State of Microfinance in J&K - KashmirCorps

State of Microfinance in J&K - KashmirCorps

State of Microfinance in J&K - KashmirCorps

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

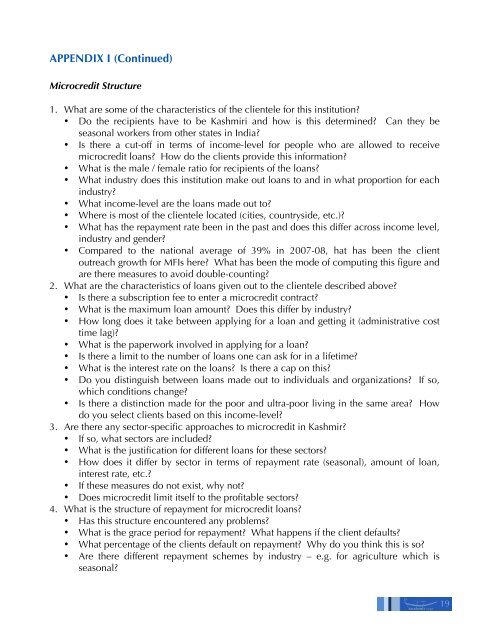

APPENDIX I (Cont<strong>in</strong>ued)<br />

Microcredit Structure<br />

1. What are some <strong>of</strong> the characteristics <strong>of</strong> the clientele for this <strong>in</strong>stitution<br />

• Do the recipients have to be Kashmiri and how is this determ<strong>in</strong>ed Can they be<br />

seasonal workers from other states <strong>in</strong> India<br />

• Is there a cut-<strong>of</strong>f <strong>in</strong> terms <strong>of</strong> <strong>in</strong>come-level for people who are allowed to receive<br />

microcredit loans How do the clients provide this <strong>in</strong>formation<br />

• What is the male / female ratio for recipients <strong>of</strong> the loans<br />

• What <strong>in</strong>dustry does this <strong>in</strong>stitution make out loans to and <strong>in</strong> what proportion for each<br />

<strong>in</strong>dustry<br />

• What <strong>in</strong>come-level are the loans made out to<br />

• Where is most <strong>of</strong> the clientele located (cities, countryside, etc.)<br />

• What has the repayment rate been <strong>in</strong> the past and does this differ across <strong>in</strong>come level,<br />

<strong>in</strong>dustry and gender<br />

• Compared to the national average <strong>of</strong> 39% <strong>in</strong> 2007-08, hat has been the client<br />

outreach growth for MFIs here What has been the mode <strong>of</strong> comput<strong>in</strong>g this figure and<br />

are there measures to avoid double-count<strong>in</strong>g<br />

2. What are the characteristics <strong>of</strong> loans given out to the clientele described above<br />

• Is there a subscription fee to enter a microcredit contract<br />

• What is the maximum loan amount Does this differ by <strong>in</strong>dustry<br />

• How long does it take between apply<strong>in</strong>g for a loan and gett<strong>in</strong>g it (adm<strong>in</strong>istrative cost<br />

time lag)<br />

• What is the paperwork <strong>in</strong>volved <strong>in</strong> apply<strong>in</strong>g for a loan<br />

• Is there a limit to the number <strong>of</strong> loans one can ask for <strong>in</strong> a lifetime<br />

• What is the <strong>in</strong>terest rate on the loans Is there a cap on this<br />

• Do you dist<strong>in</strong>guish between loans made out to <strong>in</strong>dividuals and organizations If so,<br />

which conditions change<br />

• Is there a dist<strong>in</strong>ction made for the poor and ultra-poor liv<strong>in</strong>g <strong>in</strong> the same area How<br />

do you select clients based on this <strong>in</strong>come-level<br />

3. Are there any sector-specific approaches to microcredit <strong>in</strong> Kashmir<br />

• If so, what sectors are <strong>in</strong>cluded<br />

• What is the justification for different loans for these sectors<br />

• How does it differ by sector <strong>in</strong> terms <strong>of</strong> repayment rate (seasonal), amount <strong>of</strong> loan,<br />

<strong>in</strong>terest rate, etc.<br />

• If these measures do not exist, why not<br />

• Does microcredit limit itself to the pr<strong>of</strong>itable sectors<br />

4. What is the structure <strong>of</strong> repayment for microcredit loans<br />

• Has this structure encountered any problems<br />

• What is the grace period for repayment What happens if the client defaults<br />

• What percentage <strong>of</strong> the clients default on repayment Why do you th<strong>in</strong>k this is so<br />

• Are there different repayment schemes by <strong>in</strong>dustry – e.g. for agriculture which is<br />

seasonal<br />

19

![Education in Kashmir [Arshad].pdf - KashmirCorps](https://img.yumpu.com/12199470/1/190x245/education-in-kashmir-arshadpdf-kashmircorps.jpg?quality=85)