Jubilee Insurance 2010 Annual Report

Jubilee Insurance 2010 Annual Report

Jubilee Insurance 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

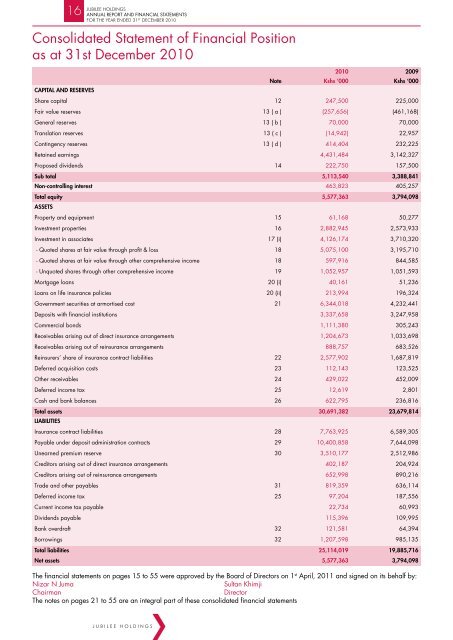

16<br />

JUBILEE HOLDINGS<br />

ANNUAL REPORT AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 ST DECEMBER <strong>2010</strong><br />

Consolidated Statement of Financial Position<br />

as at 31st December <strong>2010</strong><br />

CAPITAL AND RESERVES<br />

<strong>2010</strong> 2009<br />

Note Kshs ‘000 Kshs ‘000<br />

Share capital 12 247,500 225,000<br />

Fair value reserves 13 ( a ) (257,656) (461,168)<br />

General reserves 13 ( b ) 70,000 70,000<br />

Translation reserves 13 ( c ) (14,942) 22,957<br />

Contingency reserves 13 ( d ) 414,404 232,225<br />

Retained earnings 4,431,484 3,142,327<br />

Proposed dividends 14 222,750 157,500<br />

Sub total 5,113,540 3,388,841<br />

Non-controlling interest 463,823 405,257<br />

Total equity 5,577,363 3,794,098<br />

ASSETS<br />

Property and equipment 15 61,168 50,277<br />

Investment properties 16 2,882,945 2,573,933<br />

Investment in associates 17 (i) 4,126,174 3,710,320<br />

- Quoted shares at fair value through profit & loss 18 5,075,100 3,195,710<br />

- Quoted shares at fair value through other comprehensive income 18 597,916 844,585<br />

- Unquoted shares through other comprehensive income 19 1,052,957 1,051,593<br />

Mortgage loans 20 (i) 40,161 51,236<br />

Loans on life insurance policies 20 (ii) 213,994 196,324<br />

Government securities at armortised cost 21 6,344,018 4,232,441<br />

Deposits with financial institutions 3,337,658 3,247,958<br />

Commercial bonds 1,111,380 305,243<br />

Receivables arising out of direct insurance arrangements 1,204,673 1,033,698<br />

Receivables arising out of reinsurance arrangements 888,757 683,526<br />

Reinsurers’ share of insurance contract liabilities 22 2,577,902 1,687,819<br />

Deferred acquisition costs 23 112,143 123,525<br />

Other receivables 24 429,022 452,009<br />

Deferred income tax 25 12,619 2,801<br />

Cash and bank balances 26 622,795 236,816<br />

Total assets 30,691,382 23,679,814<br />

LIABILITIES<br />

<strong>Insurance</strong> contract liabilities 28 7,763,925 6,589,305<br />

Payable under deposit administration contracts 29 10,400,858 7,644,098<br />

Unearned premium reserve 30 3,510,177 2,512,986<br />

Creditors arising out of direct insurance arrangements 402,187 204,924<br />

Creditors arising out of reinsurance arrangements 652,998 890,216<br />

Trade and other payables 31 819,359 636,114<br />

Deferred income tax 25 97,204 187,556<br />

Current income tax payable 22,734 60,993<br />

Dividends payable 115,396 109,995<br />

Bank overdraft 32 121,581 64,394<br />

Borrowings 32 1,207,598 985,135<br />

Total liabilities 25,114,019 19,885,716<br />

Net assets 5,577,363 3,794,098<br />

The financial statements on pages 15 to 55 were approved by the Board of Directors on 1 st April, 2011 and signed on its behalf by:<br />

Nizar N Juma<br />

Sultan Khimji<br />

Chairman<br />

Director<br />

The notes on pages 21 to 55 are an integral part of these consolidated financial statements<br />

JUBILEE HOLDINGS