The green infrastructure valuation toolkit user guide

The green infrastructure valuation toolkit user guide

The green infrastructure valuation toolkit user guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Building natural value for sustainable economic development: <strong>The</strong> <strong>green</strong> <strong>infrastructure</strong> <strong>valuation</strong> <strong>toolkit</strong> <strong>user</strong> <strong>guide</strong><br />

that can be monetised to the costs of implementation - both initial capital and<br />

long-term maintenance. <strong>The</strong> cost benefit appraisal also describes the project<br />

benefits in non monetised terms through compiling indicative non-monetary<br />

quantitative outputs and short qualitative descriptions of applicable benefits.<br />

Comparing the PVs of the benefits from <strong>green</strong> <strong>infrastructure</strong> assets or<br />

improvements against associated capital and revenue costs and discounting on a<br />

common basis, is particularly relevant given that the benefits of <strong>green</strong><br />

<strong>infrastructure</strong> investment can be long term. For example, a canal-side<br />

improvement may create the setting for investment over a period of five to 10<br />

years. Some of the benefit groups, such as carbon storage and flood protection,<br />

may deliver benefits for periods of 50 years or longer.<br />

‘Discounting’ is based on the premise that people prefer to receive benefits in the<br />

present rather than in the future. <strong>The</strong> <strong>toolkit</strong> is designed to help its <strong>user</strong>s express<br />

the net present value* (NPV) of <strong>green</strong> <strong>infrastructure</strong> assets – that is their value<br />

in present terms, accounting for all the net benefits the assets will bring over their<br />

lifetime. In technical terms, the NPV is the sum of the present and discounted<br />

future flows of net benefits associated with a <strong>green</strong> <strong>infrastructure</strong> asset. <strong>The</strong><br />

discount rate* is used to reduce future benefits and costs to their present-time<br />

equivalent.<br />

<strong>The</strong> challenge in arguing the value for money case of any public sector<br />

investment is that usually the test is for the value of the benefits to equal at least<br />

the value of the costs. Preferably, it should exceed this by some margin, although<br />

not always, depending upon the wider case.<br />

For <strong>green</strong> <strong>infrastructure</strong> projects, however, it is generally accepted that it is not<br />

possible to monetise all their benefits. This means a compromise position is<br />

needed. <strong>The</strong> judgement made within the <strong>toolkit</strong> is that three components are<br />

required - reflecting the principle that the range of benefits resonate with different<br />

parts of the public sector.<br />

<br />

of a life, where it is perhaps not yet possible to directly relate <strong>green</strong><br />

<strong>infrastructure</strong> investment to health sector savings.<br />

Non-monetiseable - at least at this point - typically environmental and<br />

social benefits likely to result from a given <strong>green</strong> <strong>infrastructure</strong><br />

investment. In some instances those can still be expressed in<br />

quantitative terms.<br />

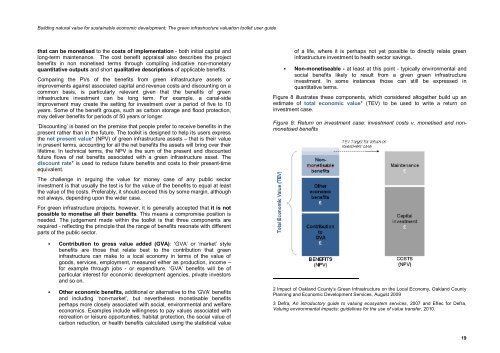

Figure 8 illustrates these components, which considered altogether build up an<br />

estimate of total economic value* (TEV) to be used to write a return on<br />

investment case.<br />

Figure 8: Return on investment case: investment costs v. monetised and nonmonetised<br />

benefits<br />

<br />

<br />

Contribution to gross value added (GVA): ‘GVA’ or ‘market’ style<br />

benefits are those that relate best to the contribution that <strong>green</strong><br />

<strong>infrastructure</strong> can make to a local economy in terms of the value of<br />

goods, services, employment, measured either as production, income –<br />

for example through jobs - or expenditure. ‘GVA’ benefits will be of<br />

particular interest for economic development agencies, private investors<br />

and so on.<br />

Other economic benefits, additional or alternative to the ‘GVA’ benefits<br />

and including ‘non-market’, but nevertheless monetisable benefits<br />

perhaps more closely associated with social, environmental and welfare<br />

economics. Examples include willingness to pay values associated with<br />

recreation or leisure opportunities, habitat protection, the social value of<br />

carbon reduction, or health benefits calculated using the statistical value<br />

2 Impact of Oakland County’s Green Infrastructure on the Local Economy, Oakland County<br />

Planning and Economic Development Services, August 2009<br />

3 Defra, An introductory <strong>guide</strong> to valuing ecosystem services, 2007 and Eftec for Defra,<br />

Valuing environmental impacts: <strong>guide</strong>lines for the use of value transfer, 2010.<br />

19