Technische Universität München Credit as an Asset Class - risklab

Technische Universität München Credit as an Asset Class - risklab

Technische Universität München Credit as an Asset Class - risklab

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHAPTER 2. CREDIT RISK TRANSFER<br />

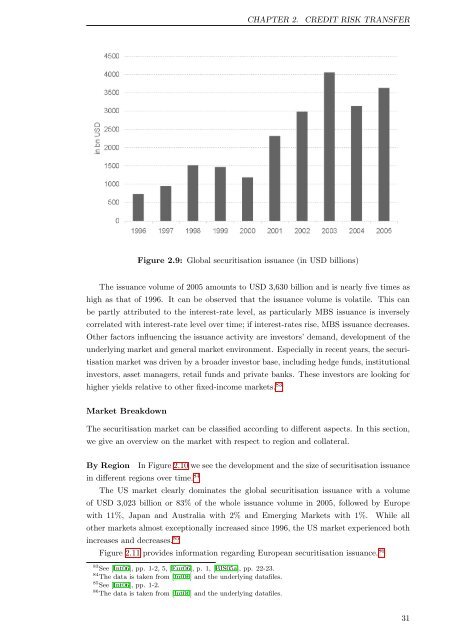

Figure 2.9: Global securitisation issu<strong>an</strong>ce (in USD billions)<br />

The issu<strong>an</strong>ce volume of 2005 amounts to USD 3,630 billion <strong>an</strong>d is nearly five times <strong>as</strong><br />

high <strong>as</strong> that of 1996. It c<strong>an</strong> be observed that the issu<strong>an</strong>ce volume is volatile. This c<strong>an</strong><br />

be partly attributed to the interest-rate level, <strong>as</strong> particularly MBS issu<strong>an</strong>ce is inversely<br />

correlated with interest-rate level over time; if interest-rates rise, MBS issu<strong>an</strong>ce decre<strong>as</strong>es.<br />

Other factors influencing the issu<strong>an</strong>ce activity are investors’ dem<strong>an</strong>d, development of the<br />

underlying market <strong>an</strong>d general market environment. Especially in recent years, the securi-<br />

tisation market w<strong>as</strong> driven by a broader investor b<strong>as</strong>e, including hedge funds, institutional<br />

investors, <strong>as</strong>set m<strong>an</strong>agers, retail funds <strong>an</strong>d private b<strong>an</strong>ks. These investors are looking for<br />

higher yields relative to other fixed-income markets. 83<br />

Market Breakdown<br />

The securitisation market c<strong>an</strong> be cl<strong>as</strong>sified according to different <strong>as</strong>pects. In this section,<br />

we give <strong>an</strong> overview on the market with respect to region <strong>an</strong>d collateral.<br />

By Region In Figure 2.10 we see the development <strong>an</strong>d the size of securitisation issu<strong>an</strong>ce<br />

in different regions over time. 84<br />

The US market clearly dominates the global securitisation issu<strong>an</strong>ce with a volume<br />

of USD 3,023 billion or 83% of the whole issu<strong>an</strong>ce volume in 2005, followed by Europe<br />

with 11%, Jap<strong>an</strong> <strong>an</strong>d Australia with 2% <strong>an</strong>d Emerging Markets with 1%. While all<br />

other markets almost exceptionally incre<strong>as</strong>ed since 1996, the US market experienced both<br />

incre<strong>as</strong>es <strong>an</strong>d decre<strong>as</strong>es. 85<br />

Figure 2.11 provides information regarding Europe<strong>an</strong> securitisation issu<strong>an</strong>ce. 86<br />

83<br />

See [Int06], pp. 1-2, 5, [Eur06], p. 1, [BIS05a], pp. 22-23.<br />

84<br />

The data is taken from [Int06] <strong>an</strong>d the underlying datafiles.<br />

85<br />

See [Int06], pp. 1-2.<br />

86<br />

The data is taken from [Int06] <strong>an</strong>d the underlying datafiles.<br />

31