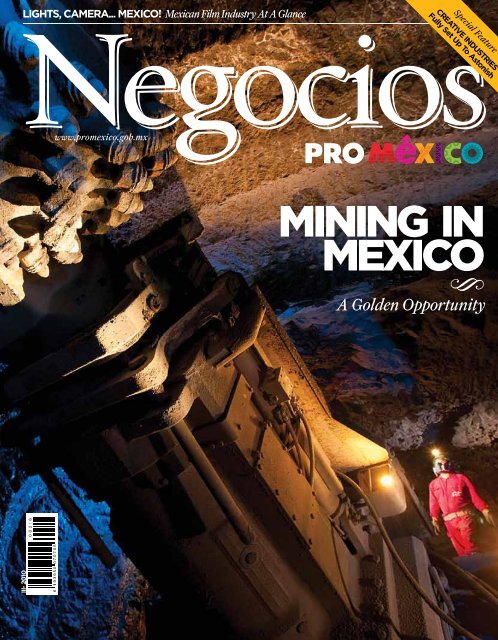

MINING IN MEXICO S - ProMéxico

MINING IN MEXICO S - ProMéxico

MINING IN MEXICO S - ProMéxico

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Special Feature<br />

Creative industries<br />

Fully Set Up To Astonish<br />

lights, camera... mexico! Mexican Film Industry At A Glance<br />

offices abroad<br />

North America<br />

Vancouver Regional Director<br />

jorge.lopez@promexico.gob.mx<br />

Offices in: Chicago, Dallas, Houston, Los<br />

Angeles, Miami, Montreal, New York,<br />

Toronto and Vancouver<br />

Chicago<br />

miguel.leaman@promexico.gob.mx<br />

Dallas<br />

diana.castaneda@promexico.gob.mx<br />

Houston<br />

carlos.marron@promexico.gob.mx<br />

Los Angeles<br />

mario.juarez@promexico.gob.mx<br />

Miami<br />

cesar.bueno@promexico.gob.mx<br />

Montreal<br />

alfonso.mojica@promexico.gob.mx<br />

New York<br />

gerardo.patino@promexico.gob.mx<br />

Toronto<br />

jose.peral@promexico.gob.mx<br />

Vancouver<br />

carlos.cacho@promexico.gob.mx<br />

Europe<br />

and Middle East<br />

Offices in: Brussels, Dubai, Frankfurt,<br />

London, Madrid, Milan, Paris and<br />

Stockholm<br />

Frankfurt<br />

jimena.ibarra@promexico.gob.mx<br />

London<br />

alexandra.haas@promexico.gob.mx<br />

Madrid<br />

ximena.caraza@promexico.gob.mx<br />

Milan<br />

claudia.esteves@promexico.gob.mx<br />

Paris<br />

dolores.beistegui@promexico.gob.mx<br />

Stockholm<br />

nicole.felix@promexico.gob.mx<br />

Asia - Pacific<br />

Offices in: Beijing, Mumbai, Seoul,<br />

Singapore, Taipei and Tokyo<br />

ProMéxico<br />

Headquarters<br />

mining in<br />

mexico<br />

+ 52 (55) 544 77070<br />

promexico@promexico.gob.mx<br />

www.promexico.gob.mx<br />

S<br />

A Golden Opportunity<br />

Seoul<br />

miguel.delvillar@promexico.gob.mx<br />

Singapore / New Markets<br />

francisco.bautista@promexico.gob.mx<br />

Taipei<br />

cesar.fragozo@promexico.gob.mx<br />

Tokyo<br />

esau.garza@promexico.gob.mx<br />

Latin America<br />

and South America<br />

Offices in: Bogotá, Guatemala, Santiago<br />

de Chile and Sao Paulo<br />

Bogotá<br />

carlos.edgar@promexico.gob.mx<br />

Guatemala<br />

ignacio.elias@promexico.gob.mx<br />

Brussels<br />

alejandro.saldivar@promexico.gob.mx<br />

Dubai<br />

jose.neif@promexico.gob.mx<br />

Beijing<br />

ari.saks@promexico.gob.mx<br />

Mumbai<br />

aldo.ruiz@promexico.gob.mx<br />

Santiago de Chile<br />

joel.enriquez@promexico.gob.mx<br />

Sao Paulo<br />

juan.pintoribeiro@promexico.gob.mx<br />

iII- 2010

offices abroad<br />

North America<br />

Vancouver Regional Director<br />

jorge.lopez@promexico.gob.mx<br />

Offices in: Chicago, Dallas, Houston, Los<br />

Angeles, Miami, Montreal, New York,<br />

Toronto and Vancouver<br />

Chicago<br />

miguel.leaman@promexico.gob.mx<br />

Dallas<br />

diana.castaneda@promexico.gob.mx<br />

ProMéxico<br />

Headquarters<br />

+ 52 (55) 544 77070<br />

promexico@promexico.gob.mx<br />

www.promexico.gob.mx<br />

Houston<br />

carlos.marron@promexico.gob.mx<br />

Los Angeles<br />

mario.juarez@promexico.gob.mx<br />

Miami<br />

cesar.bueno@promexico.gob.mx<br />

Montreal<br />

alfonso.mojica@promexico.gob.mx<br />

New York<br />

gerardo.patino@promexico.gob.mx<br />

Toronto<br />

jose.peral@promexico.gob.mx<br />

Vancouver<br />

carlos.cacho@promexico.gob.mx<br />

Europe<br />

and Middle East<br />

Offices in: Brussels, Dubai, Frankfurt,<br />

London, Madrid, Milan, Paris and<br />

Stockholm<br />

Brussels<br />

alejandro.saldivar@promexico.gob.mx<br />

Dubai<br />

jose.neif@promexico.gob.mx<br />

Frankfurt<br />

jimena.ibarra@promexico.gob.mx<br />

London<br />

alexandra.haas@promexico.gob.mx<br />

Madrid<br />

ximena.caraza@promexico.gob.mx<br />

Milan<br />

claudia.esteves@promexico.gob.mx<br />

Paris<br />

dolores.beistegui@promexico.gob.mx<br />

Stockholm<br />

nicole.felix@promexico.gob.mx<br />

Asia - Pacific<br />

Offices in: Beijing, Mumbai, Seoul,<br />

Singapore, Taipei and Tokyo<br />

Beijing<br />

ari.saks@promexico.gob.mx<br />

Mumbai<br />

aldo.ruiz@promexico.gob.mx<br />

Seoul<br />

miguel.delvillar@promexico.gob.mx<br />

Singapore / New Markets<br />

francisco.bautista@promexico.gob.mx<br />

Taipei<br />

cesar.fragozo@promexico.gob.mx<br />

Tokyo<br />

esau.garza@promexico.gob.mx<br />

Latin America<br />

and South America<br />

Offices in: Bogotá, Guatemala, Santiago<br />

de Chile and Sao Paulo<br />

Bogotá<br />

carlos.edgar@promexico.gob.mx<br />

Guatemala<br />

ignacio.elias@promexico.gob.mx<br />

Santiago de Chile<br />

joel.enriquez@promexico.gob.mx<br />

Sao Paulo<br />

juan.pintoribeiro@promexico.gob.mx

2 Negocios<br />

Contents<br />

18<br />

<strong>MEXICO</strong>, THE<br />

BEST CHOICE<br />

FOR the<br />

<strong>M<strong>IN</strong><strong>IN</strong>G</strong><br />

<strong>IN</strong>DUSTRY<br />

Mexico has a world-class<br />

mining industry with 500<br />

years of experience and it<br />

expects to attract 15 billion<br />

usd of investment in the sector<br />

between 2007 and 2012.<br />

From the CEO 6<br />

Briefs 7<br />

Mexico’s Partner inverafrut 12<br />

34<br />

Animators Take<br />

Bicentenary by<br />

storm<br />

Special Report mexico and the uk 14<br />

Business Tips mining: a strategic sector 16<br />

Special Feature Animex estudios 36<br />

Special Feature digital media 38<br />

Figures 40<br />

30<br />

Lights, Camera …<br />

Mexico!<br />

Films “made in Mexico” are not<br />

just Mexican productions, which<br />

are gradually receiving more<br />

international exposure. There<br />

is another side to the coin: the<br />

international film industry that<br />

comes to Mexico to film largescale<br />

productions.

Success is just<br />

a click away…<br />

>> Log in to Mexico<br />

www.promexico.gob.mx<br />

negocios@promexico.gob.mx<br />

+ 52 (55) 5447 70 70

4 Negocios<br />

ProMéxico<br />

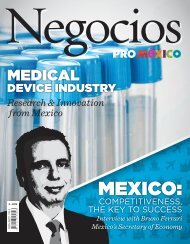

Bruno Ferrari<br />

CEO<br />

Ricardo Rojo<br />

Image and Communications Director<br />

Sebastián Escalante<br />

Managing Coordinator<br />

sebastian.escalante@promexico.gob.mx<br />

Miguel Ángel Samayoa<br />

Advertising and Suscriptions<br />

negocios@promexico.gob.mx<br />

Fernanda Luna<br />

Copy Editing<br />

taller méxico<br />

Alejandro Serratos<br />

Publisher<br />

a.serratos@tallermexico.com<br />

44<br />

Interview<br />

Lynn<br />

Fainchtein:<br />

Born Into Music<br />

The lifestyle Contents<br />

Felipe Zúñiga<br />

Editor in Chief<br />

felipe@tallermexico.com<br />

Orlando Santamaria<br />

Marketing Manager<br />

orlando@tallermexico.com<br />

Pilar Jiménez Molgado<br />

Design Director<br />

pilar@tallermexico.com<br />

Jorge Silva<br />

Design<br />

jorge@tallermexico.com<br />

Dalia Urzua Orozco<br />

Design<br />

dalia@tallermexico.com<br />

Paloma López<br />

Production<br />

paloma@tallermexico.com<br />

Vanessa Serratos<br />

Design Assistant<br />

vanessa@tallermexico.com<br />

58<br />

Destination<br />

ZACATECAS<br />

A Charming Labyrinth<br />

42 The Lifestyle Briefs<br />

48 Animation Industry<br />

La Marca del Jaguar<br />

50 Interview<br />

judith macgregor,<br />

British Ambassador to<br />

Mexico<br />

52 The Lifestyle Feature<br />

Editorial Industry:<br />

about The art of<br />

book publisHing<br />

61 Feedback<br />

The fascination<br />

for mexican<br />

handicrafts<br />

Piso de ediciones<br />

Vanesa Robles<br />

Senior Writer<br />

vanesarobles@gmail.com<br />

Karla Juárez<br />

Sandra Roblagui<br />

Lucila Valtierra<br />

Mauricio Zabalgoitia<br />

Staff Writers<br />

Translation<br />

Alejandra Díaz Alvarado<br />

Juan Manuel Romero<br />

PROOF READ<strong>IN</strong>G<br />

Graeme Stewart<br />

contributors<br />

Graeme Stewart, María Cristina Rosas,<br />

Jesús Estrada Cortés, Cristina Ávila-<br />

Zesatti, Sandra Roblagui, Francisco<br />

Vernis, Karla Barajas, Oldemar.<br />

This is an editorial project for ProMéxico<br />

by Taller México & Piso de Ediciones.<br />

ProMéxico is not responsible for inaccurate information or omissions that might exist in the information provided by the participant<br />

companies nor of their economic solvency. Title certificate of lawfulness 14459. Text certificate of lawfulness 12032. Number of Title<br />

Reserve 04-2009-012714564800-102. Postal Registry PP09-0044. Responsible editor: Sebastián Escalante. Printing: Cía. Impresora El<br />

Universal, S.A. de C.V. Distribution: ProMéxico Camino a Sta Teresa 1679, México D.F., 01900. Phone: +52 (55) 5447 7000. Negocios is an<br />

open space where diverse opinions can be expressed. The institution might or might not agree with an author’s statements; therefore the<br />

responsibility of each text falls on the writers, not on the institution, except when it states otherwise. Although this magazine verifies all<br />

the information printed on its pages, it will not accept responsibility derived from any omissions, inaccuracies or mistakes. March, 2010.<br />

Download the PDF version<br />

of Negocios ProMéxico at:<br />

negocios.promexico.gob.mx

suscribe to<br />

business anD lifestyle<br />

Discover<br />

Mexico…<br />

Get news about<br />

Mexican business<br />

environment and<br />

lifestyle delivered<br />

directly to your<br />

mailbox<br />

Contact us at:<br />

negocios@promexico.gob.mx<br />

+ 52 (55) 5447 70 70

From the CEO.<br />

Mexico’s position in the mining world should not come as a<br />

surprise. For centuries, the country has been an important<br />

player in the international arena because of its abundant<br />

mineral reserves and its potential to exploit some of the<br />

most demanded products in the market.<br />

Without a doubt, one of Mexico’s main advantages in the mining industry<br />

is its geography. The country’s rich subsoil and large mineral deposits, among<br />

many other attributes, make it one of the world’s leaders in this sector.<br />

Mexico has become one of the most attractive destinations for investments<br />

in the mining sector, not only because of its natural resources but also because<br />

of many assertive decisions.<br />

First, Mexico’s legal framework favors and protects investment. Also, its<br />

political and financial stability translate into certainty for investors and an<br />

environment that is suited for long-term business development, for example,<br />

in the area of mining activities.<br />

Second, mining is an important source of income, employments and development<br />

for Mexico, and this is reflected in solid public policies that, based on<br />

reliable and avant-garde systems, offer mining companies all the information<br />

they need to make decisions and develop business plans.<br />

The world’s leading mining companies are aware of the Mexican mining<br />

industry’s infinite potential, and they are leveraging all the advantages that<br />

Mexico offers to explore, extract and use its mineral resources.<br />

In this issue of Negocios we paint a picture of Mexico’s mining industry and<br />

we discuss why Mexico has become one of the key players in the future of the<br />

world’s mining sector.<br />

Welcome to Mexico!<br />

Bruno Ferrari<br />

ProMéxico CEO

iefs.<br />

Photo courtesy of bp<br />

RENEWABLE ENERGY<br />

Luminous<br />

Alliance<br />

BP Solar has entered into an agreement with<br />

Jabil Circuit to assemble BP Solar modules for<br />

the North American market in Jabil’s plant<br />

in Chihuahua, Mexico, as the company banks<br />

on increased solar demand in North America<br />

and Europe. The agreement calls for an initial<br />

capacity of 45 MW with the opportunity for<br />

expansion as demand increases. Production<br />

will begin in the second quarter.<br />

The plans expand BP Solar’s efforts to<br />

cut costs for its solar power panels and<br />

the manufacturing deal that the solar<br />

player struck with Jabil in October 2009,<br />

to manufacture BP Solar modules in Poland<br />

for the European market.<br />

www.bp.com / www.jabil.com<br />

AUTOMOTIVE<br />

Chrysler Fits<br />

Its Engines<br />

Mexico will play a key role in the renovation<br />

of Chrysler. After the carmaker emerged<br />

from government-backed bankruptcy in<br />

2009, it formed a global strategic alliance<br />

with Italy’s Fiat Group and now the partners<br />

are investing 550 million usd in Mexico<br />

to produce a retro-version of an Italian icon,<br />

the Fiat 500.<br />

The vehicles would be produced at Toluca,<br />

one of five Chrysler plants in Mexico,<br />

and would start distribution at year-end.<br />

Toluca’s plant could produce up to<br />

130,000 Fiat 500s a year, with 95% slated<br />

for export to the US and Latin America.<br />

The investment would generate 400 direct<br />

jobs and more than 1,200 indirect ones.<br />

The automotive industry represents<br />

20% of Mexico’s manufacturing GDP and<br />

more than 70% of its exports go to the US.<br />

www.chryslergroupllc.com / www.fiat.com<br />

Photo archive<br />

RETAIL<strong>IN</strong>G<br />

Strategic<br />

Move<br />

As it looks for new markets to boost revenues,<br />

Lowe’s Cos. Inc., the world’s second-largest<br />

home improvement retailer,<br />

opened its first two stores in Mexico, in<br />

the city of Monterrey, Nuevo León. The<br />

company has invested approximately 18<br />

million to 20 million usd in each store<br />

and about 430 associates have been<br />

hired to operate both stores along with<br />

the company’s offices in Monterrey.<br />

The store openings in Mexico continue<br />

Lowe’s long-term International growth<br />

strategy.<br />

www.lowes.com

8 Negocios Photo courtesy of nissan / goldcorp / archive<br />

AUTOMOTIVE<br />

Modeling<br />

The Future<br />

Nissan Motors opened a design center in<br />

Mexicali, Baja California. The carmaker is<br />

likely to spend close to 10 million usd over the<br />

next 10 years on its Baja California facility.<br />

Mexico has been a target for growth<br />

for the Japanese carmaker ever since it<br />

entered the country in 1961, as it seeks to<br />

benefit from its proximity to the US market<br />

and its strong trade ties with high demand<br />

potential neighbors in the south.<br />

Nissan’s Automotive Modeling Center<br />

in Mexicali is expected to help San Diegobased<br />

Nissan Design America –one of the<br />

carmaker’s three other global design centers–<br />

to develop models keeping Mexican<br />

and South American tastes in mind.<br />

www.nissan-global.com<br />

<strong>M<strong>IN</strong><strong>IN</strong>G</strong><br />

Meet Opportunity<br />

Mexico will participate at the 2010 PDAC<br />

International Convention, Trade Show & Investor<br />

Exchange, to be held in Toronto from<br />

March 7 to 10, 2010. The country will offer<br />

information regarding mining opportunities,<br />

as well as other strategic subjects for investors,<br />

such as Mexican legal framework, mining potential<br />

areas and tax incentives. PDAC is the<br />

world’s leading convention and trade show<br />

for the mineral exploration industry, jointly<br />

organized by the Prospectors and Developers<br />

Association of Canada (PDAC) and the Canadian<br />

Association of Mining Equipment and<br />

Services for Export (CAMESE).<br />

www.pdac.ca<br />

TELECOMMUNICATIONS<br />

Stays On Top<br />

SERVICES<br />

Right On Time<br />

The parcel delivery company Estafeta will<br />

increase its investment in Mexico by 66%, going<br />

from 15 million to 25 million usd in 2010.<br />

With this investment a 6% growth in sales is<br />

expected, a figure higher than that recorded<br />

in 2009, which was 2%. Of the total invest-<br />

America Móvil, Latin America’s biggest mobile<br />

operator, could invest between 3 billion<br />

and 3.5 billion usd in its operations in the<br />

Americas during 2010. The company operates<br />

in 18 countries in the region and reported<br />

201 million wireless subscribers at the end<br />

of 2009. Mexico is its largest market, where its<br />

Telcel unit had a 72% market share at the end<br />

of the third quarter of 2009, with 58.4 million<br />

subscribers. Around 850 million usd will be invested<br />

in Mexico.<br />

www.americamovil.com<br />

ment, 13 million usd will be allocated to the<br />

renewal and growth of the company’s vehicle<br />

fleet, 4 million will be used to increase<br />

infrastructure and 8 million will be invested<br />

in technology development to reduce customer<br />

service and package delivery times.<br />

www.estafeta.com.mx

iefs.<br />

<strong>M<strong>IN</strong><strong>IN</strong>G</strong><br />

The Giant<br />

Can Still<br />

Grow<br />

Bigger<br />

Grupo México, Mexico’s largest mining company,<br />

has purchased the oil-drilling company<br />

Compañía Perforadora de México (Pemsa)<br />

for 240 million usd, to increase its stake in<br />

the infrastructure development industry.<br />

Pemsa, which posted a revenue of 91<br />

million usd in 2009, has worked with Mexican<br />

state-owned oil company Pemex for 49<br />

years. It offers drilling services for onshore<br />

and offshore facilities.<br />

www.grupomexico.com<br />

Photo C-Riouz, panoramio<br />

CHEMICAL <strong>IN</strong>DUSTRY<br />

Praxair Has<br />

Plans For<br />

Mexico<br />

US industrial gases producer Praxair Inc. will<br />

invest 150 million usd in Mexico this year. The<br />

investment will be made at plants in the central<br />

Mexican towns of Ciudad Sahagún and Tepeji<br />

del Río, among others.<br />

To date, Praxair has 300 Mexican production<br />

and service facilities constructed over<br />

the last 40 years. Among its many Mexican<br />

operations, it supplies nitrogen to state-owned<br />

oil company Petróleos Mexicanos (Pemex), to<br />

increase petroleum recovery.<br />

The US based firm, the largest industrial<br />

gases company in the Americas, invested 350<br />

million usd in Mexico during 2008-2009.<br />

www.praxair.com<br />

IT<br />

Profitable<br />

Partnership<br />

Mexican IT consultancy North American<br />

Software (Nasoft) will receive an 8 million<br />

usd International Finance Corporation<br />

(IFC) investment to expand operations into<br />

new and existing Latin American markets.<br />

The IFC, a member of the World Bank<br />

Group, will receive an 18% stake in the privately<br />

held information technology firm in<br />

exchange for its investment. Nasoft is putting<br />

up another 4 million usd for its expansion,<br />

for a total investment of 12 million usd.<br />

Nasoft was founded in 2000 as a private<br />

Mexican enterprise, providing business applications<br />

consulting services in Mexico,<br />

Central America and the US. Nasoft primarily<br />

serves large domestic and international<br />

private sector companies and progressively<br />

a growing number of SMEs. The company is<br />

a top business partner of leading enterprise<br />

software application vendors.<br />

www.nasoft.com

10 Negocios Photos courtesy of eurocopter / archive<br />

RENEWABLE ENERGY<br />

Powerful<br />

Wind<br />

The Spanish company Renovalia Energy<br />

will build a wind farm in Oaxaca, southern<br />

Mexico, that will have 114 wind turbines<br />

with 228 megawatts of installed capacity<br />

and will be the second largest wind farm<br />

in Mexico.<br />

This latest wind project came to fruition<br />

after a contract of collaboration between<br />

Renovalia Energy International, Desarrollos<br />

Eólicos Mexicanos and Gesa México, the Mex-<br />

ican subsidiary of the Spanish Gamesa Wind.<br />

The Piedra Larga wind farm will cost<br />

300 million euros (about 410 million usd)<br />

and, according to company estimates, it will<br />

produce 841 gigawatt hours (GW/h) of electricity<br />

annually.<br />

The electricity produced will supply 14<br />

plants of Grupo Bimbo, one of the largest<br />

baking companies in the world, for a period<br />

of 15 years.<br />

The annual production of the 228 MW<br />

wind farm will replace 49,020 tons of oil<br />

equivalent (TOE) per year and prevent the<br />

emission into the atmosphere of 342,000 tons<br />

of CO2 per year.<br />

www.renovaliaenergy.es<br />

AEROSPACE<br />

An Ambitious Outlook<br />

French helicopter producer Eurocopter expects<br />

sales in Mexico and the surrounding region<br />

to rise 10% in 2010 from 305 million usd<br />

in 2009. The company, which sells helicopters<br />

to civilians as well as governments and their<br />

militaries, has risen in recent years to become<br />

the market leader in the region, claiming a<br />

57% share in 2009, up from 34% in 2004.<br />

The sales outlook applies to Mexico, Central<br />

America and the Caribbean, in addition<br />

to Venezuela, Colombia and Ecuador. The<br />

company delivered 24 helicopters last year to<br />

those countries.<br />

In addition Eurocopter, a subsidiary of Airbus<br />

parent European Aeronautic Defence &<br />

Space, is developing a long-term program to<br />

eventually assemble complete helicopters in<br />

Mexico, where it currently has a service facility<br />

in its hangar at Benito Juárez International<br />

Airport in Mexico City.<br />

www.eurocopter.com<br />

AUTOMOTIVE<br />

Fast & Safe<br />

According to figures<br />

from the Mexican<br />

Automotive Industry<br />

Association (AMIA, by<br />

its Spanish acronym),<br />

car production in<br />

Mexico rose 102.4%<br />

and exports soared<br />

123.6% in January<br />

2010. In that month,<br />

Mexico produced<br />

165,058 vehicles and<br />

114,193 units were<br />

exported, mainly to<br />

the US.<br />

During 2009,<br />

Mexico assembled<br />

1.56 million units and<br />

placed itself within the<br />

“top ten” producers in<br />

the world.<br />

www.amia.com.mx

iefs.<br />

FOOD<br />

Mexico’s<br />

Flavors in<br />

Russia<br />

Mexican flavors will soon invade Russia as<br />

the Russian Federal Supervision Service has<br />

approved 28 Mexican food companies to export<br />

products to that country. Russia has announced<br />

its interest to buy Mexican products<br />

such as shrimp, cereals, grains and poultry, as<br />

well as increasing its current purchase of Mexican<br />

beef and horse meat.<br />

www.sagarpa.gob.mx<br />

Photo bodaestilo<br />

MANUFACTUR<strong>IN</strong>G<br />

Building<br />

A Clean<br />

Emporium<br />

Photo icis<br />

CHEMICAL <strong>IN</strong>DUSTRY<br />

Chemistry For Business<br />

<strong>IN</strong>EOS Group has agreed terms for the<br />

sale of its fluorochemicals business to Mexichem,<br />

leading Latin American producer of<br />

PVC pipes and resin, chloralkali, hydrofluoric<br />

acid and fluorspar. The deal comprises<br />

the international business and assets related<br />

to <strong>IN</strong>EOS’ fluorochemical operations<br />

located in North America, Europe, and<br />

Asia. It is expected that on completion of the<br />

transaction, programmed for the end of March<br />

2010, the business will become an integrated,<br />

global producer of specialty fluorochemicals<br />

with worldwide presence and an annual sale<br />

revenue of over 500 million usd.<br />

www.mexichem.com.mx / www.ineos.com<br />

Denmark-based professional cleaning equipment<br />

company Nilfisk-Advance invested<br />

10 million usd in a new plant in Querétaro,<br />

Mexico, where the company estimates it will<br />

employ 200 people for the assembling of professional<br />

industrial cleaning equipment.<br />

The move is in line with the company’s<br />

global growth strategy and is designed to provide<br />

logistical and cost advantages. For over<br />

40 years, Nilfisk-Advance has distributed its<br />

products in Mexico through authorized dealers.<br />

In 2006 the firm, one of the world’s leading<br />

manufacturers of professional cleaning<br />

equipment, established its own sales company<br />

in Mexico City and followed up with sales<br />

companies in Argentina and Chile in 2008.<br />

The new plant will work as the company’s<br />

“springboard” to all of Latin America.<br />

www.nilfisk.com

12 Negocios Photos archive<br />

Juicy Business<br />

Inverafrut began as a consulting firm for businesses engaged in fruit marketing. Today it exports Mexican<br />

tropical fruits to different countries in the Americas, Europe and Asia. Its secret: forming alliances with<br />

strategic partners and a strict commitment to quality.<br />

Two young entrepreneurs are mainly responsible<br />

for 1,500 tons of tropical fruit leaving<br />

Veracruz every year for countries abroad and<br />

for putting a citrus touch to many dishes in the<br />

US and Europe. Adriana Melchor Muñoz and<br />

Luis Omar Urrutia Núñez began their business<br />

cautiously in the tropical fruit sphere<br />

but today they export to the US, Germany,<br />

France, England, Spain, Switzerland and<br />

sometimes Japan, among other countries.<br />

The international market is the prime objective<br />

of Integradora Veracruzana de Frutas<br />

Tropicales (Inverafrut), whose star product<br />

is the Persian lime which, according to these<br />

entrepreneurs, has the best quality. They<br />

are not mistaken. It has been shown that the<br />

Persian lime produced on Mexican soil surpasses<br />

the quality of that cultivated in other<br />

countries, such as Brazil, for example.<br />

Inverafrut was born in 2004 from the association<br />

between the two entrepreneurs,<br />

who began with a consultancy business<br />

for companies in the sphere of fruit growing.<br />

Once they had decided to expand their<br />

company’s activities, they began to pack<br />

and export pineapple, papaya, watermelon<br />

and mango. For five years they maintained<br />

their operations with these products and, in<br />

parallel, provided advisory services to their<br />

colleagues.

mexico’s partner inverafrut<br />

“With the advisory services we provided, we<br />

gradually built up our assets and rented premises.<br />

Before, we took a truck and machinery<br />

and everything was packed right there in the<br />

fields. Afterwards we rented a packing plant in<br />

Isla, in the south of Veracruz,” recalls Luis Omar<br />

Urrutia Núñez, Administrative Director of Inverafrut.<br />

Today the company has major growth<br />

plans, among them the inauguration of a new<br />

processing plant in March 2010, with an investment<br />

of around 450,000 usd. Currently<br />

Inverafrut’s corporate offices are in Jalapa,<br />

Veracruz. The group has two packing plants<br />

in the same state and a commercial office in<br />

Paris, France, from where the fruit sent to<br />

Europe is distributed.<br />

In their new plant they hope to consolidate<br />

a processing project with stainless steel machinery,<br />

to extract and market fruit pulp. This<br />

will enable them to increase their exports of<br />

fruits such as mango, which today face significant<br />

health restrictions. Inverafrut estimates<br />

that once it starts operations in its new processing<br />

plant, it will have the capacity to export<br />

5,000 tons of mango a year.<br />

Strategic alliances<br />

Although since 2004, when they founded the<br />

company, they have worked with tropical fruits<br />

such as mango, watermelon and pineapple,<br />

this year they are betting on Persian lime.<br />

There are many advantages, Urrutia<br />

Núñez points out. Persian lime can be harvested<br />

throughout the year and the product’s<br />

quality has no competition abroad. In<br />

addition to the star product, they will begin<br />

to strengthen the grapefruit harvest, once<br />

they decide on some strategic alliances.<br />

The forming of alliances is a strategy that<br />

has worked for them, as Luis Omar Urrutia<br />

says, since it has made it possible for them to<br />

become consolidated and above all, to have<br />

no fear of doing business.<br />

At first, as Urrutia states, exports of Inverafrut<br />

products were very complicated. It<br />

took them a long time to select the fruit, wax<br />

it, wash it, label it and pack it. There was also<br />

the traveling time to be considered.<br />

The partners traveled to rural communities,<br />

many of which lacked electric power or<br />

were in an area with extreme weather, for<br />

example. Sometimes, the entrepreneurs relate,<br />

they had to pack the fruit by candlelight<br />

or with hand-held lamps.<br />

As in this process time is a key factor, they<br />

had to face serious consequences such as the<br />

The international market<br />

is the prime objective of<br />

Integradora Veracruzana<br />

de Frutas Tropicales<br />

(Inverafrut), whose star<br />

product is the Persian<br />

lime which, according to<br />

these entrepreneurs, has<br />

the best quality.<br />

shipment arriving in a bad state, with the<br />

subsequent financial losses. This made them<br />

realize that the company they had formed<br />

needed reinforcements, so they requested<br />

information and support from different<br />

agencies. The idea was to have their own<br />

premises, with the registration of a brand,<br />

a fruit-processing machine to manufacture<br />

juices and do the packing and shipping<br />

themselves.<br />

With its new plans to industrially process<br />

the fruit, Inverafrut is planning important<br />

alliances with suppliers of large companies<br />

such as Jugos del Valle, for example.<br />

“Associating ourselves abroad has been<br />

one of our successes,” states Urrutia. But<br />

these alliances have not been the product of<br />

chance. Inverafrut has reached high quality<br />

standards that have allowed it to penetrate<br />

the most demanding markets. The company’s<br />

products are offered packed, classified,<br />

insured and represented by the Inverafrut<br />

brand. In its slogan, the company states: “It’s<br />

fruit, it’s flavor, it’s Mexico.”<br />

Its plants have special health measures<br />

to guarantee agrofood quality, from picking<br />

in the field to packaging. Furthermore, the<br />

company has pre-cooling chambers and special<br />

cold storage chambers for the conservation<br />

of the fruits, as well as systems to ensure<br />

water health, such as a water treatment<br />

plant and a wastewater treatment plant.<br />

They abide by food safety standards, international<br />

rules, and are currently working on<br />

the global certification of their products. n<br />

www.inverafrut.com

14 Negocios i The Lifestyle<br />

Photos Courtesy of The British Embassy in Mexico<br />

UK is in the Mood for Trading<br />

BY GRAEME STEWART<br />

Like two shy teenagers whose eyes meet across<br />

a crowded ballroom, Mexico and Great Britain<br />

had been coyly skirting around the dance floor<br />

of greater economic co-operation for years. The<br />

interest between the couple was obvious but something<br />

had to be done to bring them together.<br />

Then, in 2009, President Felipe Calderón<br />

was invited on a State Visit to London that<br />

would act as an ice breaker in the hopes that<br />

the British Lion and the Mexican Eagle would<br />

soon be tripping the light fantastic to the tune<br />

of increased bilateral trade.<br />

The State Visit was a great success with<br />

both families, the Calderons and Britain’s Royals,<br />

getting on famously, so much so that Prince<br />

Andrew, the Duke of York, who also happens<br />

to be the British special envoy for trade, was<br />

invited to Mexico in February 2010. Using his<br />

undeniable charm, the third child of Queen<br />

Elizabeth II and Prince Philip flirted with and<br />

wooed the Mexican business community with<br />

tales of improved economic prosperity for both<br />

countries through greater trade and investment.<br />

At long last, the dance had begun. True, its<br />

pace is more that of a sedate waltz than a hot<br />

blooded tango but the tempo will increase later<br />

this year with the visit to Mexico of Boris Johnson,<br />

Lord Mayor of London, who, like a loving<br />

uncle, will press the marriage of the blushing<br />

couple, for richer or even richer.<br />

In this article, Judith Macgregor, Great<br />

Britain’s ambassador to Mexico, gives her take<br />

on the proposed increase in trade and investment<br />

between the two countries.<br />

There was great excitement at the British Embassy<br />

in Mexico City’s Cuauhtémoc district as<br />

Prince Andrew, the UK’s special representative<br />

for international commerce and investment,<br />

was due to arrive at any minute.<br />

But Judith Macgregor, Great Britain’s ambassador<br />

to Mexico, took time out to discuss<br />

her country’s hopes of greater trade between<br />

the two countries.<br />

Slipping her tall, elegant frame on to a<br />

comfortable seat, she said: “I suppose that both<br />

Britain and Mexico have rather ignored each<br />

other in terms of bilateral trade. Certainly,<br />

the figures of trade and investment could and<br />

probably should be much higher. That is something<br />

we intend to remedy.”<br />

“It wasn’t always like this,” she asserted. “In<br />

the 19th Century British miners and engineers<br />

came to Mexico in their droves, bringing their<br />

expertise for the benefit of the relatively new<br />

nation of Mexico. Then, in the 20th Century,<br />

the US superceded all other countries in trade<br />

and investment with Mexico. But now UK<br />

Trade and Investment has launched an aggressive<br />

push for greater economic co-operation<br />

between the two countries. In fact, it has been<br />

a priority for us for the past two years but it is<br />

now being handled much more forcefully.”<br />

“It really took off last year when President<br />

Felipe Calderón was invited on a State visit to<br />

Britain. Prince Andrew accompanied him on<br />

a visit to Aberdeen to view the UK’s oil capital<br />

and the two seemed to hit it off well, so it was<br />

natural that the Prince, as the UK’s special<br />

representative for commerce and internatio-

special report mexico and the uk<br />

nal investment, should reciprocate by visiting<br />

Mexico to fan the flames of interest among the<br />

Mexican Business community,” she explained.<br />

“Of course, there has always been some<br />

trade link between the two countries and both<br />

Shell and BP work closely with Pemex on oil<br />

and gas exploration and drilling. But now we<br />

are launching two programmes, one in Britain<br />

and one in Mexico, that will promote bilateral<br />

trade between the two countries. Here in Mexico<br />

it will be called Think Britain and in the UK<br />

it will be known as Mexico Matters. We have a<br />

lot to offer each other. We will be pushing for<br />

more trade in many sectors but mainly in engineering,<br />

education, manufacturing and new<br />

technologies.”<br />

“I don’t believe that British business and<br />

industry has fully grasped the advantages of<br />

investing in Mexico. Here we have a skilled,<br />

inexpensive, hard working labor force on the<br />

doorstep of the US. British business should<br />

take advantage of this, particularly through<br />

Mexico’s participation in the North American<br />

Free Trade Association market.”<br />

“Likewise, Mexican Business can take advantage<br />

of Britain’s membership of the EU and<br />

exploit that foothold into the vast European<br />

market, not to mention our extremely good trade<br />

links with India and China. So there are advantages<br />

to be gained by both sides in opening<br />

up new markets to each other.”<br />

“There are also opportunities for British<br />

energy companies as Mexico continues to<br />

expand its oil, gas and electricity production<br />

as well as in the creative industries like information<br />

technology and education. I know that<br />

British universities are very keen to have close<br />

links with their Mexican counterparts, including<br />

the trading of students.”<br />

“So, there is a lot of interest in Mexico in the<br />

UK and, we hope, vice versa. As I said, we have<br />

a lot to offer each other.”<br />

The Ambassador’s opinions were echoed by<br />

Prince Andrew as he addressed the Mexican<br />

business community at the Club de Industriales.<br />

He said: “Both our countries have an interest<br />

in expanding and diversifying our economies<br />

to create a sustainable recovery from<br />

the economic downturn. Our economic cooperation,<br />

especially in trade and investment,<br />

has to be major. Even although trade bewteen<br />

Mexico and Britain has doubled since 2000,<br />

Brazil exports twice as much to the UK than<br />

Mexico and British exports to Mexico represnt<br />

only 0.8%. I believe that Mexico is a market that<br />

Britain should not be shying away from. Rather,<br />

we should be embracing it.” n<br />

Think Britain,<br />

Live Mexico<br />

Mexico is an international partner of<br />

great importance to the UK and will<br />

be one of the biggest economies in<br />

the world during the next 50 years,<br />

overtaking the UK on the way. It is a key<br />

market for trade and investment, now<br />

and in the future.<br />

UK and Mexico share similar values<br />

–democracy, open politics, free trade,<br />

respect for the law and human rights<br />

and a disposition to act on the main<br />

challenges of the 21st Century, such<br />

as climate change and the promotion<br />

of a global economy with sustainable<br />

growth.<br />

Both countries are very active in the<br />

multilateral forums G20, G8 plus 5,<br />

the UN Council for Human Rights, the<br />

International Atomic Energy Agency,<br />

the World Organization of Trade, the<br />

Organization for Co-operation and<br />

Economic Development and now the UN<br />

Security Council.<br />

2010 is the Bicentenary of Mexican<br />

Independence. Throughout the year, the<br />

British Embassy in Mexico, UK Trade<br />

and Investment and the British Council<br />

in Mexico along with other partners like<br />

Visit Britain, UK-Mexico Chamber of<br />

Commerce and ProMéxico decided to<br />

use the opportunity to launch the Think<br />

Britain programme in Mexico. There<br />

will be a parallel campaign in Britain<br />

called Mexico Matters.<br />

A series of activities designed to lift<br />

the profile of Mexico in the UK, and the<br />

UK in Mexico, will be organised with<br />

the objective of raising co-operation<br />

and understanding between the two<br />

countries in the areas of economics,<br />

culture and politics.<br />

Through the British Embassy and<br />

the British Council, the UK supports<br />

projects worth millions of Pounds<br />

Sterling in Mexico each year in areas<br />

like the creative industries, education,<br />

sustainable development, human rights,<br />

climate change and economic reform.<br />

That co-operation has shown the<br />

importance of the two countries<br />

working together. The main activities<br />

for 2010 include:<br />

• British Week from 24 to 28 May.<br />

• A visit to Mexico by the Lord<br />

Mayor of London, Boris Johnson<br />

in October.

16 Negocios i The Lifestyle<br />

illustration oldemar<br />

Mining: A Strategic Sector For<br />

Mexico And The World<br />

By MARÍA CRIST<strong>IN</strong>A ROSAS *<br />

Mining is a strategic sector for the Mexican economy and is one of the<br />

country’s assets when it comes to attracting foreign direct investment.<br />

Despite the international financial crisis, in 2009 Mexico remained as one of<br />

the most attractive and safe destinations for mining companies worldwide,<br />

reason why investors are taking increasing interest on Mexican mines.<br />

Current economic dynamics would be<br />

hard to understand without mining. Although<br />

some insist that modern economies<br />

derive a large proportion of their<br />

revenue and prosperity from the service<br />

sector, primary sector activities form the<br />

economy’s real bedrock. Without exaggerating,<br />

the World Bank confirms that the<br />

most significant progress toward satisfying<br />

human needs –including food, accommodation,<br />

health, education, employment<br />

and transport– relies on the increasingly<br />

efficient use of mineral resources. Furthermore,<br />

some studies suggest that activities<br />

such as manufacturing, construction<br />

and even agriculture, could not exist<br />

without mineral production.<br />

Mining plays a leading social-economic<br />

role in Mexico. At its various stages –from<br />

exploration to production– it generates a<br />

significant number of jobs and income for<br />

the country. In 2009, it accounted for 3.6%<br />

of Mexico’s GDP (mining expanded), 4% of<br />

Mexican exports and 270,000 direct jobs.<br />

Due to the rising demand for minerals<br />

by the world’s largest and most rapidlygrowing<br />

economies, mining is becoming<br />

increasingly important. China, for example,<br />

has increased its mineral consumption<br />

to support its dizzying economic<br />

growth, contributing to the growth in global<br />

prices for various minerals. African and<br />

Latin American countries are among its<br />

providers. The African continent is seen<br />

as a gigantic deposit of mineral resources –<br />

with everything from oil to coltan– and the<br />

world’s largest economies are ever more interested<br />

in that part of the world. But when<br />

it comes to mining, Mexico has a number of<br />

advantages, even over African countries.<br />

Mexico offers a solid and less risky alternative<br />

for mining production. Several African<br />

countries suffer from armed conflict, endemic<br />

diseases, poor infrastructure and lack<br />

of governmental transparency, which exponentially<br />

increases the operating costs for<br />

foreign investment despite the abundance of<br />

mineral resources.<br />

Mexico possesses significant mineral deposits<br />

that are widely sought after around<br />

the world. The country is among the twelve<br />

largest producers of 17 minerals. It is the<br />

world’s second largest producer of silver, bismuth<br />

and fluorite; the third of celestite; the<br />

fourth of wollastonite and diatomite; the fifth<br />

of lead; the sixth of cadmium and molybdenum;<br />

the seventh of zinc, salt and graphite;<br />

the eighth of manganese and baryte and the<br />

twelfth of feldspar, gold and copper.<br />

Investors are taking increasing interest<br />

in Mexican mines given their reserves of<br />

strategic minerals, some of which are key to<br />

industries such as aerospace, military and<br />

electronics.<br />

This all explains how, despite the international<br />

financial crisis, Mexico remained one<br />

of the world’s top investment destinations<br />

in 2009. In terms of mining exploration, it<br />

ranked as the top investment destination in<br />

Latin America and fourth in the world.<br />

Mexican legislation encourages investments<br />

in the sector. The 1993 Mining Law<br />

(Ley Minera) replaced the 1961 legislation<br />

and opened up new areas to foreign investment<br />

previously limited to Mexican financing.<br />

It also removed the requirement for foreign<br />

capital investments to be associated with<br />

Mexican capital in a proportion of 49-51 per<br />

cent respectively. The Foreign Investment<br />

Law further liberalized the mining industry<br />

in a process consolidated by NAFTA and the<br />

removal of several investment requirements<br />

–for production work only to use Mexican<br />

supplies, for training and technology transfer<br />

or for nationality requirements imposed on<br />

the majority of members sitting on boards of<br />

directors– as well as tariff reduction on foreign<br />

trade and the import of equipment and<br />

machinery. That opened up unprecedented<br />

opportunities for private foreign investors<br />

interested in the mining sector. The new legislation<br />

heralded another important change:<br />

the duration of concessions, which are<br />

awarded for 50 years and may be extended.<br />

The Mexican mining sector is a highly<br />

attractive investment. It is far quicker for<br />

a company to obtain an operating license<br />

in Mexico than in other countries. The US<br />

company Hecla referred to the “comparative<br />

advantages” offered by Mexico in relation<br />

to its other commercial partners, confirming<br />

that it had taken only eight months to be<br />

granted the license concession for the project<br />

at La Choya in Sonora. In the US or Canada<br />

the process would have taken between five

usiness tips<br />

and 10 years. Workers’ salaries are another<br />

incentive to invest. In Mexico, the average<br />

monthly salary in the mining sector is 482<br />

usd, compared to 1,137 usd in Brazil and 1,472<br />

usd in Turkey. In South Korea, the US and<br />

Germany the figure rises to 2,611, 3,384 and<br />

3,696 usd respectively, showing that labor<br />

costs in the sector in Mexico are between<br />

60% and 80% lower than in those countries.<br />

Therefore mining is not just a strategic sector<br />

for the Mexican economy but also for the<br />

world, which is looking ever more closely at<br />

the opportunities, potential and advantages<br />

Mexico offers in this sector. n<br />

Mexico offers a more solid and less risky<br />

alternative for mining production than other<br />

regions. The country possesses significant mineral<br />

deposits that are widely sought after<br />

around the world.<br />

*Professor and researcher in the Political and Social<br />

Sciences Faculty, National Autonomous University<br />

of Mexico (UNAM).

18 Negocios i The Lifestyle photo courtesy of minefinders<br />

<strong>MEXICO</strong>, THE<br />

BEST CHOICE<br />

FOR the<br />

<strong>M<strong>IN</strong><strong>IN</strong>G</strong> <strong>IN</strong>DUSTRY<br />

Mexico has a world-class mining industry<br />

with 500 years of experience and it expects<br />

to attract 15 billion USD of investment in the<br />

sector between 2007 and 2012.<br />

By JESÚS ESTRADA CORTÉS<br />

In the depths of Mexico’s jungles, mountain<br />

ranges or deserts, the country’s geography<br />

is a map with coordinates set<br />

for the growth of its mining industry. Its<br />

origins predate the Spanish conquest<br />

and the industry is now fully globalized, with<br />

Mexico now ranked first in Latin America and<br />

fourth in the world for investments in mining.<br />

Mexico is the second largest producer of silver<br />

in the world and is ranked among the top 12<br />

countries in terms of production of eighteen<br />

types of minerals.<br />

Mexico has become one of the most internationally<br />

competitive countries for mining<br />

at the same time as the sector has taken<br />

on a key role in the country’s own economic<br />

growth. The sector currently accounts for 3.6%<br />

of Mexico’s Gross Domestic Product (mining<br />

expanded), thanks to new and sizeable investments<br />

for large-scale projects which have an<br />

inherently long average life-span: from the exploration<br />

phase until production at optimum<br />

levels, maintaining a significant number of jobs.<br />

While the industry is optimistic about the<br />

future, with 15 billion usd of investment expected<br />

for new projects in the 2007-2012 period, it<br />

is worth taking a few steps back and revealing<br />

the background of the enormous potential of<br />

mining in Mexico today.<br />

Mining Tradition<br />

Mexico has a long history of mining, stretching<br />

back over more than 500 years, before the<br />

Spanish conquest and colonization. Mining<br />

was the driving force behind the New Spain<br />

economy. Furthermore, the country’s enormous<br />

production of silver and gold became<br />

Spain’s main source of income.<br />

This 500-year history is the reason for one<br />

of modern Mexico’s main competitive advantages.<br />

The skill developed by its workforce over<br />

the centuries has evolved into a tradition and<br />

the talent behind the industry’s operations and<br />

management is matched by the varied geography<br />

and by the geological potential in Mexico.<br />

Geological Potential<br />

Mexico’s geological terrain is one of the most<br />

tectonically active and complex in the world.<br />

Orogenesis has pushed up mountain chains all<br />

across Mexico, like the Sierra Madre Oriental,<br />

the Sierra Madre Occidental and the Sierra<br />

Madre del Sur, and these three regions have<br />

formed some of the key metallogenic areas.<br />

Gold and silver mineralization is commonly<br />

linked to the two belts of hydrothermal veins<br />

and gaps that stretch out underneath both<br />

sides of the Sierra Madre Occidental and that<br />

are located mainly in the younger volcanic sequences,<br />

in the case of both types of deposit,<br />

according to a document prepared by the Ministry<br />

of the Economy.<br />

“We currently have one of the largest mining<br />

potentials in the world, especially in terms<br />

of extracting silver, copper and gold,” the document<br />

reports.<br />

With the country’s enormous geological<br />

potential in mining, the Mexican government<br />

has set about organizing all this information<br />

for the benefit of investors. Exploration surveys<br />

have therefore been carried out, covering<br />

100% of the Mexican territory at a scale<br />

of 1:250,000 and almost a third of the country<br />

at a scale of 1:50,000, available to the general<br />

public on the Mexican Geological Survey website<br />

(www.sgm.gob.mx); essentially based on the<br />

mining-geological cartography, geochemical<br />

and geophysical program to identify and take<br />

an inventory of mineral deposits in Mexico.<br />

Quality Deposits<br />

Businessmen find a number of advantages<br />

when investing in Mexico. According to Xavier<br />

García de Quevedo, CEO of Minera México<br />

and COO of Southern Copper Corp., “the first<br />

advantage is the quality of the deposits. There<br />

is enormous unexplored mining potential and<br />

current found deposits have been of high qual

eport<br />

mining in<br />

mexico

20 Negocios i The Lifestyle photo courtesy of industrias peñoles<br />

Historical Player<br />

Industrias Peñoles began<br />

operations as a mining company in<br />

1887 and is now one of the largest<br />

mining producers in Mexico. Its<br />

exports, mainly to the US and Japan,<br />

account for nearly two-thirds of the<br />

company’s sales.<br />

Part of Mexican Corporate<br />

Grupo Bal, Peñoles is the world’s<br />

leading producer of refined silver,<br />

metallic bismuth and sodium sulfat<br />

and is among the major Latin<br />

American producers of refined<br />

gold, lead and zinc.<br />

The company owns and operates<br />

several mines throughout Mexico<br />

and is involved in several mining<br />

joint ventures as well as mining<br />

exploration projects in Peru.<br />

Among its main mining assets in<br />

Mexico are La Herradura –Mexico’s<br />

largest gold mine–, La Ciénega —the<br />

country’s richest gold mine–, Naica<br />

–the largest lead producing mine in<br />

México– and Francisco I. Madero –<br />

the country’s largest zinc mine.<br />

The company also operates the<br />

largest non-ferrous metallurgical<br />

complex (Met-Mex Peñoles) in Latin<br />

America, and the fourth largest in<br />

the world in terms of production<br />

value.<br />

Peñoles has substantial silver<br />

and gold mining interests through<br />

majority-held, publicly traded<br />

subsidiary Fresnillo, which it spun<br />

off in 2008.<br />

Fresnillo mine has been<br />

operating almost continuously<br />

since 1550. It is the largest and<br />

richest silver mine in the world and<br />

produces about 30 million ounces of<br />

silver per year, approximately 5% of<br />

the total world production of silver.<br />

Jaime Lomelín, Chief Executive<br />

Officer of Fresnillo PLC,<br />

summarizes the future plans for<br />

the mine: “We intend to maintain<br />

our position as the world’s largest<br />

primary silver producer with the<br />

aim of doubling production on<br />

a silver equivalent ounce basis<br />

by 2018 and equally increasing<br />

our gold production.” That is<br />

increase Fresnillo’s production up<br />

to 65 million ounces of silver and<br />

400,000 ounces of gold over the<br />

next eight years.<br />

Meanwhile, Peñoles remains<br />

as the most important mining<br />

company in Mexico. A historical<br />

player in the industry, engaged in<br />

exploring valuable deposits of nonferrous<br />

metals in Mexico and Latin<br />

America and profiting from one of<br />

the longest mining traditions in the<br />

world.<br />

ity. Two years ago Mexico ranked as the best<br />

location for exploration in terms of the country’s<br />

investment risk for mining.<br />

García de Quevedo, previously chairman<br />

of the Mining Chamber of Mexico, draws attention<br />

to the competitive advantages of a<br />

country “with a very strong mining tradition.<br />

Over the years, Mexico has developed genuine<br />

expertise in mining, with great technical<br />

and growth potential.”<br />

But there are other factors too, such as<br />

Mexico’s “total openness to foreign investment,<br />

that encourages any company from around the<br />

world to come and explore Mexico,” adds García<br />

de Quevedo. Here he mentions that mining<br />

attracted almost 17% of all foreign direct investment<br />

in Mexico in 2009. This only accounts for<br />

the metallic and non-metallic segments, without<br />

including the iron and steel, cement and<br />

glass industries.<br />

The importance and cost of the workforce<br />

are just as important, and highly competitive<br />

internationally, as well as productivity, which<br />

has increased significantly in recent years.<br />

Government Support<br />

Trading partners trust in Mexico and its industry’s<br />

capacity to respond to global demand for<br />

large-scale production and this is reflected in<br />

Mexico’s leading role in key market segments<br />

of the mining industry.<br />

The country is the second largest producer<br />

of silver, bismuth and fluorite; the third of celestite;<br />

the fourth of wollastonite and diatomite; the<br />

fifth of lead; the sixth of cadmium and molybdenum;<br />

the seventh of zinc, salt and graphite; the<br />

eighth of manganese and baryte and the twelfth<br />

of feldspar, gold and copper.<br />

These rankings not only reflect Mexico’s<br />

competitive advantages but they also speak<br />

volumes about other essential aspects of mining<br />

- the country’s infrastructure to ease foreign<br />

trade transactions, using road, highway, railway<br />

or shipping networks, and the straightforward<br />

mechanisms for companies to avoid doubletaxation<br />

and to exchange information on supply<br />

and demand. The Behre Dolbear report, published<br />

in 2010, places Mexico in the first place<br />

among 25 countries due to its fiscal regime.<br />

Today’s Outlook<br />

Due to these advantages, although not entirely<br />

immune to the effects of the global economic<br />

recession in 2009, Mexico’s mining industry<br />

showed signs of robustness and even growth.<br />

Figures from the Ministry of Economy<br />

show that in 2009 private investment in the<br />

mining and metal industries increased to 2.73<br />

billion usd, adding up to a total of 8.54 billion<br />

usd injected into the sector between 2007 and

eport<br />

mining in<br />

mexico<br />

A Roaring Giant<br />

The giant in the Mexican mining<br />

industry is called Minera México.<br />

The company is the mining<br />

subsidiary of Grupo México and<br />

it currently operates in Mexico,<br />

Peru and the US. It is a holding<br />

company operating in the mining<br />

and transportation industries<br />

through its two subsidiaries:<br />

Americas Mining Corporation and<br />

Infraestructura y Transportes<br />

México.<br />

Minera México operates through<br />

three business units: Mexicana de<br />

Cobre, Mexicana de Cananea and<br />

Industrial Minera México.<br />

Mexicana de Cobre, located in the<br />

Northern state of Sonora, operates<br />

an open pit copper mine, with a<br />

production of 90,000 metric tons of<br />

copper ore at the concentrator plant,<br />

22 thousand metric tons of copper,<br />

300.000 metric tons a year for the<br />

smelting plant and 300,000 for<br />

refining, 150,000 metric tons a year<br />

for heavy wire production, around<br />

15 million ounces a year of silver and<br />

100,000 ounces of gold a year in the<br />

precious metal refinery plant.<br />

Mexicana de Cananea, also based<br />

in Sonora, operates an open copper<br />

mine regarded as one of the largest<br />

in the world in copper ore reserves.<br />

The company has a concentrator<br />

plant with a daily output of 80,000<br />

metric tons and two ESDE plants<br />

with a combined capacity of 55<br />

thousand metric tons of electro won<br />

cathodes a year.<br />

The Industrial Minera México<br />

business unit is integrated by<br />

seven underground mines located<br />

in the Central and Northern parts<br />

of Mexico, where the company<br />

produces zinc, copper, silver and<br />

gold. This business unit includes<br />

the industrial processing operations<br />

for zinc and copper in the state of<br />

San Luis Potosí and it includes San<br />

Martín, the largest underground<br />

mine in Mexico, as well as Charcas,<br />

the second largest production mine<br />

04 in the country. It also includes<br />

coal mining operations in the<br />

Northeastern region of Mexico.<br />

Plans have been put in place<br />

to aid growth in production.<br />

Xavier García de Quevedo,<br />

Executive Chairman of Minera<br />

México and COO of Southern<br />

Copper Corporation –the largest<br />

mining company in Peru, which<br />

Grupo México acquired in 2005<br />

through a merger agreement– says<br />

the company has implemented<br />

important projects, such as the<br />

development of a new mine in<br />

Pilares, Sonora, next to La Caridad<br />

mine site.<br />

La Caridad mine is the most<br />

important copper producer in<br />

Mexico and it will be expanded<br />

thanks to this project. The company<br />

has investment plans there, adding<br />

up to around 700 million usd in<br />

Mexico in the coming years.<br />

However, this investment<br />

may grow a lot more considering<br />

the project Minera México is<br />

implementing at the El Arco mine,<br />

one of the largest copper fields in the<br />

world and located in the state of Baja<br />

California, where it could invest over<br />

1.5 billion usd in years to come.

22 Negocios photo courtesy of industrias peñoles<br />

2009. Of the total invested capital, 70% came<br />

from national companies with foreign capital.<br />

In December 2009, 692 exploration projects<br />

were registered in Mexico. Of this total figure,<br />

64% were gold and silver related projects,<br />

18% polymetallic projects (copper, zinc, silver<br />

and lead), 13% copper related projects and the<br />

remainder was spread out between several<br />

mineral exploration projects.<br />

Also, the Mexican mining sector posted<br />

a solid trade surplus. As of June 2009, its<br />

exports totaled almost 4 billion usd and its<br />

imports around 2 billion usd.<br />

In terms of employment, at the end of 2009<br />

Mexico’s mining industry employed 270,000<br />

workers. Mining was one of the first Mexican<br />

industrial sectors to show signs of recovery<br />

after the international downturn, generating<br />

4,613 new jobs since August 2009.<br />

Mining in Mexico has seen a year-on-year<br />

increase since 2006, at an average annual<br />

growth rate of 4.8% from 2006 to 2008. The<br />

sector registered an accumulated growth of<br />

23.4% up until September 2009.<br />

Supporting Investment<br />

Mexico was therefore able to remain as a leading<br />

investment destination in 2009 and one of<br />

strongest potentials for mining in the world.<br />

Analysis by prestigious international<br />

firms ranked Mexico in first place for exploration<br />

in Latin America and fourth in<br />

the world. The Behre Dolbear report, published<br />

in 2010, placed Mexico as the world’s<br />

fourth-best investment destination for mining<br />

among a 25-country-list and in first place<br />

regarding the fiscal regime.<br />

To assist investors, the Mexican Geological<br />

Survey has not only improved Internet<br />

access to its geological maps, as well as to<br />

inventories of minerals in the states and geochemical<br />

and geophysical research, but also<br />

the Ministry of Economy provides a follow<br />

up right from the promotion phase until providing<br />

accompaniment during the extraction<br />

or exploration phase, even afterwards,<br />

to review its performance and a successful<br />

conclusion.<br />

The government also provides all information<br />

on providers in the sector, on land<br />

ownership and the licenses and requirements<br />

for handling concessions, to guarantee<br />

legal certainty.<br />

The Ministry of Economy’s Mining Promotion<br />

Trust (FIFOMI) is another key player.<br />

In 2009 it helped capitalize micro, small and<br />

medium-sized mining companies as well as<br />

the sector’s production chain with loans worth<br />

510 million usd, 20% higher than in 2008, in<br />

addition to offering training and technical assistance<br />

to more than 8,000 companies.<br />

The government is particularly interested<br />

in reactivating those mining districts that<br />

are regions with high potential. Exploration<br />

schemes are taking place in those areas and<br />

sixteen districts are expected to be reactivated<br />

between 2009 and 2012.<br />

Work in Progress<br />

This has all combined to create a boom for investors<br />

in search of Mexico’s wealth of mineral<br />

resources, leading to new research and mining<br />

exploration.<br />

In December 2009, 262 Mexican companies<br />

backed by foreign capital were operating<br />

692 projects in Mexico. Of this total figure,<br />

74% of companies are based in Canada, 17%<br />

in the US and 2% in Australia and the United<br />

Kingdom. The remainder is spread out between<br />

another ten countries.<br />

During 2009 new exploration projects<br />

were undertaken. Among them: Palmarejo<br />

and Pinos Altos in Chihuahua, reactivation of<br />

the La Testera plant in El Triunfo, Baja California<br />

Sur and the San Francisco and Lluvia de<br />

Oro mines in Sonora, as well as increasing installed<br />

production capacity in La Encantada<br />

in Coahuila and La Parrilla and Cerro Las<br />

Minitas in Durango.<br />

In 2009, important mining projects consolidated.<br />

That was the case with the Dolores<br />

mines in Chihuahua, Campo Morado in<br />

Guerrero and Peñasquito in Zacatecas. The<br />

latter will begin operations in 2010 and along<br />

with Pinos Altos it will contribute to increase<br />

Mexican gold production by up to 40%.<br />

Other mines starting operations in 2010<br />

are Santa Elena and Luz del Cobre in Sonora,<br />

El Águila in Oaxaca, La Pitarrilla in Durango<br />

and El Boleo in Baja California Sur, which will<br />

start operations in 2011.<br />

But Mexico still has much mineral wealth<br />

to offer throughout its huge territory, enough<br />

to ensure it remains a favorite for investors<br />

with its top-quality deposits and its reliable<br />

and profitable business environment. n

eport<br />

mining in<br />

mexico<br />

Growth Is The Goal<br />

Over a short period, Canadian Goldcorp has grown from a strong intermediate player to one of the top senior gold<br />

producers in the world. It is one of the companies with the strongest production growth profile among all senior gold<br />

producers and Mexico has played a key role in that.<br />

As Salvador García, Vice President of Goldcorp Mexico, puts it: “Mexico’s major advantages are its big mineral<br />

resources and its openness to foreign investment, in addition to an ideal environment for doing business.”<br />

Goldcorp has managed to take advantage of Mexico’s assets to become one of the world’s mining strongest players.<br />

The company began its golden business relationship with Mexico eight years ago, when it took control of Minas de<br />

San Luis (Luismin), a wholly owned subsidiary of Wheaton River Minerals who merged with Goldcorp to create a major<br />

new company in the gold mining industry.<br />

Goldcorp started producing 50,000 ounces of gold per year and now produces 650,000 ounces. Furthermore, the<br />

company expects to increase these figures to 1 million ounces per year, 55% of Mexico’s total production of gold.<br />

To date, Goldcorp employs 6,000 people in Mexico and its operating assets include El Sauzal, Los Filos, San Dimas<br />

(Tayoltita) and Peñasquito gold/silver mines. The latter is the largest open pit mine in Mexico and Goldcorp has invested<br />

around 1.5 billion usd in it.<br />

To reach its production goals, Goldcorp has a solid pipeline of projects. The company is currently working in two<br />

major mining projects: the second stage of Peñasquito mine and the recently acquired Camino Rojo mine.<br />

“Growing is one of our most important short-term goals in Mexico and the Camino Rojo mine will play an important<br />

role. The company is also investing in its operating units. Each year around 60 million usd are invested to prolong the<br />

life of the mines and to explore new reserves within the project portfolio we have throughout the country,” says Salvador<br />

García.<br />

The truth to be said, Goldcorp’s growth profile is unmatched in the mining industry and Mexico has a lot to say about<br />

this story of success.

24 Negocios infographic oldemar<br />

Mining projects<br />

<strong>IN</strong> <strong>MEXICO</strong><br />

Value of Mining<br />

Production in<br />

Mexico in 2008<br />

10.5<br />

billion USD<br />

New Mining Pr<br />

2006-2009<br />

Production<br />

Investment<br />

Baja California<br />

El Arco<br />

Grupo México<br />

Advanced exploration, expects<br />

to start operations in 2012<br />

Production by State<br />

1.4 billion USD<br />

190,000 tons of copper<br />

(expected production)<br />

Baja California Sur<br />

29%<br />

Others<br />

27%<br />

Sonora<br />

Exploration Projects<br />

2009-2012<br />

16%<br />

Zacatecas<br />

15%<br />

Coahuila<br />

13%<br />

Chihuahua<br />

El Boleo<br />

Baja Mining / Kores<br />

Under construction, expects<br />

to start operations in 2011<br />

889 million USD<br />

1,535 tons of cobalt<br />

55,750 tons of copper<br />

6,300 tons of zinc sulfate<br />

Sonora<br />

692<br />

Projects<br />

Companies involved<br />

262<br />

Mining<br />

companies<br />

8.8<br />

billion USD<br />

(estimated investment)<br />

El Crestón<br />

Moly Corp<br />

Advanced exploration, expects<br />

to start operations in 2011<br />

512 million USD<br />

10,000 tons of molybdenum<br />

8,000 tons of copper<br />

Los Cedros<br />

ArcelorMittal<br />

Started operations in 2008<br />

157 million USD<br />

Mexican<br />

Grupo México<br />

Peñoles<br />

Grupo Frisco<br />

Autlán<br />

Grupo Alfil<br />

Nemisa<br />

Minas de Bacis<br />

Las Encinas<br />

Materias Primas<br />

GAN<br />

Canadian<br />

Goldcorp<br />

Pan American Silver<br />

Farallon Mining<br />

Teck Resources<br />

Alamos Gold<br />

Gammon Gold<br />

Frontera Copper<br />

First Majestic<br />

US<br />

Hecla Mining<br />

Coeur d’Alene<br />

Mines<br />

UK<br />

Vane<br />

Minerals<br />

Arian Silver<br />

Australian<br />

Kings Minerals<br />

Indo Gold<br />

2 million tons of iron ore<br />

Mulatos<br />

Alamos Gold<br />

Started operations in 2007<br />

100 million USD<br />

170,000 ounces of gold<br />

El Chanate<br />

Capital Gold<br />

Started operations in 2007<br />

35 million USD<br />

60,000 ounces of gold

ojects<br />

report<br />

mining in<br />

mexico<br />

Chihuahua<br />

El Chanate<br />

Palmarejo<br />

Coeur d’Alene Mines<br />

Started operations in 2009<br />

2.25 million USD<br />

El Crestón<br />

Mulatos<br />

Dolores<br />

9 million ounces of silver<br />

110,000 ounces of gold<br />

Pinos Altos<br />

Agnico Eagle<br />

Started operations in 2009<br />

240 million USD<br />

El Arco<br />

El Boleo<br />

Los Cedros<br />

Pinos Altos<br />

Palmarejo Ocampo<br />

190,000 ounces of gold<br />

2 million ounces of silver<br />

Dolores<br />

Minefinders<br />

Started operations in 2008<br />

250 million USD<br />

130,000 ounces of gold<br />

3 million ounces of silver<br />

Peñasquito<br />

Ocampo<br />

Gammon Gold<br />