Q2 2009 Report to Unitholders - English version (PDF 1.78 ... - RioCan

Q2 2009 Report to Unitholders - English version (PDF 1.78 ... - RioCan

Q2 2009 Report to Unitholders - English version (PDF 1.78 ... - RioCan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

Operational and Financial Highlights<br />

<strong>RioCan</strong> reported net earnings for the three months ended June 30, <strong>2009</strong> of $27.2 million ($0.12 per Unit) compared <strong>to</strong><br />

$44.8 million ($0.21 per Unit) for the same period in 2008. The primary difference between net earnings and funds from<br />

operations (“FFO”) is amortization expense and future income tax. FFO for the quarter ended June 30, <strong>2009</strong> is $67.9 million<br />

($0.30 per Unit) compared <strong>to</strong> $86.9 million ($0.40 per Unit) for the same period in 2008. The $19 million decrease in FFO is<br />

primarily comprised of decreased gains on properties held for resale of $17.4 million, increased interest expense of $7.0 million,<br />

increased general and administrative expenses of $1.4 million, offset, in part, by increased net operating income from rental<br />

properties of $7.1 million. General and administrative expenses in the second quarter of <strong>2009</strong> includes $1.3 million in<br />

restructuring charges with respect <strong>to</strong> the centralization of <strong>RioCan</strong>’s accounting department in Toron<strong>to</strong>. The increase in net<br />

operating income from rental properties of $7.1 million was primarily due <strong>to</strong> same property growth of 1.5%, acquisitions,<br />

completion of Greenfield Developments and intensification of existing properties.<br />

<strong>RioCan</strong> reported net earnings for the six months ended June 30, <strong>2009</strong> of $57.9 million ($0.26 per Unit) compared <strong>to</strong> $75.0 million<br />

($0.35 per Unit) for the same period in 2008. FFO for the six months ended June 30, <strong>2009</strong> was $138.5 million ($0.62 per Unit)<br />

compared <strong>to</strong> $155.2 million ($0.72 per Unit) for the same period in 2008. The $16.7 million decrease in FFO is primarily<br />

comprised of decreased gains on properties held for resale of $19.1 million, increased interest expense of $9.2 million, offset,<br />

in part, by increased net operating income from rental properties of $11.4 million. The increase in net operating income from<br />

rental properties of $11.4 million was primarily due <strong>to</strong> same property growth of 0.7%, acquisitions and completion of<br />

Greenfield Developments and intensification of existing properties. Additionally, in the first quarter of <strong>2009</strong>, <strong>RioCan</strong> received a<br />

lease cancellation fee of $11.5 million on the Queen and Portland development, which has been applied against the<br />

development cost of this property.<br />

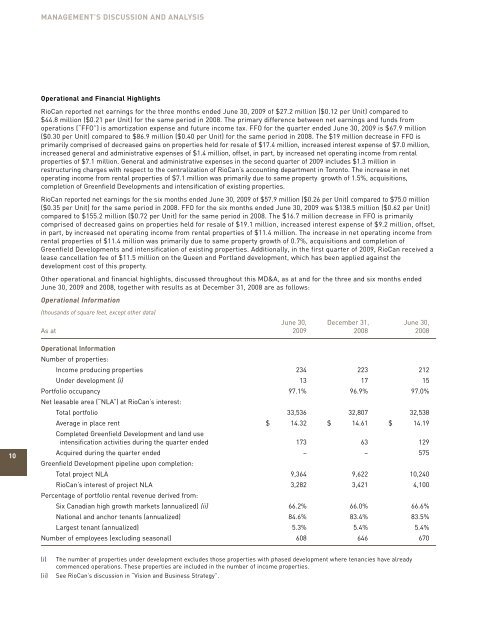

Other operational and financial highlights, discussed throughout this MD&A, as at and for the three and six months ended<br />

June 30, <strong>2009</strong> and 2008, <strong>to</strong>gether with results as at December 31, 2008 are as follows:<br />

Operational Information<br />

(thousands of square feet, except other data)<br />

June 30, December 31, June 30,<br />

As at <strong>2009</strong> 2008 2008<br />

10<br />

Operational Information<br />

Number of properties:<br />

Income producing properties 234 223 212<br />

Under development (i) 13 17 15<br />

Portfolio occupancy 97.1% 96.9% 97.0%<br />

Net leasable area (“NLA”) at <strong>RioCan</strong>’s interest:<br />

Total portfolio 33,536 32,807 32,538<br />

Average in place rent $ 14.32 $ 14.61 $ 14.19<br />

Completed Greenfield Development and land use<br />

intensification activities during the quarter ended 173 63 129<br />

Acquired during the quarter ended – – 575<br />

Greenfield Development pipeline upon completion:<br />

Total project NLA 9,364 9,622 10,240<br />

<strong>RioCan</strong>’s interest of project NLA 3,282 3,421 4,100<br />

Percentage of portfolio rental revenue derived from:<br />

Six Canadian high growth markets (annualized) (ii) 66.2% 66.0% 66.6%<br />

National and anchor tenants (annualized) 84.6% 83.4% 83.5%<br />

Largest tenant (annualized) 5.3% 5.4% 5.4%<br />

Number of employees (excluding seasonal) 608 646 670<br />

(i)<br />

(ii)<br />

The number of properties under development excludes those properties with phased development where tenancies have already<br />

commenced operations. These properties are included in the number of income properties.<br />

See <strong>RioCan</strong>’s discussion in “Vision and Business Strategy”.