Annual Report 2009 - Armenian Missionary Association of America

Annual Report 2009 - Armenian Missionary Association of America

Annual Report 2009 - Armenian Missionary Association of America

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

For the prior fiscal year, included in Armenia Buildings & Improvements above was $2,191,914 expended for the renovation <strong>of</strong> the new<br />

Armenia headquarters and $1,224,642 for the purchase <strong>of</strong> land for the Avedisian School.<br />

Due to the prohibitive cost <strong>of</strong> obtaining hazard insurance on AMAA properties in Armenia, AMAA has adopted a policy <strong>of</strong> self-insurance.<br />

While self-insurance involves modest risk, Management feels it is a cost-effective alternative and due to the geographic diversity <strong>of</strong> the<br />

properties, it does not believe any single catastrophic event will have a material impact on the financial position <strong>of</strong> the AMAA.<br />

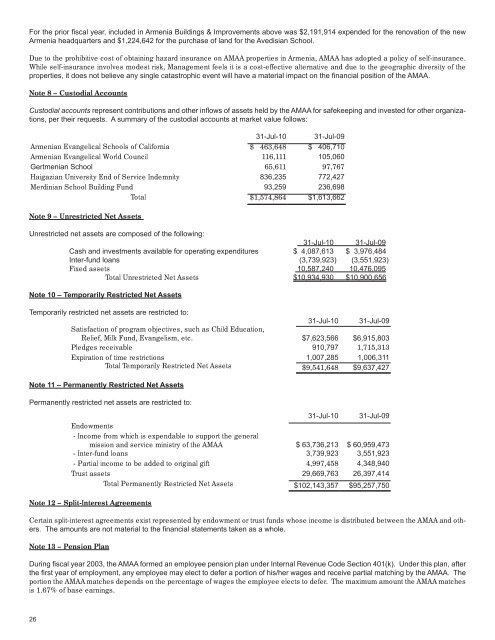

Note 8 – Custodial Accounts<br />

Custodial accounts represent contributions and other inflows <strong>of</strong> assets held by the AMAA for safekeeping and invested for other organizations,<br />

per their requests. A summary <strong>of</strong> the custodial accounts at market value follows:<br />

31-Jul-10 31-Jul-09<br />

<strong>Armenian</strong> Evangelical Schools <strong>of</strong> California $ 463,648 $ 406,710<br />

<strong>Armenian</strong> Evangelical World Council 116,111 105,060<br />

Gertmenian School 65,611 97,767<br />

Haigazian University End <strong>of</strong> Service Indemnity 836,235 772,427<br />

Merdinian School Building Fund 93,259 236,698<br />

Total $1,574,864 $1,613,662<br />

Note 9 – Unrestricted Net Assets<br />

Unrestricted net assets are composed <strong>of</strong> the following:<br />

31-Jul-10 31-Jul-09<br />

Cash and investments available for operating expenditures $ 4,087,613 $ 3,976,484<br />

Inter-fund loans (3,739,923) (3,551,923)<br />

Fixed assets 10,587,240 10,476,095<br />

Total Unrestricted Net Assets $10,934,930 $10,900,656<br />

Note 10 – Temporarily Restricted Net Assets<br />

Temporarily restricted net assets are restricted to:<br />

31-Jul-10 31-Jul-09<br />

Satisfaction <strong>of</strong> program objectives, such as Child Education,<br />

Relief, Milk Fund, Evangelism, etc. $7,623,566 $6,915,803<br />

Pledges receivable 910,797 1,715,313<br />

Expiration <strong>of</strong> time restrictions 1,007,285 1,006,311<br />

Total Temporarily Restricted Net Assets $9,541,648 $9,637,427<br />

Note 11 – Permanently Restricted Net Assets<br />

Permanently restricted net assets are restricted to:<br />

31-Jul-10 31-Jul-09<br />

Endowments<br />

- Income from which is expendable to support the general<br />

mission and service ministry <strong>of</strong> the AMAA $ 63,736,213 $ 60,959,473<br />

- Inter-fund loans 3,739,923 3,551,923<br />

- Partial income to be added to original gift 4,997,458 4,348,940<br />

Trust assets 29,669,763 26,397,414<br />

Total Permanently Restricted Net Assets $102,143,357 $95,257,750<br />

Note 12 – Split-Interest Agreements<br />

Certain split-interest agreements exist represented by endowment or trust funds whose income is distributed between the AMAA and others.<br />

The amounts are not material to the financial statements taken as a whole.<br />

Note 13 – Pension Plan<br />

During fiscal year 2003, the AMAA formed an employee pension plan under Internal Revenue Code Section 401(k). Under this plan, after<br />

the first year <strong>of</strong> employment, any employee may elect to defer a portion <strong>of</strong> his/her wages and receive partial matching by the AMAA. The<br />

portion the AMAA matches depends on the percentage <strong>of</strong> wages the employee elects to defer. The maximum amount the AMAA matches<br />

is 1.67% <strong>of</strong> base earnings.<br />

26