Form 6-K - Dr. Reddy's

Form 6-K - Dr. Reddy's

Form 6-K - Dr. Reddy's

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.<br />

DR. REDDY’S LABORATORIES LIMITED AND SUBSIDIARIES<br />

UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS<br />

(in thousands, except share and per share data)<br />

Explanation of transition to IFRS (continued)<br />

b. Exceptions from full retrospective application<br />

i. Derecognition of financial assets and liabilities exception: Financial assets and liabilities derecognized before January 1,<br />

2004 are not re-recognized under IFRS. No arrangements were identified that had to be assessed under this exception.<br />

ii. Hedge accounting exception: The Company has not identified any hedging relationships existing as of the Transition Date.<br />

Consequently, this exception of not reflecting in its opening IFRS statement of financial position a hedging relationship of a<br />

type that does not qualify for hedge accounting under IAS 39 is not applicable to the Company.<br />

c.<br />

iii. Estimates exception: Upon an assessment of the estimates made under Previous GAAP, the Company has concluded that<br />

there was no necessity to revise such estimates under IFRS except as a part of transition where estimates were required by<br />

IFRS and not required by Previous GAAP or where estimates made under Previous GAAP were to be revised to comply with<br />

IFRS, but such estimates reflected the conditions as at the Transition Date.<br />

iv. Assets classified as held for sale and discontinued operations: The Company has not classified any asset as held for sale<br />

and therefore this exception is not applicable.<br />

Reconciliations<br />

The accounting policies as stated above have been applied in preparing the condensed consolidated interim financial statements for<br />

the three months ended June 30, 2008, the comparative information for the three months ended June 30, 2007, the consolidated<br />

financial statements for the year ended March 31, 2008 and the preparation of an opening IFRS balance sheet at April 1, 2007. In<br />

preparing its opening IFRS balance sheet, comparative information for the three months ended June 30, 2007 and financial<br />

statements for the year ended March 31, 2008, the Company has adjusted amounts reported previously in financial statements<br />

prepared in accordance with Previous GAAP.<br />

An explanation of how the transition from Previous GAAP to IFRS has affected the Company’s financial position, financial<br />

performance and cash flows is set out in the following tables and the Notes that accompany the tables.<br />

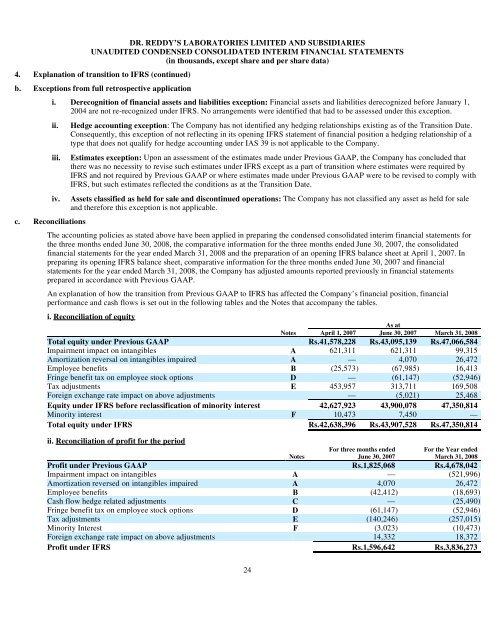

i. Reconciliation of equity<br />

As at<br />

Notes April 1, 2007 June 30, 2007 March 31, 2008<br />

Total equity under Previous GAAP Rs.41,578,228 Rs.43,095,139 Rs.47,066,584<br />

Impairment impact on intangibles A 621,311 621,311 99,315<br />

Amortization reversal on intangibles impaired A — 4,070 26,472<br />

Employee benefits B (25,573) (67,985) 16,413<br />

Fringe benefit tax on employee stock options D — (61,147) (52,946)<br />

Tax adjustments E 453,957 313,711 169,508<br />

Foreign exchange rate impact on above adjustments — (5,021) 25,468<br />

Equity under IFRS before reclassification of minority interest 42,627,923 43,900,078 47,350,814<br />

Minority interest F 10,473 7,450 —<br />

Total equity under IFRS Rs.42,638,396 Rs.43,907,528 Rs.47,350,814<br />

ii. Reconciliation of profit for the period<br />

For three months ended For the Year ended<br />

Notes June 30, 2007 March 31, 2008<br />

Profit under Previous GAAP Rs.1,825,068 Rs.4,678,042<br />

Impairment impact on intangibles A — (521,996)<br />

Amortization reversed on intangibles impaired A 4,070 26,472<br />

Employee benefits B (42,412) (18,693)<br />

Cash flow hedge related adjustments C — (25,490)<br />

Fringe benefit tax on employee stock options D (61,147) (52,946)<br />

Tax adjustments E (140,246) (257,015)<br />

Minority Interest F (3,023) (10,473)<br />

Foreign exchange rate impact on above adjustments 14,332 18,372<br />

Profit under IFRS Rs.1,596,642 Rs.3,836,273<br />

24