April 2008 Report - Central Bank of Trinidad and Tobago

April 2008 Report - Central Bank of Trinidad and Tobago

April 2008 Report - Central Bank of Trinidad and Tobago

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CENTRAL BANK OF TRINIDAD AND TOBAGO MONETARY POLICY REPORT APRIL <strong>2008</strong><br />

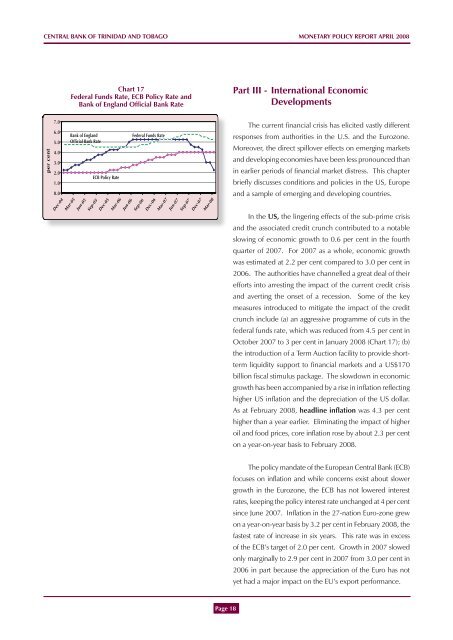

Chart 17<br />

Federal Funds Rate, ECB Policy Rate <strong>and</strong><br />

<strong>Bank</strong> <strong>of</strong> Engl<strong>and</strong> Official <strong>Bank</strong> Rate<br />

Part III - International Economic<br />

Developments<br />

The current financial crisis has elicited vastly different<br />

responses from authorities in the U.S. <strong>and</strong> the Eurozone.<br />

Moreover, the direct spillover effects on emerging markets<br />

<strong>and</strong> developing economies have been less pronounced than<br />

in earlier periods <strong>of</strong> financial market distress. This chapter<br />

briefly discusses conditions <strong>and</strong> policies in the US, Europe<br />

<strong>and</strong> a sample <strong>of</strong> emerging <strong>and</strong> developing countries.<br />

In the US, the lingering effects <strong>of</strong> the sub-prime crisis<br />

<strong>and</strong> the associated credit crunch contributed to a notable<br />

slowing <strong>of</strong> economic growth to 0.6 per cent in the fourth<br />

quarter <strong>of</strong> 2007. For 2007 as a whole, economic growth<br />

was estimated at 2.2 per cent compared to 3.0 per cent in<br />

2006. The authorities have channelled a great deal <strong>of</strong> their<br />

efforts into arresting the impact <strong>of</strong> the current credit crisis<br />

<strong>and</strong> averting the onset <strong>of</strong> a recession. Some <strong>of</strong> the key<br />

measures introduced to mitigate the impact <strong>of</strong> the credit<br />

crunch include (a) an aggressive programme <strong>of</strong> cuts in the<br />

federal funds rate, which was reduced from 4.5 per cent in<br />

October 2007 to 3 per cent in January <strong>2008</strong> (Chart 17); (b)<br />

the introduction <strong>of</strong> a Term Auction facility to provide shortterm<br />

liquidity support to financial markets <strong>and</strong> a US$170<br />

billion fiscal stimulus package. The slowdown in economic<br />

growth has been accompanied by a rise in inflation reflecting<br />

higher US inflation <strong>and</strong> the depreciation <strong>of</strong> the US dollar.<br />

As at February <strong>2008</strong>, headline inflation was 4.3 per cent<br />

higher than a year earlier. Eliminating the impact <strong>of</strong> higher<br />

oil <strong>and</strong> food prices, core inflation rose by about 2.3 per cent<br />

on a year-on-year basis to February <strong>2008</strong>.<br />

The policy m<strong>and</strong>ate <strong>of</strong> the European <strong>Central</strong> <strong>Bank</strong> (ECB)<br />

focuses on inflation <strong>and</strong> while concerns exist about slower<br />

growth in the Eurozone, the ECB has not lowered interest<br />

rates, keeping the policy interest rate unchanged at 4 per cent<br />

since June 2007. Inflation in the 27-nation Euro-zone grew<br />

on a year-on-year basis by 3.2 per cent in February <strong>2008</strong>, the<br />

fastest rate <strong>of</strong> increase in six years. This rate was in excess<br />

<strong>of</strong> the ECB’s target <strong>of</strong> 2.0 per cent. Growth in 2007 slowed<br />

only marginally to 2.9 per cent in 2007 from 3.0 per cent in<br />

2006 in part because the appreciation <strong>of</strong> the Euro has not<br />

yet had a major impact on the EU’s export performance.<br />

Page 18