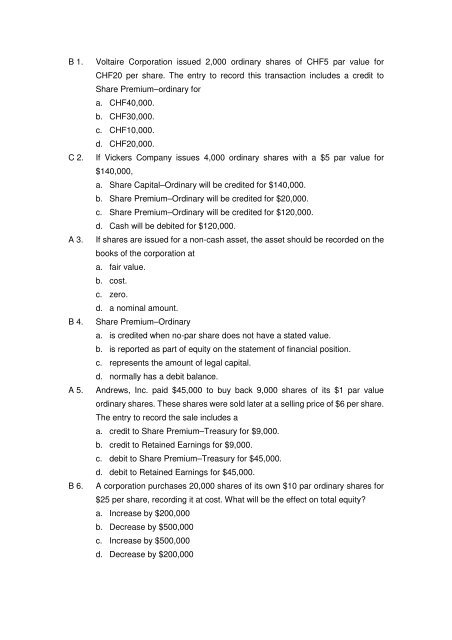

B 1. Voltaire Corporation issued 2,000 ordinary shares of CHF5 par ...

B 1. Voltaire Corporation issued 2,000 ordinary shares of CHF5 par ...

B 1. Voltaire Corporation issued 2,000 ordinary shares of CHF5 par ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

d 7. Treasury <strong>shares</strong> area. <strong>shares</strong> <strong>issued</strong> by the U.S. Treasury De<strong>par</strong>tment.b. <strong>shares</strong> purchased by a corporation and held as an investment in itstreasury.c. corporate <strong>shares</strong> <strong>issued</strong> by the treasurer <strong>of</strong> a company.d. a corporation's own <strong>shares</strong> which have been reacquired but not retired.B 8. When preference <strong>shares</strong> is cumulative, preference dividends not declared in aperiod area. considered a liability.b. called dividends in arrears.c. distributions <strong>of</strong> earnings.d. never paid.B 9. Cole <strong>Corporation</strong> issues 10,<strong>000</strong> preference <strong>shares</strong> with a $50 <strong>par</strong> value forcash at $60 per share. The entry to record the transaction will consist <strong>of</strong> a debitto Cash for $600,<strong>000</strong> and a credit or credits toa. Preference Shares for $600,<strong>000</strong>.b. Preference Shares for $500,<strong>000</strong> and Share Premium—Preferred Share for$100,<strong>000</strong>.c. Preference Shares for $750,<strong>000</strong> and Share Premium for $100,<strong>000</strong>.d. Share Premium for $600,<strong>000</strong>.D 10. Beckham Company has 1,<strong>000</strong> <strong>shares</strong> <strong>of</strong> 6%, $100 <strong>par</strong> cumulative preference<strong>shares</strong> outstanding at December 31, 201<strong>1.</strong> No dividends have been paid onthese <strong>shares</strong> for 2010 or 201<strong>1.</strong> Dividends in arrears at December 31, 2011 totala. $0.b. $600.c. $6,<strong>000</strong>.d. $12,<strong>000</strong>.D 1<strong>1.</strong> If a corporation declares a 10% <strong>ordinary</strong> share dividend, the account to bedebited on the date <strong>of</strong> declaration isa. Ordinary Share Dividends Distributable.b. Share Capital–Ordinary.c. Share Premium–Ordinary.d. Retained Earnings.B 12. Share dividends and share splits have the following effects on retainedearnings:Share Splits Share Dividendsa. Increase No changeb. No change Decrease

c. Decrease Decreased. No change No changea 13. The per share amount normally assigned by the board <strong>of</strong> directors to a smallshare dividend isa. the market value <strong>of</strong> the <strong>shares</strong> on the date <strong>of</strong> declaration.b. the average price paid by shareholders on outstanding <strong>shares</strong>.c. the <strong>par</strong> or stated value <strong>of</strong> the <strong>shares</strong>.d. zero.D 14. Prior period adjustments are reporteda. in the footnotes <strong>of</strong> the current year's financial statements.b. on the current year's statement <strong>of</strong> financial position.c. on the current year's income statement.d. on the current year's retained earnings statement.B 15. Van Luther Company had total equity <strong>of</strong> £8,650,<strong>000</strong> at January 1, 2011 and£9,807,<strong>000</strong> at December 31, 201<strong>1.</strong> The Company had net income for 2011 <strong>of</strong>£1,557,<strong>000</strong> and paid total dividends <strong>of</strong> £400,<strong>000</strong>, including the annualpreference dividend <strong>of</strong> £320,<strong>000</strong>. Van Luther's return on equity for 2011 isa. 12.5%.b. 13.4%.c. 15.9%.d. 16.9%.b 16. At December 31, the shareholders’ equity includedShare capital–<strong>ordinary</strong>, $5 <strong>par</strong> value; 1,100,<strong>000</strong> <strong>shares</strong> <strong>issued</strong>and 1,<strong>000</strong>,<strong>000</strong> <strong>shares</strong> outstanding $5,500,<strong>000</strong>Share premium–<strong>ordinary</strong> 1,400,<strong>000</strong>Retained earnings 1,500,<strong>000</strong>Treasury <strong>shares</strong>, (100,<strong>000</strong> <strong>shares</strong>)(700,<strong>000</strong>)Total equity $7,700,<strong>000</strong>The book value per <strong>ordinary</strong> share isa. $7.00b. $7.70c. $8.40d. $7.20A 17. Jennifer Company reports the following amounts for 2011:Net income $135,<strong>000</strong>Average shareholders' equity 500,<strong>000</strong>Preference dividends 35,<strong>000</strong>

Par value preference <strong>shares</strong> 100,<strong>000</strong>The 2011 rate <strong>of</strong> return on <strong>ordinary</strong> shareholders' equity isa. 25.0%.b. 22.5%.c. 27.0%.d. 33.8%.

![char str[]](https://img.yumpu.com/49874120/1/190x134/char-str.jpg?quality=85)