Mainstreaming Responsible Investment - AccountAbility

Mainstreaming Responsible Investment - AccountAbility

Mainstreaming Responsible Investment - AccountAbility

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

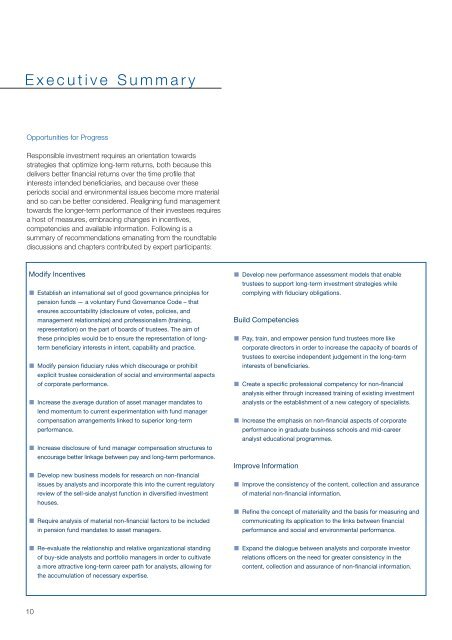

Executive Summary<br />

Opportunities for Progress<br />

<strong>Responsible</strong> investment requires an orientation towards<br />

strategies that optimize long-term returns, both because this<br />

delivers better financial returns over the time profile that<br />

interests intended beneficiaries, and because over these<br />

periods social and environmental issues become more material<br />

and so can be better considered. Realigning fund management<br />

towards the longer-term performance of their investees requires<br />

a host of measures, embracing changes in incentives,<br />

competencies and available information. Following is a<br />

summary of recommendations emanating from the roundtable<br />

discussions and chapters contributed by expert participants:<br />

Modify Incentives<br />

Establish an international set of good governance principles for<br />

pension funds — a voluntary Fund Governance Code – that<br />

ensures accountability (disclosure of votes, policies, and<br />

management relationships) and professionalism (training,<br />

representation) on the part of boards of trustees. The aim of<br />

these principles would be to ensure the representation of longterm<br />

beneficiary interests in intent, capability and practice.<br />

Modify pension fiduciary rules which discourage or prohibit<br />

explicit trustee consideration of social and environmental aspects<br />

of corporate performance.<br />

Increase the average duration of asset manager mandates to<br />

lend momentum to current experimentation with fund manager<br />

compensation arrangements linked to superior long-term<br />

performance.<br />

Increase disclosure of fund manager compensation structures to<br />

encourage better linkage between pay and long-term performance.<br />

Develop new business models for research on non-financial<br />

issues by analysts and incorporate this into the current regulatory<br />

review of the sell-side analyst function in diversified investment<br />

houses.<br />

Require analysis of material non-financial factors to be included<br />

in pension fund mandates to asset managers.<br />

Develop new performance assessment models that enable<br />

trustees to support long-term investment strategies while<br />

complying with fiduciary obligations.<br />

Build Competencies<br />

Pay, train, and empower pension fund trustees more like<br />

corporate directors in order to increase the capacity of boards of<br />

trustees to exercise independent judgement in the long-term<br />

interests of beneficiaries.<br />

Create a specific professional competency for non-financial<br />

analysis either through increased training of existing investment<br />

analysts or the establishment of a new category of specialists.<br />

Increase the emphasis on non-financial aspects of corporate<br />

performance in graduate business schools and mid-career<br />

analyst educational programmes.<br />

Improve Information<br />

Improve the consistency of the content, collection and assurance<br />

of material non-financial information.<br />

Refine the concept of materiality and the basis for measuring and<br />

communicating its application to the links between financial<br />

performance and social and environmental performance.<br />

Re-evaluate the relationship and relative organizational standing<br />

of buy-side analysts and portfolio managers in order to cultivate<br />

a more attractive long-term career path for analysts, allowing for<br />

the accumulation of necessary expertise.<br />

Expand the dialogue between analysts and corporate investor<br />

relations officers on the need for greater consistency in the<br />

content, collection and assurance of non-financial information.<br />

10