121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

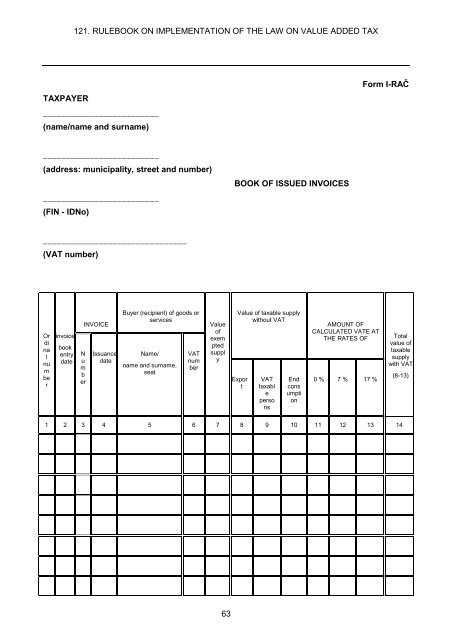

<str<strong>on</strong>g>121.</str<strong>on</strong>g> RULEBOOK ON IMPLEMENTATION OF THE LAW ON VALUE ADDED TAX<br />

TAXPAYER<br />

_________________________<br />

(name/name and surname)<br />

Form I-RAČ<br />

_________________________<br />

(address: municipality, street and number)<br />

_________________________<br />

(FIN - IDNo)<br />

BOOK OF ISSUED INVOICES<br />

_______________________________<br />

(VAT number)<br />

Or<br />

di<br />

na<br />

l<br />

nu<br />

m<br />

be<br />

r<br />

Iinvoice<br />

book<br />

entry<br />

date<br />

N<br />

u<br />

m<br />

b<br />

er<br />

INVOICE<br />

Issuance<br />

date<br />

Buyer (recipient) <strong>of</strong> goods or<br />

services<br />

Name/<br />

name and surname,<br />

seat<br />

VAT<br />

num<br />

ber<br />

Value<br />

<strong>of</strong><br />

exem<br />

pted<br />

suppl<br />

y<br />

Value <strong>of</strong> <strong>tax</strong>able supply<br />

without VAT<br />

Expor<br />

t<br />

VAT<br />

<strong>tax</strong>abl<br />

e<br />

perso<br />

ns<br />

End<br />

c<strong>on</strong>s<br />

umpti<br />

<strong>on</strong><br />

AMOUNT OF<br />

CALCULATED VATE AT<br />

THE RATES OF<br />

0 % 7 % 17 %<br />

Total<br />

<strong>value</strong> <strong>of</strong><br />

<strong>tax</strong>able<br />

supply<br />

with VAT<br />

(8-13)<br />

1 2 3 4 5 6 7 8 9 10 11 12 13 14<br />

63