FCP OP MEDICAL BioHealth-Trends - medical.lu

FCP OP MEDICAL BioHealth-Trends - medical.lu

FCP OP MEDICAL BioHealth-Trends - medical.lu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> / Annual Report as of December 31, 2010<br />

(which is not represented at all in the NBI) and for<br />

biotechnology companies with a market capitalisation of less<br />

than USD 500 million (which make up only 8 % of the<br />

market capitalisation of the NBI). In contrast, the Fund's<br />

performance was 13.3 % higher than the DRG<br />

pharmaceuticals index (+7.6 % in EUR), and only a slight<br />

-1.8 % lower than the broad market S&P 500 (+22.7 %) (all<br />

data in EUR).<br />

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> is available in both a<br />

currency hedged and a non-currency hedged unit class. The<br />

currency hedged Unit Class EUR H rose by 13.3 %* over the<br />

reporting period.<br />

A key factor that distinguishes the investment strategy used<br />

by <strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> is its stock picking<br />

method, which does not depend on any indices. The Fund's<br />

investment strategy remained unchanged during the reporting<br />

period in terms of its primary focus on young companies<br />

with innovative products whose future development should<br />

bring corresponding increases in va<strong>lu</strong>e.<br />

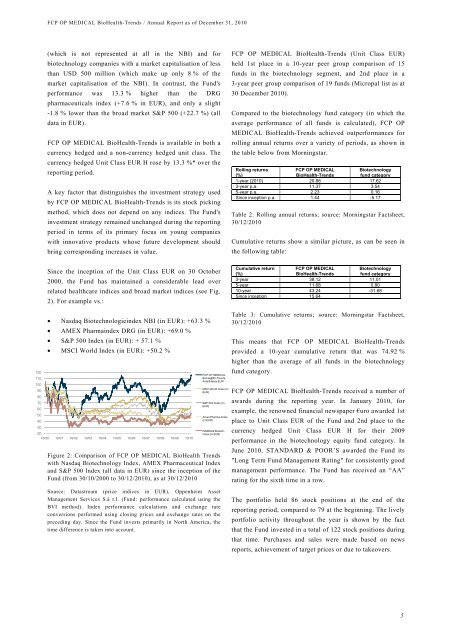

Since the inception of the Unit Class EUR on 30 October<br />

2000, the Fund has maintained a considerable lead over<br />

related healthcare indices and broad market indices (see Fig.<br />

2). For example vs.:<br />

• Nasdaq Biotechnologieindex NBI (in EUR): +63.3 %<br />

• AMEX Pharmaindex DRG (in EUR): +69.0 %<br />

• S&P 500 Index (in EUR): + 57.1 %<br />

• MSCI World Index (in EUR): +50.2 %<br />

20<br />

10/00 10/01 10/02 10/03 10/04 10/05 10/06 10/07 10/08 10/09 10/10<br />

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong><br />

BioHe@lth-<strong>Trends</strong><br />

Anteilklasse EUR<br />

MSCI World Index (in<br />

EUR)<br />

S&P 500 Index (in<br />

EUR)<br />

Amex Pharma-Index<br />

(in EUR)<br />

NASDAQ Biotech-<br />

Index (in EUR)<br />

Figure 2: Comparison of <strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong> <strong>Trends</strong><br />

with Nasdaq Biotechnology Index, AMEX Pharmaceutical Index<br />

and S&P 500 Index (all data in EUR) since the inception of the<br />

Fund (from 30/10/2000 to 30/12/2010), as at 30/12/2010<br />

Source: Datastream (price indices in EUR), Oppenheim Asset<br />

Management Services S.à r.l. (Fund: performance calculated using the<br />

BVI method). Index performance calculations and exchange rate<br />

conversions performed using closing prices and exchange rates on the<br />

preceding day. Since the Fund invests primarily in North America, the<br />

time difference is taken into account.<br />

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> (Unit Class EUR)<br />

held 1st place in a 10-year peer group comparison of 15<br />

funds in the biotechnology segment, and 2nd place in a<br />

3-year peer group comparison of 19 funds (Micropal list as at<br />

30 December 2010).<br />

Compared to the biotechnology fund category (in which the<br />

average performance of all funds is calculated), <strong>FCP</strong> <strong>OP</strong><br />

<strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> achieved outperformances for<br />

rolling annual returns over a variety of periods, as shown in<br />

the table below from Morningstar.<br />

Rolling returns<br />

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong><br />

Biotechnology<br />

(%)<br />

<strong>BioHealth</strong>-<strong>Trends</strong><br />

fund category<br />

1-year (2010) 20.88 17.62<br />

3-year p.a. 11.37 3.54<br />

5-year p.a. 2.23 0.16<br />

Since inception p.a. 1.44 -5.17<br />

Table 2: Rolling annual returns; source: Morningstar Factsheet,<br />

30/12/2010<br />

Cumulative returns show a similar picture, as can be seen in<br />

the following table:<br />

Cumulative return <strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong><br />

Biotechnology<br />

(%)<br />

<strong>BioHealth</strong>-<strong>Trends</strong><br />

fund category<br />

3-year 38.12 11.01<br />

5-year 11.68 0.80<br />

10-year 43.24 -31.68<br />

Since inception 15.64<br />

Table 3: Cumulative returns; source: Morningstar Factsheet,<br />

30/12/2010<br />

This means that <strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong><br />

provided a 10-year cumulative return that was 74.92 %<br />

higher than the average of all funds in the biotechnology<br />

fund category.<br />

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> received a number of<br />

awards during the reporting year. In January 2010, for<br />

example, the renowned financial newspaper €uro awarded 1st<br />

place to Unit Class EUR of the Fund and 2nd place to the<br />

currency hedged Unit Class EUR H for their 2009<br />

performance in the biotechnology equity fund category. In<br />

June 2010, STANDARD & POOR’S awarded the Fund its<br />

"Long Term Fund Management Rating" for consistently good<br />

management performance. The Fund has received an “AA”<br />

rating for the sixth time in a row.<br />

The portfolio held 86 stock positions at the end of the<br />

reporting period, compared to 79 at the beginning. The lively<br />

portfolio activity throughout the year is shown by the fact<br />

that the Fund invested in a total of 122 stock positions during<br />

that time. Purchases and sales were made based on news<br />

reports, achievement of target prices or due to takeovers.<br />

5