Form 6-K - Dr. Reddy's

Form 6-K - Dr. Reddy's

Form 6-K - Dr. Reddy's

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

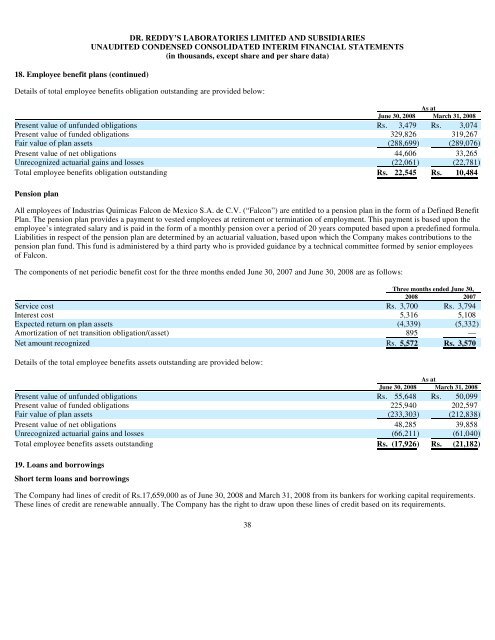

18. Employee benefit plans (continued)<br />

DR. REDDY’S LABORATORIES LIMITED AND SUBSIDIARIES<br />

UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS<br />

(in thousands, except share and per share data)<br />

Details of total employee benefits obligation outstanding are provided below:<br />

As at<br />

June 30, 2008 March 31, 2008<br />

Present value of unfunded obligations Rs. 3,479 Rs. 3,074<br />

Present value of funded obligations 329,826 319,267<br />

Fair value of plan assets (288,699) (289,076)<br />

Present value of net obligations 44,606 33,265<br />

Unrecognized actuarial gains and losses (22,061) (22,781)<br />

Total employee benefits obligation outstanding Rs. 22,545 Rs. 10,484<br />

Pension plan<br />

All employees of Industrias Quimicas Falcon de Mexico S.A. de C.V. (“Falcon”) are entitled to a pension plan in the form of a Defined Benefit<br />

Plan. The pension plan provides a payment to vested employees at retirement or termination of employment. This payment is based upon the<br />

employee’s integrated salary and is paid in the form of a monthly pension over a period of 20 years computed based upon a predefined formula.<br />

Liabilities in respect of the pension plan are determined by an actuarial valuation, based upon which the Company makes contributions to the<br />

pension plan fund. This fund is administered by a third party who is provided guidance by a technical committee formed by senior employees<br />

of Falcon.<br />

The components of net periodic benefit cost for the three months ended June 30, 2007 and June 30, 2008 are as follows:<br />

Three months ended June 30,<br />

2008 2007<br />

Service cost Rs. 3,700 Rs. 3,794<br />

Interest cost 5,316 5,108<br />

Expected return on plan assets (4,339) (5,332)<br />

Amortization of net transition obligation/(asset) 895 —<br />

Net amount recognized Rs. 5,572 Rs. 3,570<br />

Details of the total employee benefits assets outstanding are provided below:<br />

As at<br />

June 30, 2008 March 31, 2008<br />

Present value of unfunded obligations Rs. 55,648 Rs. 50,099<br />

Present value of funded obligations 225,940 202,597<br />

Fair value of plan assets (233,303) (212,838)<br />

Present value of net obligations 48,285 39,858<br />

Unrecognized actuarial gains and losses (66,211) (61,040)<br />

Total employee benefits assets outstanding Rs. (17,926) Rs. (21,182)<br />

19. Loans and borrowings<br />

Short term loans and borrowings<br />

The Company had lines of credit of Rs.17,659,000 as of June 30, 2008 and March 31, 2008 from its bankers for working capital requirements.<br />

These lines of credit are renewable annually. The Company has the right to draw upon these lines of credit based on its requirements.<br />

38