Automotive Insights 01.2013 - Roland Berger

Automotive Insights 01.2013 - Roland Berger

Automotive Insights 01.2013 - Roland Berger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Cover Story . Supplier Business outlook 2013+<br />

Having a certain size, however, seems to be gradually<br />

losing its function as a qualifier for supplier performance.<br />

By the middle of the last decade, suppliers generating<br />

revenues in excess of around EUR 5 billion annually<br />

stood out from the crowd, achieving better margins<br />

than average. Size obviously mattered at that time. This<br />

is no longer the case today. In 2011, no single group<br />

of suppliers of a particular size was significantly more<br />

profitable than the industry average, indicating that<br />

such criteria as region, customers and products have<br />

surpassed mere size in terms of relevance.<br />

Looking ahead: challenges for<br />

2013 – and beyond<br />

Taking a closer look at supplier CEOs' agendas these<br />

days, uncertainty regarding the development of<br />

production volumes, particularly in Europe, clearly<br />

tops the list. This issue has been the industry's key<br />

concern since last summer, and will likely prevail for<br />

most of this year, but it is by far not the only one.<br />

Most suppliers are currently facing a list of issues that<br />

is longer, more diverse and more complex than ever<br />

before in the past.<br />

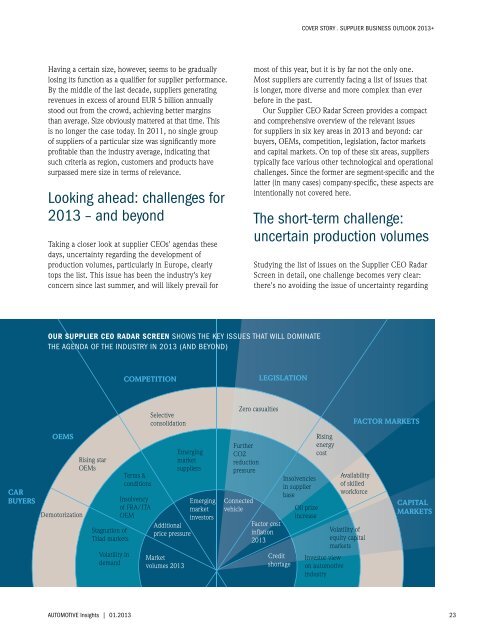

Our Supplier CEO Radar Screen provides a compact<br />

and comprehensive overview of the relevant issues<br />

for suppliers in six key areas in 2013 and beyond: car<br />

buyers, OEMs, competition, legislation, factor markets<br />

and capital markets. On top of these six areas, suppliers<br />

typically face various other technological and operational<br />

challenges. Since the former are segment-specific and the<br />

latter (in many cases) company-specific, these aspects are<br />

intentionally not covered here.<br />

The short-term challenge:<br />

uncertain production volumes<br />

Studying the list of issues on the Supplier CEO Radar<br />

Screen in detail, one challenge becomes very clear:<br />

there's no avoiding the issue of uncertainty regarding<br />

Our Supplier CEO Radar Screen shows the key issues that will dominate<br />

the agenda of the industry in 2013 (and beyond)<br />

COMPETITION<br />

LEGISLATION<br />

CAR<br />

BUYERS<br />

OEMS<br />

Demotorization<br />

Rising star<br />

OEMs<br />

Stagnation of<br />

Triad markets<br />

Volatility in<br />

demand<br />

Terms &<br />

conditions<br />

Insolvency<br />

of FRA/ITA<br />

OEM<br />

Selective<br />

consolidation<br />

Emerging<br />

market<br />

suppliers<br />

Additional<br />

price pressure<br />

Market<br />

volumes 2013<br />

Emerging<br />

market<br />

investors<br />

Connected<br />

vehicle<br />

Zero casualties<br />

Further<br />

CO2<br />

reduction<br />

pressure<br />

Factor cost<br />

inflation<br />

2013<br />

Credit<br />

shortage<br />

Insolvencies<br />

in supplier<br />

base<br />

Oil prize<br />

increase<br />

Rising<br />

energy<br />

cost<br />

FACTOR MARKETS<br />

Availability<br />

of skilled<br />

workforce<br />

Volatility of<br />

equity capital<br />

markets<br />

Investor view<br />

on automotive<br />

industry<br />

CAPITAL<br />

MARKETS<br />

<strong>Automotive</strong> <strong>Insights</strong> | <strong>01.2013</strong><br />

23