2012 City of Prince George Annual Report

2012 City of Prince George Annual Report

2012 City of Prince George Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CITY OF<br />

PRINCE GEORGE<br />

CITY OF PRINCE GEORGE <strong>2012</strong> ANNUAL MUNICIPAL REPORT<br />

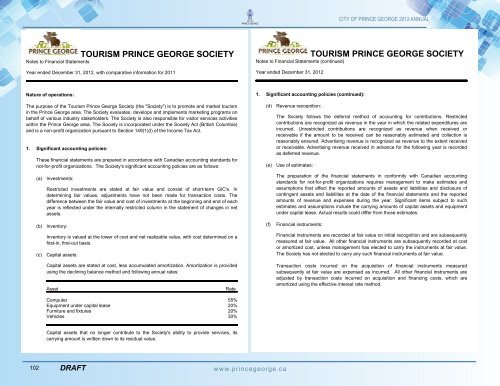

TOURISM PRINCE GEORGE SOCIETY<br />

Notes to Financial Statements<br />

Year ended December 31, <strong>2012</strong>, with comparative information for 2011<br />

TOURISM PRINCE GEORGE SOCIETY<br />

Notes to Financial Statements (continued)<br />

Year ended December 31, <strong>2012</strong><br />

Nature <strong>of</strong> operations:<br />

1. Significant accounting policies (continued):<br />

The purpose <strong>of</strong> the Tourism <strong>Prince</strong> <strong>George</strong> Society (the "Society") is to promote and market tourism<br />

in the <strong>Prince</strong> <strong>George</strong> area. The Society evaluates, develops and implements marketing programs on<br />

behalf <strong>of</strong> various industry stakeholders. The Society is also responsible for visitor services activities<br />

within the <strong>Prince</strong> <strong>George</strong> area. The Society is incorporated under the Society Act (British Columbia)<br />

and is a non-pr<strong>of</strong>it organization pursuant to Section 149(1)(l) <strong>of</strong> the Income Tax Act.<br />

1. Significant accounting policies:<br />

These financial statements are prepared in accordance with Canadian accounting standards for<br />

not-for-pr<strong>of</strong>it organizations. The Society's significant accounting policies are as follows:<br />

(d)<br />

(e)<br />

Revenue recognition:<br />

The Society follows the deferral method <strong>of</strong> accounting for contributions. Restricted<br />

contributions are recognized as revenue in the year in which the related expenditures are<br />

incurred. Unrestricted contributions are recognized as revenue when received or<br />

receivable if the amount to be received can be reasonably estimated and collection is<br />

reasonably ensured. Advertising revenue is recognized as revenue to the extent received<br />

or receivable. Advertising revenue received in advance for the following year is recorded<br />

as deferred revenue.<br />

Use <strong>of</strong> estimates:<br />

(a)<br />

Investments:<br />

Restricted investments are stated at fair value and consist <strong>of</strong> short-term GIC's. In<br />

determining fair values, adjustments have not been made for transaction costs. The<br />

difference between the fair value and cost <strong>of</strong> investments at the beginning and end <strong>of</strong> each<br />

year is reflected under the internally restricted column in the statement <strong>of</strong> changes in net<br />

assets.<br />

The preparation <strong>of</strong> the financial statements in conformity with Canadian accounting<br />

standards for not-for-pr<strong>of</strong>it organizations requires management to make estimates and<br />

assumptions that affect the reported amounts <strong>of</strong> assets and liabilities and disclosure <strong>of</strong><br />

contingent assets and liabilities at the date <strong>of</strong> the financial statements and the reported<br />

amounts <strong>of</strong> revenue and expenses during the year. Significant items subject to such<br />

estimates and assumptions include the carrying amounts <strong>of</strong> capital assets and equipment<br />

under capital lease. Actual results could differ from those estimates.<br />

(b)<br />

Inventory:<br />

(f)<br />

Financial instruments:<br />

(c)<br />

Inventory is valued at the lower <strong>of</strong> cost and net realizable value, with cost determined on a<br />

first-in, first-out basis.<br />

Capital assets:<br />

Financial instruments are recorded at fair value on initial recognition and are subsequently<br />

measured at fair value. All other financial instruments are subsequently recorded at cost<br />

or amortized cost, unless management has elected to carry the instruments at fair value.<br />

The Society has not elected to carry any such financial instruments at fair value.<br />

Capital assets are stated at cost, less accumulated amortization. Amortization is provided<br />

using the declining balance method and following annual rates:<br />

Asset<br />

Rate<br />

Transaction costs incurred on the acquisition <strong>of</strong> financial instruments measured<br />

subsequently at fair value are expensed as incurred. All other financial instruments are<br />

adjusted by transaction costs incurred on acquisition and financing costs, which are<br />

amortized using the effective interest rate method.<br />

Computer 55%<br />

Equipment under capital lease 20%<br />

Furniture and fixtures 20%<br />

Vehicles 30%<br />

Capital assets that no longer contribute to the Society's ability to provide services, its<br />

carrying amount is written down to its residual value.<br />

5<br />

102 DRAFT<br />

www.princegeorge.ca<br />

6