121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

121. rulebook on implementation of the law on value added tax

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

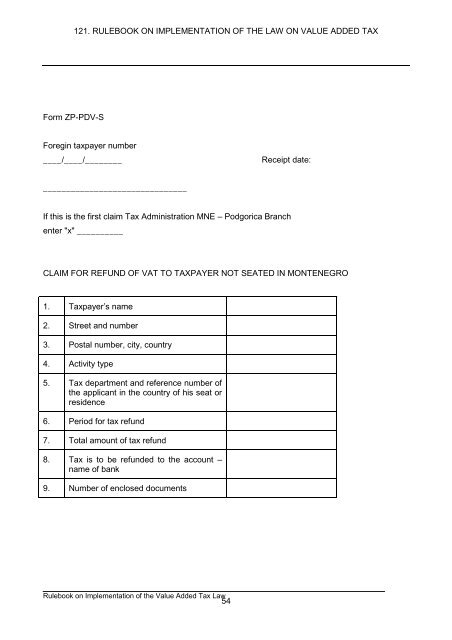

<str<strong>on</strong>g>121.</str<strong>on</strong>g> RULEBOOK ON IMPLEMENTATION OF THE LAW ON VALUE ADDED TAX<br />

Form ZP-PDV-S<br />

Foregin <strong>tax</strong>payer number<br />

____/____/________<br />

Receipt date:<br />

_______________________________<br />

If this is <strong>the</strong> first claim Tax Administrati<strong>on</strong> MNE – Podgorica Branch<br />

enter "x" __________<br />

CLAIM FOR REFUND OF VAT TO TAXPAYER NOT SEATED IN MONTENEGRO<br />

1. Taxpayer’s name<br />

2. Street and number<br />

3. Postal number, city, country<br />

4. Activity type<br />

5. Tax department and reference number <strong>of</strong><br />

<strong>the</strong> applicant in <strong>the</strong> country <strong>of</strong> his seat or<br />

residence<br />

6. Period for <strong>tax</strong> refund<br />

7. Total amount <strong>of</strong> <strong>tax</strong> refund<br />

8. Tax is to be refunded to <strong>the</strong> account –<br />

name <strong>of</strong> bank<br />

9. Number <strong>of</strong> enclosed documents<br />

Rulebook <strong>on</strong> Implementati<strong>on</strong> <strong>of</strong> <strong>the</strong> Value Added Tax Law<br />

54