Q2 2009 Report to Unitholders - English version (PDF 1.78 ... - RioCan

Q2 2009 Report to Unitholders - English version (PDF 1.78 ... - RioCan

Q2 2009 Report to Unitholders - English version (PDF 1.78 ... - RioCan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

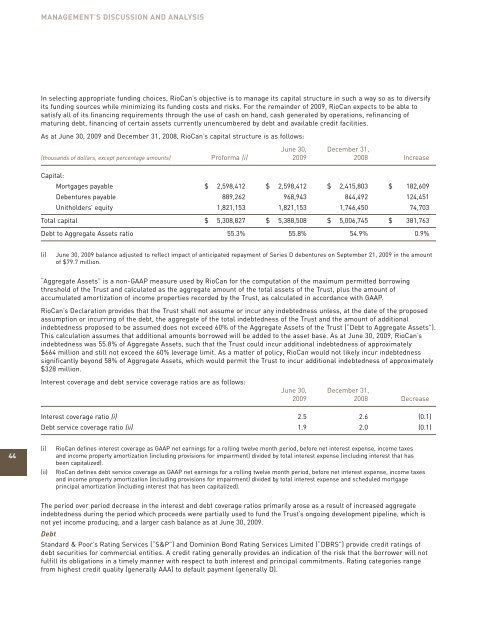

MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

In selecting appropriate funding choices, <strong>RioCan</strong>’s objective is <strong>to</strong> manage its capital structure in such a way so as <strong>to</strong> diversify<br />

its funding sources while minimizing its funding costs and risks. For the remainder of <strong>2009</strong>, <strong>RioCan</strong> expects <strong>to</strong> be able <strong>to</strong><br />

satisfy all of its financing requirements through the use of cash on hand, cash generated by operations, refinancing of<br />

maturing debt, financing of certain assets currently unencumbered by debt and available credit facilities.<br />

As at June 30, <strong>2009</strong> and December 31, 2008, <strong>RioCan</strong>’s capital structure is as follows:<br />

June 30, December 31,<br />

(thousands of dollars, except percentage amounts) Proforma (i) <strong>2009</strong> 2008 Increase<br />

Capital:<br />

Mortgages payable $ 2,598,412 $ 2,598,412 $ 2,415,803 $ 182,609<br />

Debentures payable 889,262 968,943 844,492 124,451<br />

<strong>Unitholders</strong>’ equity 1,821,153 1,821,153 1,746,450 74,703<br />

Total capital $ 5,308,827 $ 5,388,508 $ 5,006,745 $ 381,763<br />

Debt <strong>to</strong> Aggregate Assets ratio 55.3% 55.8% 54.9% 0.9%<br />

(i)<br />

June 30, <strong>2009</strong> balance adjusted <strong>to</strong> reflect impact of anticipated repayment of Series D debentures on September 21, <strong>2009</strong> in the amount<br />

of $79.7 million.<br />

“Aggregate Assets” is a non-GAAP measure used by <strong>RioCan</strong> for the computation of the maximum permitted borrowing<br />

threshold of the Trust and calculated as the aggregate amount of the <strong>to</strong>tal assets of the Trust, plus the amount of<br />

accumulated amortization of income properties recorded by the Trust, as calculated in accordance with GAAP.<br />

<strong>RioCan</strong>’s Declaration provides that the Trust shall not assume or incur any indebtedness unless, at the date of the proposed<br />

assumption or incurring of the debt, the aggregate of the <strong>to</strong>tal indebtedness of the Trust and the amount of additional<br />

indebtedness proposed <strong>to</strong> be assumed does not exceed 60% of the Aggregate Assets of the Trust (“Debt <strong>to</strong> Aggregate Assets”).<br />

This calculation assumes that additional amounts borrowed will be added <strong>to</strong> the asset base. As at June 30, <strong>2009</strong>, <strong>RioCan</strong>’s<br />

indebtedness was 55.8% of Aggregate Assets, such that the Trust could incur additional indebtedness of approximately<br />

$664 million and still not exceed the 60% leverage limit. As a matter of policy, <strong>RioCan</strong> would not likely incur indebtedness<br />

significantly beyond 58% of Aggregate Assets, which would permit the Trust <strong>to</strong> incur additional indebtedness of approximately<br />

$328 million.<br />

Interest coverage and debt service coverage ratios are as follows:<br />

June 30, December 31,<br />

<strong>2009</strong> 2008 Decrease<br />

Interest coverage ratio (i) 2.5 2.6 (0.1)<br />

Debt service coverage ratio (ii) 1.9 2.0 (0.1)<br />

44<br />

(i)<br />

(ii)<br />

<strong>RioCan</strong> defines interest coverage as GAAP net earnings for a rolling twelve month period, before net interest expense, income taxes<br />

and income property amortization (including provisions for impairment) divided by <strong>to</strong>tal interest expense (including interest that has<br />

been capitalized).<br />

<strong>RioCan</strong> defines debt service coverage as GAAP net earnings for a rolling twelve month period, before net interest expense, income taxes<br />

and income property amortization (including provisions for impairment) divided by <strong>to</strong>tal interest expense and scheduled mortgage<br />

principal amortization (including interest that has been capitalized).<br />

The period over period decrease in the interest and debt coverage ratios primarily arose as a result of increased aggregate<br />

indebtedness during the period which proceeds were partially used <strong>to</strong> fund the Trust’s ongoing development pipeline, which is<br />

not yet income producing, and a larger cash balance as at June 30, <strong>2009</strong>.<br />

Debt<br />

Standard & Poor’s Rating Services (“S&P”) and Dominion Bond Rating Services Limited (“DBRS”) provide credit ratings of<br />

debt securities for commercial entities. A credit rating generally provides an indication of the risk that the borrower will not<br />

fulfill its obligations in a timely manner with respect <strong>to</strong> both interest and principal commitments. Rating categories range<br />

from highest credit quality (generally AAA) <strong>to</strong> default payment (generally D).