You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Alumni Profile<br />

Jim Lowell ’79, P’15:<br />

A Positive Take on America’s Future<br />

By Christine Martin<br />

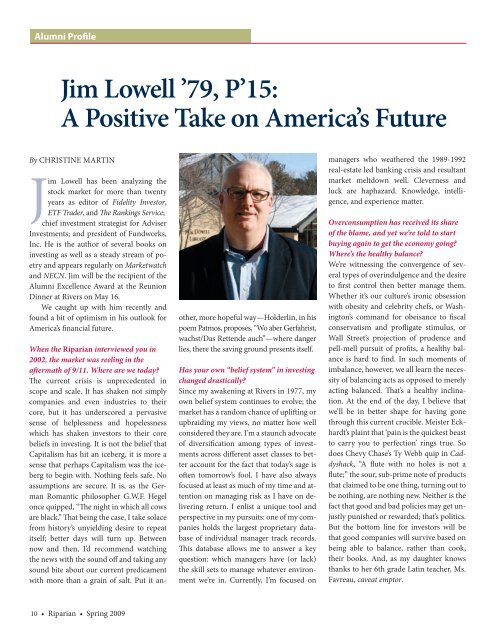

Jim Lowell has been analyzing the<br />

stock market for more than twenty<br />

years as editor of Fidelity Investor,<br />

ETF Trader, and <strong>The</strong> Rankings Service;<br />

chief investment strategist for Adviser<br />

Investments; and president of Fundworks,<br />

Inc. He is the author of several books on<br />

investing as well as a steady stream of poetry<br />

and appears regularly on Marketwatch<br />

and NECN. Jim will be the recipient of the<br />

Alumni Excellence Award at the Reunion<br />

Dinner at <strong>Rivers</strong> on May 16.<br />

We caught up with him recently and<br />

found a bit of optimism in his outlook for<br />

America’s financial future.<br />

When the Riparian interviewed you in<br />

2002, the market was reeling in the<br />

aftermath of 9/11. Where are we today<br />

<strong>The</strong> current crisis is unprecedented in<br />

scope and scale. It has shaken not simply<br />

companies and even industries to their<br />

core, but it has underscored a pervasive<br />

sense of helplessness and hopelessness<br />

which has shaken investors to their core<br />

beliefs in investing. It is not the belief that<br />

Capitalism has hit an iceberg, it is more a<br />

sense that perhaps Capitalism was the iceberg<br />

to begin with. Nothing feels safe. No<br />

assumptions are secure. It is, as the German<br />

Romantic philosopher G.W.F. Hegel<br />

once quipped, “<strong>The</strong> night in which all cows<br />

are black.” That being the case, I take solace<br />

from history’s unyielding desire to repeat<br />

itself; better days will turn up. Between<br />

now and then, I’d recommend watching<br />

the news with the sound off and taking any<br />

sound bite about our current predicament<br />

with more than a grain of salt. Put it another,<br />

more hopeful way—Holderlin, in his<br />

poem Patmos, proposes, “Wo aber Gerfahrist,<br />

wachst/Das Rettende auch”—where danger<br />

lies, there the saving ground presents itself.<br />

Has your own “belief system” in investing<br />

changed drastically<br />

Since my awakening at <strong>Rivers</strong> in 1977, my<br />

own belief system continues to evolve; the<br />

market has a random chance of uplifting or<br />

upbraiding my views, no matter how well<br />

considered they are. I’m a staunch advocate<br />

of diversification among types of investments<br />

across different asset classes to better<br />

account for the fact that today’s sage is<br />

often tomorrow’s fool. I have also always<br />

focused at least as much of my time and attention<br />

on managing risk as I have on delivering<br />

return. I enlist a unique tool and<br />

perspective in my pursuits: one of my companies<br />

holds the largest proprietary database<br />

of individual manager track records.<br />

This database allows me to answer a key<br />

question: which managers have (or lack)<br />

the skill sets to manage whatever environment<br />

we’re in. Currently, I’m focused on<br />

managers who weathered the 1989-1992<br />

real-estate led banking crisis and resultant<br />

market meltdown well. Cleverness and<br />

luck are haphazard. Knowledge, intelligence,<br />

and experience matter.<br />

Overconsumption has received its share<br />

of the blame, and yet we’re told to start<br />

buying again to get the economy going<br />

Where’s the healthy balance<br />

We’re witnessing the convergence of several<br />

types of overindulgence and the desire<br />

to first control then better manage them.<br />

Whether it’s our culture’s ironic obsession<br />

with obesity and celebrity chefs, or Washington’s<br />

command for obeisance to fiscal<br />

conservatism and profligate stimulus, or<br />

Wall Street’s projection of prudence and<br />

pell-mell pursuit of profits, a healthy balance<br />

is hard to find. In such moments of<br />

imbalance, however, we all learn the necessity<br />

of balancing acts as opposed to merely<br />

acting balanced. That’s a healthy inclination.<br />

At the end of the day, I believe that<br />

we’ll be in better shape for having gone<br />

through this current crucible. Meister Eckhardt’s<br />

plaint that ‘pain is the quickest beast<br />

to carry you to perfection’ rings true. So<br />

does Chevy Chase’s Ty Webb quip in Caddyshack,<br />

“A flute with no holes is not a<br />

flute;” the sour, sub-prime note of products<br />

that claimed to be one thing, turning out to<br />

be nothing, are nothing new. Neither is the<br />

fact that good and bad policies may get unjustly<br />

punished or rewarded; that’s politics.<br />

But the bottom line for investors will be<br />

that good companies will survive based on<br />

being able to balance, rather than cook,<br />

their books. And, as my daughter knows<br />

thanks to her 6th grade Latin teacher, Ms.<br />

Favreau, caveat emptor.<br />

10 • Riparian • Spring 2009