Jubilee Insurance 2010 Annual Report

Jubilee Insurance 2010 Annual Report

Jubilee Insurance 2010 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

32<br />

JUBILEE HOLDINGS<br />

ANNUAL REPORT AND FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 31 ST DECEMBER <strong>2010</strong><br />

NOTES (continued)<br />

4. Management of <strong>Insurance</strong> and Financial Risk (continued)<br />

Price risk<br />

The Group is exposed to equity securities price risk because of<br />

investments in quoted and unquoted shares classified either as financial<br />

assets at fair value through other comprehensive income or at fair value<br />

through profit or loss. The Group is not exposed to commodity price<br />

risk. To manage its price risk arising from investments in equity and<br />

debt securities, the Group diversifies its portfolio. Diversification of the<br />

portfolio is done in accordance with limits set by the Group. All quoted<br />

shares held by the Group are traded on the Nairobi Stock Exchange<br />

(NSE), the Uganda Securities Exchange (USE) and Dar es Salaam Stock<br />

Exchange (DSE).<br />

Group<br />

At 31 st December, <strong>2010</strong>, if the NSE and USE indices had increased/<br />

decreased by 8% with all other variables held constant and all the<br />

Group’s equity instruments moved according to the historical correlation<br />

to the index, the post-tax profit would have been Shs 32.2m lower/<br />

higher and equity would have been Shs 441m higher/lower.<br />

Company<br />

At 31 st December, <strong>2010</strong>, the Company did not hold any shares in the<br />

Nairobi Stock Exchange. If the USE indices had increased/decreased<br />

by 20% with all other variables held constant, all the companies equity<br />

instruments moved according to the historical correlation to the index,<br />

then equity movement would have been negligible.<br />

Cash flow and fair value interest rate risk<br />

Fixed interest rate financial instruments expose the Group to fair value<br />

interest rate risk. Variable interest rate financial instruments expose the<br />

Group to cash flow interest rate risk.<br />

The Group’s fixed interest rate financial instruments are government<br />

securities, deposits with financial institutions and quoted corporate<br />

bonds.<br />

The Group’s variable interest rate financial instruments are some of the<br />

quoted corporate bonds – Barclays Bank Medium Term Loan. These are<br />

held to maturity thus do not expose the Group to interest rate risk<br />

The sensitivity analysis for interest rate risk illustrates how changes in<br />

the fair value or future cash flows of a financial instrument will fluctuate<br />

because of changes in market interest rates at the reporting date.<br />

For liabilities under long-term insurance contracts with fixed and<br />

guaranteed terms, changes in interest rate will not cause a change to the<br />

amount of the liability, unless the change is severe enough to trigger a<br />

liability adequacy test adjustment. The level of the reduction of the level<br />

of interest rate that will trigger an adjustment is an interest rate of 1%.<br />

An additional liability of Shs 81 million (2009 Shs 63 million) would be<br />

required as a result of a further worsening of 20% in mortality.<br />

Investment contracts with fixed and guaranteed terms, government<br />

securities and deposits with financial institutions held to maturity are<br />

accounted for at amortised cost and their carrying amounts are not<br />

sensitive to changes in the level of interest rates.<br />

Credit risk<br />

The Group has exposure to credit risk, which is the risk that a counterparty<br />

will be unable to pay amounts in full when due. Key areas where the<br />

Group is exposed to credit risk are:<br />

• Receivables arising out of direct insurance arrangements;<br />

• Receivables arising out of reinsurance arrangements; and<br />

• Reinsurers’ share of insurance liabilities<br />

Other areas where credit risk arises include cash and cash equivalents,<br />

corporate bonds and deposits with banks and other receivables.<br />

Reinsurance is used to manage insurance risk. This does not, however,<br />

discharge the Group’s liability as primary insurer. If a reinsurer fails to<br />

pay a claim for any reason, the Group remains liable for the payment<br />

to the policyholder. The credit worthiness of reinsurers is considered on<br />

an annual basis by reviewing their financial strength prior to finalisation<br />

of any contract.<br />

The exposure to individual counterparties is also managed by other<br />

mechanisms, such as the right of offset where counterparties are<br />

both debtors and creditors of the Group. Management information<br />

reported to the Group includes details of provisions for impairment<br />

on loans and receivables and subsequent write-offs. Internal audit<br />

makes regular reviews to assess the degree of compliance with the<br />

Group procedures on credit. Exposures to individual policyholders and<br />

groups of policyholders are collected within the ongoing monitoring<br />

of the controls associated with regulatory solvency. Where there exists<br />

significant exposure to individual policyholders, or homogenous groups<br />

of policyholders, a financial analysis equivalent to that conducted for<br />

reinsurers is carried out by the Group risk department.<br />

The Government of Kenya (GOK) has a long term rating of (B+) (stable)<br />

by Standard and poors. GOK has not defaulted on debt obligation in<br />

the past.<br />

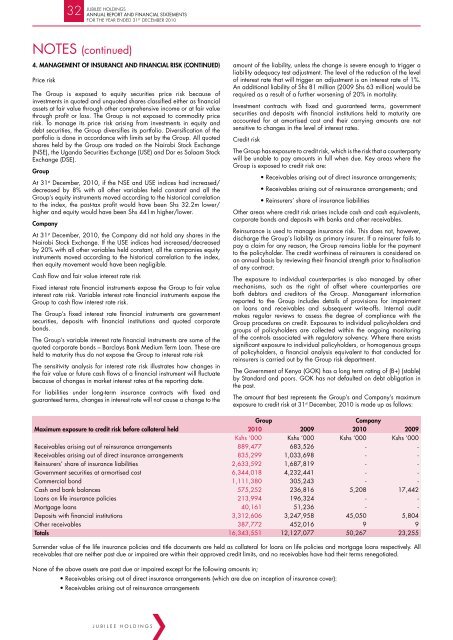

The amount that best represents the Group’s and Company’s maximum<br />

exposure to credit risk at 31 st December, <strong>2010</strong> is made up as follows:<br />

Group<br />

Company<br />

Maximum exposure to credit risk before collateral held <strong>2010</strong> 2009 <strong>2010</strong> 2009<br />

Kshs ‘000 Kshs ‘000 Kshs ‘000 Kshs ‘000<br />

Receivables arising out of reinsurance arrangements 889,477 683,526 - -<br />

Receivables arising out of direct insurance arrangements 835,299 1,033,698 - -<br />

Reinsurers’ share of insurance liabilities 2,633,592 1,687,819 - -<br />

Government securities at armortised cost 6,344,018 4,232,441 - -<br />

Commercial bond 1,111,380 305,243 - -<br />

Cash and bank balances 575,252 236,816 5,208 17,442<br />

Loans on life insurance policies 213,994 196,324 - -<br />

Mortgage loans 40,161 51,236 - -<br />

Deposits with financial institutions 3,312,606 3,247,958 45,050 5,804<br />

Other receivables 387,772 452,016 9 9<br />

Totals 16,343,551 12,127,077 50,267 23,255<br />

Surrender value of the life insurance policies and title documents are held as collateral for loans on life policies and mortgage loans respectively. All<br />

receivables that are neither past due or impaired are within their approved credit limits, and no receivables have had their terms renegotiated.<br />

None of the above assets are past due or impaired except for the following amounts in;<br />

• Receivables arising out of direct insurance arrangements (which are due on inception of insurance cover):<br />

• Receivables arising out of reinsurance arrangements<br />

JUBILEE HOLDINGS