Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

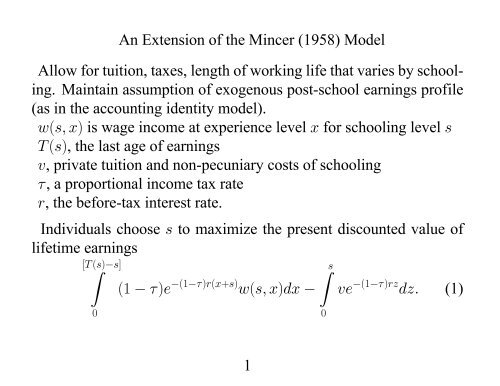

An <strong>Extension</strong> <strong>of</strong> the <strong>Mincer</strong> (1958) <strong>Model</strong><br />

Allow for tuition, taxes, length <strong>of</strong> working life that varies by schooling.<br />

Maintain assumption <strong>of</strong> exogenous post-school earnings pr<strong>of</strong>ile<br />

(as in the accounting identity model).<br />

w(s, x) is wage income at experience level x for schooling level s<br />

T (s), the last age <strong>of</strong> earnings<br />

v, private tuition and non-pecuniary costs <strong>of</strong> schooling<br />

τ, a proportional income tax rate<br />

r, the before-tax interest rate.<br />

Individuals choose s to maximize the present discounted value <strong>of</strong><br />

lifetime earnings<br />

[T<br />

Z(s)−s]<br />

Z s<br />

(1 − τ)e −(1−τ)r(x+s) w(s, x)dx − ve −(1−τ)rz dz. (1)<br />

0<br />

0<br />

1

The first order condition for a maximum yields<br />

[T 0 (s) − 1]e −(1−τ)r(T (s)−s) w(s, T (s) − s) − (1 − τ)r<br />

T(s)−s<br />

Z<br />

· e −(1−τ)rx w(s, x)dx (2)<br />

+<br />

0<br />

T (s)−s<br />

Z<br />

0<br />

e<br />

−(1−τ)rx∂w(s, x)<br />

∂s<br />

dx − v/(1 − τ) =0.<br />

Defining ˜r =(1− τ)r (the after-tax interest rate) and re-arranging<br />

terms yields,<br />

[T 0 (s) − 1]e −˜r(T(s)−s) w(s, T (s) − s)<br />

T (s)−s<br />

R<br />

0<br />

e −˜rx w(s, x)dx<br />

(Term 1)<br />

2

+<br />

T (s)−s<br />

R<br />

0<br />

h i<br />

e −˜rx ∂logw(s,x)<br />

∂s<br />

w(s, x)dx<br />

T (s)−s<br />

R<br />

0<br />

e −˜rx w(s, x)dx<br />

(Term 2)<br />

−<br />

T(s)−s<br />

R<br />

0<br />

v/(1 − τ)<br />

e −˜rx w(s, x)dx<br />

(Term 3)<br />

=˜r. (3)<br />

• Term 1 represents a life-earnings effect – the change in the present<br />

value <strong>of</strong> earnings due to a change in working-life caused by additional<br />

schooling as a fraction <strong>of</strong> the present value <strong>of</strong> earnings measured<br />

at age s.<br />

• Term 2 is the weighted effect <strong>of</strong> schooling on log earnings by age<br />

• Term 3 is the cost <strong>of</strong> tuition expressed as a fraction <strong>of</strong> lifetime income<br />

measured at age s.<br />

• The special case in the <strong>Mincer</strong> model assumes v =0and T 0 (s) =1,<br />

3

which yields<br />

Z<br />

˜r<br />

T (s)−s<br />

0<br />

e −˜rx w(s, x)dx =<br />

Z<br />

T (s)−s<br />

0<br />

e<br />

−˜rx∂w(s, x)<br />

dx<br />

∂s<br />

• also assumes multiplicative separability between the schooling and<br />

experience components <strong>of</strong> earnings, so w(s, x) =µ(s)ϕ(x) (i.e. parallel<br />

in schooling). In this special case,<br />

˜r = µ0 (s)<br />

µ(s) . (4)<br />

If wage growth is log linear in schooling, so that µ(s) =exp(ρ s s)<br />

and the above assumptions hold, then the coefficient on schooling in<br />

a <strong>Mincer</strong> equation (ρ s ) estimates the rate <strong>of</strong> return to schooling, which<br />

should equal the after-tax interest rate.<br />

4