WAY UPWARDS - HSE

WAY UPWARDS - HSE

WAY UPWARDS - HSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

82 Annual Report 2011<br />

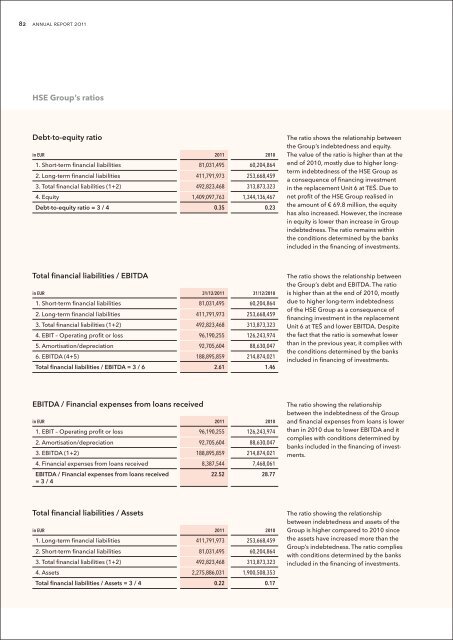

<strong>HSE</strong> Group’s ratios<br />

Debt-to-equity ratio<br />

in EUR 2011 2010<br />

1. Short-term financial liabilities 81,031,495 60,204,864<br />

2. Long-term financial liabilities 411,791,973 253,668,459<br />

3. Total financial liabilities (1+2) 492,823,468 313,873,323<br />

4. Equity 1,409,097,763 1,344,136,467<br />

Debt-to-equity ratio = 3 / 4 0.35 0.23<br />

The ratio shows the relationship between<br />

the Group’s indebtedness and equity.<br />

The value of the ratio is higher than at the<br />

end of 2010, mostly due to higher longterm<br />

indebtedness of the <strong>HSE</strong> Group as<br />

a consequence of financing investment<br />

in the replacement Unit 6 at TEŠ. Due to<br />

net profit of the <strong>HSE</strong> Group realised in<br />

the amount of € 69.8 million, the equity<br />

has also increased. However, the increase<br />

in equity is lower than increase in Group<br />

indebtedness. The ratio remains within<br />

the conditions determined by the banks<br />

included in the financing of investments.<br />

Total financial liabilities / EBITDA<br />

in EUR 31/12/2011 31/12/2010<br />

1. Short-term financial liabilities 81,031,495 60,204,864<br />

2. Long-term financial liabilities 411,791,973 253,668,459<br />

3. Total financial liabilities (1+2) 492,823,468 313,873,323<br />

4. EBIT – Operating profit or loss 96,190,255 126,243,974<br />

5. Amortisation/depreciation 92,705,604 88,630,047<br />

6. EBITDA (4+5) 188,895,859 214,874,021<br />

Total financial liabilities / EBITDA = 3 / 6 2.61 1.46<br />

The ratio shows the relationship between<br />

the Group’s debt and EBITDA. The ratio<br />

is higher than at the end of 2010, mostly<br />

due to higher long-term indebtedness<br />

of the <strong>HSE</strong> Group as a consequence of<br />

financing investment in the replacement<br />

Unit 6 at TEŠ and lower EBITDA. Despite<br />

the fact that the ratio is somewhat lower<br />

than in the previous year, it complies with<br />

the conditions determined by the banks<br />

included in financing of investments.<br />

EBITDA / Financial expenses from loans received<br />

in EUR 2011 2010<br />

1. EBIT – Operating profit or loss 96,190,255 126,243,974<br />

2. Amortisation/depreciation 92,705,604 88,630,047<br />

3. EBITDA (1+2) 188,895,859 214,874,021<br />

4. Financial expenses from loans received 8,387,544 7,468,061<br />

EBITDA / Financial expenses from loans received<br />

= 3 / 4<br />

22.52 28.77<br />

The ratio showing the relationship<br />

between the indebtedness of the Group<br />

and financial expenses from loans is lower<br />

than in 2010 due to lower EBITDA and it<br />

complies with conditions determined by<br />

banks included in the financing of investments.<br />

Total financial liabilities / Assets<br />

in EUR 2011 2010<br />

1. Long-term financial liabilities 411,791,973 253,668,459<br />

2. Short-term financial liabilities 81,031,495 60,204,864<br />

3. Total financial liabilities (1+2) 492,823,468 313,873,323<br />

4. Assets 2,275,886,031 1,900,508,353<br />

Total financial liabilities / Assets = 3 / 4 0.22 0.17<br />

The ratio showing the relationship<br />

between indebtedness and assets of the<br />

Group is higher compared to 2010 since<br />

the assets have increased more than the<br />

Group’s indebtedness. The ratio complies<br />

with conditions determined by the banks<br />

included in the financing of investments.