121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

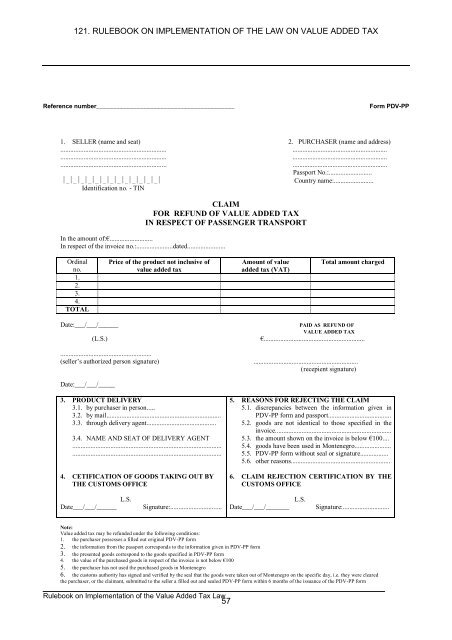

<str<strong>on</strong>g>121.</str<strong>on</strong>g> RULEBOOK ON IMPLEMENTATION OF THE LAW ON VALUE ADDED TAX<br />

Reference number_________________________________________<br />

Form PDV-PP<br />

1. SELLER (name and seat) 2. PURCHASER (name and address)<br />

................................................................ .........................................................<br />

................................................................ .........................................................<br />

................................................................ .........................................................<br />

Passport No.:..........................<br />

Country name:........................<br />

Identificati<strong>on</strong> no. - TIN<br />

CLAIM<br />

FOR REFUND OF VALUE ADDED TAX<br />

IN RESPECT OF PASSENGER TRANSPORT<br />

In <strong>the</strong> amount <strong>of</strong>:€..........................<br />

In respect <strong>of</strong> <strong>the</strong> invoice no.:......................dated.......................<br />

Ordinal<br />

no.<br />

1.<br />

2.<br />

3.<br />

4.<br />

TOTAL<br />

Price <strong>of</strong> <strong>the</strong> product not inclusive <strong>of</strong><br />

<strong>value</strong> <strong>added</strong> <strong>tax</strong><br />

Amount <strong>of</strong> <strong>value</strong><br />

<strong>added</strong> <strong>tax</strong> (VAT)<br />

Total amount charged<br />

Date:___/___/______<br />

PAID AS REFUND OF<br />

VALUE ADDED TAX<br />

(L.S.) €.............................................................<br />

.......................................................<br />

(seller’s authorized pers<strong>on</strong> signature) ...............................................................<br />

(recepient signature)<br />

Date:___/___/_____<br />

3. PRODUCT DELIVERY<br />

3.1. by purchaser in pers<strong>on</strong>.....<br />

3.2. by mail.....................................................................<br />

3.3. through delivery agent..........................................<br />

3.4. NAME AND SEAT OF DELIVERY AGENT<br />

..........................................................................................<br />

..........................................................................................<br />

4. CETIFICATION OF GOODS TAKING OUT BY<br />

THE CUSTOMS OFFICE<br />

5. REASONS FOR REJECTING THE CLAIM<br />

5.1. discrepancies between <strong>the</strong> informati<strong>on</strong> given in<br />

PDV-PP form and passport......................................<br />

5.2. goods are not identical to those specified in <strong>the</strong><br />

invoice......................................................................<br />

5.3. <strong>the</strong> amount shown <strong>on</strong> <strong>the</strong> invoice is below €100....<br />

5.4. goods have been used in M<strong>on</strong>tenegro......................<br />

5.5. PDV-PP form without seal or signature.................<br />

5.6. o<strong>the</strong>r reas<strong>on</strong>s............................................................<br />

6. CLAIM REJECTION CERTIFICATION BY THE<br />

CUSTOMS OFFICE<br />

Date___/___/______<br />

L.S.<br />

Signature:...............................<br />

Date___/___/_______<br />

L.S.<br />

Signature:............................<br />

Note:<br />

Value <strong>added</strong> <strong>tax</strong> may be refunded under <strong>the</strong> following c<strong>on</strong>diti<strong>on</strong>s:<br />

1. <strong>the</strong> purchaser possesses a filled out original PDV-PP form<br />

2. <strong>the</strong> informati<strong>on</strong> from <strong>the</strong> passport corresp<strong>on</strong>ds to <strong>the</strong> informati<strong>on</strong> given in PDV-PP form<br />

3. <strong>the</strong> presented goods corresp<strong>on</strong>d to <strong>the</strong> goods specified in PDV-PP form<br />

4. <strong>the</strong> <strong>value</strong> <strong>of</strong> <strong>the</strong> purchased goods in respect <strong>of</strong> <strong>the</strong> invoice is not below €100<br />

5. <strong>the</strong> purchaser has not used <strong>the</strong> purchased goods in M<strong>on</strong>tenegro<br />

6. <strong>the</strong> customs authority has signed and verified by <strong>the</strong> seal that <strong>the</strong> goods were taken out <strong>of</strong> M<strong>on</strong>tenegro <strong>on</strong> <strong>the</strong> specific day, i.e. <strong>the</strong>y were cleared<br />

<strong>the</strong> purchaser, or <strong>the</strong> claimant, submitted to <strong>the</strong> seller a filled out and sealed PDV-PP form within 6 m<strong>on</strong>ths <strong>of</strong> <strong>the</strong> issuance <strong>of</strong> <strong>the</strong> PDV-PP form<br />

Rulebook <strong>on</strong> Implementati<strong>on</strong> <strong>of</strong> <strong>the</strong> Value Added Tax Law<br />

57