Input Capital (TSXV: INP) â Initiating Coverage - First ... - Baystreet.ca

Input Capital (TSXV: INP) â Initiating Coverage - First ... - Baystreet.ca

Input Capital (TSXV: INP) â Initiating Coverage - First ... - Baystreet.ca

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Page 17<br />

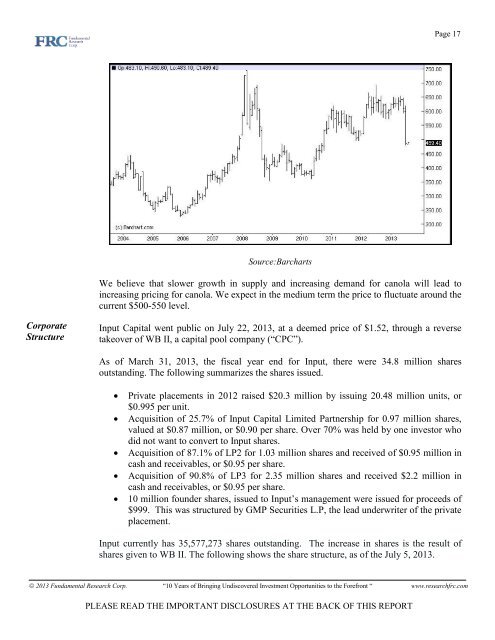

Source:Barcharts<br />

We believe that slower growth in supply and increasing demand for <strong>ca</strong>nola will lead to<br />

increasing pricing for <strong>ca</strong>nola. We expect in the medium term the price to fluctuate around the<br />

current $500-550 level.<br />

Corporate<br />

Structure<br />

<strong>Input</strong> <strong>Capital</strong> went public on July 22, 2013, at a deemed price of $1.52, through a reverse<br />

takeover of WB II, a <strong>ca</strong>pital pool company (“CPC”).<br />

As of March 31, 2013, the fis<strong>ca</strong>l year end for <strong>Input</strong>, there were 34.8 million shares<br />

outstanding. The following summarizes the shares issued.<br />

• Private placements in 2012 raised $20.3 million by issuing 20.48 million units, or<br />

$0.995 per unit.<br />

• Acquisition of 25.7% of <strong>Input</strong> <strong>Capital</strong> Limited Partnership for 0.97 million shares,<br />

valued at $0.87 million, or $0.90 per share. Over 70% was held by one investor who<br />

did not want to convert to <strong>Input</strong> shares.<br />

• Acquisition of 87.1% of LP2 for 1.03 million shares and received of $0.95 million in<br />

<strong>ca</strong>sh and receivables, or $0.95 per share.<br />

• Acquisition of 90.8% of LP3 for 2.35 million shares and received $2.2 million in<br />

<strong>ca</strong>sh and receivables, or $0.95 per share.<br />

• 10 million founder shares, issued to <strong>Input</strong>’s management were issued for proceeds of<br />

$999. This was structured by GMP Securities L.P, the lead underwriter of the private<br />

placement.<br />

<strong>Input</strong> currently has 35,577,273 shares outstanding. The increase in shares is the result of<br />

shares given to WB II. The following shows the share structure, as of the July 5, 2013.<br />

© 2013 Fundamental Research Corp. “10 Years of Bringing Undiscovered Investment Opportunities to the Forefront “ www.researchfrc.com<br />

PLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT