1. Donnelly Corporation is authorized to issue 1,000,000 ordinary ...

1. Donnelly Corporation is authorized to issue 1,000,000 ordinary ...

1. Donnelly Corporation is authorized to issue 1,000,000 ordinary ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

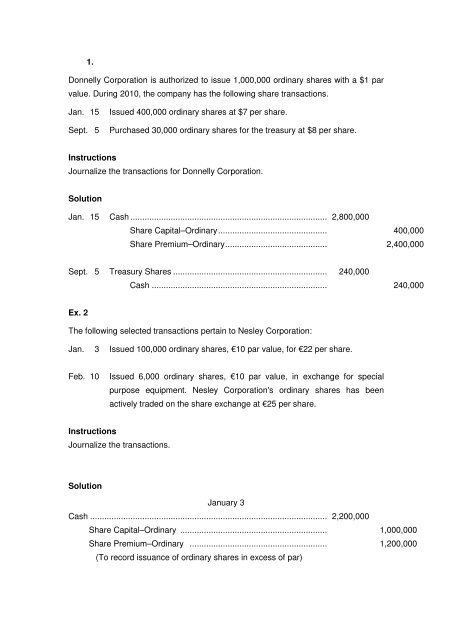

<strong>1.</strong><br />

<strong>Donnelly</strong> <strong>Corporation</strong> <strong>is</strong> <strong>authorized</strong> <strong>to</strong> <strong>is</strong>sue 1,<strong>000</strong>,<strong>000</strong> <strong>ordinary</strong> shares with a $1 par<br />

value. During 2010, the company has the following share transactions.<br />

Jan. 15<br />

Sept. 5<br />

Issued 400,<strong>000</strong> <strong>ordinary</strong> shares at $7 per share.<br />

Purchased 30,<strong>000</strong> <strong>ordinary</strong> shares for the treasury at $8 per share.<br />

Instructions<br />

Journalize the transactions for <strong>Donnelly</strong> <strong>Corporation</strong>.<br />

Solution<br />

Jan. 15 Cash ................................................................................... 2,800,<strong>000</strong><br />

Share Capital–Ordinary.............................................. 400,<strong>000</strong><br />

Share Premium–Ordinary........................................... 2,400,<strong>000</strong><br />

Sept. 5 Treasury Shares ................................................................. 240,<strong>000</strong><br />

Cash .......................................................................... 240,<strong>000</strong><br />

Ex. 2<br />

The following selected transactions pertain <strong>to</strong> Nesley <strong>Corporation</strong>:<br />

Jan. 3 Issued 100,<strong>000</strong> <strong>ordinary</strong> shares, €10 par value, for €22 per share.<br />

Feb. 10<br />

Issued 6,<strong>000</strong> <strong>ordinary</strong> shares, €10 par value, in exchange for special<br />

purpose equipment. Nesley <strong>Corporation</strong>'s <strong>ordinary</strong> shares has been<br />

actively traded on the share exchange at €25 per share.<br />

Instructions<br />

Journalize the transactions.<br />

Solution<br />

January 3<br />

Cash .................................................................................................... 2,200,<strong>000</strong><br />

Share Capital–Ordinary .............................................................. 1,<strong>000</strong>,<strong>000</strong><br />

Share Premium–Ordinary .......................................................... 1,200,<strong>000</strong><br />

(To record <strong>is</strong>suance of <strong>ordinary</strong> shares in excess of par)

February 10<br />

Equipment .......................................................................................... 150,<strong>000</strong><br />

Share Capital–Ordinary .............................................................. 60,<strong>000</strong><br />

Share Premium–Ordinary .......................................................... 90,<strong>000</strong><br />

(To record <strong>is</strong>suance of shares for equipment)<br />

3<br />

The following items were shown on the statement of financial position of Herman<br />

<strong>Corporation</strong> on December 31, 2011:<br />

Equity<br />

Share Capital–Ordinary, €5 par value, 360,<strong>000</strong> shares<br />

<strong>authorized</strong>; ______ shares <strong>is</strong>sued and ______ outstanding .............................. €1,550,<strong>000</strong><br />

Share Premium–Ordinary.................................................................................. 165,<strong>000</strong><br />

Retained Earnings............................................................................................. 750,<strong>000</strong><br />

Less: Treasury Shares (18,<strong>000</strong> shares)........................................................... (180,<strong>000</strong>)<br />

Total Equity............................................................................................ €2,285,<strong>000</strong>

Instructions<br />

Complete the following statements and show your computations.<br />

(a) The number of <strong>ordinary</strong> shares <strong>is</strong>sued was _______________.<br />

(b) The number of <strong>ordinary</strong> shares outstanding was ____________.<br />

(c) The sales price of the <strong>ordinary</strong> shares when <strong>is</strong>sued was €____________.<br />

(d) The cost per treasury share was €_______________.<br />

(e) The average <strong>is</strong>sue price of the <strong>ordinary</strong> shares was €______________.<br />

(f) Assuming that 25% of the treasury shares <strong>is</strong> sold at €20 per share, the balance in<br />

the Treasury Shares account would be €_______________.<br />

Solution<br />

(a) The number of <strong>ordinary</strong> shares <strong>is</strong>sued was 310,<strong>000</strong>.<br />

€1,550,<strong>000</strong> ÷ €5 par value = 310,<strong>000</strong> shares <strong>is</strong>sued.<br />

(b) The number of <strong>ordinary</strong> shares outstanding was 292,<strong>000</strong>.<br />

310,<strong>000</strong> <strong>is</strong>sued less 18,<strong>000</strong> in treasury = 292,<strong>000</strong> shares outstanding<br />

(c) The sales price of the <strong>ordinary</strong> shares when <strong>is</strong>sued was €1,715,<strong>000</strong>.<br />

Share capital €1,550,<strong>000</strong><br />

Plus: share premium 165,<strong>000</strong><br />

Total €1,715,<strong>000</strong><br />

(d) The cost per treasury share was € 10.<br />

€180,<strong>000</strong> ÷ 18,<strong>000</strong> = €10 per share.<br />

(e) The average <strong>is</strong>sue price of the <strong>ordinary</strong> shares was €5.53.<br />

€1,715,<strong>000</strong> ÷ 310,<strong>000</strong> shares = €5.53 per share.<br />

(f)<br />

Assuming 25% of the treasury shares <strong>is</strong> sold at €20 per share, the balance in the<br />

Treasury Shares account would be €135,<strong>000</strong>.<br />

13,500 shares × €10 = €135,<strong>000</strong>.

4<br />

On January 1, 2011, Fairly Company <strong>is</strong>sued 30,<strong>000</strong> <strong>ordinary</strong> shares with a $2 par<br />

value for $150,<strong>000</strong>. On March 1, 2011, the company purchased 6,<strong>000</strong> <strong>ordinary</strong> shares<br />

for $8 per share for the treasury. On June 1, 2011, 1,500 of the treasury shares are<br />

sold for $10 per share. On September 1, 2011, 3,<strong>000</strong> treasury shares are sold at $6<br />

per share.<br />

Instructions<br />

Journalize the share transactions of Fairly Company in 201<strong>1.</strong><br />

Solution<br />

Jan. 1 Cash ................................................................................... 150,<strong>000</strong><br />

Share Capital–Ordinary.............................................. 60,<strong>000</strong><br />

Share Premium–Ordinary........................................... 90,<strong>000</strong><br />

March 1 Treasury Shares ................................................................. 48,<strong>000</strong><br />

Cash .......................................................................... 48,<strong>000</strong><br />

June 1 Cash ................................................................................... 15,<strong>000</strong><br />

Treasury Shares......................................................... 12,<strong>000</strong><br />

Share Premium–Treasury .......................................... 3,<strong>000</strong><br />

Sept. 1 Cash ................................................................................... 18,<strong>000</strong><br />

Share Premium–Treasury................................................... 3,<strong>000</strong><br />

Retained Earnings .............................................................. 3,<strong>000</strong><br />

Treasury Shares......................................................... 24,<strong>000</strong><br />

5<br />

Richman <strong>Corporation</strong> has 120,<strong>000</strong> <strong>ordinary</strong> shares with a €5 par value outstanding. It<br />

declared a 10% share dividend on June 1 when the market price per share was €12.<br />

The shares were <strong>is</strong>sued on June 30.<br />

Instructions<br />

Prepare the necessary entries for the declaration and payment of the share dividend.

Solution<br />

June 1 Share Dividends (120,<strong>000</strong> × .10 × €12)............................... 144,<strong>000</strong><br />

Ordinary Share Dividends D<strong>is</strong>tributable...................... 60,<strong>000</strong><br />

Share Premium–Ordinary........................................... 84,<strong>000</strong><br />

June 30 Ordinary Share Dividends D<strong>is</strong>tributable .............................. 60,<strong>000</strong><br />

Share Capital–Ordinary.............................................. 60,<strong>000</strong><br />

6.<br />

Derek <strong>Corporation</strong> was organized on January 1, 2010. During its first year, the<br />

corporation <strong>is</strong>sued 40,<strong>000</strong> preference shares with a $5 par value and 400,<strong>000</strong> <strong>ordinary</strong><br />

shares with a $1 par value. At December 31, the company declared the following cash<br />

dividends:<br />

2010 $ 8,<strong>000</strong><br />

2011 $30,<strong>000</strong><br />

2012 $70,<strong>000</strong><br />

Instructions<br />

(a) Show the allocation of dividends <strong>to</strong> each class of shares, assuming the preference<br />

shares dividend <strong>is</strong> 5% and not cumulative.<br />

(b) Show the allocation of dividends <strong>to</strong> each class of shares, assuming the preference<br />

shares dividend <strong>is</strong> 6% and cumulative.<br />

(c) Journalize the declaration of the cash dividend at December 31, 2012 using the<br />

assumption of part (b).<br />

Solution<br />

(a) Preference Ordinary Total<br />

2010 $ 8,<strong>000</strong> $ -0- $ 8,<strong>000</strong><br />

2011 10,<strong>000</strong> 20,<strong>000</strong> 30,<strong>000</strong><br />

2012 10,<strong>000</strong> 60,<strong>000</strong> 70,<strong>000</strong>

(b) Preference Ordinary Total<br />

2010 $ 8,<strong>000</strong> $ -0- $ 8,<strong>000</strong><br />

2011 16,<strong>000</strong> 14,<strong>000</strong> 30,<strong>000</strong><br />

2012 12,<strong>000</strong> 58,<strong>000</strong> 70,<strong>000</strong><br />

(c) Cash Dividends ........................................................................... 70,<strong>000</strong><br />

Preference Dividends Payable............................................ 12,<strong>000</strong><br />

Ordinary Dividends Payable................................................ 58,<strong>000</strong>

![char str[]](https://img.yumpu.com/49874120/1/190x134/char-str.jpg?quality=85)