121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<str<strong>on</strong>g>121.</str<strong>on</strong>g> RULEBOOK ON IMPLEMENTATION OF THE LAW ON VALUE ADDED TAX<br />

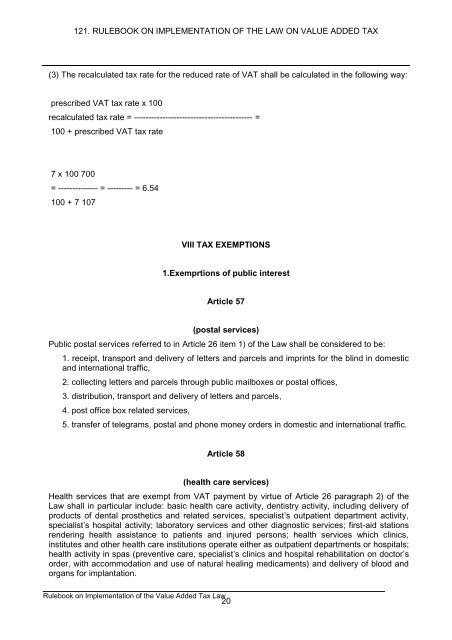

(3) The recalculated <strong>tax</strong> rate for <strong>the</strong> reduced rate <strong>of</strong> VAT shall be calculated in <strong>the</strong> following way:<br />

prescribed VAT <strong>tax</strong> rate x 100<br />

recalculated <strong>tax</strong> rate = ------------------------------------------ =<br />

100 + prescribed VAT <strong>tax</strong> rate<br />

7 x 100 700<br />

= -------------- = --------- = 6.54<br />

100 + 7 107<br />

VIII TAX EXEMPTIONS<br />

1.Exemprti<strong>on</strong>s <strong>of</strong> public interest<br />

Article 57<br />

(postal services)<br />

Public postal services referred to in Article 26 item 1) <strong>of</strong> <strong>the</strong> Law shall be c<strong>on</strong>sidered to be:<br />

1. receipt, transport and delivery <strong>of</strong> letters and parcels and imprints for <strong>the</strong> blind in domestic<br />

and internati<strong>on</strong>al traffic,<br />

2. collecting letters and parcels through public mailboxes or postal <strong>of</strong>fices,<br />

3. distributi<strong>on</strong>, transport and delivery <strong>of</strong> letters and parcels,<br />

4. post <strong>of</strong>fice box related services,<br />

5. transfer <strong>of</strong> telegrams, postal and ph<strong>on</strong>e m<strong>on</strong>ey orders in domestic and internati<strong>on</strong>al traffic.<br />

Article 58<br />

(health care services)<br />

Health services that are exempt from VAT payment by virtue <strong>of</strong> Article 26 paragraph 2) <strong>of</strong> <strong>the</strong><br />

Law shall in particular include: basic health care activity, dentistry activity, including delivery <strong>of</strong><br />

products <strong>of</strong> dental pros<strong>the</strong>tics and related services, specialist’s outpatient department activity,<br />

specialist’s hospital activity; laboratory services and o<strong>the</strong>r diagnostic services; first-aid stati<strong>on</strong>s<br />

rendering health assistance to patients and injured pers<strong>on</strong>s; health services which clinics,<br />

institutes and o<strong>the</strong>r health care instituti<strong>on</strong>s operate ei<strong>the</strong>r as outpatient departments or hospitals;<br />

health activity in spas (preventive care, specialist’s clinics and hospital rehabilitati<strong>on</strong> <strong>on</strong> doctor’s<br />

order, with accommodati<strong>on</strong> and use <strong>of</strong> natural healing medicaments) and delivery <strong>of</strong> blood and<br />

organs for implantati<strong>on</strong>.<br />

Rulebook <strong>on</strong> Implementati<strong>on</strong> <strong>of</strong> <strong>the</strong> Value Added Tax Law<br />

20