PDF - 5.5 MB - Leighton Holdings

PDF - 5.5 MB - Leighton Holdings

PDF - 5.5 MB - Leighton Holdings

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Leighton</strong><br />

<strong>Holdings</strong><br />

Quarterly<br />

Update<br />

2nd<br />

Quarter 06<br />

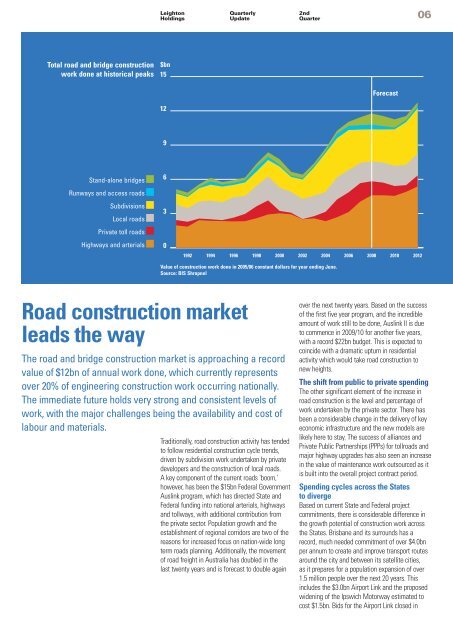

Total road and bridge construction<br />

work done at historical peaks<br />

$bn<br />

15<br />

12<br />

9<br />

Stand-alone bridges<br />

6<br />

Runways and access roads<br />

Subdivisions<br />

Local roads<br />

3<br />

Private toll roads<br />

Highways and arterials<br />

0<br />

1992<br />

1994<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

2010<br />

2012<br />

Value of construction work done in 2005/06 constant dollars for year ending June.<br />

Source: BIS Shrapnel<br />

Road construction market<br />

leads the way<br />

The road and bridge construction market is approaching a record<br />

value of $12bn of annual work done, which currently represents<br />

over 20% of engineering construction work occurring nationally.<br />

The immediate future holds very strong and consistent levels of<br />

work, with the major challenges being the availability and cost of<br />

labour and materials.<br />

Traditionally, road construction activity has tended<br />

to follow residential construction cycle trends,<br />

driven by subdivision work undertaken by private<br />

developers and the construction of local roads.<br />

A key component of the current roads 'boom,'<br />

however, has been the $15bn Federal Government<br />

Auslink program, which has directed State and<br />

Federal funding into national arterials, highways<br />

and tollways, with additional contribution from<br />

the private sector. Population growth and the<br />

establishment of regional corridors are two of the<br />

reasons for increased focus on nation-wide long<br />

term roads planning. Additionally, the movement<br />

of road freight in Australia has doubled in the<br />

last twenty years and is forecast to double again<br />

over the next twenty years. Based on the success<br />

of the first five year program, and the incredible<br />

amount of work still to be done, Auslink II is due<br />

to commence in 2009/10 for another five years,<br />

with a record $22bn budget. This is expected to<br />

coincide with a dramatic upturn in residential<br />

activity which would take road construction to<br />

new heights.<br />

The shift from public to private spending<br />

The other significant element of the increase in<br />

road construction is the level and percentage of<br />

work undertaken by the private sector. There has<br />

been a considerable change in the delivery of key<br />

economic infrastructure and the new models are<br />

likely here to stay. The success of alliances and<br />

Private Public Partnerships (PPPs) for tollroads and<br />

major highway upgrades has also seen an increase<br />

in the value of maintenance work outsourced as it<br />

is built into the overall project contract period.<br />

Spending cycles across the States<br />

to diverge<br />

Based on current State and Federal project<br />

commitments, there is considerable difference in<br />

the growth potential of construction work across<br />

the States. Brisbane and its surrounds has a<br />

record, much needed commitment of over $4.0bn<br />

per annum to create and improve transport routes<br />

around the city and between its satellite cities,<br />

as it prepares for a population expansion of over<br />

1.5 million people over the next 20 years. This<br />

includes the $3.0bn Airport Link and the proposed<br />

widening of the Ipswich Motorway estimated to<br />

cost $1.5bn. Bids for the Airport Link closed in