Jubilee Insurance 2010 Annual Report

Jubilee Insurance 2010 Annual Report

Jubilee Insurance 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34<br />

JUBILEE HOLDINGS<br />

ANNUAL REPORT AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 ST DECEMBER <strong>2010</strong><br />

NOTES (continued)<br />

4. Management of <strong>Insurance</strong> and Financial Risk (continued)<br />

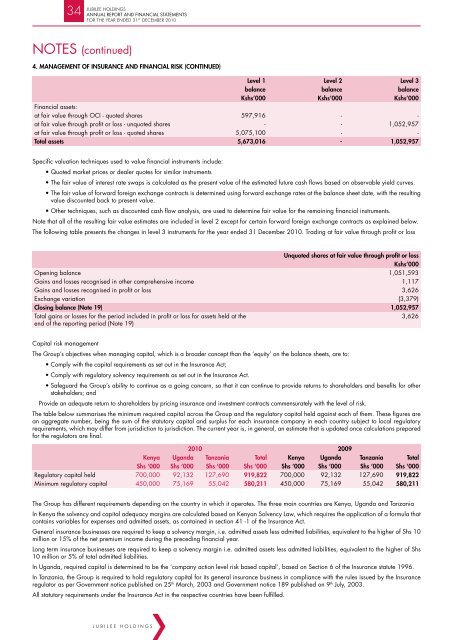

Level 1 Level 2 Level 3<br />

balance balance balance<br />

Kshs’000 Kshs’000 Kshs’000<br />

Financial assets:<br />

at fair value through OCI - quoted shares 597,916 - -<br />

at fair value through profit or loss - unquoted shares - - 1,052,957<br />

at fair value through profit or loss - quoted shares 5,075,100 - -<br />

Total assets 5,673,016 - 1,052,957<br />

Specific valuation techniques used to value financial instruments include:<br />

• Quoted market prices or dealer quotes for similar instruments<br />

• The fair value of interest rate swaps is calculated as the present value of the estimated future cash flows based on observable yield curves.<br />

• The fair value of forward foreign exchange contracts is determined using forward exchange rates at the balance sheet date, with the resulting<br />

value discounted back to present value.<br />

• Other techniques, such as discounted cash flow analysis, are used to determine fair value for the remaining financial instruments.<br />

Note that all of the resulting fair value estimates are included in level 2 except for certain forward foreign exchange contracts as explained below.<br />

The following table presents the changes in level 3 instruments for the year ended 31 December <strong>2010</strong>. Trading at fair value through profit or loss<br />

Unquoted shares at fair value through profit or loss<br />

Kshs’000<br />

Opening balance 1,051,593<br />

Gains and losses recognised in other comprehensive income 1,117<br />

Gains and losses recognised in profit or loss 3,626<br />

Exchange variation (3,379)<br />

Closing balance (Note 19) 1,052,957<br />

Total gains or losses for the period included in profit or loss for assets held at the<br />

3,626<br />

end of the reporting period (Note 19)<br />

Capital risk management<br />

The Group’s objectives when managing capital, which is a broader concept than the ‘equity’ on the balance sheets, are to:<br />

• Comply with the capital requirements as set out in the <strong>Insurance</strong> Act;<br />

• Comply with regulatory solvency requirements as set out in the <strong>Insurance</strong> Act.<br />

• Safeguard the Group’s ability to continue as a going concern, so that it can continue to provide returns to shareholders and benefits for other<br />

stakeholders; and<br />

Provide an adequate return to shareholders by pricing insurance and investment contracts commensurately with the level of risk.<br />

The table below summarises the minimum required capital across the Group and the regulatory capital held against each of them. These figures are<br />

an aggregate number, being the sum of the statutory capital and surplus for each insurance company in each country subject to local regulatory<br />

requirements, which may differ from jurisdiction to jurisdiction. The current year is, in general, an estimate that is updated once calculations prepared<br />

for the regulators are final.<br />

<strong>2010</strong> 2009<br />

Kenya Uganda Tanzania Total Kenya Uganda Tanzania Total<br />

Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000 Shs ‘000<br />

Regulatory capital held 700,000 92,132 127,690 919,822 700,000 92,132 127,690 919,822<br />

Minimum regulatory capital 450,000 75,169 55,042 580,211 450,000 75,169 55,042 580,211<br />

The Group has different requirements depending on the country in which it operates. The three main countries are Kenya, Uganda and Tanzania<br />

In Kenya the solvency and capital adequacy margins are calculated based on Kenyan Solvency Law, which requires the application of a formula that<br />

contains variables for expenses and admitted assets, as contained in section 41 -1 of the <strong>Insurance</strong> Act.<br />

General insurance businesses are required to keep a solvency margin, i.e. admitted assets less admitted liabilities, equivalent to the higher of Shs 10<br />

million or 15% of the net premium income during the preceding financial year.<br />

Long term insurance businesses are required to keep a solvency margin i.e. admitted assets less admitted liabilities, equivalent to the higher of Shs<br />

10 million or 5% of total admitted liabilities.<br />

In Uganda, required capital is determined to be the ‘company action level risk based capital’, based on Section 6 of the <strong>Insurance</strong> statute 1996.<br />

In Tanzania, the Group is required to hold regulatory capital for its general insurance business in compliance with the rules issued by the <strong>Insurance</strong><br />

regulator as per Government notice published on 25 th March, 2003 and Government notice 189 published on 9 th July, 2003.<br />

All statutory requirements under the <strong>Insurance</strong> Act in the respective countries have been fulfilled.<br />

JUBILEE HOLDINGS