YAMAHA CORPORATION ANNUAL REPORT 2000

YAMAHA CORPORATION ANNUAL REPORT 2000

YAMAHA CORPORATION ANNUAL REPORT 2000

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

27<br />

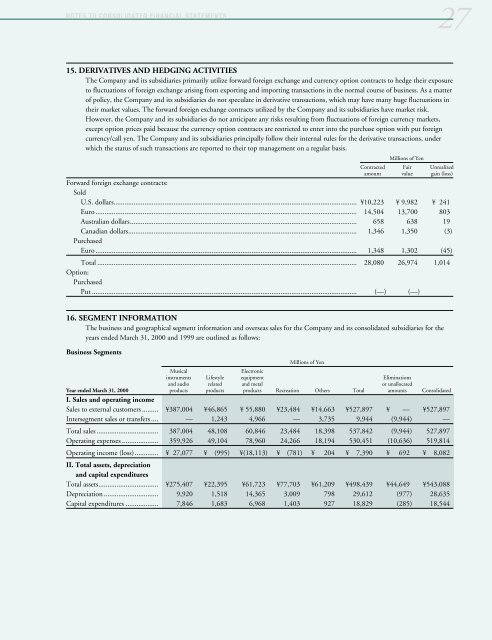

15. DERIVATIVES AND HEDGING ACTIVITIES<br />

The Company and its subsidiaries primarily utilize forward foreign exchange and currency option contracts to hedge their exposure<br />

to fluctuations of foreign exchange arising from exporting and importing transactions in the normal course of business. As a matter<br />

of policy, the Company and its subsidiaries do not speculate in derivative transactions, which may have many huge fluctuations in<br />

their market values. The forward foreign exchange contracts utilized by the Company and its subsidiaries have market risk.<br />

However, the Company and its subsidiaries do not anticipate any risks resulting from fluctuations of foreign currency markets,<br />

except option prices paid because the currency option contracts are restricted to enter into the purchase option with put foreign<br />

currency/call yen. The Company and its subsidiaries principally follow their internal rules for the derivative transactions, under<br />

which the status of such transactions are reported to their top management on a regular basis.<br />

Millions of Yen<br />

Contracted Fair Unrealized<br />

amount value gain (loss)<br />

Forward foreign exchange contracts:<br />

Sold<br />

U.S. dollars...................................................................................................................................... ¥10,223 ¥ 9,982 ¥ 241<br />

Euro ................................................................................................................................................ 14,504 13,700 803<br />

Australian dollars............................................................................................................................. 658 638 19<br />

Canadian dollars..............................................................................................................................<br />

Purchased<br />

1,346 1,350 (3)<br />

Euro ................................................................................................................................................ 1,348 1,302 (45)<br />

Total ...............................................................................................................................................<br />

Option:<br />

Purchased<br />

28,080 26,974 1,014<br />

Put .................................................................................................................................................. (—) (—)<br />

16. SEGMENT INFORMATION<br />

The business and geographical segment information and overseas sales for the Company and its consolidated subsidiaries for the<br />

years ended March 31, <strong>2000</strong> and 1999 are outlined as follows:<br />

Business Segments<br />

Millions of Yen<br />

Musical Electronic<br />

instruments Lifestyle equipment Eliminations<br />

and audio related and metal or unallocated<br />

Year ended March 31, <strong>2000</strong><br />

I. Sales and operating income<br />

products products products Recreation Others Total amounts Consolidated<br />

Sales to external customers ......... ¥387,004 ¥46,865 ¥ 55,880 ¥23,484 ¥14,663 ¥527,897 ¥ — ¥527,897<br />

Intersegment sales or transfers .... — 1,243 4,966 — 3,735 9,944 (9,944) —<br />

Total sales .................................. 387,004 48,108 60,846 23,484 18,398 537,842 (9,944) 527,897<br />

Operating expenses .................... 359,926 49,104 78,960 24,266 18,194 530,451 (10,636) 519,814<br />

Operating income (loss).............<br />

II. Total assets, depreciation<br />

and capital expenditures<br />

¥ 27,077 ¥ (995) ¥(18,113) ¥ (781) ¥ 204 ¥ 7,390 ¥ 692 ¥ 8,082<br />

Total assets................................. ¥275,407 ¥22,395 ¥61,723 ¥77,703 ¥61,209 ¥498,439 ¥44,649 ¥543,088<br />

Depreciation .............................. 9,920 1,518 14,365 3,009 798 29,612 (977) 28,635<br />

Capital expenditures .................. 7,846 1,683 6,968 1,403 927 18,829 (285) 18,544