A SERIES OF ARTICLES FRoM THE 2011 EMEA CoMPENSATIoN ...

A SERIES OF ARTICLES FRoM THE 2011 EMEA CoMPENSATIoN ...

A SERIES OF ARTICLES FRoM THE 2011 EMEA CoMPENSATIoN ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

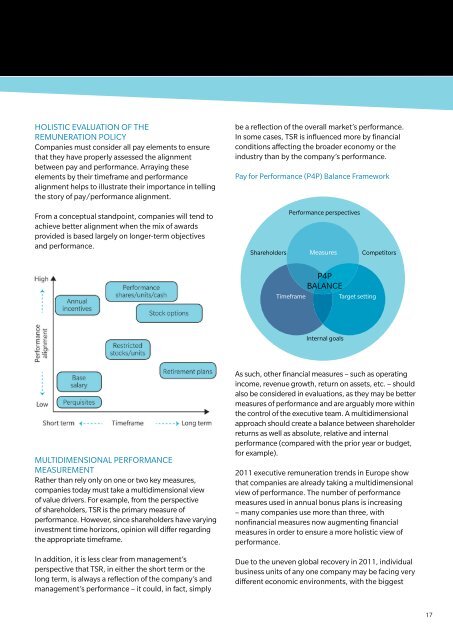

HOLISTIC EVALUATION <strong>OF</strong> <strong>THE</strong><br />

REMUNERATION POLICY<br />

Companies must consider all pay elements to ensure<br />

that they have properly assessed the alignment<br />

between pay and performance. Arraying these<br />

elements by their timeframe and performance<br />

alignment helps to illustrate their importance in telling<br />

the story of pay/performance alignment.<br />

From a conceptual standpoint, companies will tend to<br />

achieve better alignment when the mix of awards<br />

provided is based largely on longer-term objectives<br />

and performance.<br />

be a reflection of the overall market’s performance.<br />

In some cases, TSR is influenced more by financial<br />

conditions affecting the broader economy or the<br />

industry than by the company’s performance.<br />

Pay for Performance (P4P) Balance Framework<br />

Shareholders<br />

Performance perspectives<br />

Measures<br />

Competitors<br />

P4P<br />

BALANCE<br />

Timeframe<br />

Target setting<br />

Internal goals<br />

MULTIDIMENSIONAL PERFORMANCE<br />

MEASUREMENT<br />

Rather than rely only on one or two key measures,<br />

companies today must take a multidimensional view<br />

of value drivers. For example, from the perspective<br />

of shareholders, TSR is the primary measure of<br />

performance. However, since shareholders have varying<br />

investment time horizons, opinion will differ regarding<br />

the appropriate timeframe.<br />

In addition, it is less clear from management’s<br />

perspective that TSR, in either the short term or the<br />

long term, is always a reflection of the company’s and<br />

management’s performance – it could, in fact, simply<br />

As such, other financial measures – such as operating<br />

income, revenue growth, return on assets, etc. – should<br />

also be considered in evaluations, as they may be better<br />

measures of performance and are arguably more within<br />

the control of the executive team. A multidimensional<br />

approach should create a balance between shareholder<br />

returns as well as absolute, relative and internal<br />

performance (compared with the prior year or budget,<br />

for example).<br />

<strong>2011</strong> executive remuneration trends in Europe show<br />

that companies are already taking a multidimensional<br />

view of performance. The number of performance<br />

measures used in annual bonus plans is increasing<br />

– many companies use more than three, with<br />

nonfinancial measures now augmenting financial<br />

measures in order to ensure a more holistic view of<br />

performance.<br />

Due to the uneven global recovery in <strong>2011</strong>, individual<br />

business units of any one company may be facing very<br />

different economic environments, with the biggest<br />

17