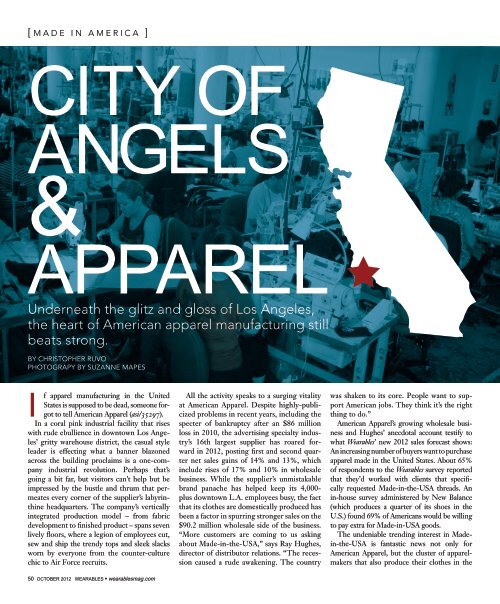

[ M ADE IN AMERICA ]<br />

CITY OF<br />

ANGELS<br />

&<br />

APPAREL<br />

<strong>Underneath</strong> <strong>the</strong> <strong>glitz</strong> <strong>and</strong> <strong>gloss</strong> <strong>of</strong> <strong>Los</strong> <strong>Angeles</strong>,<br />

<strong>the</strong> <strong>heart</strong> <strong>of</strong> American apparel manufacturing still<br />

beats strong.<br />

BY CHRISTOPHER RUVO<br />

PHOTOGRAPY BY SUZANNE MAPES<br />

I<br />

f apparel manufacturing in <strong>the</strong> United<br />

States is supposed to be dead, someone forgot<br />

to tell American Apparel (asi/35297).<br />

In a coral pink industrial facility that rises<br />

with rude ebullience in downtown <strong>Los</strong> <strong>Angeles</strong>’<br />

gritty warehouse district, <strong>the</strong> casual style<br />

leader is effecting what a banner blazoned<br />

across <strong>the</strong> building proclaims is a one-company<br />

industrial revolution. Perhaps that’s<br />

going a bit far, but visitors can’t help but be<br />

impressed by <strong>the</strong> bustle <strong>and</strong> thrum that permeates<br />

every corner <strong>of</strong> <strong>the</strong> supplier’s labyrinthine<br />

headquarters. The company’s vertically<br />

integrated production model – from fabric<br />

development to finished product – spans seven<br />

lively floors, where a legion <strong>of</strong> employees cut,<br />

sew <strong>and</strong> ship <strong>the</strong> trendy tops <strong>and</strong> sleek slacks<br />

worn by everyone from <strong>the</strong> counter-culture<br />

chic to Air Force recruits.<br />

All <strong>the</strong> activity speaks to a surging vitality<br />

at American Apparel. Despite highly-publicized<br />

problems in recent years, including <strong>the</strong><br />

specter <strong>of</strong> bankruptcy after an $86 million<br />

loss in 2010, <strong>the</strong> advertising specialty industry’s<br />

16th largest supplier has roared forward<br />

in 2012, posting first <strong>and</strong> second quarter<br />

net sales gains <strong>of</strong> 14% <strong>and</strong> 13%, which<br />

include rises <strong>of</strong> 17% <strong>and</strong> 10% in wholesale<br />

business. While <strong>the</strong> supplier’s unmistakable<br />

br<strong>and</strong> panache has helped keep its 4,000-<br />

plus downtown L.A. employees busy, <strong>the</strong> fact<br />

that its clo<strong>the</strong>s are domestically produced has<br />

been a factor in spurring stronger sales on <strong>the</strong><br />

$90.2 million wholesale side <strong>of</strong> <strong>the</strong> business.<br />

“More customers are coming to us asking<br />

about Made-in-<strong>the</strong>-USA,” says Ray Hughes,<br />

director <strong>of</strong> distributor relations. “The recession<br />

caused a rude awakening. The country<br />

was shaken to its core. People want to support<br />

American jobs. They think it’s <strong>the</strong> right<br />

thing to do.”<br />

American Apparel’s growing wholesale business<br />

<strong>and</strong> Hughes’ anecdotal account testify to<br />

what Wearables’ new 2012 sales forecast shows:<br />

An increasing number <strong>of</strong> buyers want to purchase<br />

apparel made in <strong>the</strong> United States. About 65%<br />

<strong>of</strong> respondents to <strong>the</strong> Wearables survey reported<br />

that <strong>the</strong>y’d worked with clients that specifically<br />

requested Made-in-<strong>the</strong>-USA threads. An<br />

in-house survey administered by New Balance<br />

(which produces a quarter <strong>of</strong> its shoes in <strong>the</strong><br />

U.S.) found 69% <strong>of</strong> Americans would be willing<br />

to pay extra for Made-in-USA goods.<br />

The undeniable trending interest in Madein-<strong>the</strong>-USA<br />

is fantastic news not only for<br />

American Apparel, but <strong>the</strong> cluster <strong>of</strong> apparelmakers<br />

that also produce <strong>the</strong>ir clo<strong>the</strong>s in <strong>the</strong><br />

50 OCTOBER 2012 WEARABLES • wearablesmag.com

L.A. area <strong>and</strong> sell into <strong>the</strong> ad specialty market.<br />

These manufacturers are tapping into <strong>the</strong><br />

unique apparel production strength <strong>of</strong> <strong>the</strong>ir<br />

region to capitalize on <strong>the</strong> growing dem<strong>and</strong> for<br />

domestic goods. <strong>Los</strong> <strong>Angeles</strong> started to incorporate<br />

garment manufacturing before World<br />

War II, <strong>and</strong> reached its peak employment in <strong>the</strong><br />

mid-’90s. So while <strong>the</strong> City <strong>of</strong> Angels is diminished<br />

from its heyday as <strong>the</strong> knitwear capital <strong>of</strong><br />

<strong>the</strong> country, it remains home to a vast, synergistic<br />

network <strong>of</strong> talent <strong>and</strong> businesses that make<br />

efficient production <strong>of</strong> quality apparel possible.<br />

Powered by a bevy <strong>of</strong> designers <strong>and</strong> skilled<br />

laborers, fabric suppliers <strong>and</strong> trimmers, dye<br />

houses <strong>and</strong> sewing contractors, <strong>the</strong> <strong>Los</strong> <strong>Angeles</strong><br />

area’s $13 billion apparel industry includes<br />

10,000 firms <strong>and</strong> about 50,000 clothing manufacturing<br />

jobs. “L.A. style is casual <strong>and</strong> lowkey,<br />

but our manufacturing muscle is anything<br />

but,” says Mayor Antonio Villaraigosa. “We are<br />

poised for growth.”<br />

Speed <strong>and</strong> quality<br />

That growth is well underway no matter where<br />

you look – including <strong>the</strong> industrial neighborhood<br />

<strong>of</strong> Vernon, just outside downtown L.A.<br />

<strong>and</strong> a couple <strong>of</strong> miles from 9th Avenue’s bazaarlike<br />

tangle <strong>of</strong> teeming fabric shops. Inside a<br />

faded blue building that houses Expert Performance<br />

T (asi/53404), President Sion Shaman<br />

<strong>and</strong> his management team have spearheaded<br />

mostly double-digit sales gains for six years<br />

straight. Revenue has shot up in 2012, with<br />

year-to-date business increasing 40% over<br />

2011 at <strong>the</strong> performance wear maker, which<br />

manufactures about 70% <strong>of</strong> its garments at<br />

facilities in <strong>the</strong> greater <strong>Los</strong> <strong>Angeles</strong> area.<br />

Escalating buyer interest in stateside-produced<br />

apparel has fueled, in part, <strong>the</strong> company’s<br />

bolstered bottom line. Shaman says<br />

this appetite for domestic threads is about<br />

more than customers wanting to support <strong>the</strong><br />

U.S. economy. Just as importantly, <strong>the</strong>y desire<br />

a stellar product delivered fast – achievable<br />

thanks to quick turn times that <strong>of</strong>fshore factories<br />

<strong>of</strong>ten can’t achieve. “Retailers <strong>and</strong> distributors<br />

are more reluctant to carry inventory,<br />

<strong>and</strong> with that <strong>and</strong> <strong>the</strong> constant change in<br />

“L.A. style is casual<br />

<strong>and</strong> low-key, but our<br />

manufacturing muscle<br />

is anything but. We are<br />

poised for growth.”<br />

Antonio Villaraigosa,<br />

Mayor <strong>of</strong> <strong>Los</strong> <strong>Angeles</strong><br />

trends, <strong>the</strong>y need to answer market dem<strong>and</strong><br />

much quicker,” he says. Because Expert stocks<br />

half a million yards <strong>of</strong> fabric <strong>and</strong> controls production,<br />

it can fulfill <strong>the</strong> need for speed. On<br />

average, even larger orders – say 10,000 or<br />

more pieces – are out <strong>the</strong> door in three or so<br />

weeks. “We can do in a few weeks what overseas<br />

would take 90 to 120 days,” says Shaman.<br />

By controlling cutting <strong>and</strong> sewing, suppliers<br />

can prioritize jobs to meet customer<br />

dem<strong>and</strong>s. Not long ago, with a deadline <strong>of</strong><br />

five days, American Apparel delivered 30,000<br />

<strong>of</strong> a specific T-shirt for <strong>the</strong> Air Force Reserve<br />

as part <strong>of</strong> a Kid Rock concert. Blanks Plus<br />

(asi/40642), situated a half mile down Alameda<br />

Street from American Apparel, recently<br />

made <strong>and</strong> shipped 2,500 skorts in four days,<br />

meeting <strong>the</strong> deadline <strong>of</strong> a client that had been<br />

a week <strong>and</strong> a half late getting Blanks a purchase<br />

order. “We ship anywhere in <strong>the</strong> U.S. in<br />

five to 10 days,” says Account Manager Abby<br />

de Joya. “Speed <strong>and</strong> quality are what set us<br />

apart from overseas suppliers.”<br />

As de Joya suggests, delivering a distinctive,<br />

quality product is paramount for domestic<br />

manufacturers. After all, higher labor costs<br />

mean U.S.-made apparel is pricier, without <strong>the</strong><br />

quantity price breaks that <strong>of</strong>fshore factories <strong>of</strong>fer<br />

(since American labor wages can’t be manipulated).<br />

In addition to fast turn times, L.A. manufacturers<br />

aim to justify <strong>the</strong> higher price by providing<br />

superior garments. Blanks Plus’ skilled<br />

<strong>and</strong> efficient team <strong>of</strong> cutters <strong>and</strong> sewers creates<br />

fashion-forward pieces – like women’s dolmansleeve<br />

scoop-neck tunics – from Eco-Hybrid, a<br />

syn<strong>the</strong>tic-free fabric that blends cotton with <strong>the</strong><br />

s<strong>of</strong>tness <strong>and</strong> 100% biodegradability <strong>of</strong> Modal,<br />

which is made from beech trees.<br />

At Expert, quality comes in <strong>the</strong> form <strong>of</strong><br />

inherent moisture-management built into its<br />

100% micr<strong>of</strong>iber oXymesh shirts. The wicking<br />

property lasts <strong>the</strong> life <strong>of</strong> <strong>the</strong> garments,<br />

which are treated to inhibit growth <strong>of</strong> odorcausing<br />

bacteria. “The U.S. is a leader in<br />

research, development <strong>and</strong>, in many cases,<br />

manufacturing <strong>of</strong> fibers, yarns <strong>and</strong> fabrics so<br />

we can <strong>of</strong>fer better quality,” says Shaman.<br />

In fact, a premier provider <strong>of</strong> performance<br />

wear fabric is located in downtown<br />

<strong>Los</strong> <strong>Angeles</strong>, which is advantageous for<br />

RaceReady (asi/74894). “We get easy access<br />

to some <strong>of</strong> <strong>the</strong> best resources <strong>the</strong> industry has<br />

to <strong>of</strong>fer,” says company President Tim Vadney.<br />

Headquartered in Torrance, only a half<br />

hour (traffic-less) drive south on <strong>the</strong> I-110<br />

from downtown, RaceReady manufactures<br />

L.A. BY<br />

THE NUMBERS<br />

$13 billion<br />

worth <strong>of</strong> L.A. apparel industry<br />

10,000<br />

apparel firms in <strong>the</strong> city<br />

50,000<br />

clothing manufacturing jobs<br />

14<br />

fashion schools in <strong>the</strong> city<br />

#1<br />

<strong>the</strong> rank <strong>of</strong> Port <strong>of</strong> <strong>Los</strong> <strong>Angeles</strong> as <strong>the</strong><br />

busiest port in America<br />

40%<br />

<strong>of</strong> goods imported into <strong>the</strong> U.S. come<br />

through L.A.<br />

37<br />

nationalities which have <strong>the</strong>ir largest U.S.<br />

population in L.A.<br />

wearablesmag.com • WEARABLES OCTOBER 2012 51

[ M ADE IN AMERICA ]<br />

Efficiency is essential to consistently achieving expeditious turnaround times that give domestic apparel manufacturers an edge. At American Apparel (asi/35297), employees work in<br />

teams to help maximize production flow.<br />

technical running apparel from <strong>the</strong> highestquality<br />

performance fabrics, like ReadyTech<br />

Aries, Dryline <strong>and</strong> MicroMove. Focused on<br />

innovation <strong>and</strong> creativity, RaceReady delivers<br />

value buyers can’t find elsewhere by holding<br />

patents on its men’s <strong>and</strong> women’s running<br />

shorts with pockets – a practical solution for<br />

carrying energy bars <strong>and</strong> <strong>the</strong> like on long-distance<br />

runs. “We may lose on price, but we’ll<br />

always win on value,” Vadney says.<br />

Knowing <strong>the</strong>y must continue to justify <strong>the</strong><br />

higher prices <strong>of</strong> <strong>the</strong>ir wares, domestic apparel<br />

producers focus intensely on quality control<br />

– a task made much easier when cut-<strong>and</strong>-sew<br />

operations are in your own building or closeby.<br />

For example, when a novice sewer was<br />

stitching pockets that were too large onto running<br />

shorts, RaceReady personnel caught <strong>the</strong><br />

mistake after only about 60 pairs were sewn.<br />

A similar occurrence with overseas manufacturers,<br />

Vadney says, would not have been discovered<br />

until after <strong>the</strong> clo<strong>the</strong>s arrive, causing<br />

thous<strong>and</strong>s <strong>of</strong> garments to be scrapped. “We<br />

have people going from <strong>the</strong> <strong>of</strong>fice to <strong>the</strong> factory<br />

<strong>and</strong> back daily,” says Vadney. “It helps us<br />

maintain that level <strong>of</strong> control that ensures a<br />

good product.”<br />

Ken Cheng knows exactly what Vadney<br />

means. Fed up with unpredictable delivery,<br />

inconsistent product quality <strong>and</strong> rising prices<br />

from Chinese factories, <strong>the</strong> owner <strong>of</strong> Akwa<br />

(asi/33280) decided to reshore manufacturing<br />

about three years ago to gain greater control<br />

over his apparel. Only about 20 miles outside<br />

<strong>of</strong> downtown L.A. in City <strong>of</strong> Industry, Akwa<br />

produces between 80% <strong>and</strong> 90% <strong>of</strong> its line<br />

in <strong>the</strong> <strong>Los</strong> <strong>Angeles</strong> area. “If we find a problem,<br />

we can stop it right <strong>the</strong>re <strong>and</strong> fix it,” says<br />

Cheng, who first <strong>of</strong>fshored around <strong>the</strong> year<br />

2000, having previously produced at a SoCal<br />

factory he owned. “In China, we’d be reliant<br />

on <strong>the</strong> overseas vendor <strong>and</strong> problems slip by.”<br />

“More customers are<br />

coming to us asking<br />

about Made-in-<strong>the</strong>-USA.<br />

The recession caused<br />

a rude awakening. The<br />

country was shaken to<br />

its core. People want to<br />

support American jobs.<br />

They think it’s <strong>the</strong> right<br />

thing to do.”<br />

Ray Hughes,<br />

American Apparel (asi/35297)<br />

52 OCTOBER 2012 WEARABLES • wearablesmag.com

In <strong>Los</strong> <strong>Angeles</strong> county, <strong>the</strong> average annual wage for apparel manufacturing workers in 2011 was $34,008, while textile mill employees earned $32,240. Respectively, those wages were<br />

21.3% <strong>and</strong> 15.5% greater than <strong>the</strong> 2006 averages.<br />

Ano<strong>the</strong>r way domestic manufacturers<br />

remain vital is by fulfilling smaller-volume<br />

custom orders that wouldn’t meet <strong>the</strong> minimums<br />

required by overseas factories. While<br />

Tutti Bowling Wear’s (asi/92356) bread-<strong>and</strong>butter<br />

business centers on staying amply<br />

stocked with its extensive line <strong>of</strong> bowling<br />

shirts so it can same-day ship, <strong>the</strong> <strong>Los</strong> <strong>Angeles</strong><br />

manufacturer also deals in <strong>the</strong> custom business,<br />

setting no minimums when it comes to<br />

creating one-<strong>of</strong>-a-kind bowling tops. Endusers<br />

<strong>of</strong> Tutti’s unique shirts – stitched on<br />

<strong>the</strong> sixth floor <strong>of</strong> a downtown building a few<br />

doors down from <strong>the</strong> famous Orpheum Theatre<br />

– include everyone from Justin Bieber to<br />

an automotive industry company that wanted<br />

custom tops for a trade show.<br />

All <strong>the</strong> hard work is bearing fruit. For <strong>the</strong> first<br />

six months <strong>of</strong> 2012, business at RaceReady was<br />

up 37% over <strong>the</strong> same period <strong>the</strong> year before<br />

(thanks to both domestic dem<strong>and</strong> <strong>and</strong> <strong>the</strong> company’s<br />

entry in <strong>the</strong> ad specialty market). While<br />

Blanks Plus lost about 75% <strong>of</strong> its business in<br />

2007 <strong>and</strong> 2008 as a result <strong>of</strong> clients choosing<br />

to go <strong>of</strong>fshore, about 20% <strong>of</strong> those prodigal<br />

customers have returned since 2011, drawn<br />

back by <strong>the</strong> benefits <strong>of</strong>fered by <strong>the</strong> manufacturer’s<br />

domestic production model, says de Joya.<br />

“Every day we’re getting more calls from people<br />

who say, ‘Are you 100% American-made’ ”<br />

she says. “I think it’s going to keep increasing.”<br />

Powered by people<br />

When Jose Olivos’ wife showed him <strong>the</strong> flyer<br />

about <strong>the</strong> job opening, he decided to apply. It<br />

was grunt work in shipping <strong>and</strong> receiving, but<br />

that didn’t matter; Olivos was eager for <strong>the</strong><br />

position. “I thought it was a small company,<br />

but <strong>the</strong>n I saw how big it is,” says Olivos. The<br />

company was American Apparel. And within<br />

a month, <strong>the</strong> high-performing Olivos was in<br />

a supervisory position, a role he has grown in<br />

over <strong>the</strong> last five years. “I’m making a decent<br />

living,” says <strong>the</strong> family man, originally from<br />

Mexico, during a break from his busy day. “I<br />

can afford my little luxuries.”<br />

Olivos represents what sometimes gets lost<br />

in industrial verbiage <strong>and</strong> macro-analytic discussions<br />

about stateside manufacturing: He’s<br />

<strong>the</strong> human face <strong>of</strong> <strong>the</strong> industry, one <strong>of</strong> <strong>the</strong> tens<br />

<strong>of</strong> thous<strong>and</strong>s <strong>of</strong> hardworking people powering<br />

apparel production in <strong>the</strong> greater <strong>Los</strong> <strong>Angeles</strong><br />

area. It’s <strong>the</strong>se people who create <strong>and</strong> efficiently<br />

ship <strong>the</strong> garments that company presidents<br />

brag about. It’s <strong>the</strong>ir jobs that are at stake<br />

when buyers opt for <strong>the</strong> cheaper <strong>of</strong>fshore item<br />

over one with a Made-in-<strong>the</strong>-USA label. And<br />

it’s <strong>the</strong>se workers – <strong>and</strong> <strong>the</strong> sizable contingent<br />

<strong>of</strong> unemployed workers in this country – who<br />

can benefit if <strong>the</strong> trend toward buying American<br />

holds steady or increases. “I just thank<br />

God I have a job,” says Irma Perez, a patternmaker<br />

originally from Mexico who l<strong>and</strong>ed a<br />

wearablesmag.com • WEARABLES OCTOBER 2012 53

[ M ADE IN AMERICA ]<br />

The majority (about two-thirds) <strong>of</strong> apparel production workers in <strong>the</strong> <strong>Los</strong> <strong>Angeles</strong> area are women. The workforce is dominated by immigrants <strong>of</strong> Hispanic <strong>and</strong> Asian ethnicities.<br />

position at Blanks Plus after tough economic<br />

times caused her to lose her previous apparel<br />

job at ano<strong>the</strong>r firm. “I enjoy my job because I<br />

can do it fast <strong>and</strong> right. And I like my boss. He<br />

doesn’t push us. We push ourselves.”<br />

By <strong>and</strong> large, <strong>the</strong> harrowing examples <strong>of</strong><br />

worker exploitation – poor working conditions,<br />

wage manipulation – that once besmirched <strong>the</strong><br />

L.A. industry are relegated to <strong>the</strong> past, according<br />

to a 2011 report compiled by CIT Trade<br />

Finance for <strong>the</strong> California Fashion Association.<br />

“The L.A. apparel industry <strong>of</strong> today has<br />

greatly improved working conditions from <strong>the</strong><br />

apparel industry <strong>of</strong> 10 years ago,” <strong>the</strong> report<br />

says. “Stringent self <strong>and</strong> government monitoring<br />

help ensure that ‘exploitation’ occurs<br />

very rarely.” Some apparel companies even go<br />

<strong>the</strong> extra mile for <strong>the</strong>ir employees. American<br />

Apparel has been a leader in this regard, <strong>of</strong>fering<br />

everything from an on-site medical clinic<br />

to company-subsidized lunches, public transport<br />

<strong>and</strong> health insurance, as well as free onpremise<br />

massages.<br />

Still, even if you were looking through <strong>the</strong><br />

rosiest glasses, you couldn’t call <strong>the</strong> apparel<br />

production trade easy. It’s labor-intensive. It’s<br />

hot. It’s fast-paced. There’s <strong>the</strong> crunch <strong>of</strong> constant<br />

deadlines. And while <strong>the</strong> annual wages<br />

for textile mill <strong>and</strong> apparel manufacturing<br />

workers in <strong>Los</strong> <strong>Angeles</strong> County rose 15.5%<br />

<strong>and</strong> 21.3%, respectively, between 2006 <strong>and</strong><br />

2011, <strong>the</strong>y certainly aren’t getting rich from<br />

<strong>the</strong> work. Last year, textile mill employees<br />

made $32,240 on average, while apparel manufacturing<br />

employees earned $34,008, according<br />

to <strong>the</strong> <strong>Los</strong> <strong>Angeles</strong> County Economic<br />

Development Corporation.<br />

None<strong>the</strong>less, <strong>the</strong> apparel production industry<br />

provides employment <strong>and</strong> <strong>the</strong> door to a<br />

better life for its predominantly female immigrant<br />

workforce, which in <strong>the</strong> <strong>Los</strong> <strong>Angeles</strong><br />

area is about 80% Hispanic <strong>and</strong> 16% Asian.<br />

Among <strong>the</strong> ranks <strong>of</strong> dedicated workers,<br />

<strong>the</strong>re are many unheralded personal success<br />

stories, like that <strong>of</strong> Roxanna Alvarez. Originally<br />

from El Salvador, Alvarez immigrated<br />

to Sou<strong>the</strong>rn California when she was nine <strong>and</strong><br />

later began working in shipping <strong>and</strong> receiving<br />

in <strong>the</strong> clothing industry. An outgoing<br />

go-getter with a knack for organization, she<br />

eventually moved into <strong>the</strong> administrative side<br />

<strong>of</strong> <strong>the</strong> business. Despite a difficult unemployment<br />

stint imposed by a bad economy, Alvarez<br />

earned a sales <strong>and</strong> customer service position<br />

at Expert Performance T, a job she likes <strong>and</strong><br />

was well-prepared for by nearly two decades<br />

<strong>of</strong> industry experience. Dressed casually as she<br />

sits in a comfortable, air-conditioned <strong>of</strong>fice at<br />

Expert, she doesn’t hesitate when asked what<br />

she thinks <strong>of</strong> domestic apparel manufacturing:<br />

54 OCTOBER 2012 WEARABLES • wearablesmag.com

“It gives people opportunity.”<br />

Made in L.A.’s future<br />

Will that opportunity continue The forecast is mixed.<br />

High-volume apparel production is unlikely to return to <strong>Los</strong> <strong>Angeles</strong><br />

or elsewhere in <strong>the</strong> United States. According to an August 2011<br />

study by <strong>the</strong> Boston Consulting Group, while modest-volume, laborlight<br />

products are poised for a renaissance in America over <strong>the</strong> next five<br />

years, domestic production <strong>of</strong> mass-made, labor-intensive goods (like<br />

clothing) still faces hurdles to growth.<br />

The bottom line Employment in apparel manufacturing <strong>and</strong> textile<br />

mills in <strong>the</strong> <strong>Los</strong> <strong>Angeles</strong> area isn’t going to rebound to its 1990s level,<br />

which was roughly cut in half over <strong>the</strong> last 15 years. “In <strong>the</strong> last two years,<br />

manufacturing here has been building up again,” says Shaman, “but it’s<br />

not nearly as big as what it used to be. It’s not going to go back to that.”<br />

None<strong>the</strong>less, <strong>the</strong>re is cause for optimism. Along with <strong>the</strong> revenue<br />

gains <strong>of</strong> Expert <strong>and</strong> o<strong>the</strong>r L.A.-area manufacturers who sell to ad specialty<br />

distributors, <strong>the</strong> California Fashion Association reports that <strong>the</strong><br />

<strong>Los</strong> <strong>Angeles</strong> apparel industry as a whole has carved a niche in <strong>the</strong><br />

marketplace by providing low-volume, high-fashion clothing that has<br />

short concept-to-product time. While apparel industry employment<br />

has fallen across <strong>the</strong> United States, <strong>the</strong> share <strong>of</strong> employment captured<br />

by <strong>the</strong> L.A. area has increased. Consider, too, that clothing manufacturing<br />

alone was a $5 billion business in <strong>Los</strong> <strong>Angeles</strong> County in 2010.<br />

To improve upon that impressive figure <strong>and</strong> build <strong>the</strong> industry, politicians<br />

<strong>and</strong> business leaders are wielding <strong>the</strong>ir might. Villaraigosa’s<br />

Office <strong>of</strong> Economic <strong>and</strong> Business Policy recently partnered with <strong>the</strong><br />

<strong>Los</strong> <strong>Angeles</strong> Regional Export Council to research <strong>and</strong> compile <strong>the</strong><br />

first-ever online comprehensive resource guide <strong>of</strong> apparel industry<br />

suppliers <strong>and</strong> manufacturers in L.A. The tool will serve as a roadmap<br />

to <strong>Los</strong> <strong>Angeles</strong>’ apparel industry, with <strong>the</strong> aim <strong>of</strong> driving more business<br />

to local contractors <strong>and</strong> ultimately creating more jobs. The partnership<br />

was announced in August at MAGIC, a Las Vegas trade show for <strong>the</strong><br />

fashion industry where a “Made-in-L.A.” pavilion was on display to call<br />

attention to <strong>the</strong> city’s apparel firms.<br />

Combine all that with <strong>the</strong> fact that more buyers are looking for<br />

Made-in-<strong>the</strong>-USA threads, <strong>and</strong> many <strong>Los</strong> <strong>Angeles</strong> manufacturers feel<br />

<strong>the</strong>y’re in a strong position. “We can make quality products at a competitive<br />

price <strong>and</strong> get <strong>the</strong>m to customers quickly,” says Shaman. “That<br />

business is going to grow.”<br />

That’s good news for <strong>the</strong> employees <strong>of</strong> Tarvio Sportswear, who cut<br />

<strong>and</strong> sew for Expert <strong>and</strong> are neatly stacking white performance wear<br />

T-shirts by <strong>the</strong> dozen on a summer afternoon in <strong>Los</strong> <strong>Angeles</strong> county.<br />

It’s good news for <strong>the</strong> American Apparel workers grouped into garment<br />

construction teams, stitching T-shirts <strong>and</strong> wovens as industrial<br />

fans whirl like old plane propellers in sun-baked windows. Good news,<br />

<strong>of</strong> course, for <strong>the</strong> savvy suppliers working in <strong>the</strong>ir industrial headquarters,<br />

not far from <strong>the</strong> shadow <strong>of</strong> <strong>the</strong> iconic Hollywood sign.<br />

At <strong>the</strong> end <strong>of</strong> <strong>the</strong> day, it’s good news for America.<br />

Christopher Ruvo is a staff writer for Wearables.<br />

HUB OF ACTIVITY<br />

<strong>Los</strong> <strong>Angeles</strong> isn’t <strong>the</strong> only area <strong>of</strong> <strong>the</strong> U.S. that has its<br />

fingers in apparel production. Here are o<strong>the</strong>r areas that are<br />

deeply entrenched.<br />

New York City<br />

With its condensed cluster <strong>of</strong> apparel factories <strong>and</strong> fabric suppliers,<br />

Manhattan’s hard-hit but still-vibrant Garment Center helps power<br />

<strong>the</strong> world-famous fashion industry in <strong>the</strong> city, which is home to 846<br />

fashion companies – more than London, Paris <strong>and</strong> Milan combined.<br />

Texas<br />

The Lone Star State is home to America’s greatest reserve <strong>of</strong> cotton,<br />

producing a total <strong>of</strong> 6.2 million bales <strong>of</strong> cotton for <strong>the</strong> years 2006<br />

through 2008, helping to make <strong>the</strong> U.S. <strong>the</strong> third largest cotton<br />

grower in <strong>the</strong> world.<br />

North Carolina<br />

The Sou<strong>the</strong>ast remains <strong>the</strong> primary home <strong>of</strong> textile production in <strong>the</strong><br />

U.S., with 4,400 employees working in textile <strong>and</strong> apparel firms in <strong>the</strong><br />

Tar Heel state.<br />

wearablesmag.com • WEARABLES OCTOBER 2012 55