IDFC ASSET MANAGEMENT COMPANY LIMITED - IDFC Mutual Fund

IDFC ASSET MANAGEMENT COMPANY LIMITED - IDFC Mutual Fund

IDFC ASSET MANAGEMENT COMPANY LIMITED - IDFC Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to financial statements FOR THE YEAR ENDED MARCH 31, 2013<br />

determined based on best estimate required to settle the obligation at the reporting date. These are reviewed at each reporting date and adjusted to<br />

reflect the current best estimates.<br />

l Income tax<br />

Tax expense comprises current and deferred tax. Current income tax is measured at the amount expected to be paid to the tax authorities in<br />

accordance with the Income tax Act 1961, enacted in India and tax laws prevailing in the respective tax jurisdictions where the Company operates.<br />

The tax rate and tax laws used to compute the amount are those that are enacted or substantively enacted, at the reporting date. Current income tax<br />

relating to items recognised directly in equity is recognised in equity and not in the statement of profit and loss.<br />

Deferred income taxes reflect the impact of timing differences between taxable income and accounting income originating during the current<br />

year and reversal of timing differences for the earlier years. Deferred tax is measured using the tax rates and the tax laws enacted or substantively<br />

enacted at the reporting date. Deferred income tax relating to items recognised directly in equity is recognised in equity and not in the statement of<br />

profit and loss.<br />

Deferred tax liabilities are recognised for all taxable timing differences. Deferred tax assets are recognised for deductible timing differences only<br />

to the extent that there is reasonable certainty that sufficient future taxable income will be available against which such deferred tax assets can be<br />

realised. In situations where the Company has unabsorbed depreciation or carry forward tax losses, all deferred tax assets are recognised only if<br />

there is virtual certainty supported by convincing evidence that they can be realised against future taxable profits.<br />

m Contingent liabilities<br />

A contingent liability is a possible obligation that arises from past events whose existence will be confirmed by the occurrence or non-occurrence of<br />

one or more uncertain future events beyond the control of the Company or a present obligation that is not recognised because it is not probable that<br />

an outflow of resources will be required to settle the obligation. A contingent liability also arises in extremely rare cases where there is a liability that<br />

cannot be recognised because it cannot be measured reliably. The Company does not recognise a contingent liability but discloses its existence in<br />

the financial statements.<br />

n Cash and cash equivalents<br />

Cash and cash equivalents for the purpose of cash flow statement comprises cash at bank, cash in hand, fixed deposits with an original maturity of<br />

three months or less and investment in liquid schemes of mutual funds.<br />

o Earning per share<br />

Basic earnings per share is computed by dividing the net profit or loss for the period attributable to equity shareholders by the weighted average<br />

number of equity shares outstanding during the year.<br />

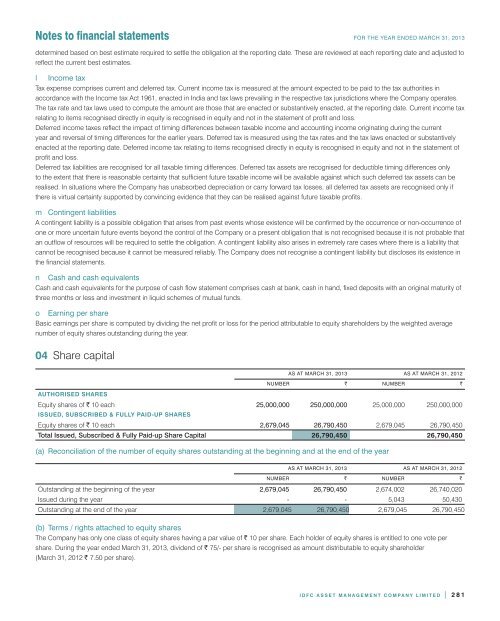

04 Share capital<br />

AS AT MARCH 31, 2013 AS AT MARCH 31, 2012<br />

NUMBER ` NUMBER `<br />

AUTHORISED SHARES<br />

Equity shares of ` 10 each 25,000,000 250,000,000 25,000,000 250,000,000<br />

ISSUED, SUBSCRIBED & FULLY PAID-UP SHARES<br />

Equity shares of ` 10 each 2,679,045 26,790,450 2,679,045 26,790,450<br />

Total Issued, Subscribed & Fully Paid-up Share Capital 26,790,450 26,790,450<br />

(a) Reconciliation of the number of equity shares outstanding at the beginning and at the end of the year<br />

AS AT MARCH 31, 2013 AS AT MARCH 31, 2012<br />

NUMBER ` NUMBER `<br />

Outstanding at the beginning of the year 2,679,045 26,790,450 2,674,002 26,740,020<br />

Issued during the year - - 5,043 50,430<br />

Outstanding at the end of the year 2,679,045 26,790,450 2,679,045 26,790,450<br />

(b) Terms / rights attached to equity shares<br />

The Company has only one class of equity shares having a par value of ` 10 per share. Each holder of equity shares is entitled to one vote per<br />

share. During the year ended March 31, 2013, dividend of ` 75/- per share is recognised as amount distributable to equity shareholder<br />

(March 31, 2012 ` 7.50 per share).<br />

<strong>IDFC</strong> <strong>ASSET</strong> <strong>MANAGEMENT</strong> <strong>COMPANY</strong> <strong>LIMITED</strong> | 281