Magna International Inc. - OMEGA

Magna International Inc. - OMEGA

Magna International Inc. - OMEGA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

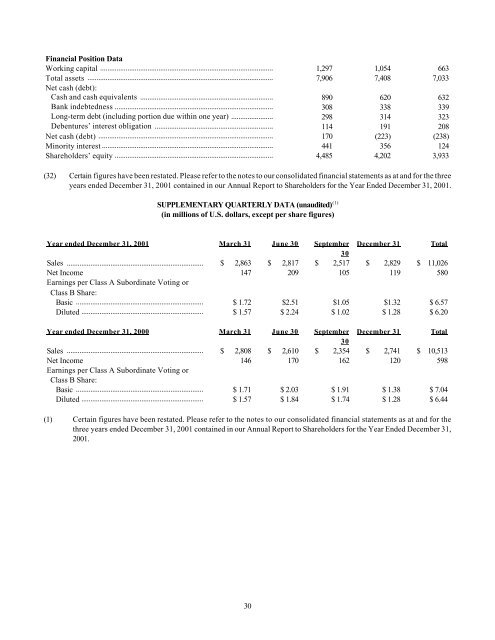

Financial Position Data<br />

Working capital ............................................................................................... 1,297 1,054 663<br />

Total assets ...................................................................................................... 7,906 7,408 7,033<br />

Net cash (debt):<br />

Cash and cash equivalents ......................................................................... 890 620 632<br />

Bank indebtedness ....................................................................................... 308 338 339<br />

Long-term debt (including portion due within one year) ....................... 298 314 323<br />

Debentures’ interest obligation ................................................................. 114 191 208<br />

Net cash (debt) ................................................................................................ 170 (223) (238)<br />

Minority interest .............................................................................................. 441 356 124<br />

Shareholders’ equity ....................................................................................... 4,485 4,202 3,933<br />

(32) Certain figures have been restated. Please refer to the notes to our consolidated financial statements as at and for the three<br />

years ended December 31, 2001 contained in our Annual Report to Shareholders for the Year Ended December 31, 2001.<br />

SUPPLEMENTARY QUARTERLY DATA (unaudited) (1)<br />

(in millions of U.S. dollars, except per share figures)<br />

Year ended December 31, 2001 March 31 June 30 September December 31 Total<br />

30<br />

Sales ........................................................................... $ 2,863 $ 2,817 $ 2,517 $ 2,829 $ 11,026<br />

Net <strong>Inc</strong>ome 147 209 105 119 580<br />

Earnings per Class A Subordinate Voting or<br />

Class B Share:<br />

Basic ...................................................................... $ 1.72 $2.51 $1.05 $1.32 $ 6.57<br />

Diluted ................................................................... $ 1.57 $ 2.24 $ 1.02 $ 1.28 $ 6.20<br />

Year ended December 31, 2000 March 31 June 30 September December 31 Total<br />

30<br />

Sales ........................................................................... $ 2,808 $ 2,610 $ 2,354 $ 2,741 $ 10,513<br />

Net <strong>Inc</strong>ome 146 170 162 120 598<br />

Earnings per Class A Subordinate Voting or<br />

Class B Share:<br />

Basic ...................................................................... $ 1.71 $ 2.03 $ 1.91 $ 1.38 $ 7.04<br />

Diluted ................................................................... $ 1.57 $ 1.84 $ 1.74 $ 1.28 $ 6.44<br />

(1) Certain figures have been restated. Please refer to the notes to our consolidated financial statements as at and for the<br />

three years ended December 31, 2001 contained in our Annual Report to Shareholders for the Year Ended December 31,<br />

2001.<br />

30