FCP OP MEDICAL BioHealth-Trends - medical.lu

FCP OP MEDICAL BioHealth-Trends - medical.lu

FCP OP MEDICAL BioHealth-Trends - medical.lu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> / Annual Report as of December 31, 2010<br />

• Ligand Pharmaceuticals Inc. for Revolade (for treating<br />

idiopathic thrombocytopenic purpura, partnership with<br />

Glaxo, EU approval)<br />

• AtriCure Inc. for AtriClip (closure system for cardiac<br />

atrial appendages)<br />

• BSD Medical Corp. for MicrothermX (for tumour<br />

radiation)<br />

• Prostrakan Group PLC for Fortesta (for treating<br />

hypogonadism, partnership with Endo Pharma)<br />

The following companies are examples of holding that<br />

entered into product partnerships and platform deals:<br />

• Basilea Pharmaceutica AG issued Astellas a license for<br />

Isavuconazole, a drug undergoing approval studies for<br />

the treatment of serious systemic fungal infections. In<br />

addition to an advance payment of CHF 75 million,<br />

Basilea can receive further milestone payments of up to<br />

CHF 478 million and double-digit royalties based on<br />

product sales. The company also retained co-promotion<br />

rights.<br />

• Neurocrine Biosciences Inc. entered into a partnership<br />

with Abbott for an endometriosis product, receiving<br />

advanced payments of USD 75 million, as well as future<br />

performance payments of up to USD 500 million and<br />

royalties on future sales.<br />

The Fund also profited from the ongoing process of<br />

consolidation in the drug and <strong>medical</strong> technology sectors. A<br />

number of portfolio companies were acquired at high price<br />

premiums or received takeover offers during the reporting<br />

period:<br />

Acquired Sub-segment From Takeover premium<br />

Bioform Medical technology Merz Pharma 60%<br />

OSI Pharma Biotechnology Astellas 55%<br />

Javelin Emerging<br />

pharmaceuticals<br />

Hospira 61%<br />

ATS Medical Medical technology Medtronic 54%<br />

Zymogenetics Biotechnology Bristol Myers<br />

Squibb<br />

84%<br />

Crucell Biotechnology Johnson &<br />

Johnson<br />

58%<br />

Cypress Emerging<br />

Financial<br />

160%<br />

pharmaceuticals investors<br />

Genzyme Biotechnology Sanofi 40%<br />

Table 5: Portfolio companies acquired in 2010, the takeover<br />

premium is based on the share price before the takeover<br />

announcement<br />

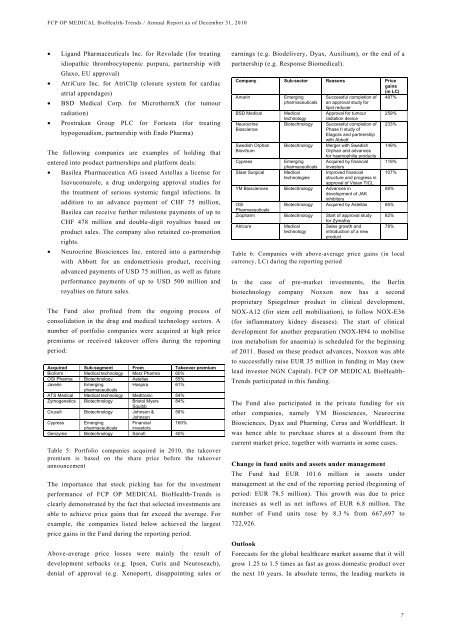

The importance that stock picking has for the investment<br />

performance of <strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<strong>Trends</strong> is<br />

clearly demonstrated by the fact that selected investments are<br />

able to achieve price gains that far exceed the average. For<br />

example, the companies listed below achieved the largest<br />

price gains in the Fund during the reporting period.<br />

Above-average price losses were mainly the result of<br />

development setbacks (e.g. Ipsen, Curis and Neuroseach),<br />

denial of approval (e.g. Xenoport), disappointing sales or<br />

earnings (e.g. Biodelivery, Dyax, Auxilium), or the end of a<br />

partnership (e.g. Response Bio<strong>medical</strong>).<br />

Company Sub-sector Reasons Price<br />

gains<br />

(in LC)<br />

Amarin Emerging<br />

pharmaceuticals<br />

Successful completion of<br />

an approval study for<br />

lipid reducer<br />

Approval for tumour<br />

radiation device<br />

487%<br />

BSD Medical Medical<br />

technology<br />

259%<br />

Neurocrine<br />

Biotechnology Successful completion of 233%<br />

Bioscience<br />

Phase II study of<br />

Elagolix and partnership<br />

with Abbott<br />

Swedish Orphan Biotechnology Merger with Swedish 149%<br />

Biovitrum<br />

Orphan and advances<br />

for haemophilia products<br />

Cypress Emerging Acquired by financial 119%<br />

pharmaceuticals investors<br />

Staar Surgical Medical<br />

Improved financial 107%<br />

technologies structure and progress in<br />

approval of Visian TICL<br />

YM Biosciences Biotechnology Advances in<br />

development of JAK<br />

inhibitors<br />

88%<br />

OSI<br />

Pharmaceuticals<br />

Biotechnology Acquired by Astellas 85%<br />

Ziopharm Biotechnology Start of approval study<br />

for Zymafos<br />

82%<br />

Atricure Medical<br />

Sales growth and<br />

78%<br />

technology introduction of a new<br />

product<br />

Table 6: Companies with above-average price gains (in local<br />

currency, LC) during the reporting period<br />

In the case of pre-market investments, the Berlin<br />

biotechnology company Noxxon now has a second<br />

proprietary Spiegelmer product in clinical development,<br />

NOX-A12 (for stem cell mobilisation), to follow NOX-E36<br />

(for inflammatory kidney diseases). The start of clinical<br />

development for another preparation (NOX-H94 to mobilise<br />

iron metabolism for anaemia) is scheduled for the beginning<br />

of 2011. Based on these product advances, Noxxon was able<br />

to successfully raise EUR 35 million in funding in May (new<br />

lead investor NGN Capital). <strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong> <strong>BioHealth</strong>-<br />

<strong>Trends</strong> participated in this funding.<br />

The Fund also participated in the private funding for six<br />

other companies, namely YM Biosciences, Neurocrine<br />

Biosciences, Dyax and Pharming, Cerus and WorldHeart. It<br />

was hence able to purchase shares at a discount from the<br />

current market price, together with warrants in some cases.<br />

Change in fund units and assets under management<br />

The Fund had EUR 101.6 million in assets under<br />

management at the end of the reporting period (beginning of<br />

period: EUR 78.5 million). This growth was due to price<br />

increases as well as net inflows of EUR 6.8 million. The<br />

number of Fund units rose by 8.3 % from 667,697 to<br />

722,926.<br />

Outlook<br />

Forecasts for the global healthcare market assume that it will<br />

grow 1.25 to 1.5 times as fast as gross domestic product over<br />

the next 10 years. In abso<strong>lu</strong>te terms, the leading markets in<br />

7