Strong Breakthrough - Masan Group

Strong Breakthrough - Masan Group

Strong Breakthrough - Masan Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS (continued)<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)<br />

For the year ended 31 December 2010<br />

Form B05/TCTD-HN<br />

For the year ended 31 December 2010<br />

Form B05/TCTD-HN<br />

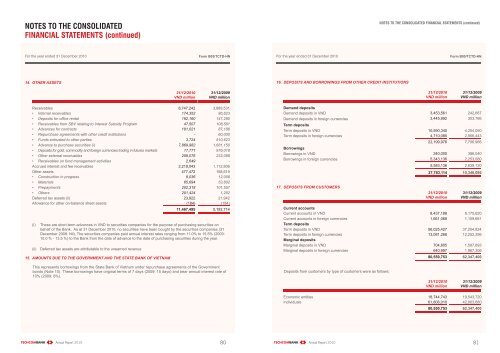

14. OTHER ASSETS<br />

16. DEPOSITS AND BORROWINGS FROM OTHER CREDIT INSTITUTIONS<br />

31/12/2010<br />

VND million<br />

31/12/2009<br />

VND million<br />

31/12/2010<br />

VND million<br />

31/12/2009<br />

VND million<br />

Receivables 8,747,242 3,889,531<br />

• Internal receivables 174,352 86,623<br />

• Deposits for offi ce rental 192,160 147,280<br />

• Receivables from SBV relating to Interest Subsidy Program 47,507 108,581<br />

• Advances for contracts 181,021 87,188<br />

• Repurchase agreements with other credit institutions - 60,000<br />

• Funds entrusted to other parties 3,724 510,623<br />

• Advance to purchase securities (i) 7,869,982 1,681,150<br />

• Deposits for gold, commodity and foreign currencies trading in futures markets 17,771 976,018<br />

• Other external receivables 258,076 232,068<br />

• Receivables on fund management activities 2,649 -<br />

Accrued interest and fee receivables 2,219,043 1,112,806<br />

Other assets 477,472 168,619<br />

• Construction in progress 8,036 12,008<br />

• Materials 65,694 53,802<br />

• Prepayments 202,318 101,557<br />

• Others 201,424 1,252<br />

Deferred tax assets (ii) 23,922 21,942<br />

Allowance for other on-balance sheet assets (184) (184)<br />

11,467,495 5,192,714<br />

(i)<br />

These are short-term advances in VND to securities companies for the purpose of purchasing securities on<br />

behalf of the Bank. As at 31 December 2010, no securities have been bought by the securities companies (31<br />

December 2009: Nil). The securities companies paid annual interest rates ranging from 11.0% to 15.5% (2009:<br />

10.0 % - 13.5 %) to the Bank from the date of advance to the date of purchasing securities during the year.<br />

(ii) Deferred tax assets are attributable to the unearned revenue<br />

15. AMOUNTS DUE TO THE GOVERNMENT AND THE STATE BANK OF VIETNAM<br />

Demand deposits<br />

Demand deposits in VND 3,453,561 242,687<br />

Demand deposits in foreign currencies 3,445,992 303,786<br />

Term deposits<br />

Term deposits in VND 10,590,340 4,254,050<br />

Term deposits in foreign currencies 4,710,085 2,906,443<br />

22,199,978 7,706,966<br />

Borrowings<br />

Borrowings in VND 240,000 386,040<br />

Borrowings in foreign currencies 5,343,136 2,253,080<br />

5,583,136 2,639,120<br />

17. DEPOSITS FROM CUSTOMERS<br />

27,783,114 10,346,086<br />

31/12/2010<br />

VND million<br />

31/12/2009<br />

VND million<br />

Current accounts<br />

Current accounts in VND 8,437,188 8,175,620<br />

Current accounts in foreign currencies 1,661,068 1,159,661<br />

Term deposits<br />

Term deposits in VND 56,025,427 37,204,824<br />

Term deposits in foreign currencies 13,081,268 12,252,296<br />

Marginal deposits<br />

Marginal deposits in VND 704,805 1,587,693<br />

Marginal deposits in foreign currencies 640,997 1,967,306<br />

80,550,753 62,347,400<br />

This represents borrowings from the State Bank of Vietnam under repurchase agreements of the Government<br />

bonds (Note 10). These borrowings have original terms of 7 days (2009: 15 days) and bear annual interest rate of<br />

10% (2009: 8%).<br />

Deposits from customers by type of customers were as follows:<br />

31/12/2010<br />

VND million<br />

31/12/2009<br />

VND million<br />

Economic entities 18,744,743 19,543,720<br />

Individuals 61,806,010 42,803,680<br />

80,550,753 62,347,400<br />

Annual Report 2010<br />

80<br />

Annual Report 2010<br />

81

![[Corporate Logo] - Masan Group](https://img.yumpu.com/49136598/1/190x245/corporate-logo-masan-group.jpg?quality=85)

![[Corporate Logo] - Masan Group](https://img.yumpu.com/46547550/1/184x260/corporate-logo-masan-group.jpg?quality=85)

![[Corporate Logo] - Masan Group](https://img.yumpu.com/44840257/1/184x260/corporate-logo-masan-group.jpg?quality=85)