Annual Report 2007 - Publications Unit - The University of Western ...

Annual Report 2007 - Publications Unit - The University of Western ...

Annual Report 2007 - Publications Unit - The University of Western ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

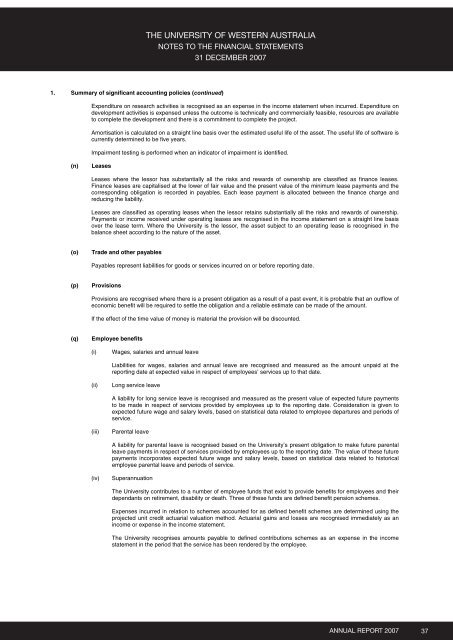

THE UNIVERSITY OF WESTERN AUSTRALIA<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER <strong>2007</strong><br />

1. Summary <strong>of</strong> significant accounting policies (continued)<br />

Expenditure on research activities is recognised as an expense in the income statement when incurred. Expenditure on<br />

development activities is expensed unless the outcome is technically and commercially feasible, resources are available<br />

to complete the development and there is a commitment to complete the project.<br />

Amortisation is calculated on a straight line basis over the estimated useful life <strong>of</strong> the asset. <strong>The</strong> useful life <strong>of</strong> s<strong>of</strong>tware is<br />

currently determined to be five years.<br />

Impairment testing is performed when an indicator <strong>of</strong> impairment is identified.<br />

(n)<br />

Leases<br />

Leases where the lessor has substantially all the risks and rewards <strong>of</strong> ownership are classified as finance leases.<br />

Finance leases are capitalised at the lower <strong>of</strong> fair value and the present value <strong>of</strong> the minimum lease payments and the<br />

corresponding obligation is recorded in payables. Each lease payment is allocated between the finance charge and<br />

reducing the liability.<br />

Leases are classified as operating leases when the lessor retains substantially all the risks and rewards <strong>of</strong> ownership.<br />

Payments or income received under operating leases are recognised in the income statement on a straight line basis<br />

over the lease term. Where the <strong>University</strong> is the lessor, the asset subject to an operating lease is recognised in the<br />

balance sheet according to the nature <strong>of</strong> the asset.<br />

(o)<br />

Trade and other payables<br />

Payables represent liabilities for goods or services incurred on or before reporting date.<br />

(p)<br />

Provisions<br />

Provisions are recognised where there is a present obligation as a result <strong>of</strong> a past event, it is probable that an outflow <strong>of</strong><br />

economic benefit will be required to settle the obligation and a reliable estimate can be made <strong>of</strong> the amount.<br />

If the effect <strong>of</strong> the time value <strong>of</strong> money is material the provision will be discounted.<br />

(q)<br />

Employee benefits<br />

(i)<br />

Wages, salaries and annual leave<br />

Liabilities for wages, salaries and annual leave are recognised and measured as the amount unpaid at the<br />

reporting date at expected value in respect <strong>of</strong> employees’ services up to that date.<br />

(ii)<br />

Long service leave<br />

A liability for long service leave is recognised and measured as the present value <strong>of</strong> expected future payments<br />

to be made in respect <strong>of</strong> services provided by employees up to the reporting date. Consideration is given to<br />

expected future wage and salary levels, based on statistical data related to employee departures and periods <strong>of</strong><br />

service.<br />

(iii)<br />

Parental leave<br />

A liability for parental leave is recognised based on the <strong>University</strong>’s present obligation to make future parental<br />

leave payments in respect <strong>of</strong> services provided by employees up to the reporting date. <strong>The</strong> value <strong>of</strong> these future<br />

payments incorporates expected future wage and salary levels, based on statistical data related to historical<br />

employee parental leave and periods <strong>of</strong> service.<br />

(iv)<br />

Superannuation<br />

<strong>The</strong> <strong>University</strong> contributes to a number <strong>of</strong> employee funds that exist to provide benefits for employees and their<br />

dependants on retirement, disability or death. Three <strong>of</strong> these funds are defined benefit pension schemes.<br />

Expenses incurred in relation to schemes accounted for as defined benefit schemes are determined using the<br />

projected unit credit actuarial valuation method. Actuarial gains and losses are recognised immediately as an<br />

income or expense in the income statement.<br />

<strong>The</strong> <strong>University</strong> recognises amounts payable to defined contributions schemes as an expense in the income<br />

statement in the period that the service has been rendered by the employee.<br />

<strong>The</strong> ANNUAL <strong>University</strong> REPORT <strong>of</strong> <strong>Western</strong> <strong>2007</strong>Australia37